Meta Platforms Inc Class A

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

20.4 EUR

51.48 B EUR

171.11 B EUR

2.18 B

About Meta Platforms, Inc.

Sector

Industry

CEO

Mark Elliot Zuckerberg

Website

Headquarters

Menlo Park

Founded

2004

IPO date

May 18, 2012

Identifiers

3

ISIN US30303M1027

Meta Platforms, Inc. engages in the development of social media applications. It builds technology that helps people connect and share, find communities, and grow businesses. It operates through the Family of Apps (FoA) and Reality Labs (RL) segments. The FoA segment consists of Facebook, Instagram, Messenger, WhatsApp, and other services. The RL segment includes augmented, mixed and virtual reality related consumer hardware, software, and content. The company was founded by Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum, and Eduardo P. Saverin on February 4, 2004, and is headquartered in Menlo Park, CA.

Related stocks

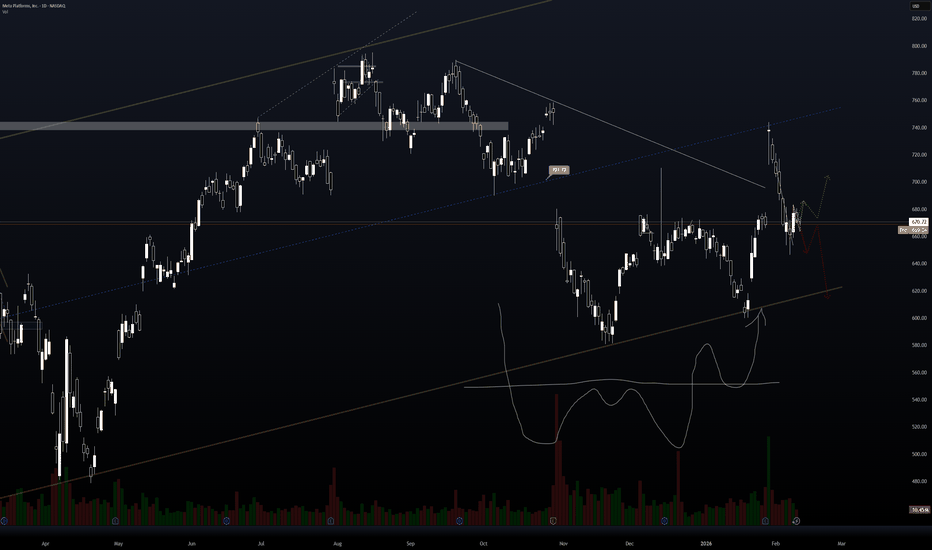

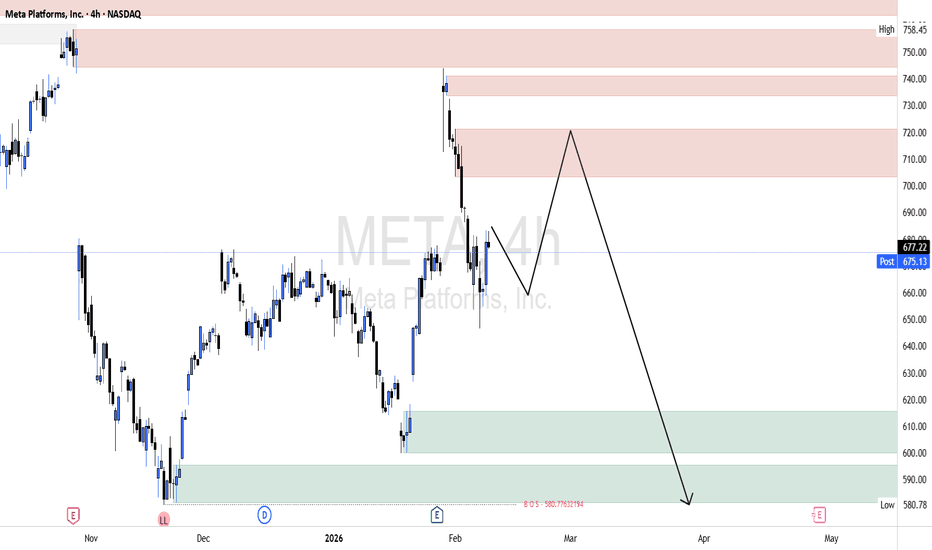

META - a deeeeep pullback soon META had solid bull run and probably this gonna follow rest of the names in this pullback.

