Moving Average Convergence / Divergence (MACD)

Education and research

Most people use the RSI as a momentum indicator, trying to find Overbought/Oversold (OBOS) conditions, and/or divergences. However there is also a way to use it as a Trend Tool. There is a mathematical relationship that connects the RSI and EMA's. The formula is RSI(x) cross-over 50-line = Close cross-over EMA(2x) i.e. RSI(14) cross-over 50 line = Close...

Moving Average Convergence / Divergence (MACD)

Read more about the MACD.

5 Indicators : LUXALGO a-Adaptive MACD b- MACD based price forcasting DGT: a-Price Action Support & resistance b- ˜Dual Supertrends REDKTRADER a-REDK EVEREX Narrative is in Arabic

The simplicity of this indicator is REALLY what has me gassed up. It's the smallest indicator I have coded but it is just so powerful. There are a million oscillators out there based on volume. My biggest problem with them is that they simply tell you whether you have volume to the upside or volume to the down side. It kind of tricks you with the lack of...

Making a trade plane using MACD Multi Time Frame. Chart & Indicator : 1. Heikin Aishi Candle 2. Current Chart MACD 3. Higher TF MACD 4. ADX Steps : 1. Look at Higher TF MACD Direction 2. Check if lower TF MACD is aligned 3. Check if ADX / trend's strength 4. Set a limit position, wait for the price to break support. 5. Set SL in previous high. Set TP...

Hello Traders, Today I wanted to go over one of my favorite as well as one of the most widely used tools in trading, the Moving Average Convergence Divergence (MACD) indicator. This moving average indicator was created invented in 1979 by Gerald Appel responsible for the MACD line and Signal line and later added to this was the histogram, developed by Thomas...

greetings, hope you're doing well and thanks for your likes and comments . Today i'm gonna teach you how to mix two indicators there's lots of indicators that you can mix together and use them, at this tutorial i'm gonna try adding MACD and RSI . 1_ Once you have added the RSI indicator, you have to open RSI settings. 2_then you have to process the way below : go...

Hello everyone, as we all know the market action discounts everything :) _________________________________Make sure to Like and Follow if you like the idea_________________________________ In this video, I am gonna explain what is the MACD and how to use it and how to identify buy and sell signals using this indicator. So what is the MACD, The MACD is a...

A new strategy that I have developed. Only enter when EMA crosses one of the longer term EMA's + a bullish cross is forming on the MACD. Ideally, you should wait for ema 8 to cross both ema 21 and 34 with a bullish cross formed/forming on MACD. Use alongside normal Support and Resistance for SL and TP levels. If used on crypto I mainly suggest just BTC as alt...

Hi every one *Definition of RSI: This indicator Is momentum base indicator. The biggest difference with momentum is that there are two line which indicate that: Is the price in the oversold or overbought area or not? We can easily compare the tops and bottoms of every instrument that we like! There is not much difference between RSI and Stochastic oscillator only...

MACD – What it is The Moving Average Convergence Divergence (MACD) is the momentum indicator that shows the relationship between two different moving averages: 1. The 12 period exponential moving average – On Tradingview it is the Fast Length. 2. The 26 periods exponential moving average –On Tradingview it is the Slow Length. The MACD line is calculated by...

Today I took the data from "Bunch of Numbers" and gave them different weight values with 7's having the most weight. I then took the formula and made it the "source" for the MACD inputs. This is the result from a super simple "short when = long, and long when = short" spam strategy. The MACD now behaves like a binary switch that turns on and off.

Is this buy signal on 4hr Chart a trap? NOT ADVICE. DYOR. CONSTRUCTION Using triple MACD's based on high, low, and close. When all signal and MACD begin to switch to negative (open range) to when all negative (close range) = red box, and vice versa = green box.

Hello guys, in this technical analysis I want to talk you about why Bitcoin is so prepare for bull run soon? Now, I selected the Weekly and Daily timeframe. Now, in weekly we see a Bitcoin bearish for MACD and price action, but there are a lot doubts that respald that a drop what a much traders hope, it's can be fake drop and the price is can to prepare to go to...

Analyse for yourself 10 Market MACD pairs including bitcoin Longs & Shorts using log scale. SPX constant (Orange). NOT ADVICE. DYOR.

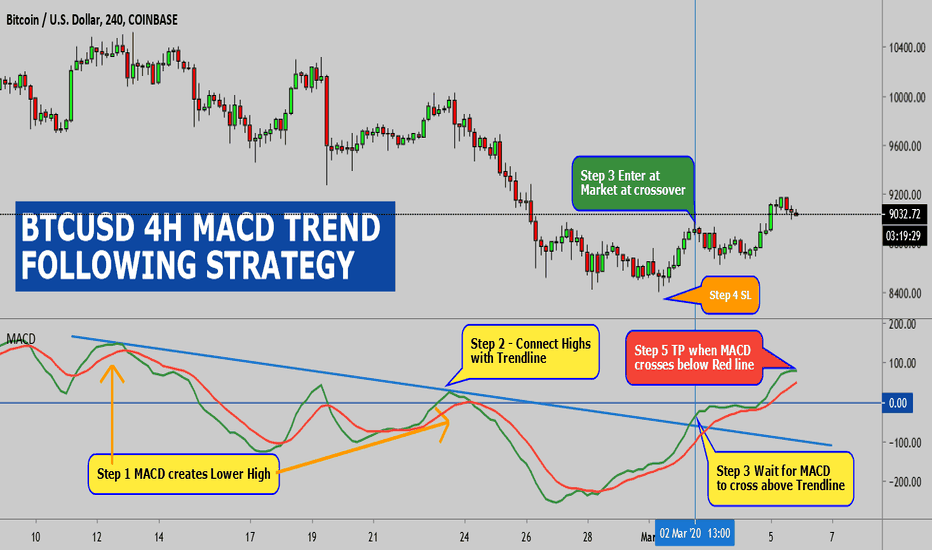

QUESTION - WHAT ARE THE BEST FOREX TRADING STRATEGIES? 1ST - MACD TREND FOLLOWING STRATEGY Step #1: Wait for the MACD lines to develop a higher high followed by a lower high swing point. This is an unorthodox approach to technical analysis. But, we at Trading Strategy Guides.com are different. We don’t mind doing uncomfortable things if that’s what it takes to...

Some evidence that drop in NIKKEI 225 MACD to <0 followed by SPX close below monthly 50 MA dealt killer blow to SPX. Caveat small sample size. NOT ADVICE. DYOR.

(Rules for A Buy Trade) Step #1: Wait for the MACD lines to develop a higher high followed by a lower high swing point. The first rule of thumb to recognize a swing high on the MACD indicator is to look at the price chart if the respective currency pair is doing a swing high the same as the MACD indicator does. A higher high is the highest swing price point on a...

Using USDCNY (Caveat- LINE BREAK CHART & small sample size) See what happens when MACD signal line drops into negative territory. Significant support line for bitcoin price. See Oil and Gold price effect on support line. Will coronavirus shut down bitcoin mining in China? What will happen when Chinese market reopen. Is bitcoin about to explode? Bahhhhhh...........