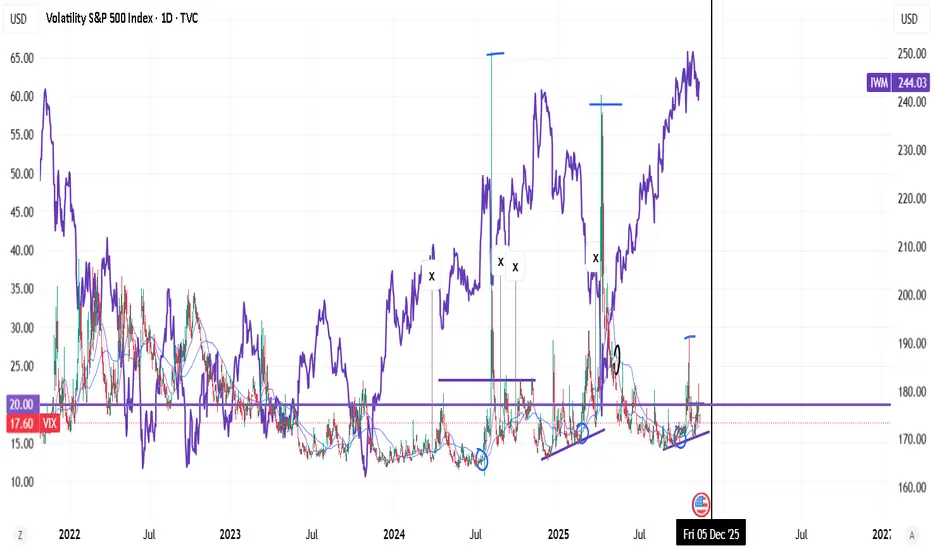

Where VIX gets 10/20/50 upswings, goes in patterns (structure). it seems it's a bad period for small caps.

Also, rising $TNX. which is the case now.

x- stands for bullish weekly macds.

Also, rising $TNX. which is the case now.

x- stands for bullish weekly macds.

Note

why does this matter?, when u get correction. You rather stick with faang or quality, not momentum stocks. You lose time. Qullamaggie said he succeeded only like 30% of times.Note

also. Peak "Lower Highs" (LHIGH) is always the start of new Risk on. Note

here's proof with $IONQ. Falling VIX and falling

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.