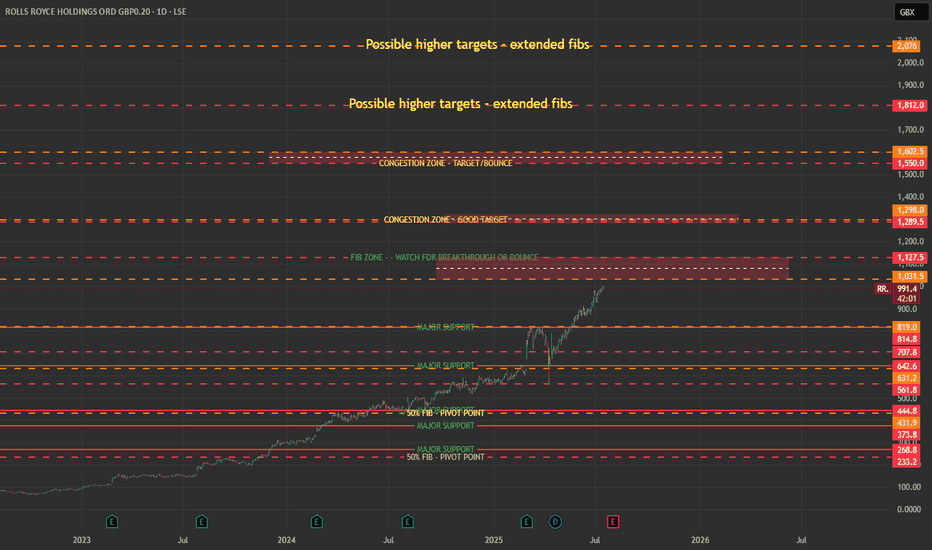

Rolls Royce on a MONSTER of a run.Shares are up roughly 1500% since November 2022 and my first thought was who is buying all these cars, but quickly realised that it was all the "other" engines and equipment that they produce and especially defense contracts that are powering this whopper of a rally.

Either way a truly monster run

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.80 EUR

3.05 B EUR

22.85 B EUR

8.26 B

About Rolls-Royce Holdings plc

Sector

Industry

CEO

Tufan Ergin-Bilgic

Website

Headquarters

London

Founded

1906

ISIN

GB00B63H8491

FIGI

BBG00FGX4WM7

Rolls-Royce Holdings Plc designs, develops, manufactures, and services integrated power systems for use in the air, on land, and at sea. The company operates its business through following segments: Civil Aerospace, Power Systems, Defense and New Markets. The Civil Aerospace segment offers commercial aero engines and aftermarket services. The Power Systems segment includes engines, power systems and nuclear systems for civil power generation. The Defense segment consists of military aero engines, naval engines, submarines and aftermarket services. The New Markets segment includes development, manufacture and sales of small modular reactors (SMRs) and new electrical power solutions. The company was founded in March 1906 and is headquartered in London, the United Kingdom.

Related stocks

Rolls-Royce Wave Analysis – 29 August 2025

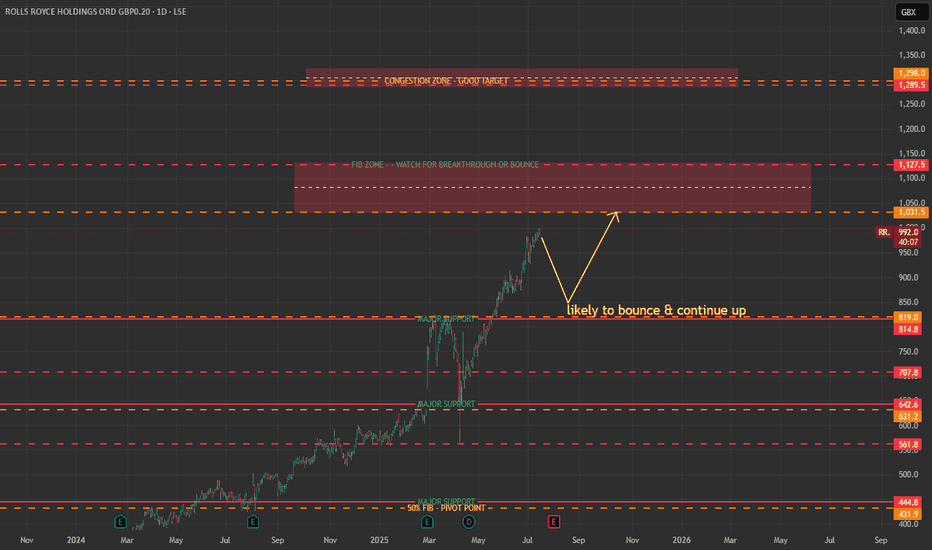

- Rolls-Royce reversed from round support level 1000.00

- Likely to rise to resistance level 1100.00

Rolls-Royce recently reversed from the support zone between the round support level 1000.00 (former resistance from July), support trendline of the daily up channel from May, lower daily Bollinger

Market Watch: Rolls Royce📈 Since April, the stock has almost doubled, running in a very strong bull trend. Right now though, it looks like that move is pausing:

• Current resistance around 1111.5 vs. the previous high of 1109 → clear consolidation zone

• Loss of upside momentum with the daily RSI flattening

• Key support si

Rolls-Royce – Alarm Bells Ringing: Ending Diagonal Risk3-Day Chart

PATTERN

• The rise from 6.58 € is unfolding as a corrective wave,

sketching a classic five-leg **Ending Diagonal**.

