BTC - Demand Did Its Job. Now Watching the ChannelBTC reacted exactly where it was supposed to... the blue demand zone held, and buyers stepped in!

Since that reaction, price has started to shift short-term momentum to the upside, forming a rising channel. Nothing aggressive yet, but structure is slowly improving.

From here, my focus is simple:

as long as BTC keeps trading within this blue channel, I’ll be patiently looking for pullbacks toward the lower bound, and from there, trend-following long setups.

The natural upside magnet remains the orange structure zone, which is still acting as the key decision area.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

2026

S&P500 Index Guess for 2026 Using Wall Street Ests

S&P 500 Index

19 hours ago

S&P500 Index Guess for 2026 Using Wall Street Ests

1

1

Grab this chart

256

19 hours ago

Wall Street each January makes an estimate for the year ahead S&P500 Index, the largest index used for indexing returns and for managing capital. It's a fascinating practice to take a 'snapshot' of the mentality of the collective wisdom of Wall Street brokerage firms. These are the top 12 brokers in the US which guide portfolio managers globally.

I included the long term average of 9%-10% as a reference so you can see that in 2025 Wall Street was bullish and clustered right around the average return as shown by the cluster of black rectangles. Oddly, the previous year estimates seem to have a "value support" function too where the market held on the pullback in the first quarter of 2025 at the level of the 2024 guesses. See for yourself how this worked in 2025.

You can also see that the cluster of guesses around 6600 in the SPX created multiple rounds of volatility in the fall of 2025 as the market ran into selling at the "common guess level". This turbulence could have been the result of people either raising cash or rotating from growth to value stocks in the 3rd-4th quarter.

So, on initial glance for 2026, I think the mid-term elections will have the most impact on the market and the uncertainty will cause sideways action through the year and finish with a sub-average, but positive year. IF we go under 6400, then I could see the market head down to 6200-6000 where I had seen it for last year.

Either way, stay tuned as I update this "guess" along the way as I have done in years past. Overall, the batting average is quite good, but decide for yourself.

Wishing you all a healthy and successful 2026!

Tim West

January 6, 2026 2:16PM EST

(hidden since yesterday due to additional scripts accidentally left on the chart hidden)

3 Indicators To Watch For 2026Since 2022, I have been using these three markets to track the direction of the US indices.

As long as US bonds are not in a downtrend, the yield curve is not inverted, and inflation is not making a comeback, US indices should remain resilient.

However, although US indices closed higher in 2025, their performance has lost its shine compared with a much smaller market such as the Singapore Straits Times Index.

Why? Because US bonds remain in a downtrend, inflation is at a crossroads, failing to move closer to the 2% target, and although the yield curve is no longer inverted, borrowing costs remain significantly higher than in the post-COVID period of 2022.

U.S. Treasury Bond Futures & Options

Ticker: ZB

Minimum fluctuation:

1/32 of one point (0.03125) = $31.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

#Microfutures

2026 Bitcoin OutlookAs a new year begins, it's time to zoom out and analyze Bitcoins structure going into 2026.

Last month we saw BTC lose the bullish trend that has been supporting price since Q4 2023. Not only is this a worry for the bulls, the way in which this level was lost is more of the problem. No bounce off the level that also coincides with 2025's yearly open shows an exhaustion from the bulls, whereas in the past revisits of the trendline a wick into the level and strong move away continues the rally.

What is being displayed currently is the same in the opposite direction, wicks into the underside of the trendline (resistance) with rejections off the level. Also this trendline resistance coincides with 2025 Yearly open resistance ($93,350).

For me currently, it's clear that the bulls must flip 2025 Yearly open and the trendline reclaim. With the Fed now starting up the money printers again and a fresh year bringing more liquidity, a continuing rate cut cycle and midterms at the end of the year in the US I think it's possible. $108,000/2024's Yearly high would be the natural target, should this be the case it would print a "right shoulder" on a head and shoulders pattern.

However the chart as it stands has the bears in control. Having closed the year as a red candle pushing price below the trendline and maintaining resistance at $94,000. Next stages for the bears would be to push below the 2026 Yearly open which then opens the door to target 2025's Yearly low ($74,500)

In conclusion the targets for both the bulls and the bears are quite clear on the weekly time frame. The bulls certainly need to get back above the trendline, with the Fed QE, Midterms and rate cuts all favor the bulls.

