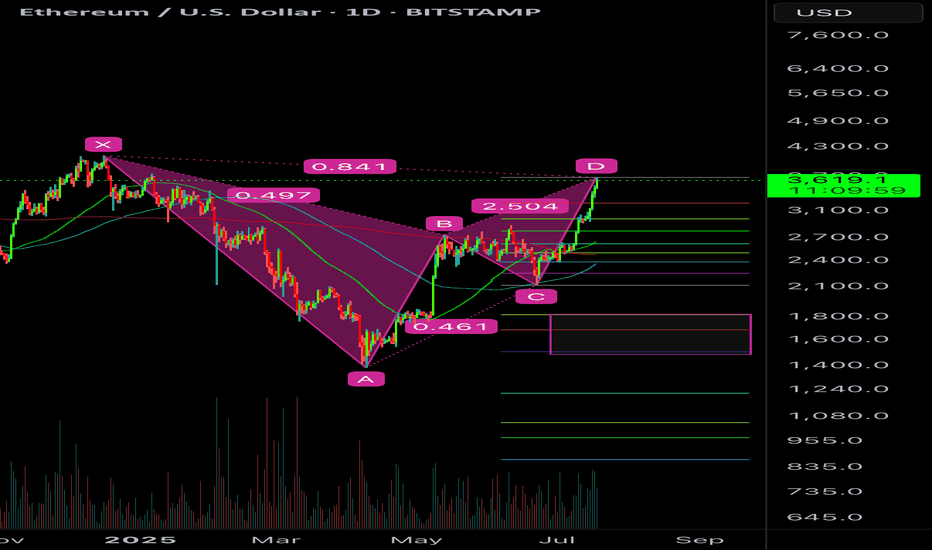

ETH BEARISH BAT POTENTIALETH can go slightly higher but it’s at/near the .886 retracement and meets a valid bearish bat pattern.

I would be targeting a full move if it is unable to break above the .886.

Too many euphoric here. The move has been really scammy off the hype news of Genius Act which everyone saw coming. Expect a sell the news event and BTC.D bounce would destroy alts for one last capitulation most alts may drop 40-50% from here. Then the real bull will start.

Bearish Bat

GBPCAD - Bearish BAT Pattern Market is forming Bearish BAT pattern, we plan our entry on break on "A" point and then plan our TP till market reaches PRZ. as these pattern are reversal patterns, we plan our next entry on D point after good bearish signal is observed. we will look into divergence or any good bearish candle. as BAT pattern usually form Divergence before Bearish trend.

For Buy Entry : Place stop loss below the "C" point and TP at PRZ

For Sell Entry : Place stop loss above PRZ (which is also a good resistance level)

Should I hold my short at $3,305.69, or exit now What do you think, fam? Should I hold my short at $3,305.69, or exit now with gold so close to my stop-loss at $3,306.57? Drop your thoughts below—I’m curious to hear how you’d play this XAU/USD setup! If you’re one of the two ready to join me at Academia for Forex Trading, let’s talk—we’ll hunt these markets together. And while you’re at it, check out Icon Collections Store—does RiverSide, Desire, or Icoca vibe with your trading energy? Let me know!

Two reasons to sell FTSE Right NOWWe are seeing some reasons to sell FTSE right now.

1) The daily trend is down.

2) H4 is pointing down, but the price is above the MA

3) There are two patterns to sell at the current level

4) 8165 is the last weeks high that will be a good resistance

Hoping for a test of last week's lows.

USDJPY Short Opportunity: Key Factors and Strategic EntryHello, traders!

I’m on standby to short the USDJPY, and here's why this setup is compelling. This analysis covers two crucial parts, providing context and strategic entry points.

Part One: Macro Fundamentals

1. China’s Treasury Offload :

- China sold $53.3 billion of Treasuries and agency bonds in Q1 2024. This reduction in US dollar assets can impact USDJPY negatively.

2. BRICS Currency Moves :

- BRICS countries are trading $4 billion in local currencies, sidelining the US dollar. This shift decreases demand for USD, potentially weakening USDJPY.

Part Two: BOJ Interventions

1. Recent BOJ Action :

- The Bank of Japan intervened in the FX market on April 29, 2024, but the attempt seemed to fail. Our community was alerted on April 26, 2024, giving us an early advantage.

2. Potential Future Intervention :

- BOJ might intervene again, but this could upset G7 partners. If intervention fails or doesn’t happen, USDJPY could fall sharply.

Trading Strategy: Bearish Patterns Confluence

Key Levels and Patterns:

- Entry Point : Short USDJPY at 159.27.

