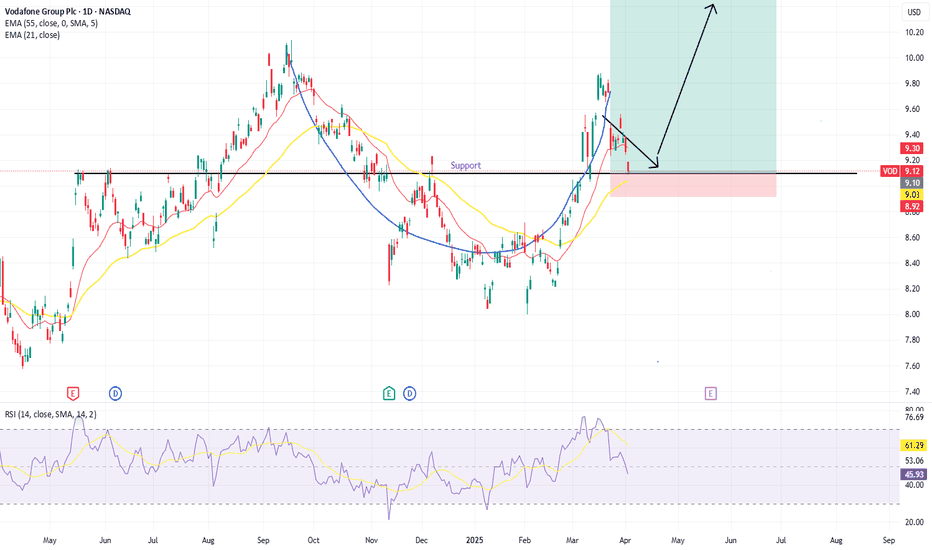

VOD | This Telecom Co. Is Ready to Explode Higher | LONGVodafone Group Plc engages in the telecommunication services in Europe and International. It offers mobile services that enable customers to call, text and access data, fixed line services, including broadband, television offerings, and voice and convergence services under the GigaKombi and Vodafone

Key facts today

On November 18, 2025, Vodafone Group Plc completed a share buyback with Merrill Lynch, acquiring shares as part of a program started on November 11, 2025.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.1670 EUR

−4.19 B EUR

37.62 B EUR

17.97 B

About Vodafone Group Public Limited Company

Sector

Industry

CEO

Margherita della Valle

Website

Headquarters

Newbury

Founded

1984

ISIN

GB00BH4HKS39

FIGI

BBG000DT2RL6

Vodafone Group Plc engages in the telecommunication services in Europe and International. It offers mobile services that enable customers to call, text and access data, fixed line services, including broadband, television offerings, and voice and convergence services under the GigaKombi and Vodafone One names. It also provides mobile, fixed and a suite of converged communication services, such as Internet of Things (IoT) comprising managed IoT connectivity, automotive and insurance services, as well as smart metering and health solutions, cloud and security portfolio comprising public and private cloud services, as well as cloud-based applications and products for securing networks and devices and international voice, IP transit and messaging services to support business customers that include small home offices and large multi-national companies. The company was founded on July 17, 1984 and is headquartered in Newbury, the United Kingdom.

Related stocks

VOD Could Rise Toward $14: Opportunity Still on the TableVOD Could Rise Toward $14: Opportunity Still on the Table

On the weekly chart, Vodafone (VOD) looks set to continue rising, with $14.00 as the next key level. This area could act as strong resistance.

Back in February 2024, VOD hit a low near $7.30. Since then, it’s climbed to around $11.50—an im

VOD - Cup and HandleThere appears to be a cup and handle pattern forming in $NASDAQ:VOD. It had strong push upward last summer and has drifted back down through the end of the year, with another strong increase back near its highs. We are now seeing a retraction following the handle portion of the pattern and today rea

Vodafone ended 10 year long bear ride?

After 10 years, Vodafone seems to have reach the bottom.

Long consolidation periods (yellow), and 2 downward channels led us to a rock bottom of 63GBP.

The last downward channel appears now to be broken with immediate resistance at 103 GBP.

Positive outlook as long term investment.

Breakout After multiple attempts at failing to break the blue resistance line price has closed strongly above this level today.

The catalyst for this was the release of good results, check them out for yourself.

In addition to this they have just got approval from their Spanish business for $5 billion. Ker-

Vodafone Set to Integrate Crypto Wallets With SIM CardsVodafone ( NASDAQ:VOD ) is utilizing SIM card technology to meet the anticipated surge in demand for cryptocurrency on mobile phones. CPO David Palmer discussed how the company is advancing blockchain use on mobile devices to manage crypto transactions. He highlighted the use of Pairpoint, a brand t

Vodaphone. Golden cross on 4hr time frame.Vodafone is currently near recent lows. Recent Price action has formed a rising wedge pattern.