The bears are currently in control and looking very strong structurally so for me in Q1 the bears must do as much damage as possible before the bulls gather momentum into the midterms in Q4.

xauusd 2026-2027As of January 2026, the XAU/USD (Gold/USD) pair is coming off an extraordinary performance in 2025, where it saw gains of over 60%, the highest since 1979.The consensus among major financial institutions like J.P. Morgan, UBS, and Goldman Sachs is that the bullish momentum will carry through 2026, though the pace may become more volatile as it reaches new psychological milestones.

📊 Market Price Forecasts

Most analysts have significantly revised their targets upward following the record-breaking surge in late 2025.

Institution2026 Target (Year-End)Primary Outlook

J.P. Morgan $5,055 /ozBullish; driven by investor diversification.

Goldman Sachs $4,900 /ozBullish; structural demand from central banks.

UBS $5,000 /ozBullish; lower real yields and policy uncertainty.

Bank of America $5,000 /ozBullish; safe-haven demand remains high.

🔍 Fundamental Analysis

The 2026 outlook is anchored by several structural shifts in the global economy:1. De-dollarization & Central Bank DemandCentral banks—particularly in Poland, Kazakhstan, Brazil, and China—are no longer just "opportunistic" buyers; they are strategic diversifiers. While 2026 demand might not hit the 1,000-tonne-per-year peak of the previous three years, it is expected to remain high (averaging 750+ tonnes), providing a solid price floor.2. Monetary Policy & Real YieldsAs the Federal Reserve's easing cycle matures in 2026, real yields are expected to drift lower. Historically, gold thrives in the 4–6 months following initial rate cuts. Investors are increasingly viewing gold not just as a hedge against inflation, but as a hedge against rising global debt levels.3. Geopolitical Risk PremiumOngoing tensions in the Middle East and Eastern Europe, combined with new trade uncertainties (tariffs and domestic policy shifts in the U.S.), continue to drive "flight-to-safety" flows into XAU/USD.

📈 Technical Analysis

(XAU/USD)As of early January 2026, gold is trading near $4,400.The Bullish Channel: The weekly chart shows Gold moving within a well-defined ascending channel. A sustained break above $4,655 would confirm a move toward the $5,000 psychological barrier.Key Support Levels: If a correction occurs, the first major support sits near $4,255. A deeper correction could see a test of the $4,150 – $4,175 zone, which represents a strong "buy the dip" area for long-term investors.Momentum Indicators: The RSI is currently in overbought territory on higher timeframes. While this suggests strength, it also signals the potential for a "blow-out" phase or a sharp, healthy distribution (correction) before the next leg up.⚠️ Key Risks to the Bullish CaseWhile the trend is upward, traders should watch for:Strong Economic Rebound: If the U.S. achieves 6–7% growth with low inflation, the need for a safe haven diminishes.Policy Reversal: A "higher for longer" stance on interest rates by major central banks would increase the opportunity cost of holding non-yielding gold.Liquidity Squeeze: Sharp corrections in the equity markets can sometimes lead to temporary gold sell-offs as investors cover margin calls

Happy New Year. Advice for traders (2026)It's 2026!

I remember ushering in the millennium... That was 26 years ago! Time flies 🚀

It is not just the start of a new month, but the start of a new year. New plans. New goals. New dreams. What's on your list?

I will have several goals. Trading-related and unrelated. I'm going to spend some time tomorrow morning pondering and writing.

I feel motivated. It helps that I've been off for the last month 🤣 But in all seriousness, I'm optimistic. I look forward to trading.

Here is my top advice for traders in 2026:

1️⃣ Keep up to date with financial market news. Trust me, your understanding of the markets and trading opportunities will increase significantly. The easiest way to do this is to watch Bloomberg TV (it's free) and TradingView's News page.

2️⃣ Diversify your trading. Don't just trade your norm. Instead, look for long-term opportunities in stocks and ETFs. Consider trading more currency pairs and indices. The more you watch, the more opportunities you'll see. Don't spread yourself too thin, but don't limit yourself to a single currency or market.

TradingView offers charting for all markets and products. From my single terminal, I can access tens of thousands of charts, including exotic FX, global stocks, and commodities, to name a few.

