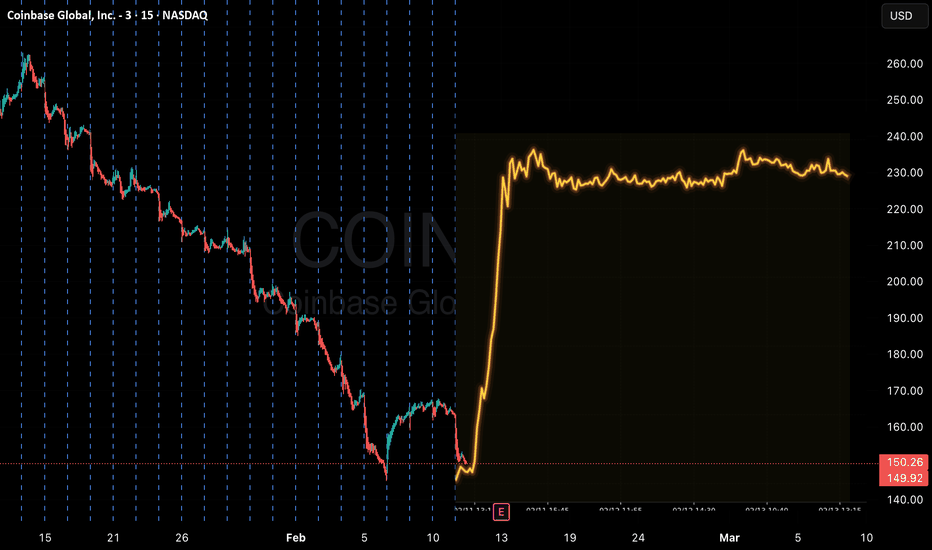

COINBASE $150 Target hit. Bear Cycle now enters Phase 2 to $55.More than 2 months ago (December 04 2025, see chart below), we gave a massive Sell Signal on Coinbase (COIN) as it was testing for several weeks its 1W MA50 (blue trend-line) without breaking above it:

Last week's dramatic sell-off finally hit our $150 mid-term Target and this week despite its

Coinbase Global, Inc. Class A

No trades

Key facts today

Coinbase Global has joined other major firms in opposing a US crypto market structure bill due to disputes over stablecoin interest provisions, as banks seek to ban stablecoin yields.

Coinbase Global's stock surged 16% after its recent earnings report, despite reporting a quarterly loss and a 22% decline in revenue that missed estimates.

Coinbase faces user complaints over delays and missing payouts in its Super Bowl 'Big Game Challenge' contest, with reports of winnings disappearing and confusion about payout eligibility.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.28 EUR

1.07 B EUR

6.11 B EUR

215.40 M

About Coinbase Global, Inc. - 3

Sector

Industry

CEO

Brian Armstrong

Website

Headquarters

New York

Founded

2012

IPO date

Apr 14, 2021

Identifiers

3

ISIN US19260Q1076

Coinbase Global, Inc. engages in the provision of a trusted platform that serves as a compliant on-ramp to the onchain economy and enables users to engage in a wide variety of activities with their crypto assets in both proprietary and third-party product experiences enabled by access to decentralized applications. It offers consumers primary financial account for the cryptoeconomy, institutions a full-service prime brokerage platform with access to deep pools of liquidity across the crypto marketplace, and developers a suite of products granting access to build onchain. The company was founded by Brian Armstrong and Fred Ernest Ehrsam in May 2012 and is headquartered in New York, NY.

Related stocks

COIN Hits Statistical Extremes — Reversion Probability RisingCOIN QuantSignals V4 Weekly 2026-02-11

ALPHA SCORE: 78 (Quant Synthesis)

CORE THESIS: Extreme oversold conditions (RSI 18.3) combined with a significant Katy AI price target of $163.42 suggest a violent mean-reversion rally toward institutional call walls.

⬢ KATY AI: MULTI-DAY VECTOR

Bias: Bulli

COIN [Coinbase] EWP TC FIB ANALYSIS DAILY TFCOIN – Daily Structure Overview

After five swings up, completing a motive wave, price formed a double top near 430 and has since entered a corrective phase. The market is now retracing the entire bullish leg from the 2022 low, with downside targeting the golden zone around the 85 area. This region

Coinbase triple-bottom, complete correction & bullish impulseThis signal is so strong that I will not have to go too much about it. It is just too simple and so hard to miss—easy to see.

When in doubt, look around. Coinbase moves together with Bitcoin and Cryptocurrency as a whole.

