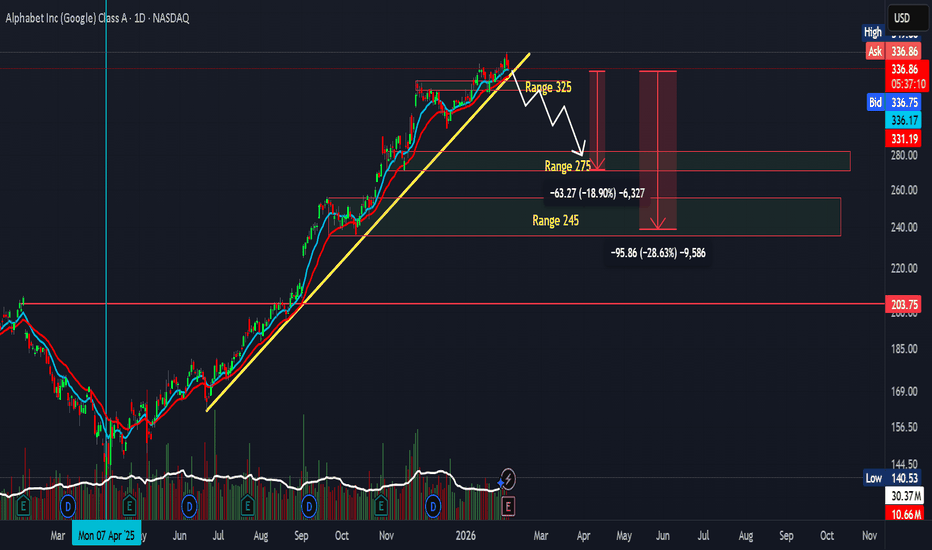

Alphabet - The only surviving stock!🏅Alphabet ( NASDAQ:GOOG ) is clearly not bearish yet:

🔎Analysis summary:

The entire tech sector is currently collapsing. But Alphabet remains totally strong and is sitting close to new all time highs. But considering that current retest of the major resistance trendline, a short term pullback

Alphabet Inc. Class C

No trades

Key facts today

The European Publishers Council has filed an antitrust complaint against Google, alleging unauthorized use of publishers' content in its AI Overviews and inadequate opt-out options.

The EU has approved Google's acquisition of cybersecurity startup Wiz, enhancing its position in cybersecurity and cloud computing without raising competition concerns.

The U.S. Commerce Department may grant chip tariff exemptions to Google and other tech firms to aid AI development, tied to Taiwan Semiconductor's $165 billion investment in Arizona factories.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9.30 EUR

112.53 B EUR

343.09 B EUR

5.05 B

About Alphabet Inc (Google) Class C

Sector

Industry

CEO

Sundar Pichai

Website

Headquarters

Mountain View

Founded

2015

IPO date

Aug 19, 2004

Identifiers

3

ISIN US02079K1079

Alphabet, Inc. is a holding company, which engages in software, health care, transportation, and other technologies. It operates through the following segments: Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services, such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment refers to infrastructure and platform services, collaboration tools, and other services for enterprise customers. The Other Bets segment relates to the sale of healthcare-related services and internet services. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

Related stocks

Google Short - Target $312Hello Traders,

After the recent impulsive move up into the 349–350 area and subsequent displacement lower, price is now retracing back into a prior supply / inefficiency zone between 338–342.

This zone aligns with:

Previous intraday structure (LH area)

Local imbalance

Premium range within current

The 2nd Phase of AI Technology is UnderwayThis tutorial is about discovering how new technologies such as AI have several phases over many years which create growth and speculation in the leading companies.

There are always 3 top contenders for a new technology sub industry. A sub industry is an industry that is within the primary industry

Google’s AI Pivot: The World’s Next Pharma GiantAlphabet recently shattered Wall Street expectations with its Q4 2025 earnings report. Management is aggressively increasing capital expenditure for 2026. This spending fuels a massive expansion of AI infrastructure. Investors now see a clear shift in Google's corporate strategy.

The Great Technol

Google Parent Alphabet Shares Are Down PremarketAlphabet’s shares (NASDAQ: NASDAQ:GOOG ) were down in premarket trading on Thursday after the company beat Wall Street’s expectations on earnings and revenue, with AI spending projected to increase hugely this year.

The Google parent shed 2.9% in premarket, after closing nearly 2.16% lower on Wedn

GOOGL Just Hit a Record Ahead of Earnings. What Its Chart Says.Google parent Alphabet NASDAQ:GOOG NASDAQ:GOOGL just hit an all-time intraday high ahead of earnings and has beaten the S&P 500 SP:SPX in pretty much every timeframe from one month to five years. What do its chart and fundamentals say heading into Wednesday's earnings report?

Let's take a loo

GOOGL Stock Analysis | Pullback Within an Established Uptrend🎯 GOOGL: The Great Heist Setup | Moving Average Pullback Play 💰

📊 Market Intelligence Brief

Asset: GOOGL (Alphabet Inc.) - NASDAQ

Strategy Type: Day/Swing Trade - Bullish Momentum

Risk Profile: Medium | Reward Potential: High 🚀

🔍 THE MASTER PLAN

We're eyeing a classic moving average pullback scenar

GOOG:Wave(3)Truncated 350.15 – Wave (4) Deepens, Targets 315-320GOOG has shown clear signs of truncation in Wave (3) at 350.15 (failed to reach the projected 360 level), invalidating the prior impulsive extension and confirming the ongoing A-B-C corrective Wave (4) from the 341.20 high.

