Local short on Silver CFDsTVC:SILVER is testing a downward correction channel, with technicals and the TVC:GOLDSILVER Ratio showing synchronized weakness. To prepare for potential outcomes, it is necessary to identify whether the zone will hold, determine where the correction might bottom out, and define the key levels that would invalidate this bearish scenario

Technicals:

Short Scenario:

- OANDA:XAGUSD price is moving in local descending channel, recently retesting the upper line and local resistance zone

- if resistance holds or in case of direct rejection price could plunge to channel middle line at 70.74 or in worser case to 64.60

- having touched the and therefore formed the bottom and upper lines of descending channel, a further 4th touch of upper line in range is possible

- in case TVC:GOLDSILVER ratio continues its movement upwards and TVC:GOLD stabilizing around 5000, the possible local bearish target for OANDA:XAGUSD will be in range

Long Scenario:

- if bulls have strengh, the price can close the order imbalance at

- whereas if price consolidates above 90.70 the bearish structure will be broken and further long trend continuation expected

- price range and will play determining role as the behavior of smart money will be followed under loop - whether they hunt the liquidity or leave it for future retest

- bearish scenario invalidated if price consolidates above 91.00

Fundamentals:

- silver's fundamental outlook remains tied to industrial demand, specifically in the solar and EV sectors

- in my opinion, gold-silver ratio has some space to increase by 25% up to 70-77 OZ of Silver for 1 OZ of Gold, which in real-world application can mean that demand on silver from factories can decrease whereas smart money are jumping into safe harbor of gold

Conclusion:

- Liquidity on Silver is lower than on Gold so setting up farer stops is a must

- In global picture I expect trend continuation on Silver, but technically on local timeframes the correction seems not to be finished yet

# - - - - -

⚠️ Signal - Sell ⬇️

✅ Entry Point - 85.61

🛑 SL - 91.61

🤑 TP 1 - 70.53

⚙️ Risk/Reward - 1 : 2.5 👌

🤑 TP 2 - 64.62

⚙️ Risk/Reward - 1 : 3.5 👌

If zone holds -

entry market with same TP and SL 84.50

Good Luck! ☺️

# - - - - -

DISCLAIMER: Not financial advice. Everyone must make trading decisions at their own risk, guided only by their own criteria and strategy for opening or not opening a trade

Beyond Technical Analysis

Gold may consolidate short-term before a breakout.📊 Market Overview:

Gold (XAU/USD) is currently trading around the 5030–5050 USD/oz zone as the market awaits inflation data and policy signals from the Fed. The USD has weakened slightly, but US bond yields remain elevated, preventing gold from breaking out strongly and keeping the market in a consolidation phase.

📉 Technical Analysis:

• Key Resistance: 5055 – 5065 | 5100 – 5120

• Nearest Support: 5010 – 5000 | 4975 – 4960

• EMA: Price is trading above the EMA 09 on H1 but below the EMA on H4, indicating a short-term bullish bias while the medium-term trend remains mixed.

• Candlestick / Volume / Momentum: H1 candles show small bodies with decreasing volume → consolidation signal. RSI is around 55–60, not in overbought territory, suggesting room for upside but lacking strong breakout momentum.

📌 Outlook:

Gold may rise slightly or continue to move sideways in the short term if the USD does not strengthen and inflation data does not exceed expectations. However, a break below 5000 could trigger stronger downside pressure.

________________________________________

💡 Trading Strategy:

SELL XAU/USD: 5100 – 5103

🎯 TP: 40 / 80 / 200 pips

❌ SL: 5107

BUY XAU/USD: 5000 – 4997

🎯 TP: 40 / 80 / 200 pips

❌ SL: 4993

Inditex joins the pressure against Shein and TemuIon Jauregui — Analyst at ActivTrades

Inditex, together with Mango and other major players in the textile sector, has joined El Corte Inglés and Carrefour in calling on national governments and the European Commission to take urgent action against what they consider unfair competition from platforms such as Shein and Temu. This initiative is being channelled through the industry association Arte, which represents Europe’s leading textile companies.

The core of the complaint lies in the asymmetry in compliance with tax, labour, and product safety regulations. According to Arte, the rapid growth of Asian e-commerce—driven by the massive inflow of low-value shipments—has overwhelmed the control capacity of European authorities. This situation not only undermines the competitiveness of local companies but also poses direct risks to consumer safety and health.

The figures support these concerns. In 2024, 4.6 billion low-value shipments entered the European Union, with a 36% year-on-year increase in the number of consumers using these platforms. The association argues that a significant portion of these products enters the EU market without adequate controls or effective compliance with European standards.