3️⃣ Keep records. The easiest way to do this is to link your trading account to a third-party site or app. If you have the time and expertise, keep your own records in Excel or a similar tool. You need to track your overall performance, your performance by month and by currency pair or market, your win rate, your average loss, and your average win.

🤞🤞 for a great 2026! Peace out.

Vedanta - My Stock Pick for 2026Starting the year at ATH. Coming out of 15 year period of consolidation.

Look for dips till 530 to enter.

Target: 765 / 1200

Support: 530 / 495 / 360

Below 495 exit temporarily and buyback on reversal above 530.

Disclaimer: I have entered the trade around 606. Looking for dips to build on position.

ETH M30 HTF FVG Tap and Mean Reversion Pullback Setup📝 Description

ETH on M30 just delivered a strong impulse into HTF premium, tapping the H1/30M FVG and stalling. The move looks exhaustive, with price now trading at a reaction zone where a mean-reversion pullback is favored before any continuation attempt.

________________________________________

📈 Signal / Analysis

Primary Bias: Short-term pullback while below 3,030–3,040

Short Setup (Reactive):

• Entry (Sell): 3,022

• Stop Loss: Above 3,040

• TP1: 3,008.80

• TP2: 2,994.88

• TP3: 2,979.74

________________________________________

🎯 ICT & SMC Notes

• Price tapped HTF FVG (H1/30M)

• Trading deep in premium

• Downside H1 FVG acting as draw

• Momentum cooling after impulse

________________________________________

🧩 Summary

This is a classic impulse to premium reaction and pullback setup. As long as ETH remains capped below the FVG, odds favor a rotation toward 3,009 to 2,980. Acceptance above premium invalidates the short.

________________________________________

🌍 Fundamental Notes / Sentiment

With markets still liquidity-driven and no fresh risk-on catalyst, short-term reactions at HTF imbalances tend to resolve with mean reversion. Trade levels, manage risk, and scale out at targets.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

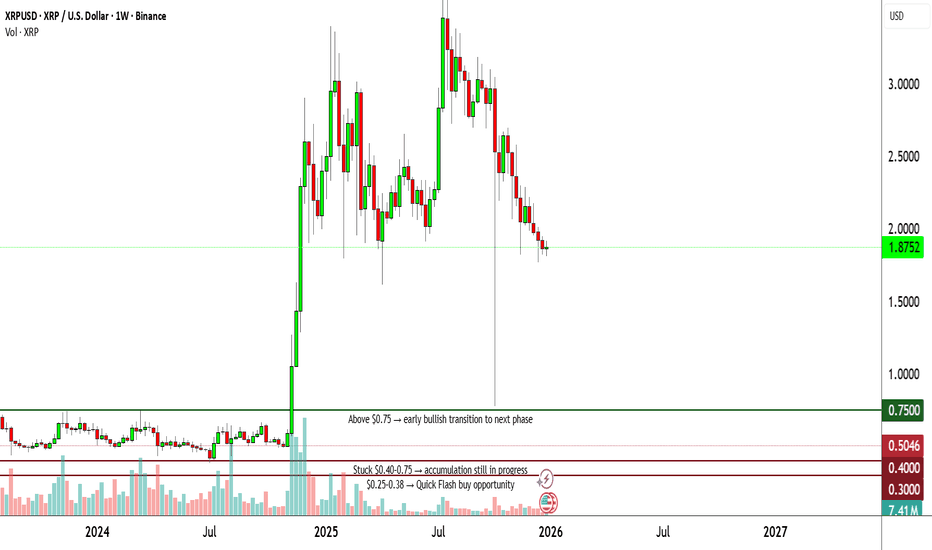

XRP 2026 prediction XRP is still in a long accumulation phase. Because a lot of money has been pulled into AI and tech stocks, crypto (especially XRP) may stay slow longer than many expect.

I think most of 2026 stays choppy or weak, with the first real shift toward bullish conditions happening closer to September 2026, not earlier.

Key Levels to Watch

Above $0.75 → Early Bullish Signal

If XRP can hold above $0.75 on the weekly chart, it suggests accumulation is ending and a new uptrend could begin.

$0.40 – $0.75 → Still Accumulating

This is the most likely range for a while. Price may move sideways, frustrate traders, and feel “dead,” but this is where long-term positions are built.

$0.25 – $0.38 → Fast Buy Zone

If price drops here, it would likely happen quickly during fear or a market shakeout. These moves usually do not last long.

