Observing Bearish Divergence in the 20-Year Bond MarketIn the world of finance and investing, keeping a watchful eye on market trends and indicators is essential for making informed decisions. Lately, I've been closely monitoring the 20-year bond market, and I've noticed some intriguing signals that could have far-reaching implications for the financial landscape.

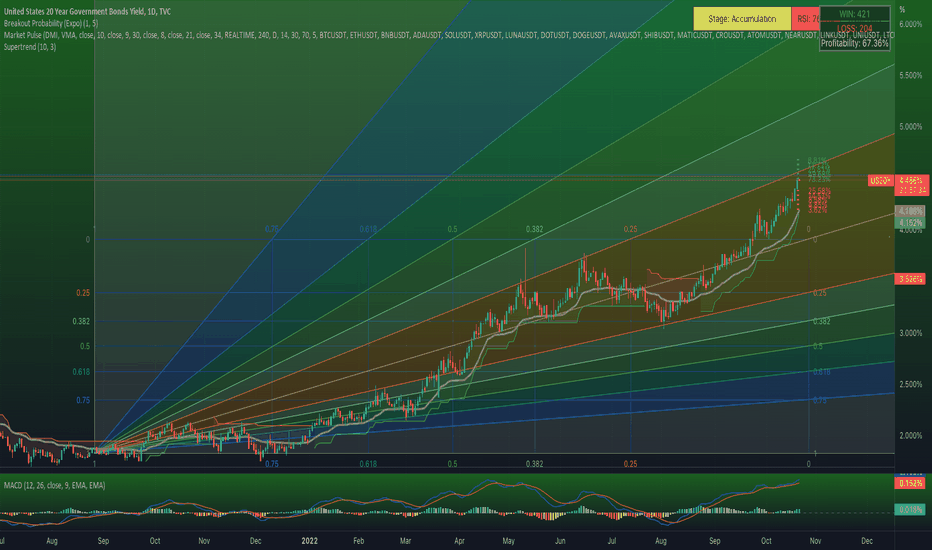

What caught my attention is the presence of a significant bearish divergence pattern on the daily chart. This divergence suggests a potential shift in market dynamics, which could have ripple effects throughout the financial sector.

Bearish divergence occurs when an asset's price makes higher highs, while a key technical indicator, such as the Relative Strength Index (RSI), makes lower highs. In the case of the 20-year bond market, this divergence is becoming increasingly evident. This pattern typically suggests a weakening bullish trend and a potential reversal in the making.

One of the intriguing aspects of this bearish divergence is its potential to put pressure on overleveraged banks. When the bond market shows signs of weakness, banks holding substantial positions in bonds can face increased risks. Overleveraging has been a concern in the financial industry, and a downturn in the bond market could be a catalyst for addressing this issue.

However, here's where things get even more interesting. While the bearish divergence might suggest a market correction or even a bear market, I have a hunch that central banks might have a different playbook in mind. Instead of allowing a sharp market downturn, they could intervene with massive Quantitative Easing (QE) programs.

Quantitative Easing is a monetary policy tool used by central banks to stimulate the economy by purchasing financial assets, typically government bonds. By injecting liquidity into the market, central banks aim to lower interest rates, encourage borrowing and spending, and provide support to the financial system during challenging times.

In this scenario, central banks might use the bearish divergence as an opportunity to step in with substantial QE measures. By doing so, they could provide a safety net for the bond market, stabilize financial institutions, and prevent a market crash.

However, there's another twist to consider. Before initiating massive QE, central banks might strategically "flush out" leverage from the market. This could involve allowing a controlled market decline to clear out excessive leverage and speculative positions. Once the market has undergone this cleansing process, central banks could then step in with their QE measures to support a healthier financial environment.

