🌐 MARKET CONTEXT

Gold is trading in a pivotal moment as safe-haven demand remains elevated while the Federal Reserve’s future policy path becomes less certain. The recent report noted that gold prices reached over $4,213/oz on November 13, 2025.

Trading Economics

Meanwhile, broader macro commentary highlights that escalating global uncertainty is sustaining gold’s safe-haven appeal.

World Bank Blogs

Sentiment currently:

Risk-on for gold when geopolitical/fiscal concerns intensify or real yields fall.

Risk-off for gold if the USD strengthens or the Fed signals fewer rate cuts than expected.

For the upcoming London → New York sessions: expect heightened sensitivity to U.S. inflation/job data and strong reactions near structural zones. The bias today remains conditionally bullish, but we must remain alert for bearish reversal if price fails at key supply zones.

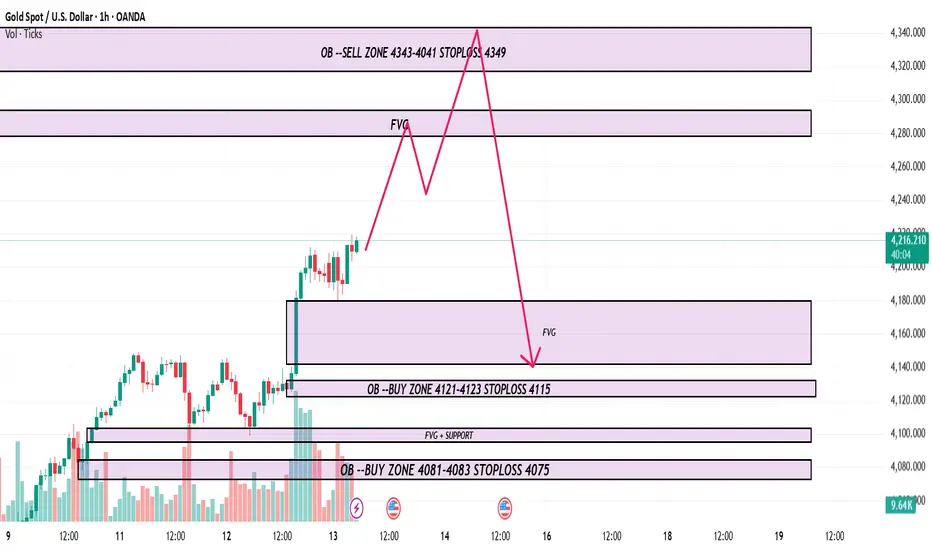

📉 TECHNICAL ANALYSIS (SMC + Liquidity Structure)

The price is showing signs of consolidation near major structural zones — this suggests a build-up of liquidity rather than a clean breakout.

Key structure to watch:

If support zones hold and we see a Change of Character (CHoCH) (i.e., lower-low becomes higher‐low) → bullish continuation.

If price reaches a major supply zone and shows a sweep or fake breakout then rejection → potential Break of Structure (BOS) to the downside.

Liquidity zones:

Demand clusters around the 4,081–4,083 and deeper around 3,990–3,988 represent potential absorption/accumulation areas.

Supply is concentrated near 4,080–4,078 (and the newly defined higher sell zone) — watch for liquidity hunt above and returning drop.

Confirmation cues: look for wicked candles, liquidity sweeps, mitigation bars, or M5/M15 structure break before entry.

🔑 KEY PRICE ZONES

4,343 – 4,041 ▶️ Sell Zone – High-range supply cluster where short-bias may apply.

4,121 – 4,123 ▶️ Buy Zone – Structural demand zone for medium-term long setups.

4,081 – 4,083 ▶️ Buy Zone – Intraday demand / reversal potential.

3,990 – 3,988 ▶️ Buy Zone (deep support) – High reward if touched with confirmation.

Stop-loss levels:

Sell stop-loss: 4,349

Buy stop-loss (4,121 zone): 4,115

Buy stop-loss (4,081 zone): 4,075

Buy stop-loss (3,990 zone): 3,982

⚙️ TRADE SETUPS

✅ BUY SCENARIO 1 – STRUCTURAL DEMAND (MID)

Entry: 4,121 – 4,123

Stop-loss: 4,115

TP1: ~4,150 TP2: ~4,190 TP3: Open

Logic: Price returns to demand zone → confirmation required (sweep + rejection) → structural long.

✅ BUY SCENARIO 2 – INTRADAY REACTION DEMAND

Entry: 4,081 – 4,083

Stop-loss: 4,075

TP1: ~4,105 TP2: ~4,140 TP3: Open

Logic: Pull-back into middle zone -> quick reaction long for London session.

⚠️ SELL SCENARIO – SUPPLY REJECTION

Entry: 4,343 – 4,041

Stop-loss: 4,349

TP1: ~4,000 TP2: ~3,950 TP3: ~3,900

Logic: Price into upper supply zone → watch for rejection pattern or liquidity sweep above → short trigger.

🧠 NOTES / SESSION PLAN

Focus on buy setups in London session from 4,081 zone and deeper 3,990 zone.

Shift to sell setup if price moves into 4,343–4,041 and shows rejection during New York session.

Avoid entering immediately before major U.S. economic releases; look for confirmation (M5/M15) after news.

