Nasdaq 100 Index

No trades

About Nasdaq 100 Index

The NASDAQ-100 is an index that is constituted by 100 of the largest companies listed on the NASDAQ stock exchange, which is the second largest in the world only after the New York Stock Exchange by market capitalization. The companies that are listed in this index range from a variety of industries like Technology, Telecommunications, Biotechnology, Media, and Services. The NASDAQ-100 was first calculated in January 31 of 1985 by NASDAQ and it is a modified capitalization-weighted index. This index has been of good reference to investors that want to know how the stock market is performing without financial services companies, this given that the index excludes financial companies.

Related indices

Nasdaq 100 — Distribution? A Familiar Warning Sign...Back in October, when Bitcoin was trading well above 100k, I raised a rhetorical question:

👉 Were those three months of range trading above 100k actually distribution, not reaccumulation?

The market eventually answered.

It was distribution.

And today, BTC is trading in what many would define as b

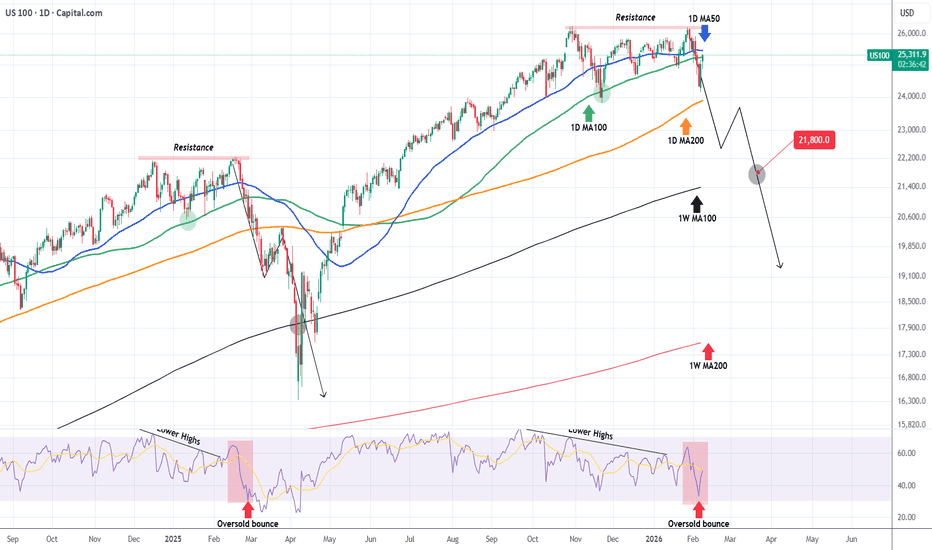

NASDAQ 's long-term consolidation resembles prior peaks.Nasdaq (NDX) has been practically trading sideways since October 30 2025. This 3-month consolidation resembles Nasdaq's last aggressive correction that started in late February 2025. As you can see both have a Resistance Zone that kept the consolidation valid until a 2nd rejection that (in the 2025

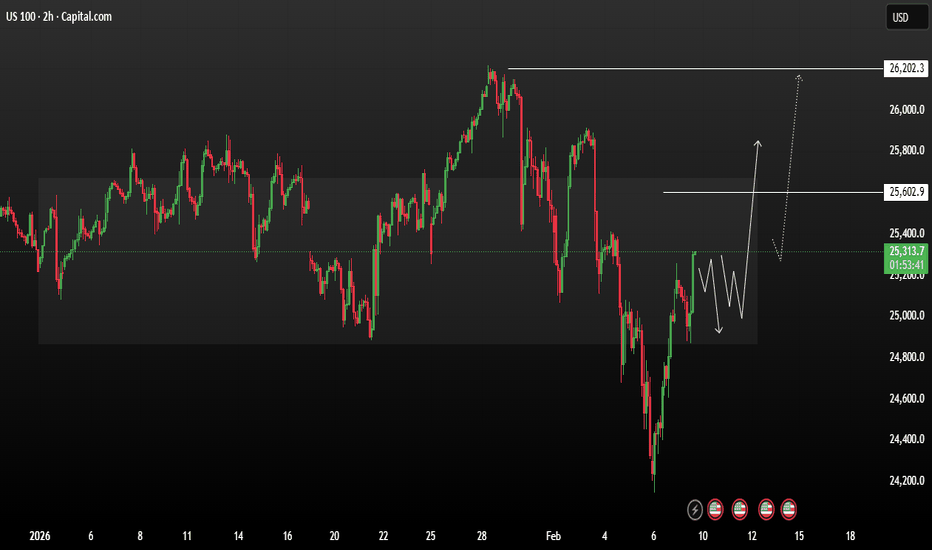

USNAS100 consolidation bullish range formationUS100 trading in a broad consolidation a rebound Price recently formed a strong bullish recovery from the February low near 24,300, followed by a corrective pullback and short-term range formation.

