Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.16 EUR

−278.48 M EUR

793.09 M EUR

302.19 M

About SentinelOne, Inc.

Sector

Industry

CEO

Tomer Weingarten

Website

Headquarters

Mountain View

Founded

2013

ISIN

US81730H1095

FIGI

BBG01M3451X4

SentinelOne, Inc. engages in the provision of endpoint security software that detects, models, and predicts threat behavior to block attacks on any computing device. Its services include vigilance, support, and training. The company was founded by Tomer Weingarten and Almog Cohen in 2013 and is headquartered in Mountain View, CA.

Related stocks

SentinelOne Looks Like Palantir Before The BreakoutIn every market cycle, some high-growth companies are misunderstood—until they aren’t. Palantir (PLTR) was one such stock, dismissed early for its lack of profitability and complex model, only to soar when its AI tools gained traction. Now, SentinelOne (NYSE: S) may be next in line.

🧠 What Sentinel

S SentinelOne Options Ahead of EarningsIf you haven`t bought S before the recent rally:

Now analyzing the options chain and the chart patterns of S SentinelOne prior to the earnings report this week,

I would consider purchasing the 20usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $2.50.

If t

Shorting sentinelonecompany Info ; :

SentinelOne ensures the security of IoT devices through a combination of its Endpoint Protection Platform (EPP) and its Singularity platform. The EPP is designed to detect, prevent, and respond to advanced cyber threats.

Price action : shorting at the zone target is 1:7

1/3/25 - $s - Back in sub $23, but small1/3/25 :: VROCKSTAR :: NYSE:S

Back in sub $23, but small

- previous entry was so good at $17 that I sold too quickly (tends to be something I do - working on it in '25 - but i also cut losers too so that's good)

- i like the inflecting margins here, profitable inflecting and mid 20s growth for a

S SentinelOne Options Ahead of EarningsIf you haven`t bought S before the previous breakout:

Now analyzing the options chain and the chart patterns of S SentinelOne prior to the earnings report this week,

I would consider purchasing the 30usd strike price Calls with

an expiration date of 2024-12-6,

for a premium of approximately $0.87.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 7B0 is featured.

US software stocks: Overlooked operating systems

17 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 7B0 is 15.80 EUR — it has increased by 3.61% in the past 24 hours. Watch SentinelOne, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange SentinelOne, Inc. Class A stocks are traded under the ticker 7B0.

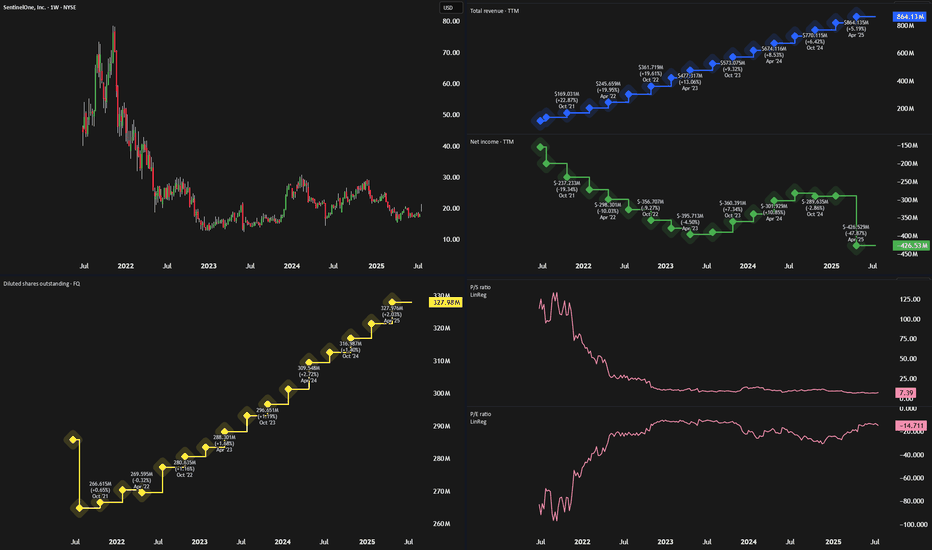

7B0 stock has risen by 1.94% compared to the previous week, the month change is a 17.04% rise, over the last year SentinelOne, Inc. Class A has showed a −18.97% decrease.

We've gathered analysts' opinions on SentinelOne, Inc. Class A future price: according to them, 7B0 price has a max estimate of 25.62 EUR and a min estimate of 16.23 EUR. Watch 7B0 chart and read a more detailed SentinelOne, Inc. Class A stock forecast: see what analysts think of SentinelOne, Inc. Class A and suggest that you do with its stocks.

7B0 stock is 5.32% volatile and has beta coefficient of 1.26. Track SentinelOne, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is SentinelOne, Inc. Class A there?

Today SentinelOne, Inc. Class A has the market capitalization of 5.09 B, it has increased by 13.13% over the last week.

Yes, you can track SentinelOne, Inc. Class A financials in yearly and quarterly reports right on TradingView.

SentinelOne, Inc. Class A is going to release the next earnings report on Dec 9, 2025. Keep track of upcoming events with our Earnings Calendar.

7B0 earnings for the last quarter are 0.04 EUR per share, whereas the estimation was 0.02 EUR resulting in a 41.15% surprise. The estimated earnings for the next quarter are 0.05 EUR per share. See more details about SentinelOne, Inc. Class A earnings.

SentinelOne, Inc. Class A revenue for the last quarter amounts to 212.14 M EUR, despite the estimated figure of 212.12 M EUR. In the next quarter, revenue is expected to reach 218.91 M EUR.

7B0 net income for the last quarter is −63.09 M EUR, while the quarter before that showed −183.83 M EUR of net income which accounts for 65.68% change. Track more SentinelOne, Inc. Class A financial stats to get the full picture.

No, 7B0 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 12, 2025, the company has 2.8 K employees. See our rating of the largest employees — is SentinelOne, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SentinelOne, Inc. Class A EBITDA is −249.00 M EUR, and current EBITDA margin is −34.63%. See more stats in SentinelOne, Inc. Class A financial statements.

Like other stocks, 7B0 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SentinelOne, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SentinelOne, Inc. Class A technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SentinelOne, Inc. Class A stock shows the sell signal. See more of SentinelOne, Inc. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.