In conclusion, the bearish divergence in the 20-year bond market is a noteworthy development that has the potential to impact various aspects of the financial sector. While it may indicate a weakening trend, it's essential to keep in mind that central banks often have tools at their disposal to mitigate the effects of market turbulence. Their actions in response to this divergence could be crucial in determining the market's direction in the coming months.

As an investor, it's essential to stay informed, closely monitor market trends, and be prepared for various potential outcomes. The financial world is dynamic and ever-changing, and being adaptable to different scenarios is key to successful investment strategies.

Trade ideas

US20YR - The end is in sightBonds have been selling off at unprecedented rates for unprecedented lengths. The yield curve as started the un-invert indicating the recession is less than a year out.

The question remains if rates will remain "higher for longer" or if the flattening will include a swift fall in rates due to recessionary pressures, possibly leading to deflation.

If Steven Van Meters and Harry Dent 's predictions are (eventually) true then a play in TLT or TMF is warranted and would lead to gains in the multiples.

TLT vs. US20Y ~ Snapshot TA / Inverse Correlations V2Update from original TLT vs. US20Y idea:

- Switched to New Pane comparison for optimized viewing/zooming in on price movements.

- Added TLT Candles for better price action analysis.

- Added TLT trend lines for greater emphasis on inverse correlation + indication of trend break-outs.

Boost/Follow appreciated, cheers :)

AMEX:HYG NASDAQ:TLT TVC:US02Y TVC:US05Y TVC:US10Y TVC:US20Y TVC:US30Y

TLT vs. US20Y ~ Snapshot TA / Inverse CorrelationsTVC:US20Y double-tops, while NASDAQ:TLT creates a double-bottom..

Question to ask tho - has US20Y actually double-topped, or is this just retracement for a bigger push beyond ATHs?

Looking for further signs of confirmation that long-ended yields have indeed peaked...then I'll feel more confident in popping the champagne.

Boost/Follow appreciated, cheers :)

AMEX:HYG TVC:US02Y TVC:US05Y TVC:US10Y TVC:US30Y

US20YHi, everybody should consider this huge upward move in longterm bond yield ....

but in my opinion now it is reaching resistance and if it breaks this floor it can attach upper band of parallel channel....

additionally to all of them look at TLT longterm bond ETF always you need to track this for interest rate expectations insight.....

Good luck

Yields Surging / TLT FallingThe technical weekly uptrend that yields have formed is rather astonishing.

The sheer power of this move suggests likely more upside yields. Some basic measured moves suggest a potential whopping 5.7% on the 20 year.

Imagine TLT long bond traders!

Nothing is probable but it makes you wonder if inflation is becoming more entrenched since the bond market is very forward looking.

US Treasury 20 Year Bond Yield Curve - Year to DateWho would have thought we might be seeing 20 year guaranteed 10% returns on US Treasuries soon.. but it could certainly happen. Short the things on the way up, and keep your cash available to buy every one of them in sight on the way down.

Rates on a 3month Treasury are up an astounding 7,780% - Year to Date.

How to improve your trading by looking at interest rates: Part 2Hey everyone! 👋

This month, we wanted to explore the topic of interest rates; what they are, why they are important, and how you can use interest rate information in your trading. This is a topic that new traders typically gloss over when starting out, so we hope this is a helpful and actionable series for new people looking to learn more about macroeconomics and fundamental analysis!

Last week we took a look at how to find bond prices on our platform, as well as a few quick tips for understanding how and why interest rates move. If you'd like a quick refresher, click the link at the bottom of this post. This week, let's take a look at why understanding interest rates is important to your trading, and how you can use this info to your advantage.

You can think of rates markets in three dimensions.

1.) Absolute

2.) Relative

3.) Through Time

In other words;

1.) How are rates traded on an absolute basis? AKA, do they offer an attractive risk/reward for investors?

2.) How are rates traded on a relative basis? AKA, what separates bond prices between different countries?

3.) How are rates traded through time? AKA, what is the "Yield Curve"?

