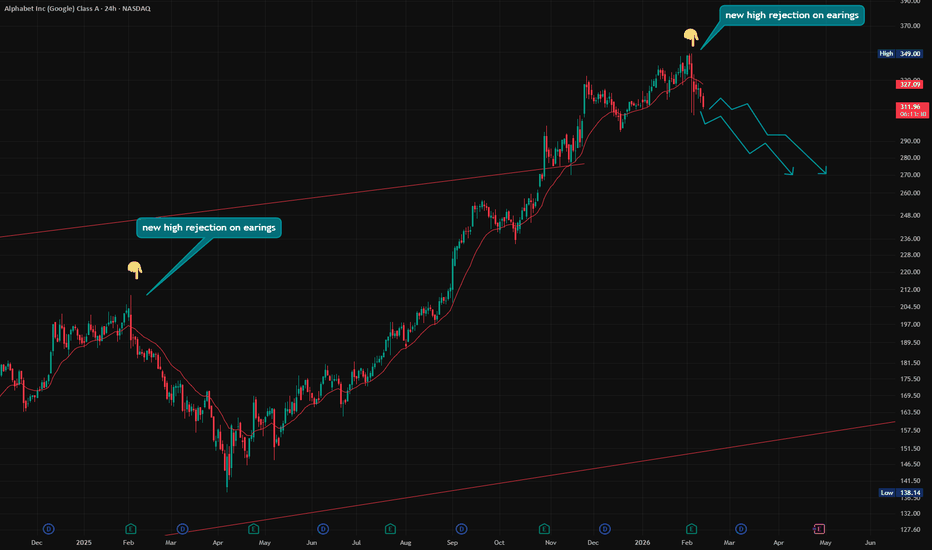

Alphabet - The only surviving stock!🏅Alphabet ( NASDAQ:GOOG ) is clearly not bearish yet:

🔎Analysis summary:

The entire tech sector is currently collapsing. But Alphabet remains totally strong and is sitting close to new all time highs. But considering that current retest of the major resistance trendline, a short term pullback

Alphabet Inc. Class C

No trades

Key facts today

In January 2026, Google issued $45 billion in bonds to fund AI infrastructure. In February, it launched a seven-part debt program, including a 100-year note, to support this expansion.

Google is being investigated by the EU for allegedly manipulating ad prices on its search engine, focusing on auction practices that may be raising costs for advertisers.

The U.S. Department of Justice is investigating major tech firms, including Google, after the exit of its former leader, Gail Slater.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9.30 EUR

112.53 B EUR

343.09 B EUR

5.05 B

About Alphabet Inc (Google) Class C

Sector

Industry

CEO

Sundar Pichai

Website

Headquarters

Mountain View

Founded

2015

IPO date

Aug 19, 2004

Identifiers

3

ISIN US02079K1079

Alphabet, Inc. is a holding company, which engages in software, health care, transportation, and other technologies. It operates through the following segments: Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services, such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment refers to infrastructure and platform services, collaboration tools, and other services for enterprise customers. The Other Bets segment relates to the sale of healthcare-related services and internet services. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

Related stocks

Google Short - Target $312Hello Traders,

After the recent impulsive move up into the 349–350 area and subsequent displacement lower, price is now retracing back into a prior supply / inefficiency zone between 338–342.

This zone aligns with:

Previous intraday structure (LH area)

Local imbalance

Premium range within current

GOOGL Stock Analysis | Pullback Within an Established Uptrend🎯 GOOGL: The Great Heist Setup | Moving Average Pullback Play 💰

📊 Market Intelligence Brief

Asset: GOOGL (Alphabet Inc.) - NASDAQ

Strategy Type: Day/Swing Trade - Bullish Momentum

Risk Profile: Medium | Reward Potential: High 🚀

🔍 THE MASTER PLAN

We're eyeing a classic moving average pullback scenar

Alphabet ($GOOGL) is likely heading back toward at least $270.Alphabet ( NASDAQ:GOOGL ) is likely heading back toward at least $270.

Four reasons: 👇

- New high rejection on earnings. We saw a similar setup about a year ago — markets often repeat behavior.

- The 2025 trend showed a late-stage acceleration, which historically often precedes a reversal.

- The

GOOGL Weekly Rebound Setup: Institutional Flow Signals Upside GOOGL QuantSignals V4 — Weekly Bullish Rebound Trade

Signal: BUY CALLS

Conviction: Moderate

Alpha Score: 72

Time Horizon: Weekly (Exp: Friday)

Projected Move: +2.5–3%

👉 Primary Thesis: Smart-money call accumulation + heavy call OI near $325 creates a magnetic effect for price, supporting a ta