Follow the chart not trends!

TASI | Premium Pricing – Patience Required 1/1/2026

TASI is currently trading in a premium zone, where upside potential is limited and risk-to-reward for new long positions is unfavorable.

Market structure suggests that price is still in the process of seeking sell-side liquidity below. A deeper retracement into the discount area would be a healthy and high-probability move before any sustained bullish continuation.

At this stage, buying strength is not advised. The preferred approach is to remain patient and wait for:

A sell-side liquidity sweep

Re-entry into discount

Clear bullish confirmation and structure shift

Only after these conditions are met would long opportunities offer a favorable risk profile.

Patience remains the key edge.

BTC - Where the 2026 Bottom Might Actually FormLet me be clear from the start.

This is not about calling a bottom today.

It’s about comparing this cycle to the previous ones.

📉 From a structural point of view:

Price is trading below the key moving average, and as long as that MA is not reclaimed to the upside, the trend remains bearish.

At the same time, momentum confirms this view.

The MACD has flipped bearish, which historically marks the transition from expansion into a corrective cycle.

In previous BTC cycles, the real bottom never formed until both conditions were met:

- MACD flips back bullish

- Price reclaims the moving average

Until that happens, we stay in a bearish or corrective regime, even if price bounces short term.

🧠 Now zooming out.

When you compare this structure to prior cycles, Bitcoin tends to:

• Correct deeply

• Find support at prior major resistance

• Reset momentum near long term demand

• Then flip trend again

On this chart, that area is very clear.

The green zone around 55k to 65k aligns with:

• Previous cycle highs

• Strong historical demand

• The lower boundary of the long-term rising structure

If history rhymes again, this is where we would expect:

• Momentum to stabilize

• MACD to start curling bullish

• Price to eventually reclaim the moving average

⏳ Timing wise , based on previous cycles, this process usually takes time.

That points toward late 2026, roughly October and beyond, not before.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Happy New Year 2026 — Trade Smart, Stay Disciplinedwe step into 2026, may clarity replace noise, patience replace haste, and execution replace hesitation.

May every trade be planned, every risk calculated, and every loss treated as tuition—not failure. Wishing all traders a year of emotional control, consistent decision-making, and an equity curve that trends steadily upward.

Happy New Year 2026 — trade smart, manage risk, and let probabilities work in your favor.

What I Expect from 2026Scenarios • Markets • Levels • Positioning

First of all, I want to thank everyone for the activity under my previous post .

More than 300 likes are not just numbers to me — they show that you read, think, and ask the right questions. These are exactly the people who motivate me to keep sharing my perspective.

I don’t write for algorithms.

I write for those who want real results and understand that results come through process, discipline, and the right environment.

This text is not about fast growth or guessing the bottom.

It is about patience, structure, and working during moments of maximum pain.

In 2026, the market will be selective: opportunities will become fewer, and the cost of mistakes will be higher.

This is exactly when an advantage is built — by those who can wait and work systematically, not alone.

___________________________________________

Context and Philosophy of 2026

2026 is a year of reassessment and awareness.

A year when the market stops rewarding haste and illusions.

We are in a bearish phase, and according to my calculations, it will likely last almost until the end of the year. This is not a time for emotions or hope — it is a time for learning and preparing for the next cycle.

It’s important to accept a simple truth:

the market does not owe you opportunities every day.

No trade is also a position.

I’ve been in financial markets since 2009 and in crypto since 2016.

I’ve seen how every cycle looks different but ends the same way — disappointment and denial. That is exactly where the market pushes the majority in 2026.

___________________________________________

What Really Happened in 2025

2025 became the year of maximum institutional involvement.

ETFs, derivatives, structured products, and complex instruments fully integrated crypto into the global financial system.

And the global financial market is:

- highly competitive

- professional

- cold and calculated

This is not a place for belief — this is where capital positions, hedges, and extracts liquidity.

Crypto remains a young industry, but it is already playing by adult rules.

Many failed to understand this — and paid for it.

___________________________________________

The Main Mistake Most Will Make in 2026

Two things:

1. Believing in a quick reversal

2. Increasing risk in an attempt to “win it back”

Hope is the most expensive emotion in the market.

The market does not pay for hope — it pays for timing, structure, and execution.

