Philip Morris (PM) — Strong Support or the Calm Before the Drop?

Short-Term Outlook (1–3 months)

Current Situation:

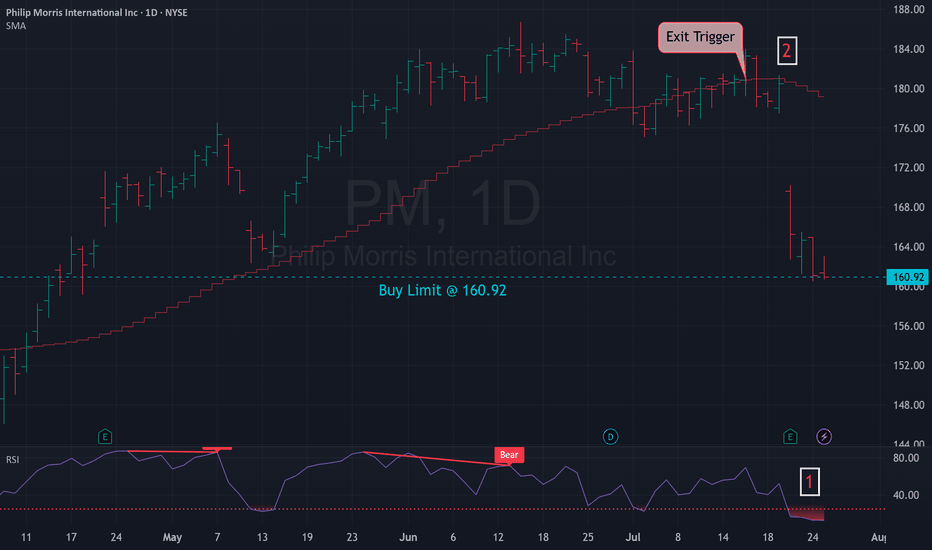

Philip Morris stock is trading around $153.39, sitting right on a key support zone. The price recently bounced after a sharp correction but now faces resistance near the 50-day moving average (around $158.30). This makes the coming days critic

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4 CHF

6.39 B CHF

34.23 B CHF

1.55 B

About Philip Morris International Inc

Sector

Industry

CEO

Jacek Olczak

Website

Headquarters

Stamford

Founded

1847

ISIN

US7181721090

FIGI

BBG000L8MM96

Philip Morris International, Inc. is a holding company, which engages in the business of delivering a smoke-free future and evolving a portfolio for the long term to include products outside of the tobacco and nicotine sector. It operates through the following geographical segments: Europe Region (Europe), South and Southeast Asia, Commonwealth of Independent States, Middle East, and Africa Region (SSEA, CIS, and MEA), East Asia, Australia, and PMI Duty Free Region (EA, AU, and PMI DF), and Americas Region (Americas). The Europe segment includes all the European Union countries, Switzerland, the United Kingdom, Ukraine, Moldova, and Southeast Europe. The SSEA, CIS, and MEA segment focuses on South and Southeast Asia, the African continent, the Middle East, Turkey, Israel, Central Asia, Caucasus, and Russia. The EA, AU, and PMI DF segment is involved in the consolidation of international duty-free business with East Asia and Australia. The Americas segment is comprised of the United States, Canada, and Latin America. The company was founded by Philip Morris in 1847 and is headquartered in Stamford, CT.

Related stocks

PM has reached important support Price has followed the broader trend structure outlined in prior updates since August and has now reached a key mid-term support zone, where at least a temporary bounce is likely.

Alternatively, a breakdown below 140 would increase the odds of a move toward 130 support.

On the macro time frame, the

Philip Morris Turning Point: Surge to $200 or Drop to $140?

Technical Analysis

Overall Trend: The stock is in an upward channel, and the ascending trendline (blue) has been validated multiple times, showing strong price reactions.

Moving Average: The price is fluctuating near the 50-day moving average, which acts as short-term support/resistance.

