Natural Gas Building Momentum for a New Impulsive RallyNatural Gas Building Momentum for a New Impulsive Rally

On the 4-hour timeframe, Natural Gas is forming large continuation patterns, signaling potential for another upward move.

An accumulation phase was observed in early September 2025, followed by another at the beginning of October. As we enter a new month, the price may be preparing to launch a fresh impulsive leg to the upside, as illustrated in the chart, before entering another corrective phase.

Key target levels:

4.28

4.48

4.60

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Trade ideas

Time for a correction.Natural gas prices have surged by 50% over the past month, even with storage levels at record highs. Increased exports to Europe and recent cold temperatures have contributed to rising prices. For the next two weeks, warmer-than-usual temperatures are anticipated, which may lead to a price correction before the next increase. We still have plenty of time before the true winter season arrives(January-February), and prices cannot continue to rise exponentially indefinitely. This is an early entry to short, I will be looking to short heavily at $5.4

NATURAL GAS(XNGUSD) | Final Wave 2 Flush Before Mega Wave 3⚡ NATURAL GAS – The Final Flush Before the Supercycle ⚡

After topping out in 2005 , Natural Gas has spent nearly two decades inside a massive corrective structure — slowly grinding lower, retracing, and shaking out every long-term bull in sight.

What we’re seeing now could be the final leg of Wave 2 in that entire supercycle.

This ongoing correction, stretching from 2005 to now, is likely entering its final phase — an exhaustion move that could complete between $1.466–$1.413 .

This zone aligns perfectly with:

✅ Deep 0.786 Fibonacci retracement of the previous impulse

✅ Historical demand and structural support

✅ Liquidity resting beneath long-term lows

✅ Smart Money accumulation footprints beginning to show

If price stabilizes here, we could be witnessing the foundation of a new multi-year Wave 3 , which historically tends to be the most explosive move in the Elliott Wave cycle.

🧭 Technical & Structural Overview

📊 Elliott Wave View:

Wave 1: 2005–2021 impulsive phase

Wave 2: 2021–present, deep ABC correction (now in the C-wave)

Expected completion: $1.466–$1.413 zone

Next: Wave 3 lift-off → potential parabolic move

📐 Fibonacci & Wave Confluence:

0.786 retracement zone → $1.4–$1.5 (ideal Wave 2 termination area)

Wave 3 1.618 extension → $68

Supercycle 2.618 projection → $700+

🧠 Smart Money Concept:

Institutions love to accumulate during despair.

We can already see signs of a liquidity sweep , followed by potential accumulation and a pending market structure shift once price reclaims levels above $3.5–$4.0.

🌍 Fundamentals Align

Global LNG demand continues to rise, especially across Asia and Europe.

US export capacity and infrastructure expansion add long-term bullish pressure.

Supply investment remains underweight — a key setup for future price shocks.

Despite green energy growth, Natural Gas remains the bridge fuel for stability.

This macro alignment supports a generational reversal once the current flush completes.

🎯 Price Map

💎 Wave 2 Completion Zone: $1.466–$1.413

🚀 Wave 3 Target (1.618 ext): $60–$70

🌠 Supercycle Wave 5 (2.618 ext): $700+

⚠️ Invalidation: Sustained breakdown below $1.40

💬 Summary

Natural Gas is approaching the final phase of a two-decade correction — an extremely rare setup in macro wave structure.

When Wave 2 completes, the stage will be set for one of the strongest commodity bull waves in modern market history.

📈 “When the crowd sees destruction, smart money sees construction — and that construction may already be starting around $1.4.”

What are you seeing in your charts? Do you think the bottom is in, or do we need one more liquidity sweep first? 👇

#NaturalGas #NatGasUSD #ElliottWave #WaveAnalysis #SmartMoney #Fibonacci #MarketStructure #Commodities #EnergyMarkets #MacroCycle #CommoditySupercycle #Wave3Setup #TechnicalAnalysis #TradingView #Investing

Hear Me OutNatty’s October Pump – What’s Next?

Natural Gas ripped higher through October, right in line with seasonal tendencies. Historically, November tends to cool off as hedging activity stabilizes heading into winter—and early price action suggests that pattern is holding.