- Confluence : This level aligns with a Bearish Bat Pattern and an ABCD Pattern, strengthening the case for a short position.

Final Thoughts

Considering the macro fundamentals and recent BOJ actions, the stage is set for a potential sharp fall in USDJPY. The bearish patterns at 159.27 provide a technical basis for entry, adding to the conviction.

Stay vigilant and manage risk carefully. Happy trading!

Trading GER30 on Tariff DayToday will be a big day for the stock market in 2025. The tariffs to be implemented promises to either make or break the market.

Last week we saw a massive sell off and on Monday and Tuesday we have seen the markets gain a decent amount. However here is what needs to be noted for all indexes:

1) The Daily downtrend is intact

2) The H4 MA is pointing down

3) On GER30,we see a bat pattern to sell

4) H1, M30, M15 is OB and has a double top

We should not follow the news, but instead focus on the charts. Based on this, we will enter a short position and expect the market to resume the downtrend.

Stop loss will be 200 pips around 25700. Good luck!

CHF/USD 4H Analysis - Potential Bearish Reversal Setup

🔹 Market Structure & Price Action:

The price has been trending upwards inside a rising channel, forming higher highs and higher lows.

Recently, price tapped into a key resistance zone (black box), indicating a potential reversal.

A possible bearish correction could unfold from this level.

📉 Bearish Scenario:

If the price fails to hold the resistance, a bearish rejection could drive price downward.

The first major support target aligns with the previous demand zone around 1.10700.

A further drop could test the 1.09100 support area, as shown in the green zones.

📈 Bullish Alternative:

A break and hold above resistance could invalidate the bearish setup and signal further upside movement.

🔻 Trading Plan:

Sell bias near resistance with confirmations (e.g., rejection wicks, bearish engulfing, trendline break).

Targeting the marked support levels.

Invalidation if price breaks and closes above the resistance.

A massive drop on HK50 coming upThere is a huge pattern on the Daily Chart to sell the HK50 index pointing to a 2000 pip drop. However we are going to take the smaller pattern on this as shown below.

1) We are approaching the strong resistance zone of 23,650

2) There is a bat pattern

3) This is counter trend, so we will wait for 2-3 hours to take this trade

Will update when we take the trade.

Candlestick chart.• Chart Type: Candlestick chart.

• Key Price Levels:

• The price is currently around 2,947.210.

• Resistance zone near 2,947.210 - 2,945.564.

• Support zones at 2,924.576, 2,896.066, and 2,889.915.

• Further downside target at 2,879.550.

• Pattern: A potential Head and Shoulders or Bearish Reversal pattern is drawn.

• Projection:

• A rejection from the upper resistance zone is anticipated.

• Price may consolidate before breaking lower.

• Bearish targets are marked at 2,896.066, 2,889.915, and 2,879.550.

Energy Fuels Stock: Potential Reversal Ahead?AMEX:UUUU

After reaching a low of $0.78 in March 2020, AMEX:UUUU has been on a recovery path. Currently, it's forming an inverted head and shoulders pattern, with the key neckline at $7.47. A breakout above this level could signal a move towards $9.73.

However, watch out for the bearish alt-bat pattern near $9.73, which could lead to a pullback. Stay alert for key price action and adjust your risk accordingly.

⚠️ Note: Any violation of the $4.19 support would invalidate the projected patterns in this idea.

AUDCAD BAT PATTERNHarmonic Pattern Trading Strategy:

1. Combine patterns with 2-3 confirmations (e.g., MA, BB, RSI, Stoch) for increased accuracy.

2. Implement proper risk management.

3. Limit exposure to 3% of capital per trade.

4. Exercise caution: Not every Harmonic Pattern presents a good trading opportunity.

5. Conduct thorough diligence and analysis before trading.

Disciplined approach = Enhanced edge.

EURNZD BEARISH BATHarmonic Pattern Trading Strategy:

1. Combine patterns with 2-3 confirmations (e.g., MA, BB, RSI, Stoch) for increased accuracy.

2. Implement proper risk management.

3. Limit exposure to 3% of capital per trade.

4. Exercise caution: Not every Harmonic Pattern presents a good trading opportunity.

5. Conduct thorough diligence and analysis before trading.

Disciplined approach = Enhanced edge.

Dot Target why 20$ KUCOIN:DOTUSDT BINANCE:DOTUSDT BINANCE:DOTUSDT.P CRYPTOCAP:DOT

---

### **1. Fibonacci Retracement Analysis**

- **Levels Observed**:

- **0% (High)**: **55.081** (all-time high or recent significant high).

