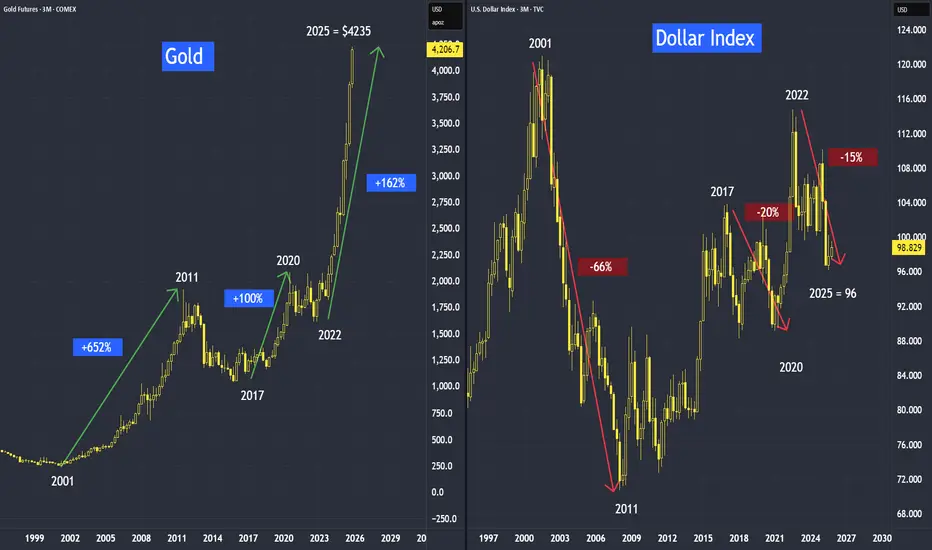

The inverse relationship between gold and the dollar is evident. Interestingly, we observe that when the dollar falls, gold rises—but the magnitude of gold’s increase is often greater than the dollar’s decline.

As we can see when dollar declines, gold went up.

From 2001 to 2011, when dollar was down, gold went up.

From 2017 to 2020, when dollar was down, gold went up.

And from 2022 to current, when dollar is down, gold is up.

With de-dollarization, this also means gold may have more upside potential.

Conversely, when the dollar increases, gold declines by almost the same magnitude.

Apart from de-dollarization, what are the other reasons dollar will face more headwinds?

There are three elements

• Existing debt,

• more money printing and

• tariffs,

All these 3 elements are not going to go away anytime soon, as long as the debt continue to rise, more money to be printed and more tariffs impose, dollar downtrend is likely to continue. When dollar is down, gold is up.

And these trends did not happen recently. It is taking shape over the past decades with a lower dollar, we can see how nicely the trends have seated on its historical troughs and peaks forming the channel for the dollar, and also in the gold over the decades.

This tutorial video version:

Mirco Gold Futures and Options

Ticker: MGC

Minimum fluctuation:

0.10 per troy ounce = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

As we can see when dollar declines, gold went up.

From 2001 to 2011, when dollar was down, gold went up.

From 2017 to 2020, when dollar was down, gold went up.

And from 2022 to current, when dollar is down, gold is up.

With de-dollarization, this also means gold may have more upside potential.

Conversely, when the dollar increases, gold declines by almost the same magnitude.

Apart from de-dollarization, what are the other reasons dollar will face more headwinds?

There are three elements

• Existing debt,

• more money printing and

• tariffs,

All these 3 elements are not going to go away anytime soon, as long as the debt continue to rise, more money to be printed and more tariffs impose, dollar downtrend is likely to continue. When dollar is down, gold is up.

And these trends did not happen recently. It is taking shape over the past decades with a lower dollar, we can see how nicely the trends have seated on its historical troughs and peaks forming the channel for the dollar, and also in the gold over the decades.

This tutorial video version:

Mirco Gold Futures and Options

Ticker: MGC

Minimum fluctuation:

0.10 per troy ounce = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

konhow@weipedia.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

konhow@weipedia.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.