Trade ideas

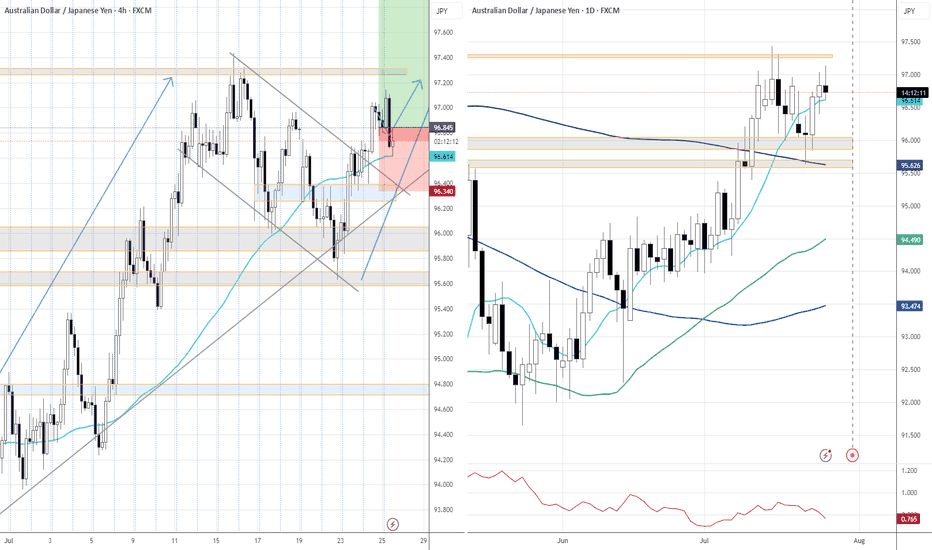

AUDJPY 4Hour TF - August 3rd,2025🟦 AUDJPY 4H Analysis Bearish Idea

📅 August 3rd, 2025

🔹 Top-Down Trend Bias:

• Monthly – Bullish

• Weekly – Bullish

• Daily – Bullish

• 4H – Bearish

AUDJPY has broken cleanly below prior structure around 96.15, signaling short term bearish momentum within a higher timeframe bullish environment. Price is currently approaching key decision zones.

🔍 Key Zone: 96.15 – 96.45

This former support zone may now act as a bearish retest area and new resistance. This offers a potential entry for continuation plays if structure holds below.

✅ Scenario A: Bearish Continuation (Blue Path)

1.If price retests and rejects from 96.15–96.45

2.Look for bearish confirmation (rejection wicks, engulfing, LTF structure shift)

Target: 94.50

This setup is trend aligned with current 4H momentum and offers a clean structure based downside.

⚠️ Scenario B: Bullish Reclaim (Orange Path)

1.If price breaks and holds above 96.45

2.Could signal a shift back toward higher timeframe bullish continuation

Target: 97.20 resistance zone

This is a counter-trend idea on the 4H and requires confirmation

🧠 Final Notes

• Short-term bearish bias while price remains below 96.45

• Let the retest confirm the direction

• Clean structure = clean setups

AUD/JPY H4 SHORT SETUP – 4 August 2025📊 Trade Plan: AUD/JPY – August 2025

🧠 Summary:

AUD/JPY has broken a clear ascending channel and retested the breakdown area, aligning with a marked sell zone. Institutional data supports JPY strength and AUD weakness, while trend projections suggest downside momentum into mid-August.

1. Technical Analysis (4H Chart)

Channel Break: Price broke below the rising trendline after a multi-week uptrend.

Sell Zone: 95.98 area, acting as broken structure + pivot resistance.

TP Target: ~92.30 — near key historical support and S2 area.

Bearish Structure: Lower highs forming after failed breakouts above 97.15.

Pivot Resistance & Supply Clusters align with the sell zone.