Risk-management: each trade max ~2% account risk; adjust size accordingly. Trail stop once TP1 achieved.

Expect choppy price action and fake moves; patience and structure confirmation are key.

🏁 CONCLUSION

Today’s plan: Bias leans bullish conditionally, with multiple buy zones at 4,121–4,123, 4,081–4,083, and 3,990–3,988 offering structured opportunities. However, a strong sell trigger remains valid at the supply zone 4,343–4,041, if rejection occurs. Trade should be guided by confirmation, strict risk control, and alignment with SMC structure.

Gold is trading in a pivotal moment as safe-haven demand remains elevated while the Federal Reserve’s future policy path becomes less certain. The recent report noted that gold prices reached over $4,213/oz on November 13, 2025.

Trading Economics

Meanwhile, broader macro commentary highlights that escalating global uncertainty is sustaining gold’s safe-haven appeal.

World Bank Blogs

Sentiment currently:

Risk-on for gold when geopolitical/fiscal concerns intensify or real yields fall.

Risk-off for gold if the USD strengthens or the Fed signals fewer rate cuts than expected.

For the upcoming London → New York sessions: expect heightened sensitivity to U.S. inflation/job data and strong reactions near structural zones. The bias today remains conditionally bullish, but we must remain alert for bearish reversal if price fails at key supply zones.

📉 TECHNICAL ANALYSIS (SMC + Liquidity Structure)

The price is showing signs of consolidation near major structural zones — this suggests a build-up of liquidity rather than a clean breakout.

Key structure to watch:

If support zones hold and we see a Change of Character (CHoCH) (i.e., lower-low becomes higher‐low) → bullish continuation.

If price reaches a major supply zone and shows a sweep or fake breakout then rejection → potential Break of Structure (BOS) to the downside.

Liquidity zones:

Demand clusters around the 4,081–4,083 and deeper around 3,990–3,988 represent potential absorption/accumulation areas.

Supply is concentrated near 4,080–4,078 (and the newly defined higher sell zone) — watch for liquidity hunt above and returning drop.

Confirmation cues: look for wicked candles, liquidity sweeps, mitigation bars, or M5/M15 structure break before entry.

🔑 KEY PRICE ZONES

4,343 – 4,041 ▶️ Sell Zone – High-range supply cluster where short-bias may apply.

4,121 – 4,123 ▶️ Buy Zone – Structural demand zone for medium-term long setups.

4,081 – 4,083 ▶️ Buy Zone – Intraday demand / reversal potential.

3,990 – 3,988 ▶️ Buy Zone (deep support) – High reward if touched with confirmation.

Stop-loss levels:

Sell stop-loss: 4,349

Buy stop-loss (4,121 zone): 4,115

Buy stop-loss (4,081 zone): 4,075

Buy stop-loss (3,990 zone): 3,982

⚙️ TRADE SETUPS

✅ BUY SCENARIO 1 – STRUCTURAL DEMAND (MID)

Entry: 4,121 – 4,123

Stop-loss: 4,115

TP1: ~4,150 TP2: ~4,190 TP3: Open

Logic: Price returns to demand zone → confirmation required (sweep + rejection) → structural long.

✅ BUY SCENARIO 2 – INTRADAY REACTION DEMAND

Entry: 4,081 – 4,083

Stop-loss: 4,075

TP1: ~4,105 TP2: ~4,140 TP3: Open

Logic: Pull-back into middle zone -> quick reaction long for London session.

⚠️ SELL SCENARIO – SUPPLY REJECTION

Entry: 4,343 – 4,041

Stop-loss: 4,349

TP1: ~4,000 TP2: ~3,950 TP3: ~3,900

Logic: Price into upper supply zone → watch for rejection pattern or liquidity sweep above → short trigger.

🧠 NOTES / SESSION PLAN

Focus on buy setups in London session from 4,081 zone and deeper 3,990 zone.

Shift to sell setup if price moves into 4,343–4,041 and shows rejection during New York session.

Avoid entering immediately before major U.S. economic releases; look for confirmation (M5/M15) after news.

Risk-management: each trade max ~2% account risk; adjust size accordingly. Trail stop once TP1 achieved.

Expect choppy price action and fake moves; patience and structure confirmation are key.

🏁 CONCLUSION

Today’s plan: Bias leans bullish conditionally, with multiple buy zones at 4,121–4,123, 4,081–4,083, and 3,990–3,988 offering structured opportunities. However, a strong sell trigger remains valid at the supply zone 4,343–4,041, if rejection occurs. Trade should be guided by confirmation, strict risk control, and alignment with SMC structure.

Real-Time Trade and Proceed:

t.me/+16FNHtbGpTNmODRl

11 - 15 Scalping VIP Daily

Swing Trade post Free

OrderFlow & Option Update Free

t.me/+16FNHtbGpTNmODRl

11 - 15 Scalping VIP Daily

Swing Trade post Free

OrderFlow & Option Update Free

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Real-Time Trade and Proceed:

t.me/+16FNHtbGpTNmODRl

11 - 15 Scalping VIP Daily

Swing Trade post Free

OrderFlow & Option Update Free

t.me/+16FNHtbGpTNmODRl

11 - 15 Scalping VIP Daily

Swing Trade post Free

OrderFlow & Option Update Free

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.