Short it anywhere with some longer expiry puts. My preference would be Enter and Exit with good R:R zones and take profits. Expecting a fast move to the downside soon.

I prefer to use round number targets

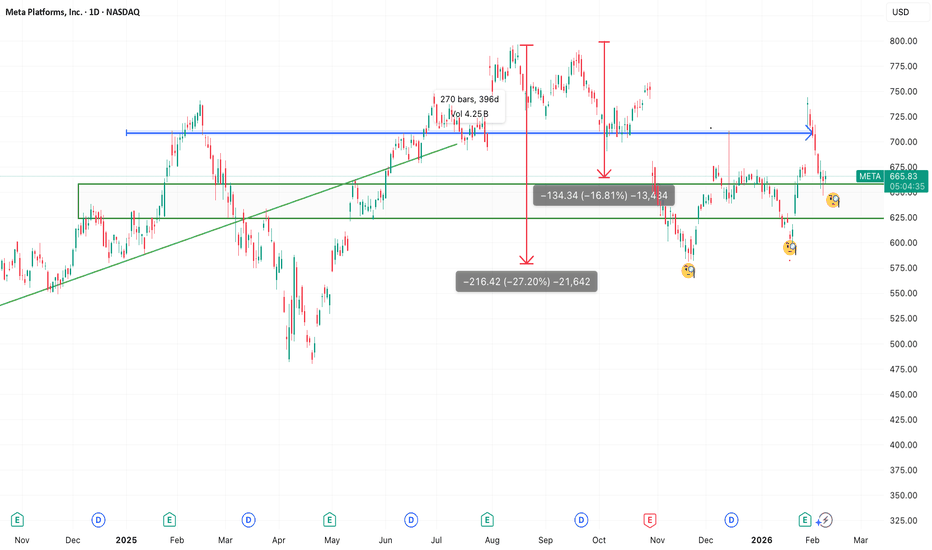

META: Third Higher Low + good Risk/Reward Setup#META

Third test of $625 support after -25% pullback from ATHs.

The Setup:

- Entry: $665

- Stop: $644

- Target 1: $720

- Target 2: ATHs ($750+)

Why I like it:

- Triple bottom = institutional accumulation

- Higher lows = buyers stepping up earlier each time

- Risk/reward 3:1 to first target

Target

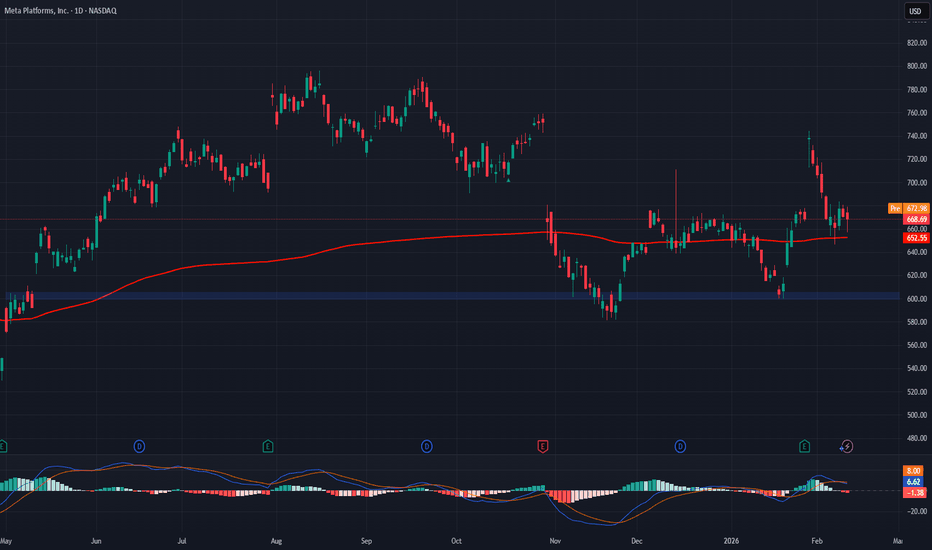

Midterm Stock Forecast for METANASDAQ:META At $594, Meta enters a buy zone after the sharp decline since late October. H1 technicals show stabilizing momentum. First target stands at $660, and extension toward $760 remains possible if ad revenue and AI-driven engagement trends stay strong. Valuation still supports midterm upsid

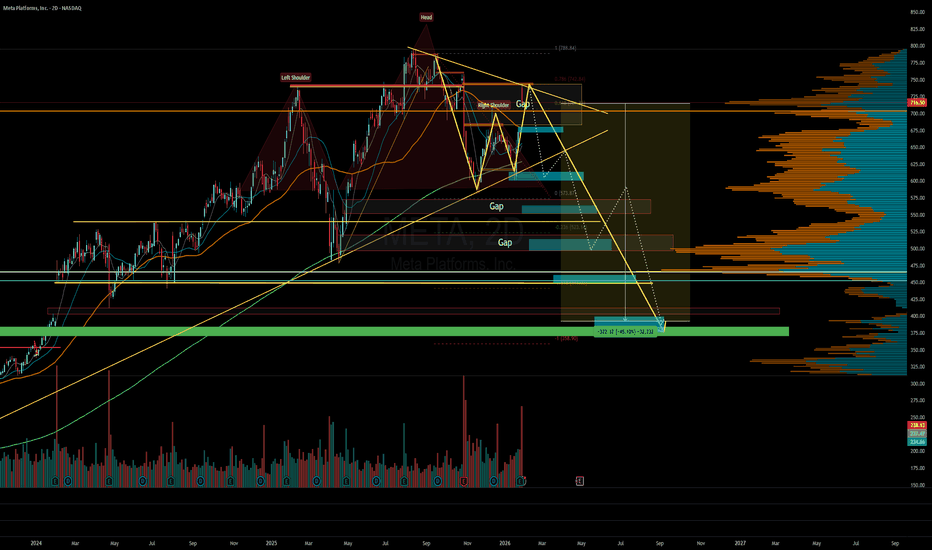

Meta Platforms (META) — AI Flywheel + New Monetization LanesOperating the world’s largest social & messaging ecosystem, Meta is scaling AI, AR/VR, and metaverse infrastructure to deepen engagement and extend monetization beyond ads.

Key Catalysts

AI-Driven Ads = Core Engine

Q4’25 revenue: $59.9B (+24% YoY); Q1’26 guide: $53.5–$56.5B.

Advanced models lift r

Live trading on Meta Platforms (META)The price has reached the midpoint of its channel with a valid divergence and is currently at the 78% retracement level of its previous bullish move. Based on one of our trading systems, a buy signal has also been issued.

NASDAQ:META

Follow proper risk and money management.

This is just my pe

META Long*META

First Long then Short

We are still operating within a larger bearish market structure. The prior impulse to the downside remains dominant, and the recent upside move is corrective, not a trend reversal. Price has already shown weakness after tapping into higher supply, and overall structure f

