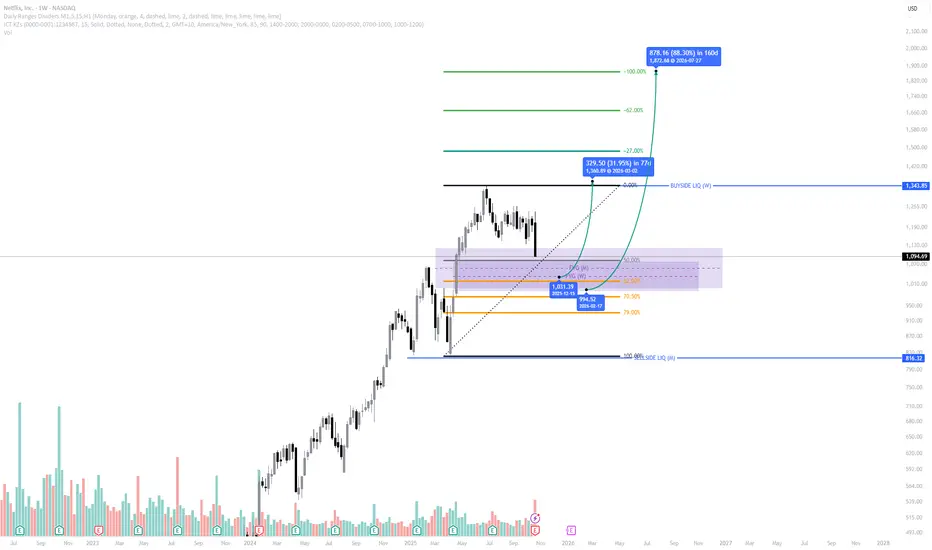

Netflix (NASDAQ: NFLX) is currently retracing into a high-probability multi-timeframe setup, aligning several ICT confluences that suggest a potential re-entry opportunity within a bullish continuation narrative.

Market Structure:

Price remains bullish overall, with clear higher highs (HH) and higher lows (HL). The recent decline represents a healthy retracement inside a developing higher-timeframe structure.

Fair Value Gap (FVG) Alignment:

The current pullback has driven price into an overlapping Monthly and Weekly FVG, an area of institutional interest where price has previously shown strong reactions.

This zone often serves as a re-accumulation region before expansion.

Optimal Trade Entry (OTE):

The FVG aligns directly within the 62%–79% Fibonacci retracement zone, known as the golden OTE zone.

This overlap of structural retracement and imbalance discount makes it a prime setup from a smart money perspective.

Liquidity & Target Zones:

- Discount Range: $944 – $1,033

- Primary Buyside Liquidity (BSL): $1,345

- Extended Target: $1,872 (100% expansion projection)

Each level aligns with liquidity pools and Fibonacci extension targets visible on higher timeframes.

Trade Bias:

Bullish, with focus on accumulation and confirmation within the OTE discount range.

A weekly bullish displacement or rejection candle within this zone would strengthen the case for long continuation plays.

Summary:

NFLX is presenting a multi-timeframe high-probability setup, where a clean retracement into an overlapping Monthly/Weekly FVG and OTE zone creates a strong case for re-entry.

If the discount zone holds, expect expansion toward buyside liquidity and potential continuation into 2026.

Market Structure:

Price remains bullish overall, with clear higher highs (HH) and higher lows (HL). The recent decline represents a healthy retracement inside a developing higher-timeframe structure.

Fair Value Gap (FVG) Alignment:

The current pullback has driven price into an overlapping Monthly and Weekly FVG, an area of institutional interest where price has previously shown strong reactions.

This zone often serves as a re-accumulation region before expansion.

Optimal Trade Entry (OTE):

The FVG aligns directly within the 62%–79% Fibonacci retracement zone, known as the golden OTE zone.

This overlap of structural retracement and imbalance discount makes it a prime setup from a smart money perspective.

Liquidity & Target Zones:

- Discount Range: $944 – $1,033

- Primary Buyside Liquidity (BSL): $1,345

- Extended Target: $1,872 (100% expansion projection)

Each level aligns with liquidity pools and Fibonacci extension targets visible on higher timeframes.

Trade Bias:

Bullish, with focus on accumulation and confirmation within the OTE discount range.

A weekly bullish displacement or rejection candle within this zone would strengthen the case for long continuation plays.

Summary:

NFLX is presenting a multi-timeframe high-probability setup, where a clean retracement into an overlapping Monthly/Weekly FVG and OTE zone creates a strong case for re-entry.

If the discount zone holds, expect expansion toward buyside liquidity and potential continuation into 2026.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.