- **0.236**: **42.594**.

- **0.5**: **28.625** (midpoint of retracement).

- **0.618**: **22.381**.

- **0.65**: **20.688** (golden pocket).

- **0.786**: **13.491**.

- **1.0 (Low)**: **2.168** (all-time low or recent significant low).

---

### **2. Current Price**

- The price is currently around **7.790**, significantly lower than the golden pocket (0.618–0.65) and closer to the lower Fibonacci levels.

---

### **3. Take-Profit Level at $20**

- **Why $20?**

- **Golden Pocket Zone**: The **0.618–0.65 Fibonacci zone** is considered a high-probability reversal area. Many traders set their take-profit just below this zone to ensure profit capture before significant resistance is encountered.

- **Psychological Level**: The $20 price point serves as a psychological resistance, where many traders might exit, amplifying sell pressure.

- **Confluence with Historical Data**: Previous price action near this level likely showed significant resistance/support, aligning with Fibonacci levels.

---

### **4. Resistance and Support Zones**

- **Major Resistance Levels**:

- **22.381–20.688**: The golden pocket and primary target zone.

- **28.625**: Midpoint retracement, another key resistance level.

- **Support Levels**:

- **13.491**: **0.786 Fibonacci level**, which may act as a strong base for further upward momentum.

- **2.168**: All-time low or significant recent low.

---

### **5. Potential Price Scenarios**

- **Bullish Case**:

- If the price breaks through **13.491**, it could rally toward the golden pocket zone near **20.688–22.381**.

- A breakout beyond **22.381** could extend the rally toward **28.625** or even higher.

- **Bearish Case**:

- If the price fails to hold **13.491**, it may revisit lower levels, potentially near the all-time low of **2.168**.

---

### **6. Strategy and Recommendations**

- **Entry Point**:

- Current prices near **7.790** are ideal if the upward trend continues.

- **Take-Profit**:

- The take-profit at **$20** is conservative and aligns with the golden pocket zone.

- **Stop-Loss**:

- Set below **13.491** to minimize losses if the trend reverses.

---

### **7. Market Psychology**

- Many traders use Fibonacci retracement levels to define take-profits. The golden pocket is a popular area where selling pressure increases, causing potential reversals.

Price rengeBAT/USDT Chart:

Trend: Uptrend Price above moving average (yellow line).

Support: Green zone

Around 0.2317.

Resistance: Red zone Around 0.3778.

Possible Strategy:

Buy: Breaked EMA snd firs resistance

Sell: If price fails to break resistance

Note: Always consider market new and overall trends.

GBP/NZD Hits Highest Level Since 2016: Is a Move Down Ahead?The GBP/NZD is currently testing its highest price in recent years, nearing the significant resistance level of 2.1900. This area has served as a notable barrier since 2016 and often sees increased selling interest. The price action in this zone, combined with the emergence of a harmonic pattern, suggests a potential reversal or correction. Furthermore, recent price movements, particularly the candles from October 30 and 31 breaking below the low of October 29, indicate rising bearish momentum, reinforcing the possibility of selling pressure in the near term.

Bat Harmonic Pattern Structure

A Bat harmonic pattern is developing in the GBP/NZD chart, providing additional reversal signals near historical resistance:

Point X: The starting point of the move, at a previous significant high.

Point A: The bottom of the initial correction.

Point B: The price retracement to the 38.2% level of the XA extension.

Point C: The second correction reaching 88.2% of the AB move.

Point D (Potential Reversal Zone): Near 2.1847, aligning with the 88.6% level of the XA extension and the resistance at 2.1900, indicating an optimal area for potential sell opportunities.

The Bat pattern suggests a crucial resistance level where buyers might struggle, especially considering the proximity to historical highs.

Price Action Analysis and Sell Signals

Recent price action further highlights selling interest:

Selling Pressure at Highs: The October 30 and 31 candles broke below the October 29 low, signalling possible exhaustion of the bullish trend and indicating increased seller interest. This behaviour raises warning signals for a potential short-to-medium-term reversal.

Potential Move Down Ahead

Given the convergence of the harmonic pattern and historical resistance, a short strategy is advisable between 2.1800 and 2.1900. Here are critical points to consider for GBP/NZD:

Potential Sell Zone : The resistance between 2.1800 and 2.1900 represents a prime short zone, combining the D point of the Bat with historical resistance.

Primary Target : The support around 2.1400 corresponds to the B region of the Bat formation, typically the first target when trading harmonic patterns.

