Happy Monday traders,

I’ve reviewed the latest data again and nothing has changed my view. The structure still looks weak underneath the surface and the setup for downside remains strong.

Summary:

• Price rising → Market pushing higher, looks strong on the surface.

• Stablecoin OI increasing → New leveraged perp positions opening. Speculative money is driving the move, not real buyers.

• Coin-margined OI dropped, then slightly increased → Shorts were closed during the breakout, and now new shorts are opening near the highs.

• Spot CVD flat or slightly negative → Real demand is still missing. Spot traders aren’t supporting this move.

• Stablecoin CVD rising → Perp traders are aggressively buying, lifting price artificially.

• Long/Short ratio falling (2.05 → 1.02) → Fewer longs and more shorts entering. Shorts are fading strength while price keeps rising.

• Price up + OI up + Spot CVD flat → Buyers are being absorbed by new shorts. This is distribution forming at the highs.

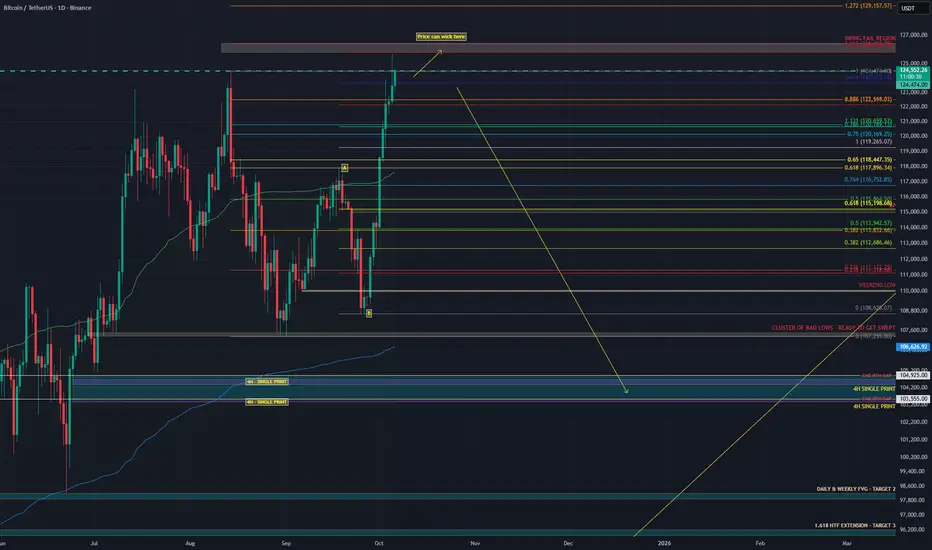

• Possible short-term move to 126K → Could sweep weekend highs during RTH for liquidity before a potential reversal.

• If Spot CVD stays flat while OI rises on that move → That would likely be the final squeeze before a deeper dump.

-------------------

1️⃣ The same leverage-driven structure

The breakout on September 25 looked impressive, but it was built on leverage rather than real spot demand.

2️⃣ Spot demand is still missing

Spot CVD moved from -18.38K → -16.44K (about +10.5%), while futures OI rose almost the same amount. That tells you everything: the breakout was driven by futures leverage, not real spot buying.

Everyone’s renting Ferraris (perp longs), but no one is actually buying one (spot BTC). Once the rental stops, the cars vanish and prices drop.

3️⃣ The long-short ratio collapse

On September 25, the aggregated long/short ratio (Binance + Bybit) was 2.05, meaning twice as many longs as shorts. Today it sits near 1.02, even though price is higher.

This is a classic case of perps pushing while smarter money fades.

4️⃣ Why I still think Bitcoin will bleed

This looks like distribution, not accumulation.

That’s not a healthy uptrend. It’s a top-heavy market waiting for the bid to dry up. When it does, the unwind will likely be quick as leveraged positions are forced out.

Think of it like a rubber band. The more it’s stretched by leverage without real demand, the harder it snaps when buying power runs out.

⚖️ TL;DR

The move up was built on leverage, not ownership.

Spot hasn’t confirmed, and shorts are stacking into strength.