In response, the sector is calling for a set of concrete measures:

Effective enforcement of existing regulations before introducing new ones.

Stronger customs controls and traceability, supported by technological solutions.

The introduction of fees on low-value imports, such as the €3 per package charge that the EU plans to apply from 1 July to shipments below €150.

Sanctions and market access restrictions for platforms that repeatedly fail to comply with regulations.

Implications for Inditex

From a competitive standpoint, this initiative has important implications for Inditex. The group operates under a model focused on quality control, traceability, logistical efficiency, and strict regulatory compliance. As such, stricter enforcement of the rules does not represent an operational disadvantage. On the contrary, it could help rebalance the market against business models based purely on volume and low cost, supported by regulatory loopholes.

While this is not an immediate catalyst for earnings, it represents a positive structural factor in the medium term—particularly if the European Union moves toward more effective customs controls and more consistent enforcement of regulations across all 27 Member States.

Technical analysis of Inditex (Ticker: ITX.ES)

From a technical perspective, Inditex maintains a long-term primary uptrend. The price is trading above the 50- and 100-day moving averages, confirming underlying strength. After reaching all-time highs at €58.07, the stock has entered a phase of orderly consolidation.

The RSI stands around 63.5%, showing no signs of overbought conditions or bearish divergences, while the MACD remains in positive territory, supporting trend continuation. A key support area is located around €53.77, coinciding with the 50-day moving average and the zone from which the last bullish impulse began.

If the price clearly breaks above recent highs, the technical outlook points to a potential extension toward the €60 level. Otherwise, a further correction could lead to a retest of support, with the next relevant level at €52.21. For now, there are no clear signs of exhaustion, and the most likely scenario remains one of continued upside.

Conclusion

The pressure from European commerce against Shein and Temu is not an isolated episode, but rather a coordinated effort to correct regulatory imbalances that have intensified in recent years. In this context, Inditex starts from a solid position, both fundamentally and technically, within a competitive environment that could evolve more favourably over the coming quarters.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

Gold prices recover - consolidating below 5180⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) attracts some sellers near $5,035 during the early Asian session on Tuesday. The precious metal edges lower amid improved risk sentiment and some profit-taking. Traders brace for key US economic data later this week, including delayed employment and inflation reports.

The yellow metal retreats after rising over the previous two days, as traders returned to equities on improved risk sentiment. The S&P 500 extends the rally to near its all-time highs following a volatile week. Additionally, hopes for the United States (US)-Iran negotiations could undermine a traditional asset such as Gold. Iran’s President Masoud Pezeshkian described the Friday nuclear talks with the US as “a step forward,” even as he pushed back against any attempts at intimidation

⭐️Personal comments NOVA:

Gold prices are stable, trading sideways around 5000, consolidating below resistance levels of 5080 and 5182.

⭐️SET UP GOLD PRICE

🔥SELL GOLD zone: 5180 - 5182 SL 5187

TP1: $5160

TP2: $5140

TP3: $5120

🔥BUY GOLD zone: 4903- 4901 SL 4896

TP1: $4920

TP2: $4940

TP3: $4955

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold ¡WARNING! Very Powerful 11th and 12th + Panic CycleFollow me here on TW for my regular critical updates on crypto (BTC, ETH, SOL, MSTR) and metals (GLD, SL, PL) based on Martin Armstrong's Socrates.

Look in my TW Ideas for posts of each market individually.

Gold, Silver & Platinum have PANIC CYCLES this Thursday 12th.

Gold has the STRONGEST TARGET on the 12th whereas Silver & Platinum on the 11th.

Last week was a STRONG TARGET that produced a LOW.

This week is NOT a target in Gold. It is for Silver & Platinum so, I would not be surprised to see a CYCLE INVERSION with a continued rally into next week on all 3 metals.

A PANIC CYCLE is either of these two:

A penetration of the prior session high AND low.

A very strong move in the same trend direction (up).

In either scenario, it may or may NOT change the trend so, if it panic down then it can still continue rallying the very next next day into next week.

I must say this is very hard to predict BUT I will bet that they will rally HARD on the 11th then PANIC DOWN on the 12th then continue the rally into next week.

¡EXTREME CAUTION IS WARRANTED! ¡FOR REAL!

¡Good luck! 🙏🏻

Silver ¡WARNING! Very Powerful 11th and 12th + Panic CycleFollow me here on TW for my regular critical updates on crypto (BTC, ETH, SOL, MSTR) and metals (GLD, SL, PL) based on Martin Armstrong's Socrates.