Weather Outlook

Late November: Forecasts point to colder conditions for the Midwest and East, which could boost heating demand. However, much of this has already been priced in from long-range models.

December: Current outlook leans toward a warm start, but the duration is uncertain. If warmth persists, expect reduced hedging and softer demand.

Fundamentals Snapshot

Storage: U.S. working gas in storage sits at 3,915 Bcf, about 162 Bcf above the 5-year average—the highest pre-winter level in five years.

Production: Lower-48 dry gas output is near 110 Bcf/d, an all-time high, up roughly 8% year-over-year.

Exports: LNG feedgas flows remain strong at ~17 Bcf/d, with new capacity ramping up. Pipeline exports to Mexico are also trending higher.

Power Burn: Slightly below last winter at ~31.6 Bcf/d versus 32.5 Bcf/d, as coal, nuclear, and renewables offset gas demand.

Technical Picture

Natty recently hit the 78.6% Fibonacci retracement near $4.40 from the March high, which acted as resistance. Current range:

Resistance: $4.40–$4.45

Support: $4.15

A break below $4.15 opens downside targets:

38.2% Fib: ~$3.94

50% Fib: ~$3.80

Major demand zone: ~$3.50

Momentum indicators are rolling over from overbought territory, suggesting a corrective phase before any renewed upside.

My Base Case

Expect a retracement toward $3.50–$3.80 by late December, assuming:

Warm December persists.

Storage remains above average.

No major polar vortex event.

I’ll reassess at that level for potential long setups into Q1.

Risk Scenarios

Bullish Risk: A sudden Arctic blast or prolonged cold in December could spike heating demand and trigger a short squeeze, pushing Natty back above $4.50.

Supply Risk: LNG export disruptions or pipeline outages could tighten balances unexpectedly.

Sentiment Angle

Hedge Funds: CFTC positioning shows managed money net longs have increased during the October rally but remain below historical extremes—room for more volatility.

Retail Bias: Social chatter leans bullish after the October pump, which often precedes corrective phases.

Natural Gas - Golden CrossWhen this signal occurs you better no how to trade it.

The golden cross has now occured on the daily chart.

This is the 50MA intersecting with the daily 200 MA.

This is a medium to long term bullish signal that suggests nat gas over $5.

In the very short term traders often take profits and gains but buying dips over the next several weeks is a high technical probable setup.

LNG Week 46: +40 BCF Build Beats 5-Yr Avg as Cold Snap Ends*Due to the platform's features, the charts are arranged in sequence from left to right, from the first to the tenth chart. The charts were created by our team and based on an analysis from Bloomberg and the EIA data. This analysis was conducted in cooperation with Anastasia Volkova, analyst of LSE.

Current prices compared to price dispersion 10 days before expiration, by month since 2010

December and winter contracts continue to rise, remaining well above the upper limit of the interquartile range. The current NGZ25 contract is trading above USD 4.5, which corresponds to the February 2026 contract and the December 2027 contract.

Forward curve compared to 2020-2025

The shape of the 2025 forward curve on nearby contracts has broken away from the 2023–2024 ranges, but contracts with delivery in two years and beyond continue to show clear price stabilization at historically stable levels.

Current stocks and forecast for next week compared to 2019-2024

According to the forecast for week 45 (November 7), gas reserves in underground storage facilities will increase by +40 BCF, which is higher than the average of +31 BCF for the past five years, but is within the upper quantile of 58 BCF. At the same time, the stock level will reach 3954 BCF, which corresponds to the 2024 level.

HDD+CDD based on current NOAA data and forecast for the next two weeks compared to 1994-2024

Current HDD+CDD values by region show maximum values for the previous 30 years of observations. After November 13, HDD is expected to decrease due to warming and return to average values and below.

HDD+CDD based on current NOAA data and forecast compared to 1994-2024 by region

In terms of regions, the sharp cold snap mainly affected the central regions and the South Atlantic. By November 13-14, temperatures are expected to return to average values.

Weekly total supply/demand difference compared to 2014-2024

On November 10, the difference between supply and demand in 2025 is in the middle range for 2014–2024, indicating a balance between supply and demand for this period.

Number of days for delivery from warehouses

The graph shows the number of days of supply from storage alone, based on current consumption levels. As of November 12, 2025, reserves are sufficient for approximately 30 days, which is below the historical minimum. With this level of reserves and consumption, even minor disruptions in production or spikes in demand could cause significant price reactions, especially in late winter and early spring.