• Overlapping candles, slowing momentum and converging

trendlines confirm the terminal nature of the move.

KEY GUIDELINES

1. **White rising trendline** = last line of

RR > Gate Closed >Recent price action suggests a potential double-bottom formation near the prior resistance level at the current low of circa 530's. A failure to break above this level could lead to further downside pressure, with the next support level anticipated around the psychological level of 500.😍

Will Rolls Royce print 60% correction to 180p?Since the long idea (linked below) price action has melted up 600% in only 21 months. Astonishing. A plethora of long ideas are now published, including on this platform.

The Motley Fool, July 11th - recommended buy

“Rolls-Royce’s share price looks very undervalued to me, with strong business grow

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

RYCEF5062062

Rolls-Royce Plc 5.75% 15-OCT-2027Yield to maturity

—

Maturity date

Oct 15, 2027

XS181957492

Rolls-Royce Plc 1.625% 09-MAY-2028Yield to maturity

—

Maturity date

May 9, 2028

XS224432208

Rolls-Royce Plc 4.625% 16-FEB-2026Yield to maturity

—

Maturity date

Feb 16, 2026

XS224432178

Rolls-Royce Plc 5.75% 15-OCT-2027Yield to maturity

—

Maturity date

Oct 15, 2027

60LZ

Rolls-Royce Plc 3.375% 18-JUN-2026Yield to maturity

—

Maturity date

Jun 18, 2026

42XB

Rolls-Royce Plc 3.625% 14-OCT-2025Yield to maturity

—

Maturity date

Oct 14, 2025

49WN

Rolls-Royce Plc 5.75% 15-OCT-2027Yield to maturity

—

Maturity date

Oct 15, 2027

43AB

Rolls-Royce Plc 3.625% 14-OCT-2025Yield to maturity

—

Maturity date

Oct 14, 2025

49VS

Rolls-Royce Plc 5.75% 15-OCT-2027Yield to maturity

—

Maturity date

Oct 15, 2027

49WA

Rolls-Royce Plc 4.625% 16-FEB-2026Yield to maturity

—

Maturity date

Feb 16, 2026

See all RRU bonds

Curated watchlists where RRU is featured.

Frequently Asked Questions

The current price of RRU is 12.58 EUR — it has increased by 0.32% in the past 24 hours. Watch Rolls-Royce Holdings plc stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange Rolls-Royce Holdings plc stocks are traded under the ticker RRU.

RRU stock has risen by 1.29% compared to the previous week, the month change is a 1.13% rise, over the last year Rolls-Royce Holdings plc has showed a 124.64% increase.

We've gathered analysts' opinions on Rolls-Royce Holdings plc future price: according to them, RRU price has a max estimate of 16.64 EUR and a min estimate of 10.40 EUR. Watch RRU chart and read a more detailed Rolls-Royce Holdings plc stock forecast: see what analysts think of Rolls-Royce Holdings plc and suggest that you do with its stocks.

RRU stock is 2.27% volatile and has beta coefficient of 1.20. Track Rolls-Royce Holdings plc stock price on the chart and check out the list of the most volatile stocks — is Rolls-Royce Holdings plc there?

Today Rolls-Royce Holdings plc has the market capitalization of 103.74 B, it has increased by 2.35% over the last week.

Yes, you can track Rolls-Royce Holdings plc financials in yearly and quarterly reports right on TradingView.

Rolls-Royce Holdings plc is going to release the next earnings report on Feb 26, 2026. Keep track of upcoming events with our Earnings Calendar.

RRU earnings for the last half-year are 0.18 EUR per share, whereas the estimation was 0.11 EUR, resulting in a 63.27% surprise. The estimated earnings for the next half-year are 0.14 EUR per share. See more details about Rolls-Royce Holdings plc earnings.

Rolls-Royce Holdings plc revenue for the last half-year amounts to 10.55 B EUR, despite the estimated figure of 10.34 B EUR. In the next half-year revenue is expected to reach 11.95 B EUR.

RRU net income for the last half-year is 5.15 B EUR, while the previous report showed 1.66 B EUR of net income which accounts for 210.37% change. Track more Rolls-Royce Holdings plc financial stats to get the full picture.

Rolls-Royce Holdings plc dividend yield was 1.06% in 2024, and payout ratio reached 19.96%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 3, 2025, the company has 42.21 K employees. See our rating of the largest employees — is Rolls-Royce Holdings plc on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Rolls-Royce Holdings plc EBITDA is 4.57 B EUR, and current EBITDA margin is 16.78%. See more stats in Rolls-Royce Holdings plc financial statements.

Like other stocks, RRU shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Rolls-Royce Holdings plc stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Rolls-Royce Holdings plc technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Rolls-Royce Holdings plc stock shows the buy signal. See more of Rolls-Royce Holdings plc technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.