How to search for an exchange and discover new assetsIn this video, we show you how to use the search box to find specific exchanges and discover new assets on those exchanges. Our goal is to make global financial data more open and accessible for all of our members. When you create a TradingView account, you instantly gain access to data from around the world.

To get started, head to the search box and type in the name of the exchange you're interested in and add a colon ":" to the end of it. For example, type "NYSE:" to see NYSE listed securities or "NSE:" to see NSE listed securities. You can do this for all of the exchanges listed on TradingView.

At the top right of the search dropdown is a button that says "All Exchanges." Click this to see all of the exchanges available to you and the region of the world they are based in. You can use this to refine your search and discover new exchanges.

If you have any questions, please write them in the comments below and our team will do their best to help. If you enjoyed this video tutorial, press the like button. Thanks for watching and we hope this tutorial helps you with your research, trading, and market knowledge.

Further reading:

- Chart Every US Listed Futures Contract From ICE

- Announcing New Data Feeds From Indonesia, Hang Seng, and More

- A Look Back at New Brokers, Exchanges, and Data on TradingView

Trade ideas

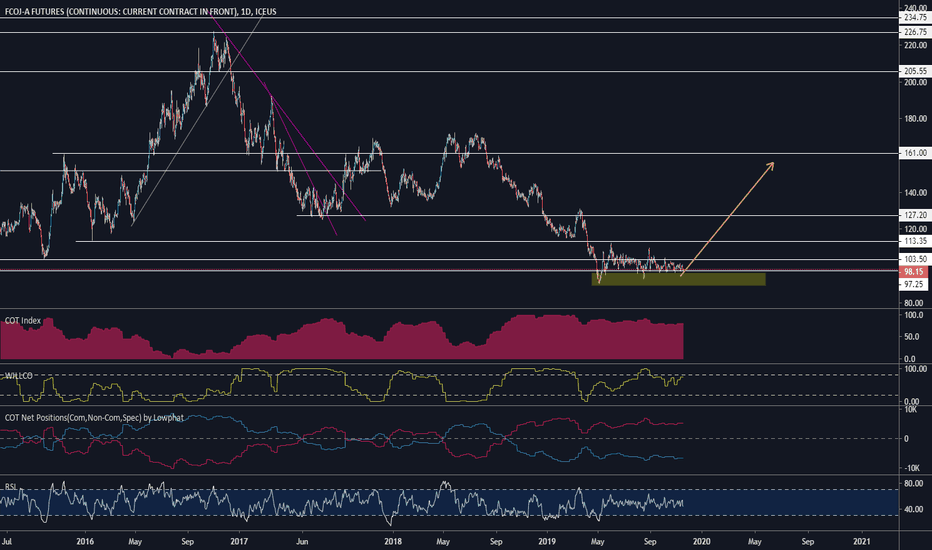

OJ THE SAFE HAVEN..

PROs:

Seasonally a good month for OJ

Broke through critical resistance at 122.05

Smart money hedgers are net long

Making higher lows on the weekly time frame, from the 6th March

Bearish sentiment amongst small speculators

OJ is in high demand due to COVID

Risk outlook is considered medium at this stage

CONs:

Demand is in a long term decline

Global oversupply of OJ

Negative divergence in play (2)

Highly volatile over the past 3 months (and in general)

Trading below strong overhead supply

Report:

The strong breakout above trendline resistance on the 20th of March 2020 at (1) was your first clue prices would probably head higher after ranging over the past 13 months. However, within a week OJ fell back to retest what is now dual support at (1), which was respected and has since bounced hard creating higher lows on the weekly time frame. The overall strength of this market is questionable as illustrated at (2).

Bottomcatcher’s Opinion: For short term traders a long position could be taken at the 124.00 handle with a stop loss in place at 121.35, and a target set at the 130.00 handle just below strong resistance at (3) and 50% fib level (taken from the highs of July 2018 and the lows of May 2019). For those in it for the long haul, a convincing break above resistance at (3) would be their buy signal with 145s as a first target, and 152s in extension as a second target to watch out for.

OJ Long - Our breakfast favourite a lot of OJ is going to be consumed whilst we stay at home with this COVID situation.

Demand is going up so price is going up

I might be a bit late to this party but let's see, COVID19 situation in USA is just starting and we know Americans like their OJ . #MakeAmericaGreatAgain

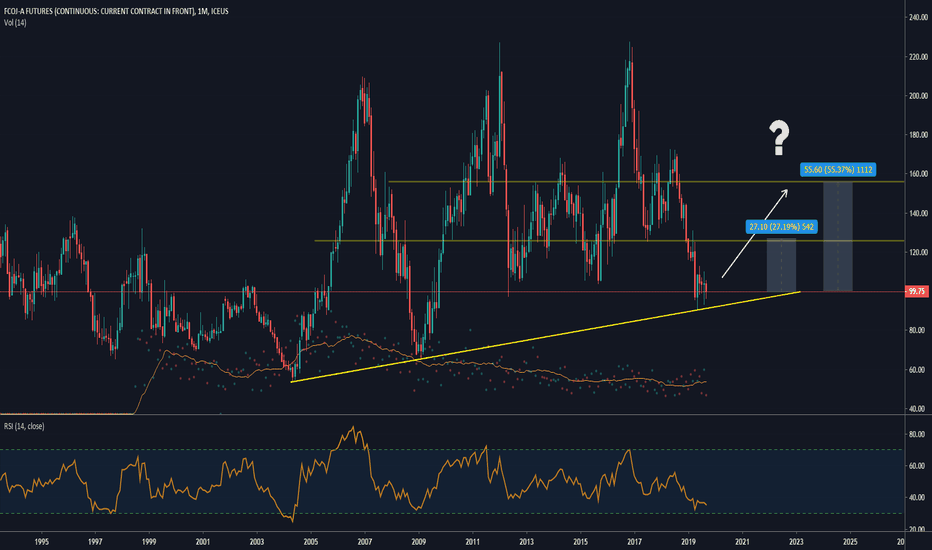

Is It Too Late To Buy Orange Juice ?The FCOJ-A futures contract is the world benchmark contract for the global frozen concentrated orange juice market.

Is it too late to buy Orange Juice ? I'll wait for the correction.

Disclaimer:

We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature,

and are therefore are unqualified to give investment recommendations.

Always do your own research and consult with a licensed investment professional before investing.

This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.

Orange Juice I have some strong evidence that orange juice has bottomed and we are starting a strong bullish trend, let’ go to the facts. First of all, we have non-commercials for the last 6 weeks taking profits in their shorts and this move has accelerated this week at the point that we got a COT signal to go long. The signal is triggered when the stochastics indicator applied to non-commercials net positions enter an overbought region, this means that they are pushing harder to the long side.

Well from risk-return it completes worth the shot here, if we are wrong the stop loss is very cheap and the price is accumulating for the first time after this massive downtrend.

After a little research in my database, I found two interesting news articles. The first one is from seeking alpha and what got my attention was this:

"In summary, dryness in Brazil will be closely watched by coffee traders in the weeks and months ahead. I believe staying long coffee will be a smart play into October. There are several teleconnections around the globe with respect to ocean temperatures, I watch, that will play a critical role for soybeans (SOYB), coffee, wheat (WEAT), orange juice and other commodities."

And this another of from the economist and my eyes were focused on this:

"But the pact should improve market access for French cheese, Brazilian orange juice, and Argentine fish, as well as car parts made in Europe, which now attract Mercosur tariffs of 14-18%."

Folks, in other words, this profit-taking has a reason, the demand for orange juice is about to increase globally so I conclude that this commodity is mispriced and we can profit from this.