Filling level of European storage facilities

The overall fill rate of European gas storage facilities as of November 12 is 82.2%, which is 8% below the average fill rate and 10% lower than last year. Seasonally, Europe is entering a period of withdrawal from storage facilities.

Filling level of European storage facilities by country

Particularly low storage levels of 60-80% are observed in Croatia, Denmark, Germany, Latvia, the Netherlands, and Slovakia. At the same time, storage levels in Poland, Italy, France, Romania, and Portugal have reached 90-100%.

Electricity generation by source

Compared to last week, the US48 energy balance for November 12, 2025, is characterized by an increase in gas generation (+1.5%) and coal generation (+1.6%) and a decrease in wind generation (-3%) and nuclear generation (-1%).

Natural Gas - The Short SqueezeNatural gas had another stellar rally today.

Bouncing hard off the 7 day moving average and making new weekly highs.

We have completed the measured bull flag move in the near term so an extra rally from here is pure shorts getting cooked in my opinion.

With price action rallying so far so quickly we pared back and secured some profits on our natural gas equity positions.

We sold our RRC December calls for 115% gain.

We trimmed our AR January calls for 65% gain.

We still have equity exposure and positions in profit so now it becomes a game of managing protecting profits.

In the near term I would not be surprised to see a minor pullback or 1-2 weeks of consolidation.

Is This the Start of the Next Natural Gas Upswing?💨 Natural Gas (XNG/USD) — “Profit Pathway Setup” 🎯 Swing / Day Trade Edition

📊 Market Overview:

The Energies Market is heating up — and Natural Gas is showing its next potential boom move! After a confirmed Moving Average Breakout, bulls are sneaking back in. 🕵️♂️

This setup blends discipline + creativity, using the Thief-Trader layered entry method — designed to catch price action efficiently while minimizing emotional errors. ⚙️

⚔️ Trade Plan (Bullish Setup):

Entry Zones (Layered Buys):

🟩 3.500

🟩 3.600

🟩 3.700

(You can expand your buy layers depending on your own comfort and risk plan.)

Stop-Loss (Thief SL):

🧯 3.350 — just below the nearest lower-low candle wick.

💬 Dear Ladies & Gentlemen (Thief OG’s) — this SL is a personal style choice, not a fixed rule. Manage your risk your way.

Target (Profit Escape Zone):

🎯 4.100 — a strong resistance + overbought + trap + distribution zone.

💬 Reminder: I’m not forcing my TP; you’re the boss of your own bag — make your profits, then take them! 💰

📈 Why This Setup Works:

🧠 Technical Confirmation: MA breakout = bullish continuation in progress.

🎯 Layering Strategy: Multiple limit orders reduce average cost + improve flexibility.

🏗️ Structural Setup: Clear accumulation → breakout → markup pattern emerging.

🧩 Exit Logic: Resistance + trap-zone = high-probability exit zone for profit capture.

🌍 Related Assets to Watch (Correlation Check):

💹 NYMEX:NG1! — Natural Gas futures benchmark, strong global mirror.

AMEX:UNG — U.S. NatGas ETF; sentiment confirmation.

🛢️ BLACKBULL:WTI / BLACKBULL:BRENT — closely tied to energy flow; when oil strengthens, gas often follows.

⚡ TVC:DXY — dollar strength can inversely impact commodity demand.

💵 FX:EURUSD — macro correlation to risk appetite across energy & FX.

Keep eyes on these pairs — their momentum helps confirm or contradict your NatGas bias. 👀

📌 Key Takeaways:

✅ Trend Bias: Bullish

💪 Setup Type: Swing / Day Trade hybrid

🧮 Risk : Reward: Favorable above 1 : 3

⏳ Holding Window: Short-term → Mid-term (2 – 5 days typical)

🧭 Trade Management: Stick to your plan — don’t chase, layer smart.