🔔 Technical Bias: Bearish

2. COT (Commitment of Traders) Sentiment

Currency Long % Short % Δ Weekly

AUD 20.22% 79.78% +1.14% (slightly more bearish)

JPY 68.99% 31.01% -5.01% (stronger bullish sentiment)

Institutions are highly short AUD and long JPY, supporting bearish AUD/JPY.

🔔 COT Bias: Strongly Bearish

3. Retail Sentiment

Retail Traders:

64% long AUD/JPY, 36% short.

This contrarian signal supports a bearish bias, since retail is heavily long while price is breaking down.

🔔 Retail Bias: Bearish

4. Trend Projection

All models (green, black, red) suggest:

Short-term bounce around 96.5–97.2

Medium-term decline into 95.5, 95.0, then 94.5–94.0 by Aug 6–7

Bearish scenario points to 93.5 and lower.

🔔 Projection Bias: Bearish

Focus sell on AJHappy weekend guys. On last week AJ has formed a huge engulfing candle bear. Looking closer at small time frame, price has formed a double top and it had actually broker the neckline to end the week. I am going to find any possible short setups, targeting 1:1 on this formation. It does seem start to continue the downtrend at long term though...

AUDJPY-Inverted Head & Shoulders Pattern at Reversal levelThe AUDJPY pair has formed a classic Inverted Head and Shoulders pattern, typically a strong bullish reversal signal. As seen on the daily chart, the left shoulder, head, and right shoulder have all developed with a clearly defined neckline near the 95.80–96.00 zone. Price action recently broke above this neckline but has since entered a consolidation phase between 95.00–97.00.

Bullish Scenario (Breakout Confirmation)

If AUDJPY decisively breaks above the 97.00 resistance with strong bullish momentum and volume, the inverted head and shoulders pattern will be fully confirmed. In this case, traders can expect an upward continuation toward:

Short-term Target: 99.00

Medium-term Target: 101.00

Measured Move Target: ~102.00 based on pattern height

Risk:

False breakout followed by quick pullback under neckline

Sudden JPY strength due to geopolitical or fundamental news

AUD weakness due to interest rate decisions or economic data

Sideways/Neutral Scenario (Extended Consolidation)

Another possibility is that AUDJPY continues to range between 95.00–97.00 for an extended period without a decisive breakout. This may happen if the market awaits more macroeconomic cues or central bank guidance.

Risk:

Whipsaws and fakeouts within the range

Frustration due to lack of clear direction

Risk Management Tips:

Wait for confirmation: Only trade post breakout or breakdown with candle close above 97.00 or below 95.00

Use tight stop-loss: Keep stops just below support or above resistance zones

Position sizing: Avoid overleveraging in rangebound conditions

Diversify exposure: Don’t put all capital into one trade setup

Conclusion:

AUDJPY is at a critical decision point. The inverted head and shoulders structure is bullish in nature, but the current consolidation adds uncertainty. Traders should stay alert for either a breakout for trend continuation or a breakdown invalidating the setup. Use proper risk management in all cases.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

AUDJPY at Resistance: Could we see a reversal here?The market on this pair shows us a classic scenario where price presses into a resistance zone after a sustained bullish move. Price action approaching this zone appears hesitant, with smaller candles and wicks showing signs of exhaustion, meaning the possibility that buying momentum is weakening. There is a clear intention in this structure and I am anticipating a reversal here.

My first target (TP1) at 95.400 is placed just above a previous structure low and it’s a logical level for a partial exit, as price may pause or react there. The second target (TP2), placed even lower, hints at a full mean reversion idea targeting the origin of the previous bullish leg.

The setup requires patience, waiting for confirmation perhaps in the form of a strong bearish rejection before committing to the short. Overall, it’s a disciplined setup that mirrors the kind of analysis I like to gravitate toward: structured, simple and driven by high probability reversal zones.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDJPY: goodbye uptrend?On the 4H chart, AUDJPY has printed a textbook double top pattern, breaking the rising trendline and diving below the 95.6–95.78 support zone - now acting as resistance. The pair is currently retesting this zone from below, which often provides a clean re-entry point for bears.