Primary Count (Orange Line – 5-3-5 structure):

Wave (3) truncated, curren

Google - Last earnings call before tariffs affect revenue?Hi guys please find below the analysis we did for Google (ALPHABET)

Alphabet Inc. (NASDAQ: GOOG) is poised to deliver a robust Q1 2025 earnings report, with analysts projecting revenue of $89.22 billion—an 11% year-over-year increase—and net income of $24.71 billion ($2.01 per share), up from $23.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

GOOG6224229

Alphabet Inc. 5.7% 15-NOV-2075Yield to maturity

5.77%

Maturity date

Nov 15, 2075

GOOG6065579

Alphabet Inc. 5.3% 15-MAY-2065Yield to maturity

5.71%

Maturity date

May 15, 2065

GOOG6065578

Alphabet Inc. 5.25% 15-MAY-2055Yield to maturity

5.60%

Maturity date

May 15, 2055

GOOG6224228

Alphabet Inc. 5.45% 15-NOV-2055Yield to maturity

5.58%

Maturity date

Nov 15, 2055

GOOG5025304

Alphabet Inc. 2.05% 15-AUG-2050Yield to maturity

5.44%

Maturity date

Aug 15, 2050

GOOG5025305

Alphabet Inc. 2.25% 15-AUG-2060Yield to maturity

5.33%

Maturity date

Aug 15, 2060

GOOG6224227

Alphabet Inc. 5.35% 15-NOV-2045Yield to maturity

5.32%

Maturity date

Nov 15, 2045

GOOG5025303

Alphabet Inc. 1.9% 15-AUG-2040Yield to maturity

5.04%

Maturity date

Aug 15, 2040

GOOG6224226

Alphabet Inc. 4.7% 15-NOV-2035Yield to maturity

4.70%

Maturity date

Nov 15, 2035

A4EKPE

Alphabet Inc. 4.375% 06-NOV-2064Yield to maturity

4.62%

Maturity date

Nov 6, 2064

GOOG6065581

Alphabet Inc. 4.5% 15-MAY-2035Yield to maturity

4.59%

Maturity date

May 15, 2035

See all ABEC bonds

Frequently Asked Questions

The current price of ABEC is 268.50 EUR — it has decreased by −1.82% in the past 24 hours. Watch Alphabet Inc. Class C stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Alphabet Inc. Class C stocks are traded under the ticker ABEC.

ABEC stock has fallen by −9.51% compared to the previous week, the month change is a −4.62% fall, over the last year Alphabet Inc. Class C has showed a 47.67% increase.

We've gathered analysts' opinions on Alphabet Inc. Class C future price: according to them, ABEC price has a max estimate of 375.00 EUR and a min estimate of 231.10 EUR. Watch ABEC chart and read a more detailed Alphabet Inc. Class C stock forecast: see what analysts think of Alphabet Inc. Class C and suggest that you do with its stocks.

ABEC reached its all-time high on Feb 2, 2026 with the price of 292.55 EUR, and its all-time low was 27.85 EUR and was reached on Oct 8, 2015. View more price dynamics on ABEC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ABEC stock is 3.08% volatile and has beta coefficient of 1.12. Track Alphabet Inc. Class C stock price on the chart and check out the list of the most volatile stocks — is Alphabet Inc. Class C there?

Today Alphabet Inc. Class C has the market capitalization of 3.29 T, it has increased by 1.95% over the last week.

Yes, you can track Alphabet Inc. Class C financials in yearly and quarterly reports right on TradingView.

Alphabet Inc. Class C is going to release the next earnings report on Apr 28, 2026. Keep track of upcoming events with our Earnings Calendar.

ABEC earnings for the last quarter are 2.40 EUR per share, whereas the estimation was 2.24 EUR resulting in a 7.04% surprise. The estimated earnings for the next quarter are 2.18 EUR per share. See more details about Alphabet Inc. Class C earnings.

Alphabet Inc. Class C revenue for the last quarter amounts to 96.92 B EUR, despite the estimated figure of 94.78 B EUR. In the next quarter, revenue is expected to reach 89.23 B EUR.

ABEC net income for the last quarter is 29.34 B EUR, while the quarter before that showed 29.81 B EUR of net income which accounts for −1.59% change. Track more Alphabet Inc. Class C financial stats to get the full picture.

Yes, ABEC dividends are paid quarterly. The last dividend per share was 0.18 EUR. As of today, Dividend Yield (TTM)% is 0.26%. Tracking Alphabet Inc. Class C dividends might help you take more informed decisions.

Alphabet Inc. Class C dividend yield was 0.26% in 2025, and payout ratio reached 7.68%. The year before the numbers were 0.32% and 7.46% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 10, 2026, the company has 190.82 K employees. See our rating of the largest employees — is Alphabet Inc. Class C on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Alphabet Inc. Class C EBITDA is 131.04 B EUR, and current EBITDA margin is 37.30%. See more stats in Alphabet Inc. Class C financial statements.

Like other stocks, ABEC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Alphabet Inc. Class C stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Alphabet Inc. Class C technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Alphabet Inc. Class C stock shows the buy signal. See more of Alphabet Inc. Class C technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.