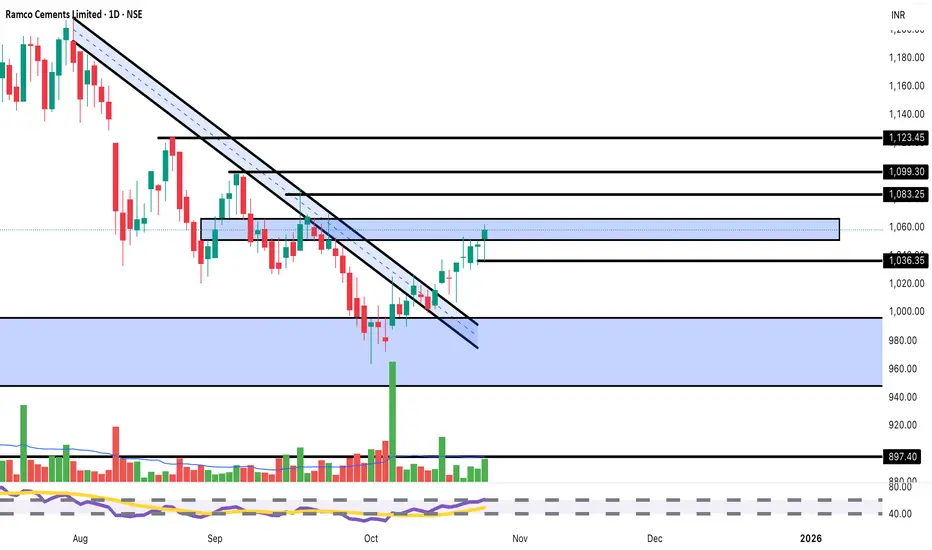

BUY Setup 🏗️

Entry: ₹1,058-1,065 (Current Level)

Target 1: ₹1,083-1,090

Target 2: ₹1,099-1,110

Target 3: ₹1,123-1,135 (Extended)

Stop Loss: ₹1,036

Technical Rationale:

Breaking above descending channel (blue shaded area) - major bullish reversal

Strong momentum with +1.11% gain today

Price reclaiming 1,060 resistance zone

Breaking above both declining trendlines convincingly

High volume (343.03K) supporting the breakout

Consolidation zone (1,000-1,060) now acting as support

RSI trending upward, showing momentum building

Cement sector showing strength on infrastructure demand

Multiple resistance levels mapped: 1,036, 1,083, 1,099, 1,123

Clear support at 1,000 psychological level

V-shaped recovery from October lows

Risk-Reward: Strong 1:3+ ratio

Pattern: Falling wedge/descending channel breakout - highly reliable bullish reversal pattern

Strategy: Medium-term swing trade - Book 30% at T1 (1,085), 30% at T2 (1,105), trail remaining with SL at 1,065 after T1

Key Levels:

Breakout Zone: 1,060 (critical level crossed)

Strong Resistance: 1,083, 1,099, 1,123

Major Support: 1,036, 1,000, 980

Sector Catalyst:

Infrastructure spending boost expected

Cement demand picking up seasonally

For educational purposes only. Not SEBI registered. Major pattern breakout - manage position sizing appropriately. Cement stocks can be volatile. Conduct thorough research before investing.

Entry: ₹1,058-1,065 (Current Level)

Target 1: ₹1,083-1,090

Target 2: ₹1,099-1,110

Target 3: ₹1,123-1,135 (Extended)

Stop Loss: ₹1,036

Technical Rationale:

Breaking above descending channel (blue shaded area) - major bullish reversal

Strong momentum with +1.11% gain today

Price reclaiming 1,060 resistance zone

Breaking above both declining trendlines convincingly

High volume (343.03K) supporting the breakout

Consolidation zone (1,000-1,060) now acting as support

RSI trending upward, showing momentum building

Cement sector showing strength on infrastructure demand

Multiple resistance levels mapped: 1,036, 1,083, 1,099, 1,123

Clear support at 1,000 psychological level

V-shaped recovery from October lows

Risk-Reward: Strong 1:3+ ratio

Pattern: Falling wedge/descending channel breakout - highly reliable bullish reversal pattern

Strategy: Medium-term swing trade - Book 30% at T1 (1,085), 30% at T2 (1,105), trail remaining with SL at 1,065 after T1

Key Levels:

Breakout Zone: 1,060 (critical level crossed)

Strong Resistance: 1,083, 1,099, 1,123

Major Support: 1,036, 1,000, 980

Sector Catalyst:

Infrastructure spending boost expected

Cement demand picking up seasonally

For educational purposes only. Not SEBI registered. Major pattern breakout - manage position sizing appropriately. Cement stocks can be volatile. Conduct thorough research before investing.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.