This area also aligns with the 0.705–0.79 Fibonacci retracement, reinforcing it as a key resistance. If the price rejects this zone, the next target is 93.85 (1.618 Fibo projection), followed by 93.25 and potentially 91.71 if momentum strengthens.

Fundamentally, the yen gains strength on risk-off flows and diverging rate expectations, while the Australian dollar is pressured by falling commodity prices and a likely pause from the RBA. This widens the rate differential and weakens AUD.

As long as price remains below 95.78, sellers are in control. Watch for a rejection from this retest zone.

AUDJPY Technical & Order Flow AnalysisOur analysis is based on a multi-timeframe top-down approach and fundamental analysis.

Based on our assessment, the price is expected to return to the monthly level.

DISCLAIMER: This analysis may change at any time without notice and is solely intended to assist traders in making independent investment decisions. Please note that this is a prediction, and I have no obligation to act on it, nor should you.

Please support our analysis with a boost or comment!

AUD/JPY bulls eye 99, 100The yen is broadly weaker, which is even allowing a weaker Australian dollar to rise. And with a decent bullish trend on the daily chart, I am now seeking dips within a recent consolidation range in anticipation of a move to 99 or even 100.

Matt Simpson, Market Analyst at City Index and Forex.com

AUD/JPY POSSIBLE SETUPThis pair has made a clean 3-leg pullback into a solid resistance zone.

Price action is now near the 50 EMA — a key area we watch closely.

From here, we’re waiting for confirmation:

✅ Strong volume

✅ Aligned momentum

✅ A clear engulfing candle

If all of that lines up, we’ll drop to the 1-hour chart and look for a precise entry trigger using the VMS strategy.

Patience first. Execution second.

Let the setup come to you.

AUDJPY Bullish Continuation Key Support and Resistance Levels

Resistance Level 1: 97.527

Resistance Level 2: 98.091

Resistance Level 3: 99.00

Support Level 1: 96.00

Support Level 2: 95.574

Support Level 3: 95.060

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

AUDJPY Poised to Start a Distribution Phase to 98.70AUDJPY Poised to Start a Distribution Phase to 98.70

On the 60-minute chart, AUDJPY has completed the accumulation phase, and it appears that AUDJPY is preparing for a breakout phase.

This is happening on the 60-minute chart.

The price that has already formed a pattern has a lower form and chances are that it may fall further from this area.

If this happens, AUDJPY may start another impulsive downward move.

In the overall picture, AUDJPY faced a strong resistance near 97.30 and is indicating a downward move to 95.70.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Falling towards overlap support?AUD/JPY is falling towards the pivot, which has been identified as an overlap support and could bounce to the 1st resistance.

Pivot: 95.65

1st Support: 94.82

1st Resistance: 96.69

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

AUD-JPY Bearish Breakout! Sell!

Hello,Traders!

AUD-JPY made a bearish

Breakout of the rising support

Line and we are bearish biased

So we will be expecting a

Further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDJPY - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

AUDJPY – DAILY FORECAST Q3 | W31 | D30 | Y25

📊 AUDJPY – DAILY FORECAST

Q3 | W31 | D30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:AUDJPY

AUD/JPY Poised for Breakout After Liquidity Trap? 🔍 Key Observations:

🔻 Trendline resistance holding strong, forming lower highs.

📉 Sell-side liquidity resting just below horizontal support (marked zone).

💧 Price dipped into liquidity grab zone twice — sign of stop hunt.

🔁 Classic accumulation schematic forming — repeated sweeps before potential breakout.

📊 Volume divergence: Selling pressure weakening while liquidity is swept.

📉 RSI shows bullish divergence (price making lower lows, RSI making higher lows).

🔁 Rejection at RSI 40-level could indicate a bounce.

📈 Expectation:

One more fake breakdown below 96.500 could trigger aggressive buying — setting up a potential parabolic move toward 97.200+ if breakout occurs.