Secondary Target : Should a breakout continue, the next significant support is near 2.1000, coinciding with the C level of the Bat formation.

Traders should remain cautious of any breaks above 2.1900, as this could indicate a breakout above a crucial resistance level on the daily chart.

Conclusion

The GBP/NZD pair is in a complex technical setup, presenting potential opportunities for short positions due to the confluence of the Bat harmonic pattern and the historical resistance at 2.1900. With signs of selling pressure evident in the recent price action, especially following the candles on October 30 and 31, traders should closely monitor this region as it may signal the onset of a correction.

Disclaimer:

74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK.

USD/CHF Bearish Setup: Technical Analysis & Trade OpportunityPattern Formation: Bearish Bat Harmonic Pattern:

The USD/CHF is currently forming a Bearish Bat Harmonic Pattern, which suggests a potential reversal to the downside. The pattern is nearing completion at a key resistance level, providing a strong setup for a bearish entry.

Key Resistance and Fibonacci Confluence:

The pair has received a significant rejection from a crucial resistance zone, which aligns precisely with the 0.786 Fibonacci retracement level. This confluence strengthens the bearish outlook, indicating that sellers are defending this area effectively.

RSI Analysis:

Bearish Divergence A clear Bearish Divergence is evident on the 4-hour Relative Strength Index (RSI), further supporting the bearish sentiment. As the price makes higher highs, the RSI is making lower highs, indicating weakening bullish momentum and signaling a potential reversal.

Trade Setup:

Entry, Stop Loss, and Take Profit Levels

Entry Level: 0.86325

Stop Loss: 0.86955

Risk Management:

The stop loss is set slightly above the resistance level to protect against false breakouts and unexpected volatility.

Take Profit Targets:

TP-1: 0.85695 - This level provides a conservative target for traders looking to secure initial profits.

TP-2: 0.85065 - A medium target that aligns with further downside potential, giving room for extended profits.

TP-3: 0.84435 - A more ambitious target for traders expecting a deeper retracement.

Conclusion:

The USD/CHF pair presents a compelling bearish setup based on the Bearish Bat Harmonic Pattern, resistance at the 0.786 Fibonacci level, and bearish RSI divergence. Traders should monitor price action near the entry point and follow proper risk management, as outlined in the trade setup.

#BAT/USDT#BAT

The price is moving in a descending channel on the 4-hour frame and is sticking to it very well and is expected to break it upwards

We have a bounce from a major support area in green at 0.1550

We have a downtrend on the RSI indicator that was broken upwards which supports the rise

We have a trend to stabilize above the 100 moving average which supports the rise

Entry price 0.1700

First target 0.1920

Second target 0.2033

Third target 0.2152

USDJPY Analysis and Trade OpportunitiesLike I mentioned in our weekend live session, I don't see any BOJ intervention happening soon.

The earliest I’m looking is when the market reaches 158.73, with the next level at 159.66.

Around 157.74 is the level I'll be looking for a buying opportunity using the existing strategy that I've used for many years.

Key Levels:

Potential Intervention Levels :

- 158.73

- 159.66

- Buying Opportunity : Around 157.74

Shorting Opportunities :

1-Hourly Chart :

- Bearish Bat Pattern Completion : 158.15

- ABCD Pattern Completion : 158.39 if the Bearish Bat Pattern does not complete

Strategy :

- Buying at 157.74 : Use the tried and tested strategy that has worked over the years.

- Shorting Opportunities : Monitor the 1-hourly chart for potential Bearish Bat Pattern at 158.15 and ABCD Pattern at 158.39.

What’s your trade plan for USDJPY? Any valuable insights you’d like to share? Comment down below.

EURUSD Bearish Trend and Bearish Bat Pattern CompletionEURUSD Bearish Trend and Bearish Bat Pattern Completion

Instrument: EUR/USD

Timeframe: 1-Hourly Chart

Current Direction: Bearish

Analysis:

EUR/USD is currently exhibiting a bearish trend. While the impulse to short immediately is strong, my preferred entry level is at 169.54. This price point aligns with the completion of a bearish bat pattern on the 1-hourly chart.

Key Points:

- Bearish Trend: The overall trend for EUR/USD is downwards.

- Bearish Bat Pattern: Completion level at 169.54, which offers a high-probability short setup.

- Entry Level: 169.54

- Chart Pattern: Bearish Bat Pattern

- Timeframe: 1-Hourly Chart

Strategy:

- Wait for Price to Reach 169.54: Monitor the price action and wait for it to approach the 169.54 level.

- Confirmation: Look for bearish confirmation signals around this level to enter a short position.