🎯 Short-term note

There’s a chance we see one more push toward the 126K region during RTH to sweep the weekend highs before rolling over. If that happens with spot CVD still flat and OI climbing, it’ll likely be the final liquidity grab before a larger move down.

Until spot CVD turns positive and OI stabilizes, my view remains the same: Bitcoin will bleed.

Interested in the Order Flow data that I used for this Analysis? Check it out here => ibb.co/Fk4yPbPw

I’ve reviewed the latest data again and nothing has changed my view. The structure still looks weak underneath the surface and the setup for downside remains strong.

Summary:

• Price rising → Market pushing higher, looks strong on the surface.

• Stablecoin OI increasing → New leveraged perp positions opening. Speculative money is driving the move, not real buyers.

• Coin-margined OI dropped, then slightly increased → Shorts were closed during the breakout, and now new shorts are opening near the highs.

• Spot CVD flat or slightly negative → Real demand is still missing. Spot traders aren’t supporting this move.

• Stablecoin CVD rising → Perp traders are aggressively buying, lifting price artificially.

• Long/Short ratio falling (2.05 → 1.02) → Fewer longs and more shorts entering. Shorts are fading strength while price keeps rising.

• Price up + OI up + Spot CVD flat → Buyers are being absorbed by new shorts. This is distribution forming at the highs.

• Possible short-term move to 126K → Could sweep weekend highs during RTH for liquidity before a potential reversal.

• If Spot CVD stays flat while OI rises on that move → That would likely be the final squeeze before a deeper dump.

-------------------

1️⃣ The same leverage-driven structure

The breakout on September 25 looked impressive, but it was built on leverage rather than real spot demand.

- Stablecoin OI (aggregated) increased from 257K → 285K contracts (+10.9%)

- This shows fresh leveraged exposure coming from perps, not genuine buyers

- Coin-margined OI dropped from 7.58B → 7.29B during that breakout as shorts were closed out

- It has now started to rise slightly again at current prices, meaning new coin-margined positions are opening near the highs, most likely shorts fading strength

2️⃣ Spot demand is still missing

Spot CVD moved from -18.38K → -16.44K (about +10.5%), while futures OI rose almost the same amount. That tells you everything: the breakout was driven by futures leverage, not real spot buying.

Everyone’s renting Ferraris (perp longs), but no one is actually buying one (spot BTC). Once the rental stops, the cars vanish and prices drop.

3️⃣ The long-short ratio collapse

On September 25, the aggregated long/short ratio (Binance + Bybit) was 2.05, meaning twice as many longs as shorts. Today it sits near 1.02, even though price is higher.

- Early breakout longs have been closed or liquidated

- New traders entering the market are mostly shorts

- OI is still rising, showing new short positioning, not liquidation exits

- Stablecoin-perp CVD is still climbing, meaning buyers are pushing price up but every uptick is met with new short liquidity

This is a classic case of perps pushing while smarter money fades.

4️⃣ Why I still think Bitcoin will bleed

This looks like distribution, not accumulation.

- Perp traders are driving the move

- Spot buyers still haven’t shown up

- Shorts are building into the highs

That’s not a healthy uptrend. It’s a top-heavy market waiting for the bid to dry up. When it does, the unwind will likely be quick as leveraged positions are forced out.

Think of it like a rubber band. The more it’s stretched by leverage without real demand, the harder it snaps when buying power runs out.

⚖️ TL;DR

- Stablecoin OI +10.9% → leverage driven

- Coin OI fell, then rose slightly → shorts covered, new shorts forming near highs

- Spot CVD flat → no real buyers

- Long/Short ratio 2.05 → 1.02 → longs out, shorts in

The move up was built on leverage, not ownership.

Spot hasn’t confirmed, and shorts are stacking into strength.

🎯 Short-term note

There’s a chance we see one more push toward the 126K region during RTH to sweep the weekend highs before rolling over. If that happens with spot CVD still flat and OI climbing, it’ll likely be the final liquidity grab before a larger move down.

Until spot CVD turns positive and OI stabilizes, my view remains the same: Bitcoin will bleed.

Interested in the Order Flow data that I used for this Analysis? Check it out here => ibb.co/Fk4yPbPw

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.