⚠️ Pro Tip:

If price breaks below 3.350, it’s a signal to step aside — no hero moves. 🛑

Price structure > emotions. Stay patient, and let the plan do the heavy lifting. 🧘♂️

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#NaturalGas #XNGUSD #EnergyTrading #SwingTrading #DayTrading #TechnicalAnalysis #BreakoutStrategy #CommodityTrading #ForexTrading #TradingIdeas #RiskManagement #MarketAnalysis #EnergyMarkets #TradingView #ChartAnalysis

Natural Gas - Bullish Long Term SignalNatural Gas rallied on inventories today.

Inventory report came in better than expected. 33B build vs 34B estimate.

Natural Gas is on the precipous of squeezing to $5.40

A golden cross is set to occur in the next few sessions....When the 50MA and the 200 MA crossover occurs it likely means the medium to long term price goes higher.

In the very near term that signal often results in some profit taking.

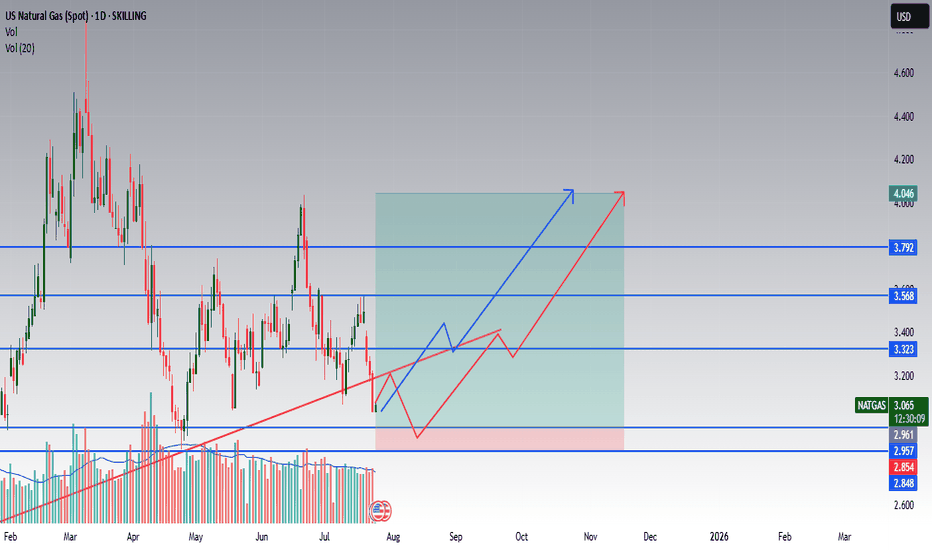

NATGAS Long Setup – Accumulation + Breakout OpportunityInstrument: US Natural Gas (Spot)

Timeframe: 1D

Published: July 24, 2025

By: @Rendon

📈 Idea Summary:

Natural gas is showing signs of accumulation after a corrective downtrend. Price recently tested key horizontal support around $2.96–$2.85 and is now attempting a recovery. Two potential bullish scenarios are outlined:

🧠 Bullish Scenarios:

🔵 Scenario A (blue path): Clean breakout above $3.32 with strong volume could lead to a continued push toward $3.56 → $3.79 → $4.05.

🔴 Scenario B (red path): Price may first retest the $2.96–$2.85 demand zone again before bouncing and gradually rallying toward $4.05.

🔍 Key Levels:

Support: 2.961 / 2.957 / 2.854

Resistance: 3.323 → 3.568 → 3.792 → 4.046

🛑 Invalidation:

A decisive close below $2.84 would invalidate the bullish thesis and suggest further downside risk.

📊 Volume Insight:

Volume has been drying up, which may indicate a potential spring or absorption before a breakout.

✅ Trade Plan (example):

Entry: On retest of $2.95 or break of $3.32

Stop Loss: Below $2.84

Target: First TP at $3.56, then trail toward $4.05

💬 Let me know in the comments how you see NATGAS developing and which path you’re betting on!

Cup and Handle Breakout On Natural GasNatural Gas price formed a smooth rounded base, a classic cup pattern.

Then, the breakout came with a strong bullish candle, confirming momentum has shifted fully in favor of the bulls.

After this breakout, we can expect a brief pullback.

As long as price holds above the breakout zone, the structure remains bullish.

The next leg higher is anticipated to target the 4.100 area, completing the measured move of the pattern.

In short, buyers are in charge, and this breakout looks ready to extend further.

Natural Gas Short Squeeze!Natural Gas has entered the weekly short squeeze level.