Looking at the 4 hour chart the 50ma has crossed above the 200ma, a golden cross.

Rising rsi is also in an uptrend.

I suspect the price will move out of wedge, my guess is it will be upwards.

Do your own r

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS147248377

Vodafone Group Public Limited Company 3.0% 12-AUG-2056Yield to maturity

6.53%

Maturity date

Aug 12, 2056

XS310965596

Vodafone Group Public Limited Company 6.375% 03-JUL-2050Yield to maturity

6.41%

Maturity date

Jul 3, 2050

XS146849423

Vodafone Group Public Limited Company 3.375% 08-AUG-2049Yield to maturity

6.40%

Maturity date

Aug 8, 2049

VOD5538098

Vodafone Group Public Limited Company 5.75% 10-FEB-2063Yield to maturity

6.06%

Maturity date

Feb 10, 2063

VOD5839595

Vodafone Group Public Limited Company 5.875% 28-JUN-2064Yield to maturity

6.01%

Maturity date

Jun 28, 2064

VOD5839594

Vodafone Group Public Limited Company 5.75% 28-JUN-2054Yield to maturity

6.01%

Maturity date

Jun 28, 2054

US92857WBS8

Vodafone Group Public Limited Company 4.875% 19-JUN-2049Yield to maturity

5.95%

Maturity date

Jun 19, 2049

VOD5538097

Vodafone Group Public Limited Company 5.625% 10-FEB-2053Yield to maturity

5.95%

Maturity date

Feb 10, 2053

US92857WBU3

Vodafone Group Public Limited Company 4.25% 17-SEP-2050Yield to maturity

5.91%

Maturity date

Sep 17, 2050

US92857WBT6

Vodafone Group Public Limited Company 5.125% 19-JUN-2059Yield to maturity

5.88%

Maturity date

Jun 19, 2059

US92857WBM1

Vodafone Group Public Limited Company 5.25% 30-MAY-2048Yield to maturity

5.88%

Maturity date

May 30, 2048

See all VODI bonds

ISFD

iShares PLC - iShares Core FTSE 100 UCITS ETF Accum Hedged USDWeight

0.75%

Market value

134.26 M

USD

Explore more ETFs

Curated watchlists where VODI is featured.

Frequently Asked Questions

The current price of VODI is 1.0530 EUR — it has decreased by −2.48% in the past 24 hours. Watch Vodafone Group Public Limited Company stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Vodafone Group Public Limited Company stocks are traded under the ticker VODI.

VODI stock has risen by 3.12% compared to the previous week, the month change is a 6.91% rise, over the last year Vodafone Group Public Limited Company has showed a 26.68% increase.

We've gathered analysts' opinions on Vodafone Group Public Limited Company future price: according to them, VODI price has a max estimate of 1.59 EUR and a min estimate of 0.68 EUR. Watch VODI chart and read a more detailed Vodafone Group Public Limited Company stock forecast: see what analysts think of Vodafone Group Public Limited Company and suggest that you do with its stocks.

VODI reached its all-time high on May 26, 2015 with the price of 3.6680 EUR, and its all-time low was 0.7294 EUR and was reached on Apr 9, 2025. View more price dynamics on VODI chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

VODI stock is 2.59% volatile and has beta coefficient of 1.10. Track Vodafone Group Public Limited Company stock price on the chart and check out the list of the most volatile stocks — is Vodafone Group Public Limited Company there?

Today Vodafone Group Public Limited Company has the market capitalization of 25.33 B, it has increased by 7.54% over the last week.

Yes, you can track Vodafone Group Public Limited Company financials in yearly and quarterly reports right on TradingView.

Vodafone Group Public Limited Company is going to release the next earnings report on May 19, 2026. Keep track of upcoming events with our Earnings Calendar.

VODI earnings for the last half-year are 0.07 EUR per share, whereas the estimation was 0.04 EUR, resulting in a 62.44% surprise. The estimated earnings for the next half-year are 0.03 EUR per share. See more details about Vodafone Group Public Limited Company earnings.

VODI net income for the last half-year is 814.74 M EUR, while the previous report showed −5.21 B EUR of net income which accounts for 115.64% change. Track more Vodafone Group Public Limited Company financial stats to get the full picture.

As of Nov 18, 2025, the company has 92 K employees. See our rating of the largest employees — is Vodafone Group Public Limited Company on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Vodafone Group Public Limited Company EBITDA is 15.56 B EUR, and current EBITDA margin is 40.37%. See more stats in Vodafone Group Public Limited Company financial statements.

Like other stocks, VODI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Vodafone Group Public Limited Company stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Vodafone Group Public Limited Company technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Vodafone Group Public Limited Company stock shows the buy signal. See more of Vodafone Group Public Limited Company technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.