__________________________________________________________________________________

Market Overview

__________________________________________________________________________________

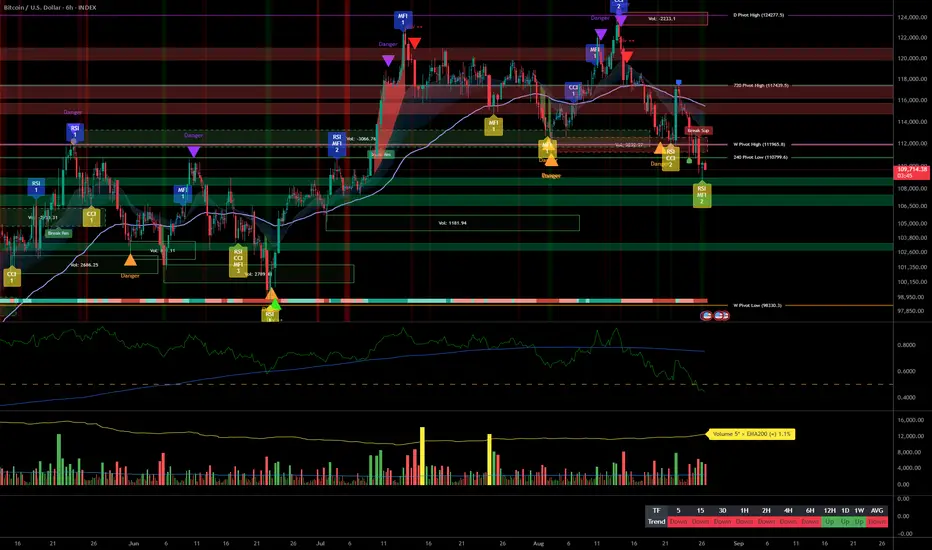

BTC remains in a controlled pullback after the 124,277 rejection, compressing above 109k and gravitating toward the 107,100 HTF pivot. Sellers keep the upper hand, but a technical bounce can emerge if key supports hold.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

Below 111k, sellers drive the tape; favor “sell the rip” while keeping a tactical long only on clean reactions at support.

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Most timeframes lean bearish, with 4H/2H contrarian hints at a major HTF support.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro turns more easing‑friendly yet data‑dependent, while institutional BTC demand persists despite deleveraging.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

Market sits in controlled range‑down, anchored by a key HTF pivot.

– Trend: Bearish/cautious below 111k, bounce potential if 107.1k holds.

– Top setup: “Sell the rip” at 110.6–111.0k; “Buy the dip” only on a clean 107.1k reaction and reclaim > 110.6k.

– Macro: Easing bias (Fed/RBA) helps a reclaim, but US data and trade tensions can cap risk.

Stay disciplined: trade confirmations and respect invalidations.

Market Overview

__________________________________________________________________________________

BTC remains in a controlled pullback after the 124,277 rejection, compressing above 109k and gravitating toward the 107,100 HTF pivot. Sellers keep the upper hand, but a technical bounce can emerge if key supports hold.

- Momentum: Bearish 📉 with lower highs/lows; selling pressure dominates below 111k.

- Key levels:

– Resistances (HTF/LTF): 110.6–111.0k • 111.9k (W) • 114–115k (D)

– Supports (HTF): 109.0–109.3k • 107,100 (240 PL) • 103,000 (former demand) - Volumes: Moderate on 2H–6H, Normal on 1D → no capitulation; likely low‑range chop/wicks.

- Multi-timeframe signals: LTF (15m–2H) trending down; 4H/2H show local bullish divergence (ISPD = BUY) near 107.1k; overall trend bias still Down.

- Risk On / Risk Off Indicator: SELL (sell bias) — confirms the bearish momentum; a move to NEUTRE ACHAT would better support a bounce.

__________________________________________________________________________________

Trading Playbook

__________________________________________________________________________________

Below 111k, sellers drive the tape; favor “sell the rip” while keeping a tactical long only on clean reactions at support.

- Global bias: Mildly bearish below 111.0k; main invalidation on a 4H close > 111.0k.

- Opportunities:

– Fade the 110.6–111.0k bounce with a tight stop; target 109.6k then 109.0k.

– Tactical long on a strong 107.1k reaction (wick rejection + 2H/4H reclaim > 110.6k), target 111.9k.

– Continuation short if 4H/D closes below 107.1k toward 103k. - Risk zones / invalidations:

– A firm break below 107.1k invalidates longs and opens 103k, then 96.3k.

– A confirmed reclaim above 111.9k invalidates most shorts and opens 114–115k. - Macro catalysts (Twitter, Perplexity, news):

– Powell signaling a possible September cut but data‑dependent → solid prints help reclaim 110.6k+.

– US data (Durable Goods, Consumer Confidence) → negative surprises raise odds of a 107.1k break.

– Trade tensions (tariffs/supply‑chain) → risk premium, can cap rebounds. - Action plan:

– Long Plan (tactical): Entry 109.2k and 107.3–107.1k / Stop < 106.8k / TP1 110.6k, TP2 111.9k, TP3 114–115k / R:R ~2.0–2.5R.

– Short Plan (fade or breakdown): Entry 110.6–111.0k OR after 4H close < 107.1k / Stop > 111.2k (fade) or >108.2k (break) / TP1 109.6k (fade) or 103k (break), TP2 109.0k or 99–98k / R:R ~1.8–2.5R.

__________________________________________________________________________________

Multi-Timeframe Insights

__________________________________________________________________________________

Most timeframes lean bearish, with 4H/2H contrarian hints at a major HTF support.

- 1D/12H/6H: Lower highs/lows under 111k; magnet toward 107.1k; 114–115k only after a firm reclaim > 111.0k.

- 4H/2H: Bullish divergence (ISPD = BUY) around 108.8–109.3k/107.1k; only buy if 110.6k is reclaimed, then 111.9k tests.

- 1H/30m/15m: Trend favors sell‑the‑rip; fade 110.4–111.0k; watch liquidity sweeps sub‑109k to 108.6k; need a volume regime shift to reverse.

__________________________________________________________________________________

Macro & On-Chain Drivers

__________________________________________________________________________________

Macro turns more easing‑friendly yet data‑dependent, while institutional BTC demand persists despite deleveraging.

- Macro events: Powell hints at a possible September cut (data‑dependent); RBA minutes tilt dovish; trade tensions (tariffs/undersea supply) → tactically supportive for risk unless inflation/geopolitics flip risk‑off.

- Bitcoin analysis: US spot ETF inflows (+$219M on Aug 25) signal resilient institutional demand; players like MicroStrategy near ~3% of supply → steady float absorption.

- On-chain data: CEX reserves ~3.27M BTC with recent net outflows; ~1,703 BTC moved from Coinbase Institutional to custody → accumulation bias, but high derivatives OI = squeeze‑prone.

- Expected impact: If easing narrative and inflows persist, reclaiming 110.6k/111.0k becomes more likely; risk‑off shocks raise the odds of a 107.1k break.

__________________________________________________________________________________

Key Takeaways

__________________________________________________________________________________

Market sits in controlled range‑down, anchored by a key HTF pivot.

– Trend: Bearish/cautious below 111k, bounce potential if 107.1k holds.

– Top setup: “Sell the rip” at 110.6–111.0k; “Buy the dip” only on a clean 107.1k reaction and reclaim > 110.6k.

– Macro: Easing bias (Fed/RBA) helps a reclaim, but US data and trade tensions can cap risk.

Stay disciplined: trade confirmations and respect invalidations.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.