When the Cryptocurrency market is bullish and set to grow, Coinbase (COIN) i

Coinbase Is Down 60%+ Since July. What Its Chart Says Now.Coinbase Global NASDAQ:COIN is heading into earnings this week at a time when the crypto firm's stock has fallen more than 60% from its July all-time high, has lost some 50% in three months and recently fell for 13 consecutive sessions. Let's see what technical and fundamental analysis tell us abo

COIN, Elliot wave degree changed, Wave 2 complete?NASDAQ:COIN has a larger sell off then expected completely falling out of its rising wedge. This suggests that the top was a wave 1, completing 5 wave ups diminishing with wave V, with a poke above all time high, IPO launch.

The Elliot wave count is textbook. Wave C of 2 looks to have complete 5 w

Coinbase - Watching for confirmation of a bottomLooking at the micros, if we do in fact have a bottom in place, then we should target the target box completing b next. After that, we would then ideally head higher to the $190 region for c of (a). In what I am counting as a possible b wave, we need only OML for it to be considered complete. I coul

Coinbase: Navigating Tech Innovation and Global RiskCoinbase recently reported a staggering $667 million loss for the final quarter, missing several analyst targets. Despite this fiscal setback, the stock surged as investors found the current valuation increasingly attractive. Market experts remain divided on whether the company represents a bargain

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

COIN5259272

Coinbase Global, Inc. 3.625% 01-OCT-2031Yield to maturity

6.25%

Maturity date

Oct 1, 2031

COIN5259270

Coinbase Global, Inc. 3.375% 01-OCT-2028Yield to maturity

4.87%

Maturity date

Oct 1, 2028

COIN5424425

Coinbase Global, Inc. 0.5% 01-JUN-2026Yield to maturity

—

Maturity date

Jun 1, 2026

US19260QAG2

Coinbase Global, Inc. 0.0% 01-OCT-2029Yield to maturity

—

Maturity date

Oct 1, 2029

COIN6034335

Coinbase Global, Inc. 0.25% 01-APR-2030Yield to maturity

—

Maturity date

Apr 1, 2030

US19260QAJ6

Coinbase Global, Inc. 0.0% 01-OCT-2032Yield to maturity

—

Maturity date

Oct 1, 2032

See all 1QZ bonds

Frequently Asked Questions

The current price of 1QZ is 138.06 EUR — it has decreased by −0.43% in the past 24 hours. Watch Coinbase Global, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Coinbase Global, Inc. Class A stocks are traded under the ticker 1QZ.

1QZ stock has fallen by −1.74% compared to the previous week, the month change is a −33.96% fall, over the last year Coinbase Global, Inc. Class A has showed a −50.72% decrease.

We've gathered analysts' opinions on Coinbase Global, Inc. Class A future price: according to them, 1QZ price has a max estimate of 370.82 EUR and a min estimate of 101.13 EUR. Watch 1QZ chart and read a more detailed Coinbase Global, Inc. Class A stock forecast: see what analysts think of Coinbase Global, Inc. Class A and suggest that you do with its stocks.

1QZ stock is 2.67% volatile and has beta coefficient of 2.50. Track Coinbase Global, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is Coinbase Global, Inc. Class A there?

Yes, you can track Coinbase Global, Inc. Class A financials in yearly and quarterly reports right on TradingView.

Coinbase Global, Inc. Class A is going to release the next earnings report on May 7, 2026. Keep track of upcoming events with our Earnings Calendar.

1QZ earnings for the last quarter are −2.12 EUR per share, whereas the estimation was 0.85 EUR resulting in a −350.49% surprise. The estimated earnings for the next quarter are 0.45 EUR per share. See more details about Coinbase Global, Inc. Class A earnings.

Coinbase Global, Inc. Class A revenue for the last quarter amounts to 1.52 B EUR, despite the estimated figure of 1.54 B EUR. In the next quarter, revenue is expected to reach 1.36 B EUR.

1QZ net income for the last quarter is −567.67 M EUR, while the quarter before that showed 368.62 M EUR of net income which accounts for −254.00% change. Track more Coinbase Global, Inc. Class A financial stats to get the full picture.

No, 1QZ doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 17, 2026, the company has 4.95 K employees. See our rating of the largest employees — is Coinbase Global, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Coinbase Global, Inc. Class A EBITDA is 924.93 M EUR, and current EBITDA margin is 15.25%. See more stats in Coinbase Global, Inc. Class A financial statements.

Like other stocks, 1QZ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Coinbase Global, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Coinbase Global, Inc. Class A technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Coinbase Global, Inc. Class A stock shows the strong sell signal. See more of Coinbase Global, Inc. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.