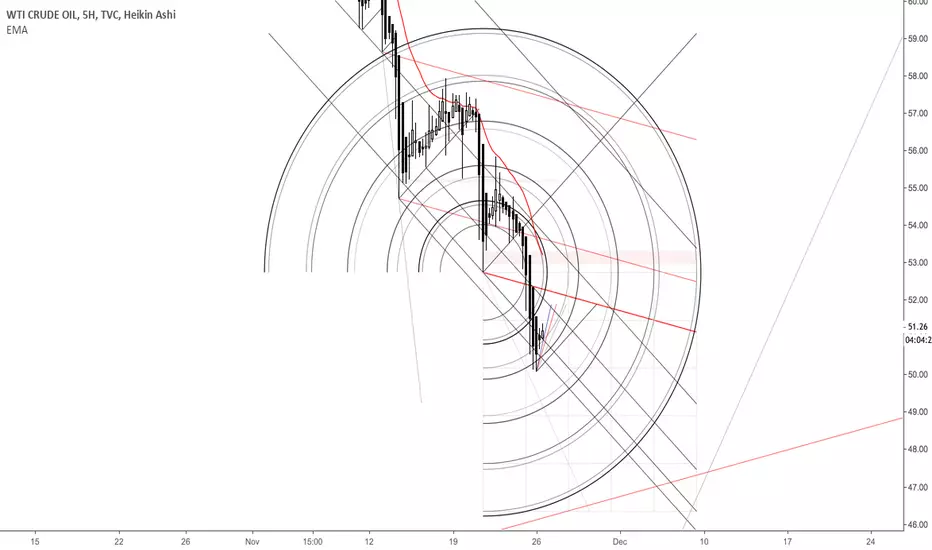

USOIL is likely to pullback to around 5220 where continuation sellers are expected to enter the market. As for now, buying any minor pullback to 5085 towards the 5220 area and flipping short around there seems reasonable. Shorter timeframe for trade entries and thorough risk management is of utmost importance. It is better to get out of the market with minimal loss than hold the bag for weeks. This is overly a bearish market and the previous times sellers were too eager to sell and didn't wait for any significant pullback. There's a sense of urgency in the market and people are selling any pullbacks so being careful with longs is a must.

Trade active

In long @ 5084 stop 5049 & 1R-3R targetsTrade closed: target reached

1/2 position closed @ 1R, remaining half open with the same stop. A risk free trade.Trade closed: target reached

3R target on the remaining 1/2 position. 2R on the full position.Note

Limit sell order @ 5195, stop @ 5230Trade active

Trade closed: target reached

Booked 1/2 position @ 1.1R, the remaining half working with same stop. A risk free trade.Trade closed: target reached

Booked the remaining 1/2 with 3R. 2R on the full position.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.