📉 BTC/USDT Market Update

Bitcoin has broken down key structural levels, confirming a bearish outlook in the short to mid-term.

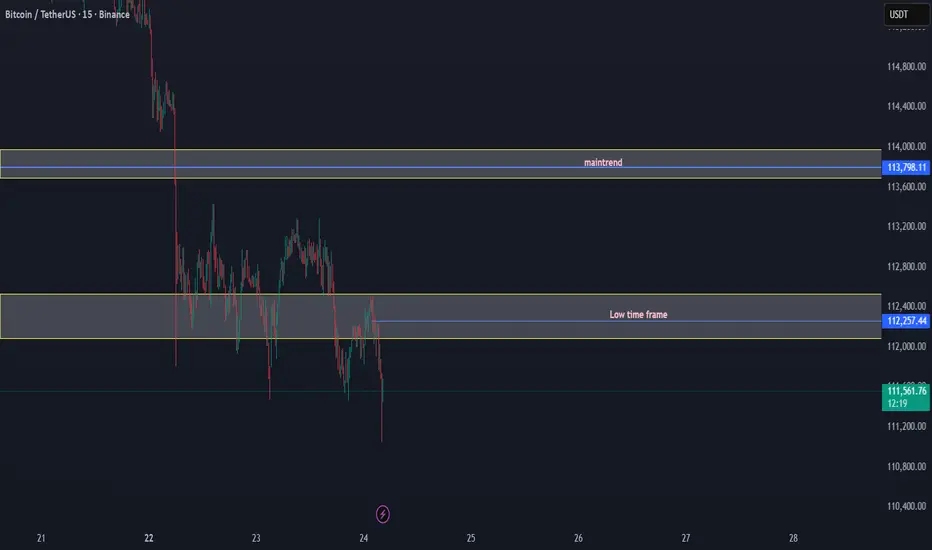

✅ Low Time Frame Support Lost: The $112,083 – $112,531 demand zone has failed to hold, indicating that buyers are losing control on lower time frames.

✅ Main Trend Zone Rejected: The $113,798 – $114,000 supply area acted as strong resistance, and BTC was unable to reclaim this key trend level.

✅ Momentum: Current price action shows continuation to the downside, with sellers stepping in aggressively after repeated failed attempts to sustain higher levels.

Bias: Bearish

As long as BTC trades below $113,800, the market structure favors sellers. Further downside pressure may target the $111,000 – $110,800 range in the near term.

⚠️ Key Levels to Watch:

Resistance: $113,800 – $114,000 (Main trend rejection zone)

Support: $111,000 – $110,800 (Next liquidity pool)

Bitcoin has broken down key structural levels, confirming a bearish outlook in the short to mid-term.

✅ Low Time Frame Support Lost: The $112,083 – $112,531 demand zone has failed to hold, indicating that buyers are losing control on lower time frames.

✅ Main Trend Zone Rejected: The $113,798 – $114,000 supply area acted as strong resistance, and BTC was unable to reclaim this key trend level.

✅ Momentum: Current price action shows continuation to the downside, with sellers stepping in aggressively after repeated failed attempts to sustain higher levels.

Bias: Bearish

As long as BTC trades below $113,800, the market structure favors sellers. Further downside pressure may target the $111,000 – $110,800 range in the near term.

⚠️ Key Levels to Watch:

Resistance: $113,800 – $114,000 (Main trend rejection zone)

Support: $111,000 – $110,800 (Next liquidity pool)

❤️Follow the channel for daily updates

Trading lower timeframes and the main trend.

🟡Join updates Telegram free

t.me/SatochiTraderoriginal

💎For contact t.me/Sato100x

📊 Earn with our hedge fund

✅ satohedge.com

Trading lower timeframes and the main trend.

🟡Join updates Telegram free

t.me/SatochiTraderoriginal

💎For contact t.me/Sato100x

📊 Earn with our hedge fund

✅ satohedge.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

❤️Follow the channel for daily updates

Trading lower timeframes and the main trend.

🟡Join updates Telegram free

t.me/SatochiTraderoriginal

💎For contact t.me/Sato100x

📊 Earn with our hedge fund

✅ satohedge.com

Trading lower timeframes and the main trend.

🟡Join updates Telegram free

t.me/SatochiTraderoriginal

💎For contact t.me/Sato100x

📊 Earn with our hedge fund

✅ satohedge.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.