Tecnically Price is currently trading around 25,260, consolidating above the lower support zone near

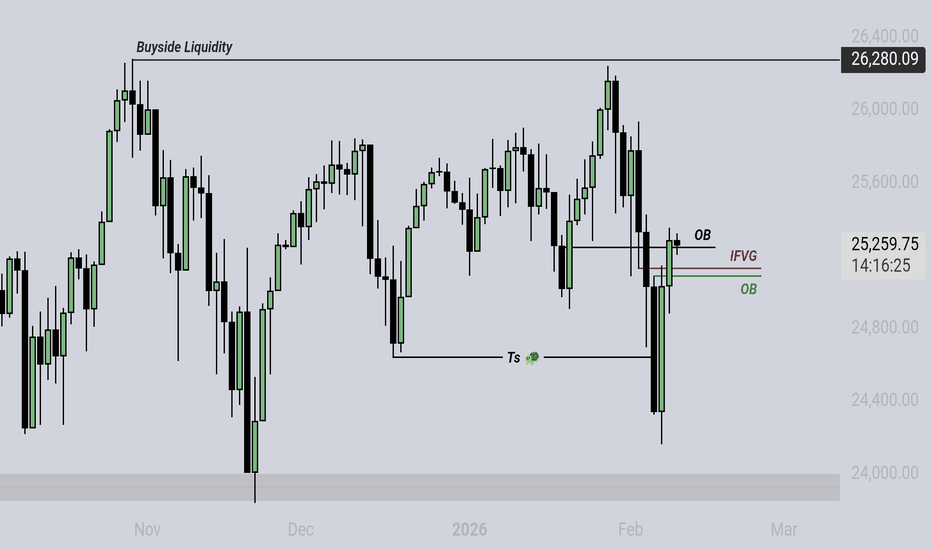

USNAS100 | Data Week Keeps Nasdaq Under PressureUSNAS100 | Futures Quiet Ahead of Key U.S. Jobs Data

Nasdaq futures remained subdued as investors awaited the delayed U.S. employment report, while continuing to monitor corporate earnings and the broader economic outlook.

Technical Outlook

The Nasdaq maintains a bearish structure while trading be

NAS100 H4 | Bullish RiseThe price is falling towards our buy entry level at 25,126.66, which is an overlap support.

Our stop loss is set at 24,342.56, which is a swing low support.

Our take profit is set at 25,843.81, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos

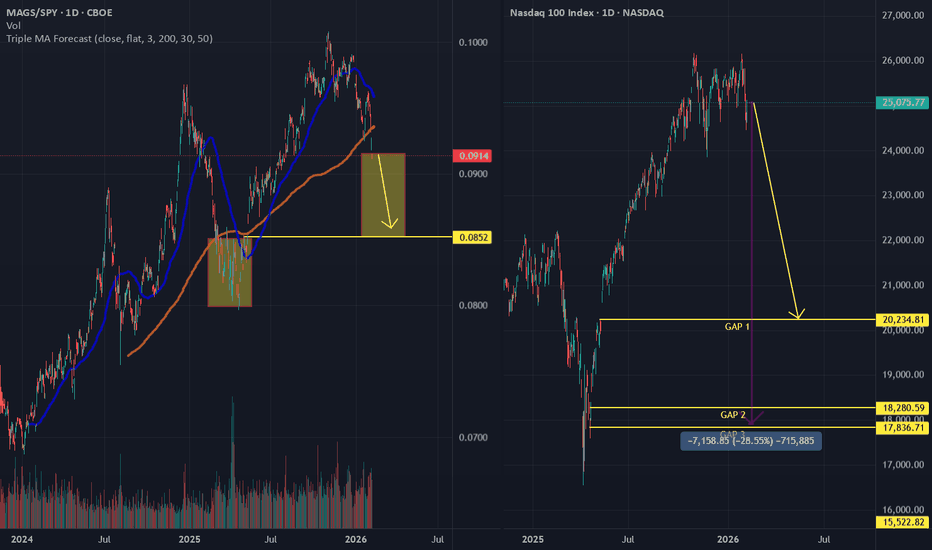

Nasdaq Crash Incoming: Wave 3 of 3 DownOver in this video, I go through the 5th wave up and identify 2 key things for this top:

1. Wave 5 = Wave 3, since wave 1 is the longest, wave 3 cannot be the shortest wave.

2. 2 Spinning tops marks the peak on 29th and 30th Oct 2025.

The first wave down is a "leading diagonal" because wave 4 overl

Most Traders Misunderstand Engulfing Candles… Here’s What I SeeI see it everywhere:

A big red candle appears → people immediately call it a bearish engulfing.

But after watching price action for a while, I realised something uncomfortable:

👉 Not every strong candle is an engulfing.

👉 And not every engulfing actually means reversal.

In the highlighted example

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's value movements over previous years to identify recurring trends.