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US30303M8D7

Meta Platforms, Inc. 3.85% 15-AUG-2032Yield to maturity

16.10%

Maturity date

Aug 15, 2032

FB5581331

Meta Platforms, Inc. 5.75% 15-MAY-2063Yield to maturity

5.95%

Maturity date

May 15, 2063

FB5868810

Meta Platforms, Inc. 5.55% 15-AUG-2064Yield to maturity

5.95%

Maturity date

Aug 15, 2064

FB6221365

Meta Platforms, Inc. 5.75% 15-NOV-2065Yield to maturity

5.94%

Maturity date

Nov 15, 2065

FB5458295

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

5.87%

Maturity date

Aug 15, 2062

FB5868809

Meta Platforms, Inc. 5.4% 15-AUG-2054Yield to maturity

5.83%

Maturity date

Aug 15, 2054

FB5581330

Meta Platforms, Inc. 5.6% 15-MAY-2053Yield to maturity

5.81%

Maturity date

May 15, 2053

FB6221364

Meta Platforms, Inc. 5.625% 15-NOV-2055Yield to maturity

5.80%

Maturity date

Nov 15, 2055

FB5522214

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

5.79%

Maturity date

Aug 15, 2052

FB5522241

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

5.77%

Maturity date

Aug 15, 2062

FB6221369

Meta Platforms, Inc. 5.5% 15-NOV-2045Yield to maturity

5.61%

Maturity date

Nov 15, 2045

See all FB2A bonds

Frequently Asked Questions

The current price of FB2A is 538.3 EUR — it has decreased by −1.75% in the past 24 hours. Watch Meta Platforms Inc Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Meta Platforms Inc Class A stocks are traded under the ticker FB2A.

FB2A stock has fallen by −3.88% compared to the previous week, the month change is a −0.22% fall, over the last year Meta Platforms Inc Class A has showed a −22.77% decrease.

We've gathered analysts' opinions on Meta Platforms Inc Class A future price: according to them, FB2A price has a max estimate of 963.79 EUR and a min estimate of 589.73 EUR. Watch FB2A chart and read a more detailed Meta Platforms Inc Class A stock forecast: see what analysts think of Meta Platforms Inc Class A and suggest that you do with its stocks.

FB2A reached its all-time high on Feb 17, 2025 with the price of 707.9 EUR, and its all-time low was 14.0 EUR and was reached on Sep 4, 2012. View more price dynamics on FB2A chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

FB2A stock is 2.07% volatile and has beta coefficient of 1.54. Track Meta Platforms Inc Class A stock price on the chart and check out the list of the most volatile stocks — is Meta Platforms Inc Class A there?

Today Meta Platforms Inc Class A has the market capitalization of 1.36 T, it has decreased by −2.90% over the last week.

Yes, you can track Meta Platforms Inc Class A financials in yearly and quarterly reports right on TradingView.

Meta Platforms Inc Class A is going to release the next earnings report on Apr 29, 2026. Keep track of upcoming events with our Earnings Calendar.

FB2A earnings for the last quarter are 7.56 EUR per share, whereas the estimation was 6.99 EUR resulting in a 8.13% surprise. The estimated earnings for the next quarter are 5.58 EUR per share. See more details about Meta Platforms Inc Class A earnings.

Meta Platforms Inc Class A revenue for the last quarter amounts to 50.99 B EUR, despite the estimated figure of 49.77 B EUR. In the next quarter, revenue is expected to reach 46.54 B EUR.

FB2A net income for the last quarter is 19.39 B EUR, while the quarter before that showed 2.31 B EUR of net income which accounts for 739.69% change. Track more Meta Platforms Inc Class A financial stats to get the full picture.

Yes, FB2A dividends are paid quarterly. The last dividend per share was 0.45 EUR. As of today, Dividend Yield (TTM)% is 0.33%. Tracking Meta Platforms Inc Class A dividends might help you take more informed decisions.

Meta Platforms Inc Class A dividend yield was 0.32% in 2025, and payout ratio reached 8.94%. The year before the numbers were 0.34% and 8.38% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 15, 2026, the company has 78.86 K employees. See our rating of the largest employees — is Meta Platforms Inc Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Meta Platforms Inc Class A EBITDA is 86.76 B EUR, and current EBITDA margin is 50.70%. See more stats in Meta Platforms Inc Class A financial statements.

Like other stocks, FB2A shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Meta Platforms Inc Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Meta Platforms Inc Class A technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Meta Platforms Inc Class A stock shows the neutral signal. See more of Meta Platforms Inc Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.