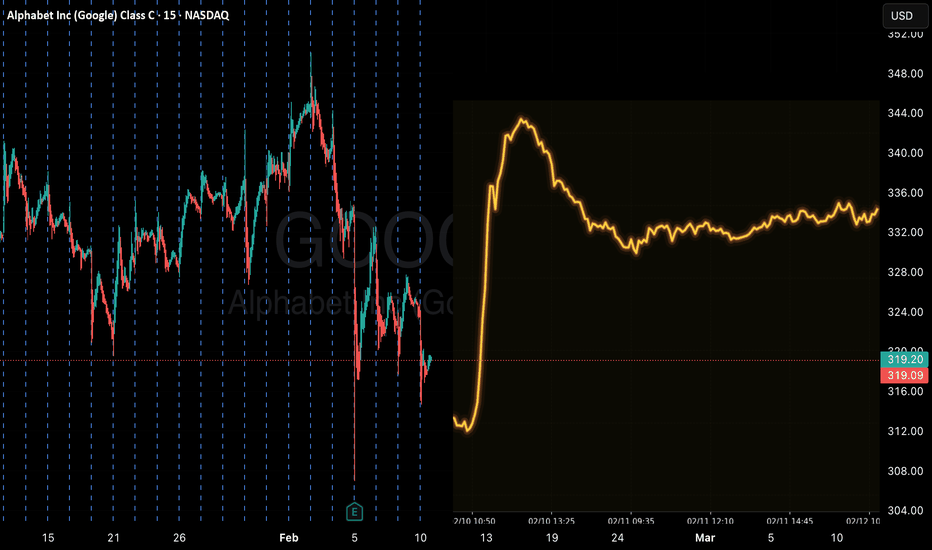

Google Holds Below $350 Ahead of EarningsAlphabet (Google) shares have fallen more than 4.5% over the last two sessions, heading into today’s earnings release. The market is awaiting Q4 2025 results, with expectations pointing to revenue of around $111 billion, which would represent approximately 15% year-over-year growth, along with an ex

The 2nd Phase of AI Technology is UnderwayThis tutorial is about discovering how new technologies such as AI have several phases over many years which create growth and speculation in the leading companies.

There are always 3 top contenders for a new technology sub industry. A sub industry is an industry that is within the primary industry

GOOG:Wave(3)Truncated 350.15 – Wave (4) Deepens, Targets 315-320GOOG has shown clear signs of truncation in Wave (3) at 350.15 (failed to reach the projected 360 level), invalidating the prior impulsive extension and confirming the ongoing A-B-C corrective Wave (4) from the 341.20 high.

Primary Count (Orange Line – 5-3-5 structure):

Wave (3) truncated, curren

GOOG: Will Buyers Defend the Earnings Low Again?Google Cloud grew ~48% YoY last quarter, outpacing Microsoft’s cloud growth. The market narrative remains clear: Google is viewed as an AI winner, and that perception hasn’t shifted.

After earnings, GOOG opened weak at 312.22 but aggressively reversed intraday to 331.25. That move signaled clear re

GOOG bullback shall be considered as compelling opportunityGiven massive volumes on April tariffs shake-outs, I believe that Google started a new major impulse run.

What I counted with black digits is wave 1 in bigger 5-waves structure.

I will buying around $260-270 as I believe this pullback might end around 38.2 fib of wave 3. However, technically, it

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of ABEC is 260.50 EUR — it has increased by 0.17% in the past 24 hours. Watch Alphabet Inc. Class C stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on HAM exchange Alphabet Inc. Class C stocks are traded under the ticker ABEC.

ABEC stock has fallen by −5.23% compared to the previous week, the month change is a −8.30% fall, over the last year Alphabet Inc. Class C has showed a 46.33% increase.

We've gathered analysts' opinions on Alphabet Inc. Class C future price: according to them, ABEC price has a max estimate of 373.22 EUR and a min estimate of 230.00 EUR. Watch ABEC chart and read a more detailed Alphabet Inc. Class C stock forecast: see what analysts think of Alphabet Inc. Class C and suggest that you do with its stocks.

ABEC reached its all-time high on Feb 2, 2026 with the price of 292.40 EUR, and its all-time low was 28.25 EUR and was reached on Oct 8, 2015. View more price dynamics on ABEC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ABEC stock is 0.63% volatile and has beta coefficient of 1.12. Track Alphabet Inc. Class C stock price on the chart and check out the list of the most volatile stocks — is Alphabet Inc. Class C there?

Today Alphabet Inc. Class C has the market capitalization of 3.17 T, it has decreased by −5.43% over the last week.

Yes, you can track Alphabet Inc. Class C financials in yearly and quarterly reports right on TradingView.

Alphabet Inc. Class C is going to release the next earnings report on Apr 28, 2026. Keep track of upcoming events with our Earnings Calendar.

ABEC earnings for the last quarter are 2.40 EUR per share, whereas the estimation was 2.24 EUR resulting in a 7.04% surprise. The estimated earnings for the next quarter are 2.19 EUR per share. See more details about Alphabet Inc. Class C earnings.

Alphabet Inc. Class C revenue for the last quarter amounts to 96.92 B EUR, despite the estimated figure of 94.78 B EUR. In the next quarter, revenue is expected to reach 89.61 B EUR.

ABEC net income for the last quarter is 29.34 B EUR, while the quarter before that showed 29.81 B EUR of net income which accounts for −1.59% change. Track more Alphabet Inc. Class C financial stats to get the full picture.

Yes, ABEC dividends are paid quarterly. The last dividend per share was 0.18 EUR. As of today, Dividend Yield (TTM)% is 0.27%. Tracking Alphabet Inc. Class C dividends might help you take more informed decisions.

Alphabet Inc. Class C dividend yield was 0.26% in 2025, and payout ratio reached 7.68%. The year before the numbers were 0.32% and 7.46% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 13, 2026, the company has 190.82 K employees. See our rating of the largest employees — is Alphabet Inc. Class C on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Alphabet Inc. Class C EBITDA is 131.04 B EUR, and current EBITDA margin is 38.17%. See more stats in Alphabet Inc. Class C financial statements.

Like other stocks, ABEC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Alphabet Inc. Class C stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Alphabet Inc. Class C technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Alphabet Inc. Class C stock shows the buy signal. See more of Alphabet Inc. Class C technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.