Stay tuned for updates and trade wisely!

EURUSD: A Sideway Consolidation with Bearish SignalsEURUSD is currently showing a sideway consolidation on the weekly chart, but the daily chart is painting a different picture:

- Bearish Fib-3 Bat pattern with RSI Divergence

I'm eyeing two potential entry points on the 1-hourly chart:

1. Resistance retest at 1.0852

2. Type 2 retest of the Bearish Bat Pattern at 1.0879

What's your take on this setup? Share your trade plans and thoughts in the comments!

Understanding Bearish and Bullish Bat Harmonic Patterns

Understanding Bearish and Bullish Bat Harmonic Patterns: A Professional Guide for Traders

In the dynamic world of trading, identifying potential reversal points is crucial for making informed decisions. Two powerful tools that professional traders often rely on are the Bearish and Bullish Bat Harmonic Patterns. These patterns, grounded in Fibonacci ratios, offer insights into market behavior and help in predicting price movements. This article delves into the intricacies of these patterns, providing a comprehensive guide for traders.

__________________The Bearish Bat Harmonic Pattern_________________________

The Bearish Bat Harmonic Pattern is a reversal pattern that indicates a potential decline in price after an upward correction. Here's how to identify and interpret this pattern:

X-A Leg: The initial move where the price falls from point X to point A.

A-B Leg: The price then retraces upwards from point A to point B, typically reaching 38.2% to 50% of the X-A leg.

B-C Leg: The price falls again from point B to point C, retracing 38.2% to 88.6% of the A-B leg.

C-D Leg: The final leg sees the price rise from point C to point D. Point D is the critical point, expected at the 88.6% retracement level of the X-A leg and coinciding with the 161.8% extension of the B-C leg.

Key Fibonacci Ratios:

A-B: 38.2% to 50% retracement of X-A

B-C: 38.2% to 88.6% retracement of A-B

C-D: 88.6% retracement of X-A and 161.8% extension of B-C

Trading Strategy: Traders should look for selling opportunities around point D, anticipating a downward move following the completion of the pattern.

Entry, Stop-Loss (SL), and Take-Profit (TP) Criteria:

Entry: Enter a short position at or near point D.

Stop-Loss (SL): Place the stop-loss slightly above point X to account for any potential false breakouts.

Take-Profit (TP): Set the first TP at the 61.8% retracement of the C-D leg and the second TP at the 100% retracement of the C-D leg.

_________________________The Bullish Bat Harmonic Pattern_____________________

Conversely, the Bullish Bat Harmonic Pattern signals a potential rise in price after a downward correction. Here are the steps to identify and utilize this pattern:

X-A Leg: The initial move where the price rises from point X to point A.

A-B Leg: The price then retraces downwards from point A to point B, typically reaching 38.2% to 50% of the X-A leg.

B-C Leg: The price rises again from point B to point C, retracing 38.2% to 88.6% of the A-B leg.

C-D Leg: The final leg sees the price fall from point C to point D. Point D is the critical point, expected at the 88.6% retracement level of the X-A leg and coinciding with the 161.8% extension of the B-C leg.

Key Fibonacci Ratios:

A-B: 38.2% to 50% retracement of X-A

B-C: 38.2% to 88.6% retracement of A-B

C-D: 88.6% retracement of X-A and 161.8% extension of B-C

Trading Strategy: Traders should look for buying opportunities around point D, anticipating an upward move following the completion of the pattern.

Entry, Stop-Loss (SL), and Take-Profit (TP) Criteria:

Entry: Enter a long position at or near point D.

Stop-Loss (SL): Place the stop-loss slightly below point X to account for any potential false breakouts.

Take-Profit (TP): Set the first TP at the 61.8% retracement of the C-D leg and the second TP at the 100% retracement of the C-D leg.

______________________Practical Application and Tips_______________________

To effectively utilize these patterns, traders should:

Use Confirmation Indicators: Always combine harmonic patterns with other technical indicators, such as RSI or MACD, to confirm potential reversal points.

Practice Patience: Wait for the pattern to fully develop and reach point D before taking action.

Risk Management: Implement strict risk management strategies, including stop-loss orders, to protect against potential false signals.

Conclusion:

The Bearish and Bullish Bat Harmonic Patterns are powerful tools in a trader's arsenal, providing a structured approach to identifying potential market reversals. By understanding and applying these patterns, traders can enhance their decision-making process and improve their trading performance. Remember, like all technical analysis tools, these patterns are most effective when used in conjunction with other indicators and sound risk management practices. Happy trading!