🚀 USD/CAD Forecast – Multi-TF Breakdown 🚀

Alright fam, let’s break this pair down clean and simple 👇

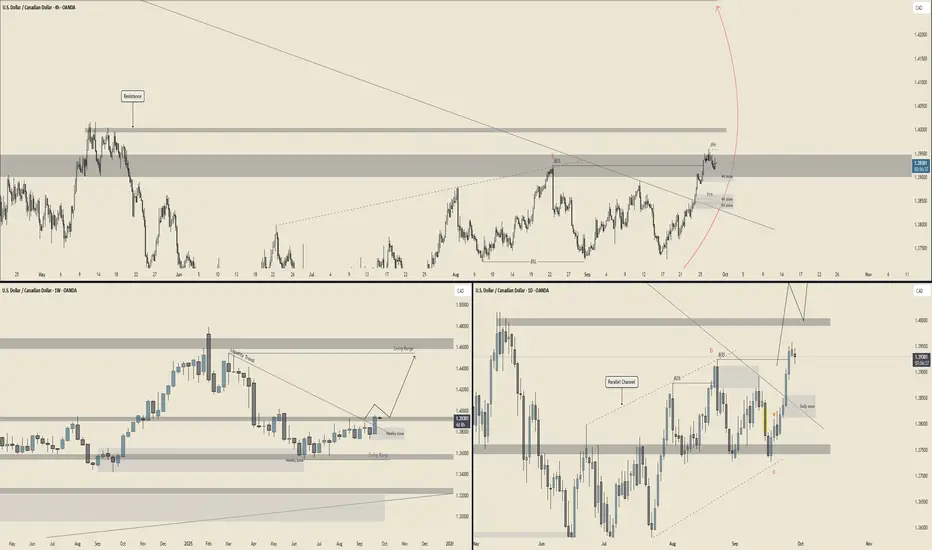

🕰 Weekly Outlook

Big picture: USD/CAD is pressing right into that juicy weekly supply zone around 1.39 – 1.40. Price has been riding the liquidity trend, and structure suggests there’s still room to climb into the 1.42 – 1.44 swing range before any major rejection.

Bias: Bullish until we see rejection from the 1.40s.

📆 Daily Structure

On the daily, we just had a Break of Structure (BOS) to the upside. Price tapped into a clean daily demand zone near 1.38 – 1.385 and bounced hard. Now we’re marching toward that daily supply at 1.40 – 1.405.

If buyers hold momentum, expect a sweep into that zone before deciding whether we get:

🐂 A clean breakout → continuation to 1.42+.

🐻 A rejection → deeper pullback back toward 1.38 – 1.375.

⏱ 4H Play

Zooming in, the 4H shows an impulse-retracement-impulse cycle. Price just tagged resistance near 1.395. Short-term, we could get a pullback into the discount zones (1.388 – 1.384) before another leg up.

The 71% fib retrace aligns with demand — that’s where buyers likely reload for a push back at the highs.

🎯 Summary

Bias: Bullish to neutral.

Upside Target: 1.405 → 1.42 (weekly supply).

Downside Risk: 1.384 (4H demand). Lose that → deeper flush into 1.375.

Gameplan: Wait for a pullback into 1.388-1.384 for longs, or fade rejection at 1.405 for shorts.

🔥 USD/CAD is heating up — the real fight will be in that 1.40 supply zone. Will bulls break it, or will bears smack it back down?

Alright fam, let’s break this pair down clean and simple 👇

🕰 Weekly Outlook

Big picture: USD/CAD is pressing right into that juicy weekly supply zone around 1.39 – 1.40. Price has been riding the liquidity trend, and structure suggests there’s still room to climb into the 1.42 – 1.44 swing range before any major rejection.

Bias: Bullish until we see rejection from the 1.40s.

📆 Daily Structure

On the daily, we just had a Break of Structure (BOS) to the upside. Price tapped into a clean daily demand zone near 1.38 – 1.385 and bounced hard. Now we’re marching toward that daily supply at 1.40 – 1.405.

If buyers hold momentum, expect a sweep into that zone before deciding whether we get:

🐂 A clean breakout → continuation to 1.42+.

🐻 A rejection → deeper pullback back toward 1.38 – 1.375.

⏱ 4H Play

Zooming in, the 4H shows an impulse-retracement-impulse cycle. Price just tagged resistance near 1.395. Short-term, we could get a pullback into the discount zones (1.388 – 1.384) before another leg up.

The 71% fib retrace aligns with demand — that’s where buyers likely reload for a push back at the highs.

🎯 Summary

Bias: Bullish to neutral.

Upside Target: 1.405 → 1.42 (weekly supply).

Downside Risk: 1.384 (4H demand). Lose that → deeper flush into 1.375.

Gameplan: Wait for a pullback into 1.388-1.384 for longs, or fade rejection at 1.405 for shorts.

🔥 USD/CAD is heating up — the real fight will be in that 1.40 supply zone. Will bulls break it, or will bears smack it back down?

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.