Another impeccable rally, it makes you wonder where the bullish fundamentals are coming from.

It hasn't been from the inventory level demand.

Perhaps their is a escalation or conflict brewing that we will be discovering soon enough.

We have been discussing the Nat GAs inventories and how they were into good accumulation levels.

If Nat gas can hold above that weekly high pivot it swing the probabilities in favor of a $5 target.

NATGAS Long and Short (B setup)My previous analysis for NATGAS didn't very well catch the upper channel. I have adjusted the upper current channel of NATGAS according to the CHOC that happened on the 4Hr on 28 AUG 2025. Thus, my currently 2 weeks plan is to target the upper channel with correction to the current support level at 3.138 near the lower channel.

The setup up is simple. My current bias shifted to bullish for next 2 months. Therefore, internal and external price action with POIs is my entry points for long and short, as is shown in this setup.

Warm November vs. Record LNG: Why Gas Holds $4Weather – Strong Bearish Driver: Actual NOAA forecasts (6–10d and 8–14d) are consistently warm, with a 70% probability of above-normal temperatures in key regions. This is a strong bearish factor for heating demand.

EIA: The latest report (Oct 30) showed a +74 Bcf injection vs. a +71 Bcf consensus. That’s a bearish factor. Total storage remains +171 Bcf above the 5-year average.

LNG exports: On October 25 we had a record 17.3 bcfd, and on November 1 the market expected 17.9 bcfd — a new all-time high. That’s +0.6 bcfd in a week, which is a lot for late October. A powerful bullish driver.

Storage is high and the weather is warm, but price is not falling because everyone is watching the LNG number at 17–18 bcfd.

Because of the U.S. government shutdown, CFTC (COT) reports are not being published. Nobody sees the real positioning of large funds.

Fundamentals are pushing down, technicals are pulling up, and the lack of COT does not allow the trend to be confirmed.

The seasonal weight of weather in November puts weather in the first place in terms of price impact.

Exports are very strong, almost record level — that’s why the market doesn’t want to drop even when weather and storage are “bearish.” In this context LNG acts as a support and explains why price is still holding below 4.20 instead of pulling back to 3.6.

Weather is bearish right now, which means you cannot just “relax and hold a trend long.”

The market has formed an upper range and will wait to see what changes first — a shift in NOAA (warmer/colder) or a drop/disruption in LNG. That’s what will drive the next move.

A short from a false breakout of 4.18 and buys from levels are intraday trades.

XNG ( Natural Gas)⚡ Natural Gas Showing Stronger Short-Term Potential Than WTI! 🌿

While crude oil (WTI) is struggling to find firm direction, Natural Gas is heating up with renewed momentum.

✅ Weather shifts are boosting short-term demand.

✅ Technical structure looks cleaner with higher lows forming.

✅ Fundamentals favor gas — seasonal consumption is rising while supply remains tight.

Meanwhile, WTI is consolidating under resistance, showing less conviction from buyers.

📊 Short-Term View:

👉 Natural Gas — Bullish Bias

👉 WTI Crude — Neutral

Energy markets often move together, but this time Natural Gas looks ready to lead the way. 🔥

#NaturalGas #WTI #Commodities #EnergyMarkets #TradingView #BullishSetup #GasVsOil #ShortTermTrade

Natural Gas Prices Hover Near a Three-Year HighNatural Gas Prices Hover Near a Three-Year High

As the XNG/USD chart shows today, natural gas prices are trading close to the March peak, which is the highest level since December 2022.

According to Trading Economics, the rise in gas prices has been driven by several factors:

→ Despite short-term warming in the US, weather models point to colder conditions ahead.

→ LNG exports remain elevated, as European buyers continue seeking alternatives to Russian gas. In November, average shipments across the eight major US terminals reached 17.8 billion cubic feet per day, exceeding the previous record of 16.7 billion in October.

→ The International Energy Agency expects global demand for oil and gas to continue rising until 2050, reflecting uncertainties surrounding the pace of the energy transition.

At the same time, chart analysis suggests that the upside potential may be limited.

Technical Analysis of XNG/USD

Price action is approaching a major resistance area, formed by:

→ the upper boundary of the channel, widened after the bullish breakout in late October;

→ the psychological level of $5.000 per MMBtu;

→ the previously mentioned March high.

