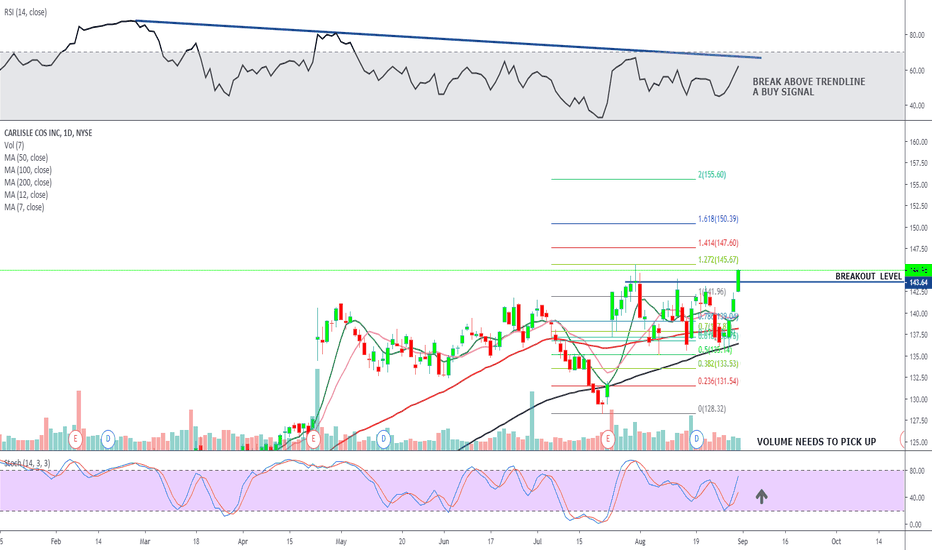

Carlisle trading above channelCarlisle Cos Inc. (CSL) presently trading above significant channel resistance. If a weekly settlement above this channel resistance occurs, this would place (CSL) in a buy signal where gains of 15% would be expected within 2-3 months, and 20-25% within 5-8 months. Inversely, if (CSL) does not manag

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

15.2 EUR

825.81 M EUR

4.83 B EUR

41.34 M

About Carlisle Companies Incorporated

Sector

Industry

CEO

David Christian Koch

Website

Headquarters

Scottsdale

Founded

1917

ISIN

US1423391002

FIGI

BBG000BTCH11

Carlisle Cos., Inc. engages in the design, manufacture, and distribution of building envelope products and energy solutions. It operates through the Carlisle Construction Materials (CCM) and Carlisle Weatherproofing Technologies (CWT) segments. The CCM segment produces single-ply roofing products and warranted roof systems and accessories for the commercial building industry, including ethylene propylene diene monomer (“EPDM”), thermoplastic polyolefin (“TPO”) and polyvinyl chloride (“PVC”) membrane, polyiso insulation, and engineered metal roofing and wall panel systems for commercial and residential buildings. The CWT segment produces spray polyurethane foam technologies, architectural metal, heating, ventilation and air conditioning (HVAC) hardware and sealants, below-grade waterproofing, and air and vapor barrier systems focused on the weatherproofing and thermal performance of the building envelope. The company was founded by Charles S. Moomy in 1917 and is headquartered in Scottsdale, AZ.

Related stocks

$CSL continuing to move higher!Notes:

* I last spoke about this a couple of days ago as it was bouncing off of its 50 day line

* Since then it has gaped up and is now breaking above the resistance level of $254.44

* It's still offering an early entry as it's still close to its 50 day line and trading above average volume

* Every

$CSL finding support at its 50day line. Can it move higher?Notes:

* Great earnings

* Very strong up trend on all time frames

* Pays out dividends

* Showing tonnes of strength and accumulation

* Basing for the past 4 months while the general market and the respective sector took a nasty hit

* Currently finding support at its 50 day line

* Printed a Pocket

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

CSL6150106

Carlisle Companies Incorporated 5.55% 15-SEP-2040Yield to maturity

5.44%

Maturity date

Sep 15, 2040

CSL6150107

Carlisle Companies Incorporated 5.25% 15-SEP-2035Yield to maturity

5.05%

Maturity date

Sep 15, 2035

CSL5259125

Carlisle Companies Incorporated 2.2% 01-MAR-2032Yield to maturity

4.55%

Maturity date

Mar 1, 2032

CSL4952059

Carlisle Companies Incorporated 2.75% 01-MAR-2030Yield to maturity

4.32%

Maturity date

Mar 1, 2030

CSL4565299

Carlisle Companies Incorporated 3.75% 01-DEC-2027Yield to maturity

4.15%

Maturity date

Dec 1, 2027

See all CLE bonds

Frequently Asked Questions

The current price of CLE is 272.6 EUR — it has decreased by −3.43% in the past 24 hours. Watch Carlisle Companies Incorporated stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange Carlisle Companies Incorporated stocks are traded under the ticker CLE.

CLE stock has fallen by −2.43% compared to the previous week, the month change is a −1.51% fall, over the last year Carlisle Companies Incorporated has showed a −33.71% decrease.

We've gathered analysts' opinions on Carlisle Companies Incorporated future price: according to them, CLE price has a max estimate of 347.53 EUR and a min estimate of 284.42 EUR. Watch CLE chart and read a more detailed Carlisle Companies Incorporated stock forecast: see what analysts think of Carlisle Companies Incorporated and suggest that you do with its stocks.

CLE stock is 0.33% volatile and has beta coefficient of 1.12. Track Carlisle Companies Incorporated stock price on the chart and check out the list of the most volatile stocks — is Carlisle Companies Incorporated there?

Today Carlisle Companies Incorporated has the market capitalization of 11.50 B, it has decreased by −2.60% over the last week.

Yes, you can track Carlisle Companies Incorporated financials in yearly and quarterly reports right on TradingView.

Carlisle Companies Incorporated is going to release the next earnings report on Feb 10, 2026. Keep track of upcoming events with our Earnings Calendar.

CLE earnings for the last quarter are 4.78 EUR per share, whereas the estimation was 4.57 EUR resulting in a 4.59% surprise. The estimated earnings for the next quarter are 3.12 EUR per share. See more details about Carlisle Companies Incorporated earnings.

Carlisle Companies Incorporated revenue for the last quarter amounts to 1.15 B EUR, despite the estimated figure of 1.12 B EUR. In the next quarter, revenue is expected to reach 961.35 M EUR.

CLE net income for the last quarter is 181.60 M EUR, while the quarter before that showed 216.81 M EUR of net income which accounts for −16.24% change. Track more Carlisle Companies Incorporated financial stats to get the full picture.

Yes, CLE dividends are paid quarterly. The last dividend per share was 0.94 EUR. As of today, Dividend Yield (TTM)% is 1.29%. Tracking Carlisle Companies Incorporated dividends might help you take more informed decisions.

Carlisle Companies Incorporated dividend yield was 1.00% in 2024, and payout ratio reached 20.38%. The year before the numbers were 1.02% and 23.61% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Nov 10, 2025, the company has 5.7 K employees. See our rating of the largest employees — is Carlisle Companies Incorporated on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Carlisle Companies Incorporated EBITDA is 1.06 B EUR, and current EBITDA margin is 26.08%. See more stats in Carlisle Companies Incorporated financial statements.

Like other stocks, CLE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Carlisle Companies Incorporated stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Carlisle Companies Incorporated technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Carlisle Companies Incorporated stock shows the sell signal. See more of Carlisle Companies Incorporated technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.