Most people will leave not because the market is “bad,” but because they will break psychologically. I’ve seen it many times: different cycles, different faces — the same mistakes.

If you stay in the market, you must relearn it every cycle.

___________________________________________

Macro Environment and Market Conditions

Key factors I’m watching:

- interest rates

- regulation

- capital flow direction

- narratives that attract new liquidity

Regulation is neither an enemy nor a savior — it is reality.

Licenses, requirements, and rules are shaping a market that is becoming part of the global financial system.

2026 is a year of redistribution and accumulation, not growth.

Liquidity is fragmented. There are too many projects, too many tokens, and not enough capital for everyone. Stablecoins are growing, but still not enough to “feed” the entire market.

___________________________________________

Altcoins in 2026: My View

My position is strict and honest:

Most altcoins face collapse, cleansing, and increased regulatory pressure.

The reasons are clear:

- an excessive number of tokens

- fragmented attention

- constant unlock pressure

- funds sitting in long-term profit

- lack of sustainable economics

There will be exceptions — but they will be rare.

Paradoxically, memecoins (despite my skepticism) did one useful thing:

they forced people to learn on-chain analysis, search for inefficiencies, and track capital flows.

What remains structurally alive

RWA (tokenized real-world assets)

infrastructure

DeFi v2 as an alternative to the traditional system

At the same time, we must be honest: potential returns in altcoins are structurally declining compared to previous cycles.

___________________________________________

Bitcoin — Base Scenario for 2026 and Key Levels

My base scenario is continued pressure and bottom formation.

Capitulation will affect:

- traders

- investors

- miners

- funds

- large corporations

The market will be cleansed of large holders.

This process is always painful — and always necessary.

Key ranges

- base: 48,000 – 74,000

- extreme zones: 38,000 – 46,000

My operating logic

- the first meaningful accumulation zone is around 64k

- limit orders are placed lower

- buying only during moments of panic

- no rush, no emotions

There is an old saying:

“ We enter the market when there is blood in the streets .”

This is not drama — this is how asymmetric advantage is built.

Short squeezes are possible, but they will be short-lived.

Markets do not trend higher on disappointment.

In my view, the final deep phase of this cycle and the shift toward early bullish conditions align closer to September 2026.

___________________________________________

Other Markets and Diversification

One of the biggest mistakes crypto traders make is thinking the world ends with crypto.

Blockchain is infrastructure — not the entire market.

That’s why in 2026 I diversify across:

- gold

- oil

- indices

- stocks

- and only very selectively crypto assets

Other markets are:

- more liquid

- more structured

- often cleaner in execution

S&P 500

So far there are no clear reversal signals, but after new highs I expect correction or stagnation. The reasons are obvious: the AI bubble, debt pressure, and liquidity concentration.

Gold

A historical safe haven. The trend remains intact.

My long-term target is $6,000 ± $1,000.

DXY

Weakening is possible, but the dollar is likely to maintain dominance due to digitization and global settlement demand.

Oil

One of my key instruments. Expensive oil is not beneficial for the US, and I see no strong reasons for sustainably high prices in the short term.

___________________________________________

Narratives Beyond Crypto

The world is reaching the limits of energy supply.

Energy is becoming a strategic advantage.

Those who produce electricity efficiently will be in a strong position.

Alternative energy sources and the entire energy chain will play a key role.

AI is not just hype.

AI will drive breakthroughs in medicine, energy, data analysis, and financial markets.

Global instability is no longer a forecast — it is a condition.

We are moving toward a reset of global processes and agreements.

___________________________________________

My Trading Approach in 2026

- more cash

- short-biased trading when structure allows

- only selective entries

- waiting for panic

- minimized risk

If there is no setup - there is no trade.

That is discipline.

And one more thing: if you are tired - rest.

The market will not disappear.

Your capital and your mindset are your main assets.

___________________________________________

Personal Commitment and Community

In 2026, I will relaunch the Academy and deeply integrate AI tools.

For members of my community, the Academy will be free under specific conditions.

Discipline is not motivation.

Discipline is the ability to follow a plan regardless of emotions.

Growth is slow alone. It is faster in the right environment.

I am building a strong trading community where:

- thinking evolves

- on-chain capital flows are analyzed

- portfolios with limit orders are structured

- experience is shared, not illusions

Some of these portfolios have already started activating, and one position is around +15%. This is not luck — this is systematic work.

