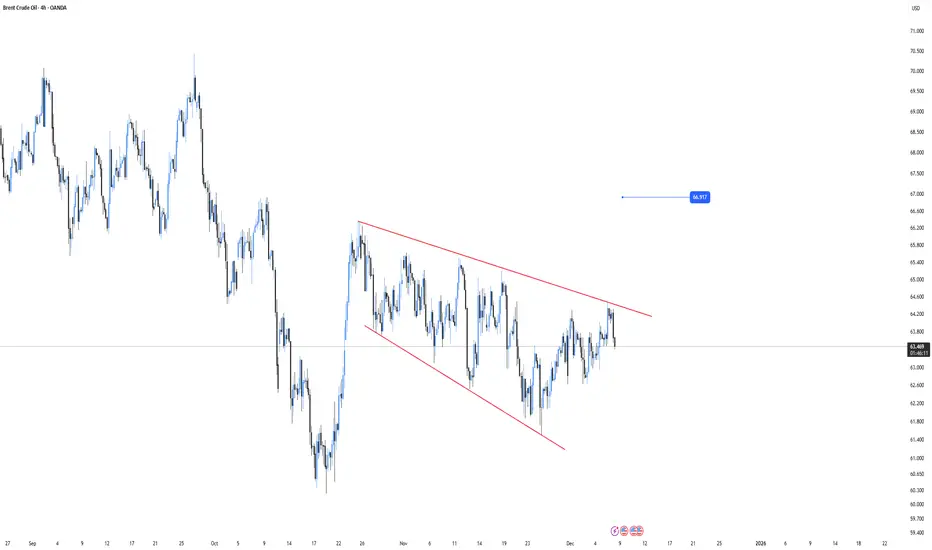

Brent crude has been developing inside a broadening / expanding corrective structure after the previous impulsive decline.

The volatility within this formation suggests indecision, yet the overall flow still fits the classic sequence of:

Impulse → Expanding Correction → Potential Next Impulse.

From a technical perspective, price has repeatedly respected the boundaries of the expanding structure, building a base of higher lows and compressing toward a breakout zone. A confirmed break above the upper trend line would unlock bullish momentum, with the 66.80–67.00 region standing out as the first major target due to unfilled inefficiencies and prior liquidity clusters.

What reinforces this scenario is that multiple technical analysts currently view the ongoing consolidation as a corrective phase rather than the start of a new bearish trend. Several independent traders identify the same broadening pattern, expecting a bullish expansion once the correction completes.

Fundamentally, short-term sentiment also supports the possibility of a rebound. Demand forecasts have recently stabilized, OPEC+ continues to manage supply conditions, and weekly inventory fluctuations have provided intermittent support for crude. These factors often allow corrective structures to resolve upward before broader macro trends take over.

At the institutional level, Goldman Sachs projects Brent to average near the mid-66s in the second half of 2025, aligning closely with the structural target from this chart. However, it is worth noting that EIA and S&P Global caution that global supply could still outweigh demand later on—meaning any bullish impulse may be limited unless fundamental conditions shift.

In summary:

This is an observational analysis, not financial advice.

The volatility within this formation suggests indecision, yet the overall flow still fits the classic sequence of:

Impulse → Expanding Correction → Potential Next Impulse.

From a technical perspective, price has repeatedly respected the boundaries of the expanding structure, building a base of higher lows and compressing toward a breakout zone. A confirmed break above the upper trend line would unlock bullish momentum, with the 66.80–67.00 region standing out as the first major target due to unfilled inefficiencies and prior liquidity clusters.

What reinforces this scenario is that multiple technical analysts currently view the ongoing consolidation as a corrective phase rather than the start of a new bearish trend. Several independent traders identify the same broadening pattern, expecting a bullish expansion once the correction completes.

Fundamentally, short-term sentiment also supports the possibility of a rebound. Demand forecasts have recently stabilized, OPEC+ continues to manage supply conditions, and weekly inventory fluctuations have provided intermittent support for crude. These factors often allow corrective structures to resolve upward before broader macro trends take over.

At the institutional level, Goldman Sachs projects Brent to average near the mid-66s in the second half of 2025, aligning closely with the structural target from this chart. However, it is worth noting that EIA and S&P Global caution that global supply could still outweigh demand later on—meaning any bullish impulse may be limited unless fundamental conditions shift.

In summary:

- The market structure supports a bullish breakout scenario.

- Technical analysts widely agree on the expanding correction framework.

- Short-term fundamentals allow for a recovery toward 66–67.

- Longer-term outlook remains mixed, so managing risk above key resistance is essential.

This is an observational analysis, not financial advice.

Note

Feel free to share your view, do you also see this expanding correction as a bullish setup, or a distribution phase preparing for lower prices?Join myTelegram Channel: t.me/G_Traders

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join myTelegram Channel: t.me/G_Traders

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.