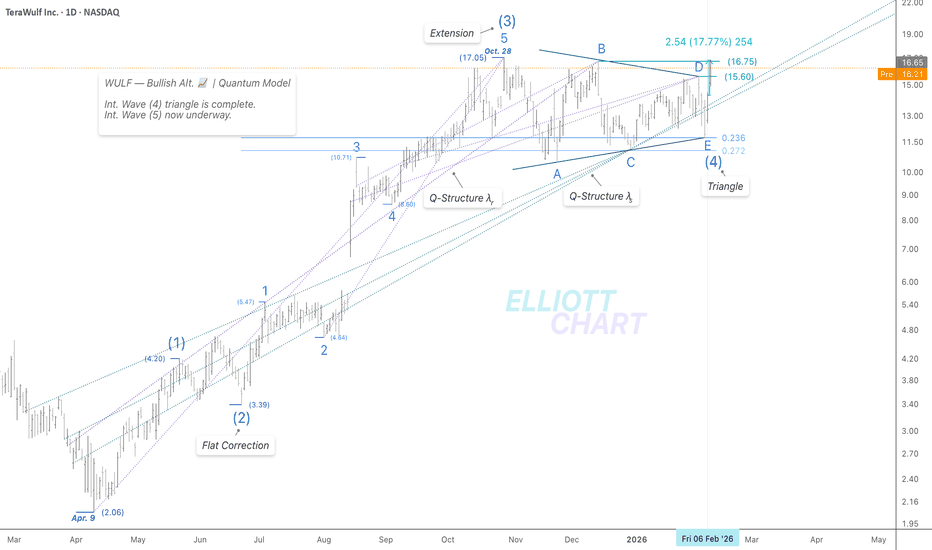

WULF | WeeklyNASDAQ:WULF — Quantum Model Projection

Bullish Alt. 📈

As illustrated on the chart, the Q-Structures λᵣ and λₛ , through their confluences, have defined a consolidation zone, resolving into a Triangle correction within Intermediate Wave (4), with its final subdivision—Minor Wave E—still pendin

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.42 USD

−72.42 M USD

140.05 M USD

270.99 M

About TeraWulf Inc.

Sector

Industry

CEO

Paul B. Prager

Website

Headquarters

Easton

Founded

2021

IPO date

Oct 27, 1993

Identifiers

3

ISIN US88080T1043

TeraWulf, Inc. owns and operates fully integrated environmentally clean bitcoin mining facilities in the United States. TeraWulf will generate domestically produced bitcoin powered by nuclear, hydro and solar energy. The company was founded by Paul Prager and Nazar Khan on February 8, 2021 and is headquartered in Easton, MD.

Related stocks

WULF | DailyNASDAQ:WULF — Quantum Model Projection

Bullish Alternative📈

As highlighted in the previous update, the consolidation phase within the Intermediate Wave (4) triangle, supported by Q-Structure λₛ , appears to have concluded. The projected advance of Intermediate Wave (5) may have begun with Frida

WULF | DailyNASDAQ:WULF — Quantum Model Projection

Bullish Alt. 📈 | Daily Update

WULF rallied 17.77%💫 intraday, right on schedule!!

With the decisive breaks above $15.60 and $16.75, the consolidation within the Intermediate Wave (4) triangle has concluded, fully confirming the launch of Intermediate Wave (

Absolute parabolic move incoming on WULF?OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can c

WULF | DailyNASDAQ:WULF — Quantum Model Projection

Bullish Alternative 📈

As outlined in the previous update(Feb. 3 Daily), the triangle’s final subdivision—Minor Wave E, marked by an approximately 14% decline—may have concluded the consolidation phase within Intermediate Wave (4) that has been in place sinc

WULF | DailyNASDAQ:WULF — Quantum Model Projection

Bullish Alternative 📈

Despite a 16% intraday advance, the absence of a decisive close above $15.42 keeps Minor Wave E unresolved, with structure potentially developing as a flat or triangle supported by the

Q-Structure λₛ along the divergent zone.

🔖 Thi

WULF | DailyNASDAQ:WULF — Quantum Model Projection

Bullish Alt. 📈 | Daily

Since late October, Triangle Intermediate Wave (4) has matured into a textbook formation, with its final Minor Wave E pullback held by the Q-Structure λₛ within the divergent zone, as anticipated.

Despite Minor E’s internal structure

TeraWulf Inc. (WULF) Expands Low-Cost Bitcoin ProductionTeraWulf Inc. (WULF) operates large-scale Bitcoin mining sites powered by low-cost, zero-carbon energy sources such as nuclear and hydro. By focusing on clean, efficient power, the company aims to mine Bitcoin at lower costs than traditional operators. Growth comes from expanding mining capacity, im

WULF | DailyNASDAQ:WULF — Bullish Alt. 📈 | Quantum Model

Under the 2nd alternative, Triangle Intermediate Wave (4) remains in progress, with a revised Minor Wave D now complete and Minor Wave E pulling back(~13%📉) toward Q-Structure λₛ , along the divergent zone.

🔖 This outlook is derived from insights wi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of WULF is 16.26 USD — it has decreased by −0.75% in the past 24 hours. Watch TeraWulf Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange TeraWulf Inc. stocks are traded under the ticker WULF.

WULF stock has risen by 19.53% compared to the previous week, the month change is a 12.64% rise, over the last year TeraWulf Inc. has showed a 234.91% increase.

We've gathered analysts' opinions on TeraWulf Inc. future price: according to them, WULF price has a max estimate of 37.00 USD and a min estimate of 17.00 USD. Watch WULF chart and read a more detailed TeraWulf Inc. stock forecast: see what analysts think of TeraWulf Inc. and suggest that you do with its stocks.

WULF reached its all-time high on Nov 17, 2021 with the price of 43.98 USD, and its all-time low was 0.54 USD and was reached on Mar 17, 2023. View more price dynamics on WULF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

WULF stock is 15.69% volatile and has beta coefficient of 2.57. Track TeraWulf Inc. stock price on the chart and check out the list of the most volatile stocks — is TeraWulf Inc. there?

Today TeraWulf Inc. has the market capitalization of 6.66 B, it has increased by 12.50% over the last week.

Yes, you can track TeraWulf Inc. financials in yearly and quarterly reports right on TradingView.

TeraWulf Inc. is going to release the next earnings report on Feb 26, 2026. Keep track of upcoming events with our Earnings Calendar.

WULF earnings for the last quarter are −1.13 USD per share, whereas the estimation was −0.04 USD resulting in a −2.49 K% surprise. The estimated earnings for the next quarter are −0.13 USD per share. See more details about TeraWulf Inc. earnings.

TeraWulf Inc. revenue for the last quarter amounts to 50.58 M USD, despite the estimated figure of 53.00 M USD. In the next quarter, revenue is expected to reach 44.55 M USD.

WULF net income for the last quarter is −455.05 M USD, while the quarter before that showed −18.37 M USD of net income which accounts for −2.38 K% change. Track more TeraWulf Inc. financial stats to get the full picture.

No, WULF doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 14, 2026, the company has 12 employees. See our rating of the largest employees — is TeraWulf Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TeraWulf Inc. EBITDA is −38.10 M USD, and current EBITDA margin is 0.42%. See more stats in TeraWulf Inc. financial statements.

Like other stocks, WULF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TeraWulf Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TeraWulf Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TeraWulf Inc. stock shows the strong buy signal. See more of TeraWulf Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.