Chart Overview

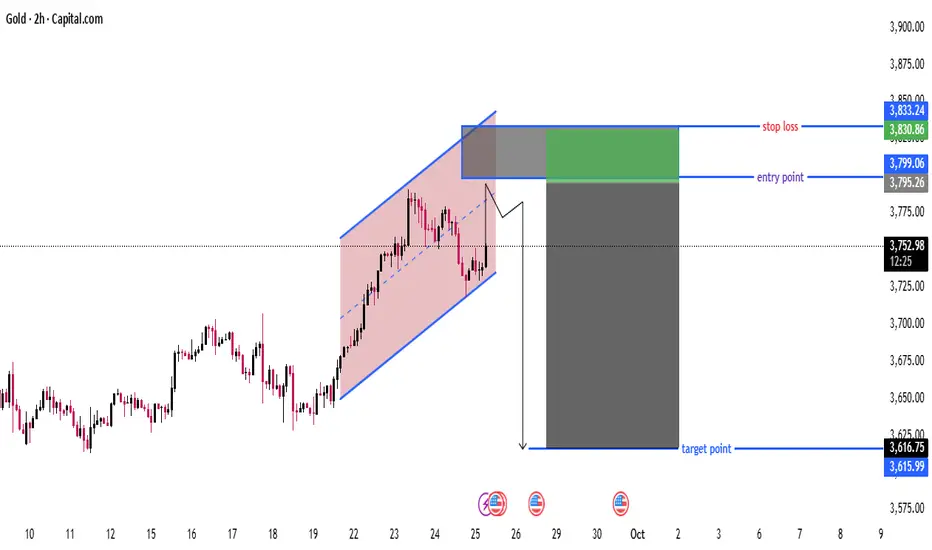

This chart shows a bearish setup for Gold, suggesting a short (sell) trade with the following key components:

🔵 Channel Analysis

Rising Parallel Channel: Price has been moving within an ascending channel (pink shaded area), indicating a short-term uptrend.

The recent candle breaks or touches the lower boundary of this channel, hinting at a potential breakdown.

📉 Trade Setup

This looks like a short (sell) trade idea based on a potential breakout to the downside.

Component Level Details

Entry Point 3,799.06 Entry zone marked in green; at/near the lower trendline of the ascending channel

Stop Loss 3,833.24 Just above the recent highs and the channel top

Target Point 3,616.75–3,615.99 Target area marked in blue; aligns with a prior support zone

✅ Trade Logic

Bearish Bias: Price action shows weakening momentum near the top of the channel.

Breakdown Expected: Entry assumes a breakdown of the ascending channel.

Risk-Reward Ratio (RRR): Very favorable — large potential move down compared to the stop loss range.

📊 Risk Management

Stop Loss: Properly placed above resistance zone — protects against false breakouts.

Target Zone: Based on historical support/resistance structure.

RRR Estimate: Approx. 1:5+, which is excellent if the move materializes.

⚠️ Potential Risks

False Breakout: Price could rebound back into the channel, invalidating the bearish thesis.

Fundamental Triggers: Gold is sensitive to macroeconomic news (e.g., interest rate changes, geopolitical tension, inflation data).

📌 Summary

This is a well-structured short trade setup based on a rising channel breakdown.

With a clear entry, stop loss, and profit target, it presents a high-reward, controlled-risk opportunity.

Best confirmed with:

Bearish candlestick confirmation at the entry point

Volume spike on breakdown

Fundamental catalysts supporting gold weakness

This chart shows a bearish setup for Gold, suggesting a short (sell) trade with the following key components:

🔵 Channel Analysis

Rising Parallel Channel: Price has been moving within an ascending channel (pink shaded area), indicating a short-term uptrend.

The recent candle breaks or touches the lower boundary of this channel, hinting at a potential breakdown.

📉 Trade Setup

This looks like a short (sell) trade idea based on a potential breakout to the downside.

Component Level Details

Entry Point 3,799.06 Entry zone marked in green; at/near the lower trendline of the ascending channel

Stop Loss 3,833.24 Just above the recent highs and the channel top

Target Point 3,616.75–3,615.99 Target area marked in blue; aligns with a prior support zone

✅ Trade Logic

Bearish Bias: Price action shows weakening momentum near the top of the channel.

Breakdown Expected: Entry assumes a breakdown of the ascending channel.

Risk-Reward Ratio (RRR): Very favorable — large potential move down compared to the stop loss range.

📊 Risk Management

Stop Loss: Properly placed above resistance zone — protects against false breakouts.

Target Zone: Based on historical support/resistance structure.

RRR Estimate: Approx. 1:5+, which is excellent if the move materializes.

⚠️ Potential Risks

False Breakout: Price could rebound back into the channel, invalidating the bearish thesis.

Fundamental Triggers: Gold is sensitive to macroeconomic news (e.g., interest rate changes, geopolitical tension, inflation data).

📌 Summary

This is a well-structured short trade setup based on a rising channel breakdown.

With a clear entry, stop loss, and profit target, it presents a high-reward, controlled-risk opportunity.

Best confirmed with:

Bearish candlestick confirmation at the entry point

Volume spike on breakdown

Fundamental catalysts supporting gold weakness

join my telegram channel t.me/goldmitalteam

t.me/goldmitalteam

t.me/goldmitalteam

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

join my telegram channel t.me/goldmitalteam

t.me/goldmitalteam

t.me/goldmitalteam

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.