Meanwhile, the more than 50% rally since early autumn has been significant, and long-position holders may be tempted to take profits. Therefore, if the price attempts to break above these resistance levels, it may result in a false bullish breakout (a buyer’s trap) followed by a pullback.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Is This the Start of a Fresh Bull Run in Natural Gas (XNG/USD)?🎯 XNG/USD Natural Gas: The Great Energy Heist! 💰⛽

📊 Market Overview

Natural Gas is setting up for a classic "Ocean's Eleven" style breakout! The 382 Triangular Moving Average has been breached by the bulls, and the trend confirmation is IN. Time to plan our strategic entry into this energy market opportunity!

🔥 The Master Plan: BULLISH Setup

Strategy Type: Swing/Day Trade - Cash Flow Management

Confirmation Signal: 382 Triangular Moving Average breached to the upside ✅

Entry Method: Buy the dip when TMA confirms the bullish trend

💎 Layered Entry Strategy (Scale In Like a Pro!)

⚠️ IMPORTANT: You can enter at ANY price level after the breakout confirmation! Set alerts on your trading platform to catch the breakout easily.

Recommended Entry Layers:

🎯 Layer 1: $3.100

🎯 Layer 2: $3.150

🎯 Layer 3: $3.200

🎯 Layer 4: $3.250

🎯 Layer 5: $3.300

This layering approach helps average your entry and reduces risk!

🛡️ Risk Management Zone

Stop Loss: $3.000

⚠️ Disclaimer: This is MY stop loss level based on my risk tolerance. YOU should determine your own stop loss based on YOUR risk management rules and account size. Trade at your own risk!

🎪 Target Zone: The Great Escape!

Primary Target: $3.600 🚀

Why $3.600? This level acts as:

🚧 Strong resistance (Police barricade zone!)

📉 Oversold bounce area

Potential bull trap zone

Exit Strategy: Lock in profits BEFORE reaching the target zone. Secure your gains and don't get greedy!

⚠️ Disclaimer: This is MY target based on my analysis. YOU should take profits at levels that match YOUR trading plan and risk tolerance. Always trade at your own risk!

🔗 Correlated Assets to Watch

Keep an eye on these related markets for confirmation:

AMEX:UNG (United States Natural Gas Fund) - Direct correlation

AMEX:BOIL (2x Leveraged Natural Gas ETF) - Amplified moves

AMEX:KOLD (Inverse Natural Gas ETF) - Opposite direction

AMEX:XLE (Energy Sector SPDR) - Broad energy sector correlation

NYMEX:CL1! (Crude Oil) - Energy sector correlation

COMEX:HG1! (Copper) - Industrial demand indicator

Key Correlation Point: Natural Gas often moves with broader energy sentiment. Watch crude oil and energy sector strength for confirmation of bullish momentum.

📝 Key Technical Points

✅ 382 Triangular Moving Average breakout = Trend confirmation

✅ Layered entries reduce average cost and risk

✅ Multiple timeframe confluence at target zone

✅ Energy sector showing relative strength

✅ Risk-reward ratio favors bulls above $3.000

⚡ Trading Notes

This setup combines technical precision with proper risk management. The TMA breach is a strong momentum indicator, and the layered entry approach allows for strategic position building. Remember to manage your position size according to your account and always have a plan before entering!

🎭 The "Thief Style" Disclaimer

🎪 FOR ENTERTAINMENT & EDUCATIONAL PURPOSES ONLY!

This "thief style" trading strategy is presented with a fun, heist-themed twist to make technical analysis more engaging. This is NOT financial advice. I'm not a licensed financial advisor, and you should NOT blindly follow any trading setup. Always do your own research, consult with licensed professionals, and never risk more than you can afford to lose. Trading is risky, and past performance doesn't guarantee future results. This is my personal analysis shared for educational purposes only! 🎭

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#NaturalGas #XNG #XNGUSD #EnergyTrading #SwingTrading #DayTrading #TechnicalAnalysis #TriangularMovingAverage #TMA #Breakout #BullishSetup #TradingStrategy #RiskManagement #LayeredEntry #CashFlowManagement #EnergyCommodities #NatGas #CommodityTrading #TrendTrading #PriceAction

XNGUSD, Accumulation to Expansion? Weekly Long Into Winter RiskI’ve initiated a long on Natural Gas from weekly structure. Price has rotated inside this area since ’23 and is now reacting at a confluence of trendline support + prior demand. The plan is to hold into Q4, when seasonality (heating demand + potential hurricane/LNG disruptions) often provides upside tailwinds. Risk is defined on the weekly chart; I’ll manage around swings and let the position work.