Key Supp

$PM Maintains a Strong Uptrend: Long at $147.17!Philip Morris International Inc. ( NYSE:PM ) is showing a “Strong Uptrend” on a 1-week chart. 📈 We bought at $109.86 and sold at $142.88 previously. Now at $169.17, we’re in a long position at $147.17. With a Trend Score of 8/8 and 100% signal alignment, the short-term projected price is $196.2 (

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US718172AU3

Philip Morris International Inc. 3.875% 21-AUG-2042Yield to maturity

5.60%

Maturity date

Aug 21, 2042

4I1L

Philip Morris International Inc. 4.25% 10-NOV-2044Yield to maturity

5.55%

Maturity date

Nov 10, 2044

4I1H

Philip Morris International Inc. 4.875% 15-NOV-2043Yield to maturity

5.52%

Maturity date

Nov 15, 2043

4I1E

Philip Morris International Inc. 4.125% 04-MAR-2043Yield to maturity

5.47%

Maturity date

Mar 4, 2043

PM3831486

Philip Morris International Inc. 4.5% 20-MAR-2042Yield to maturity

5.46%

Maturity date

Mar 20, 2042

PM3699035

Philip Morris International Inc. 4.375% 15-NOV-2041Yield to maturity

5.41%

Maturity date

Nov 15, 2041

US718172AC3

Philip Morris International Inc. 6.375% 16-MAY-2038Yield to maturity

5.12%

Maturity date

May 16, 2038

PM6217609

Philip Morris International Inc. 4.625% 29-OCT-2035Yield to maturity

4.95%

Maturity date

Oct 29, 2035

PM6064954

Philip Morris International Inc. 4.875% 30-APR-2035Yield to maturity

4.87%

Maturity date

Apr 30, 2035

PM5929960

Philip Morris International Inc. 4.9% 01-NOV-2034Yield to maturity

4.82%

Maturity date

Nov 1, 2034

PM5751981

Philip Morris International Inc. 5.25% 13-FEB-2034Yield to maturity

4.81%

Maturity date

Feb 13, 2034

See all PMI bonds

Curated watchlists where PMI is featured.

Frequently Asked Questions

The current price of PMI is 117 CHF — it has increased by 1.71% in the past 24 hours. Watch Philip Morris International Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SIX exchange Philip Morris International Inc. stocks are traded under the ticker PMI.

PMI stock has fallen by −5.56% compared to the previous week, the month change is a −4.80% fall, over the last year Philip Morris International Inc. has showed a 1.74% increase.

We've gathered analysts' opinions on Philip Morris International Inc. future price: according to them, PMI price has a max estimate of 178.37 CHF and a min estimate of 128.10 CHF. Watch PMI chart and read a more detailed Philip Morris International Inc. stock forecast: see what analysts think of Philip Morris International Inc. and suggest that you do with its stocks.

PMI stock is 1.71% volatile and has beta coefficient of 0.00. Track Philip Morris International Inc. stock price on the chart and check out the list of the most volatile stocks — is Philip Morris International Inc. there?

Today Philip Morris International Inc. has the market capitalization of 192.31 B, it has increased by 5.69% over the last week.

Yes, you can track Philip Morris International Inc. financials in yearly and quarterly reports right on TradingView.

Philip Morris International Inc. is going to release the next earnings report on Feb 5, 2026. Keep track of upcoming events with our Earnings Calendar.

PMI earnings for the last quarter are 1.78 CHF per share, whereas the estimation was 1.67 CHF resulting in a 6.95% surprise. The estimated earnings for the next quarter are 1.36 CHF per share. See more details about Philip Morris International Inc. earnings.

Philip Morris International Inc. revenue for the last quarter amounts to 8.64 B CHF, despite the estimated figure of 8.47 B CHF. In the next quarter, revenue is expected to reach 8.35 B CHF.

PMI net income for the last quarter is 2.76 B CHF, while the quarter before that showed 2.40 B CHF of net income which accounts for 14.86% change. Track more Philip Morris International Inc. financial stats to get the full picture.

Yes, PMI dividends are paid quarterly. The last dividend per share was 1.17 CHF. As of today, Dividend Yield (TTM)% is 3.60%. Tracking Philip Morris International Inc. dividends might help you take more informed decisions.

Philip Morris International Inc. dividend yield was 4.40% in 2024, and payout ratio reached 117.24%. The year before the numbers were 5.46% and 102.46% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Nov 11, 2025, the company has 83.1 K employees. See our rating of the largest employees — is Philip Morris International Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Philip Morris International Inc. EBITDA is 12.29 B CHF, and current EBITDA margin is 39.85%. See more stats in Philip Morris International Inc. financial statements.

Like other stocks, PMI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Philip Morris International Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Philip Morris International Inc. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Philip Morris International Inc. stock shows the neutral signal. See more of Philip Morris International Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.