It's worth taking a little bit of a deeper look at each of these dimensions and how they work. This week we will begin by looking at interest rates from an 'Absolute' standpoint . 🏦

When it comes to looking at bonds as an investment vehicle on this straightforward basis, investors in the broader market will typically look at how attractive bonds are from a yield / total return perspective vs. other asset classes, like equities, commodities, and cryptocurrencies.

When it comes to gauging this total return question, the three main risks are important to know about:

1.) Central Bank Funds Rate risk

2.) Inflation Risk

3.) Credit Risk

In other words;

1.) Will the central bank rate move in such a way that makes the interest rate I'm receiving on a bond uncompetitive?

2.) Bonds are loans with timers. Will inflation eat away at my principal in terms of buying power faster than I'm being compensated?

3.) Can my counterparty make me whole when the bond comes due?

For the United States, the third question is typically "ignored" as lending money to the U.S. government is oftentimes viewed as "risk free", but in all scenarios understanding the attractiveness of bond yields over given time horizons vs. interest rates and inflation is a huge question.

In addition to that, absolute risk/reward for rates needs to be compared to other asset classes. If the S&P 500 is yielding 2%, paid out from the earnings of the biggest companies in the country, then how does the risk of holding equities compare to the risks of holding bonds? Understanding how institutions are judging this decision can often be gauged by looking at the movement of interest rates in the open market. When stocks are outperforming bonds, institutional demand for stocks is higher, indicating that people are feeling good and want to take risk. When bonds are outperforming stocks, it can be indicative that people would prefer to hold 'risk free' interest payment vehicles as opposed to equity in companies with worsening economic prospects.

This is the most straightforward way of looking at interest rates - how do they compare to the absolute risks in the market, and how do they compare to other "yield" streams? Do they make sense from a risk/reward perspective?

One final thing - If interest rates are rising, then the amount of return needed to "compensate" for taking risk needs to get higher and higher, or other assets like equities begin to look uncompetitive. Additionally, higher interest rates mean that future cashflows are worth less, given that most valuation calculations rely on the "risk free rate".

As an example, this implosion happened late last year, as people began selling bonds and interest rates began to rise. As interest rates rose, stocks that had a good chunk of their "value" priced into the future got hit the hardest, as the value of those cash flows in real terms dropped.

Interest rates can help a lot for putting the big moves in the market into perspective. 😀

That's all for this week! Next week, we will take a look at how credit risk and FX risk plays into relative bond pricing, and how different sovereign bonds may or may not appear attractive to one another on a relative basis. Our final week will look at the yield curve, and how risk over time affects demand for rates.

Cheers!

-Team TradingView

Here's last week's post if you're not caught up:

USa 10 Years bond USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

USA 20 Years Bond USA Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

I'm keeping an eye on this channel top for US20YSoon it might be a good time to buy TLT or TMF. The top for bond yields looks near to me as it gets close to this channel top. A good confirmation for a pullback would be to watch for a break in the stoch support.

You could argue that it is also making a megaphone pattern with the support at 2.6% and the resistance at the channel top. I looked into this pattern and it could be bullish or bearish unfortunately, so it is hard to say what it'll do until it breaks either side. I charted a bullish possibility and target if it does break out, such a move could end up quite bad for the market, so I hope it won't happen.

ETF Strategy - Monthly return result (MAR 2022)Monthly return (FEB 2022): -16.58%

SMTMI Strategy YOY : -4.72%

In March, based on our ETF strategy, we were positioned on ETF that follow US Long term Bonds.

This switch towards LT bonds is explained by the aim to protect our positions from the important drop of stock market that started end of 2021 and also

by the anticipation of the policy rate decided by the FED in early 2022 to counter inflation .

However, the international situation was then impacted by a new major event, the war in Ukraine.

This new situation brings great uncertainty for the future. The market reacts to this uncertainty by lowering yields on long term bonds

and therefore a decrease in the value of our long-term bond ETF.