___________________________________________

One Honest Question

Ask yourself honestly:

Are you here to prove something to the market — or to achieve a sustainable result?

Because results only come through self-study, discipline, and a repeatable process.

___________________________________________

Final Thoughts

Markets reward preparation, not urgency.

Give the market time. Give the system time.

If you are still here in 2026 — you are already ahead of most.

The main task is simple: stay in the game.

Build positions when it hurts.

Grow when it is quiet.

Best regards EXCAVO

XAUUSD 2026!Report of the past three years of analysis

All analyses were based on Ichimoku.

The trend over these three years was forecasted as bullish,

which resulted in three consecutive green annual candles, exactly as expected.

(Tradable levels were announced every week)

Now, the new year analysis: 2026

Based on Ichimoku, the annual trend of gold will remain bullish in 2026.

Contrary to my presonal intention, new all-time highs will be formed.

Fibonacci provides levels of these highs, as shown on the chart.

BTC 30m Partial FVG Tap, Lower Imbalance Fill Setup📝 Description

BTC on M30 just made a shallow tap into the upper FVG, followed by immediate hesitation. With only a partial fill completed, it’s reasonable to expect price to seek the lower FVG for a more complete imbalance fill before any meaningful continuation.

________________________________________

📈 Signal / Analysis

Primary Bias: Short-term pullback while below 89,000–89,100

Short Setup (Reactive):

• Entry (Sell): 88,800

• Stop Loss: Above 89,00

• TP1: 88,600

• TP2: 88,340

• TP3: 87,915 (30M FVG midline)

________________________________________

🎯 ICT & SMC Notes

• Price tapped 30M FVG in premium

• HTF FVG H4/H1 overhead caps upside

• No clean CHOCH + BOS for bullish continuation

• RSI flattening → momentum exhaustion

• Liquidity draw sitting below recent lows

________________________________________

🧩 Summary

This looks like impulse and pause then retrace. As long as BTC stays below 89k, odds favor a pullback to 88.4k and 87.9k. Acceptance above premium invalidates the short and opens room higher.

________________________________________

🌍 Fundamental Notes / Sentiment

With markets still headline-sensitive and liquidity tight, quick rotations around key levels are favored. Trade the reaction at FVGs and keep risk tight.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Alibaba (BABA) - Structure Reload Before the Next Expansion?📈After a powerful impulsive leg higher, BABA is now doing exactly what strong trends are supposed to do: correct, not reverse. Price is pulling back into a key structural support, aligning perfectly with the lower bound of the rising blue channel.

⚔️This area is critical. As long as this structure holds, the market remains overall bullish, and pullbacks are viewed as opportunities rather than threats.

The plan is simple and disciplined:

🏹I’ll be looking for trend-following longs around the intersection of structure support and the rising channel, with continuation toward the upper channel and higher levels.

Only a clean breakdown below structure would invalidate this bullish scenario. Until then, the trend remains intact and patience is rewarded.

Is this consolidation the calm before the next expansion leg? 🤔📊

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

As a common idea in gold...!It seems like a common idea that gold has a chance to reach the desired price range on the chart to reach higher targets and start to fluctuate upwards again!?

Or should we wait for certain events in the election of influential people in larger economies or wait for the decision-making of warmongers and warlords who consider the blood of ordinary people as the leach of their impure and worthless life! I recommend watching the movie "Lord of War" for sure.

Good luck

Silver - Strength Speaks Loudest!!🏆Silver has been one of the strongest performers across almost the entire market, consistently outperforming most assets and leading the momentum higher.

📈Structurally, price remains firmly bullish , respecting the rising blue channel with clean impulsive moves followed by shallow corrections. This behavior is exactly what strong trends look like.

🏹As long as this rising blue channel holds , the plan remains straightforward:

I’ll be looking for trend-following longs on every correction, not chasing highs, but waiting patiently for pullbacks into structure.

Only a clear and decisive break below the channel would invalidate this bullish thesis. Until then, Silver remains a buy-the-dip market, favoring continuation rather than reversal.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Solanas first real runThink outside the box, think about how early you are to this game. Black and white t.v, slavery, wifi, ethernet, was all pretty recent if you really think about it. 2026 is a step in the future, with all pillars build and foundations laid since the 2000's, we are geared to see historical moments this next couple years... are you ready?