Technicals (Weekly)

• Range base reclaimed: Price is bouncing from the same 2023–2024 accumulation zone (roughly 2.5–3.0).

• Multi-touch trendline support: Current candle is reacting at the rising base trendline; wicks show responsive buying.

• Structure targets: First objective is a move back into mid-range supply; extension aims toward the upper band shown on the chart.

Fundamentals Supporting Long Bias

• Seasonality: Q4 typically brings rising Heating Degree Days across the Northern Hemisphere; winter risk premia often get priced ahead of the draw season.

• LNG pull: Ongoing ramp in global LNG demand + incremental U.S. export capacity tends to tighten the domestic balance on cold forecasts or unplanned outages elsewhere.

• Supply discipline: Gas rig counts have lagged after the 2024 price slump; that slower supply response can tighten later-year balances if weather cooperates.

• Weather & Gulf risk: Peak hurricane season can interrupt Gulf production and processing, periodically supporting price.

• Europe draw season: As EU storage transitions from injection to draws, import needs rise, keeping a bid under seaborne gas.

Trade Plan:

• Entry: From weekly support (see chart).

• Management: Trail below fresh higher lows on the daily; take partials at fib/structure levels; let a runner target the upper band if momentum broadens.

What Breaks the Thesis

• A persistently warm Q4, outsized storage overhang into winter, major LNG outages/delays, or a renewed surge in production that swamps demand.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

LNG Week 44: 80 BCF Storage Gain as Demand Edges Supply*Due to the platform's features, the charts are arranged in sequence from left to right, from the first to the Eighth chart. The charts were created by our team and based on an analysis from Bloomberg and the EIA data. This analysis was conducted in cooperation with Anastasia Volkova, analyst of LSE.

Current prices compared to price dispersion 10 days before expiration, by month since 2010

The expiration of the NGX25 contract was above the median according to data from 2010. Quotations for December and winter contracts for 2026 support growth and remain above the upper limit of the interquartile range.

Forward curve compared to 2020-2025

The shape of the forward curve in 2025 shows a steady convergence and is even closer to the configurations recorded in 2023 and 2024 for comparable dates. This trend is particularly evident in contracts with delivery in three years or more, where prices are steadily converging towards historical levels.

Current stocks and forecast for next week compared to 2019-2024

According to the forecast for week 43 (October 20-26), gas reserves in underground storage facilities will increase by +80 BCF, which is slightly above the average of +78 BCF for the past 5 years.

15-day sliding sum HDD+CDD based on current NOAA data and forecast for the next two weeks compared to 1994-2024

The current values of HDD+CDD accumulated over 15 days are in the average range for 1994–2024. The forecast for the coming week suggests that the values will exceed the average by 15–20 points, but in two weeks, there will be a trend toward returning to the average and below.

Accumulated HDD+CDD for 15 days based on current NOAA data and forecast compared to 1994-2024 by region

The current values of HDD+CDD accumulated over 15 days remain within the average range for 1994–2024. The forecast for the next two weeks suggests a return to the average weather trend in all regions.

Weekly total supply/demand difference compared to 2014-2024

This week, the difference between supply and demand in 2025 rose above the average values for 2014–2024, indicating that demand is growing faster than supply.

Number of days for delivery from warehouses

The graph shows the number of days of supply from storage facilities alone, based on current consumption levels. At the end of October 2025, reserves will last for approximately 34 days, which is below the lower limit of the interquartile range. With such a moderately reduced level of reserves, even minor disruptions in production or spikes in demand could cause sharp price reactions, especially in late winter and early spring.

Anomalies in weather (HDD+CDD) and fundamental factors

Overall, fundamental and weather factors are within the expected range, except for continued growth in consumption in the residential and commercial sectors caused by the start of the heating season. However, there has been no significant cooling at the start of the heating season so far.