Look in my TW Ideas for posts of each market individually.

Gold, Silver & Platinum have PANIC CYCLES this Thursday 12th.

Gold has the STRONGEST TARGET on the 12th whereas Silver & Platinum on the 11th.

Last week was a STRONG TARGET that produced a LOW.

This week is NOT a target in Gold. It is for Silver & Platinum so, I would not be surprised to see a CYCLE INVERSION with a continued rally into next week on all 3 metals.

A PANIC CYCLE is either of these two:

A penetration of the prior session high AND low.

A very strong move in the same trend direction (up).

In either scenario, it may or may NOT change the trend so, if it panic down then it can still continue rallying the very next next day into next week.

I must say this is very hard to predict BUT I will bet that they will rally HARD on the 11th then PANIC DOWN on the 12th then continue the rally into next week.

¡EXTREME CAUTION IS WARRANTED! ¡FOR REAL!

¡Good luck! 🙏🏻

Potential Massive Fibonacci Time Cycle TurnToday 02/09/26 the Dow Jones Industrial Average (DJI) made a new all-time high unconfirmed by the Dow Transportation Average, S&P 500, and Nasdaq Composite.

This high comes at the end point of a massive Fibonacci time cycles covering 97 – years.

The starting point is the DJI mania peak made in 1929.

The bisect point is the major peak made in 1966. This was the first time the DJI reached 1,000 and the climax of a 34 – year secular bull market that began in 1932.

The day of the DJI 1966 top was 02/09/66.

Today could be the start of a significant DJI decline.

EURUSD sideways, breakout and price increase.Related Information:!!! ( EUR / USD )

The Euro (EUR) is trading broadly unchanged against the US Dollar (USD) on Tuesday, hovering near 1.1917 at the time of writing and consolidating at one-week highs following a two-session advance. The greenback remains under pressure ahead of a series of key US macroeconomic releases, while a moderately positive risk backdrop continues to weigh on the currency.

The USD is still struggling to recover from last week’s disappointing labor market data. Adding to the soft tone, White House economic adviser Kevin Hassett cautioned on Monday that job creation is likely to slow in the coming months, citing the impact of US President Donald Trump’s immigration policies and rising productivity. These remarks, delivered ahead of Wednesday’s release of the January Nonfarm Payrolls (NFP) report, have done little to shore up demand for the US Dollar.

personal opinion:!!!

The accumulation is continuing, awaiting a breakout from the uptrend, while the DXY index remains weak.

Important price zone to consider : !!!

Resistance zone point: 1.19300, 1.19500 zone

Support zone :1.18850 zone

Follow us for the most accurate gold price trends.

MSTR ¡Warning! Possible LOW Today Tuesday 10thFollow me here on TW for my regular critical updates on crypto (BTC, ETH, SOL, MSTR) and metals (GLD, SL, PL) based on Martin Armstrong's Socrates.

Look in my TW Ideas for posts of each market individually.

MSTR has a target today/tomorrow with an opposite direction into Monday. If today/tomorrow produces a LOW there's a possibility of a nice rally into Monday. The Daily Stochastic is gaining upward energy.

¡Good luck! 🙏🏻

gold on buy unless h4 fails closing above 5078#XAUUSD price still bullish unless next H4 fails closing above the rectangle then another fall will occur.

Buy below 5038 2 times breakout, target 5078, 5194 long, SL 5016.

If prices fails to close above 5078,86 on next H4 then price will drop once more. H1 breakout below 5021 will reach 5000, 4980 again.

XAUUSD LONG VIEW !!Bullion climbed as much as 0.6% after closing lower on Tuesday. Consumer spending unexpectedly stalled in December, setting the scene for a delayed and highly anticipated January jobs report on Wednesday.

Key Scenarios

✅ Bullish Case 🚀 → Demand Zone 5042 5041

🎯 Target 1: 5,075

🎯 Target 2: 5,086

The Dow is still bullishAfter price hit full TP (122+ pips) in our previously published setup idea attached to this post, price displaced the structural high signalling more bullish momentum that's showing no sign of weakness for now.

That brings us back to the origin of the displacement in H1 (entry).

This week, the first NFP for the year will be released and today is ADP employment, let's see if price is able to start pushing down to trap early buyers before Wednesday NFP to push price to the ATH after tapping us in.

SL: 8.2 pips (extend to 10 pips for space)

TP: 100 pips

RR: 1:12+

The daily close is aboveHi, I’m Maicol, an Italian trader.

I study Gold since 2019.

I need your support.

Leave a like and follow me.

It’s a small thing for you, but important for my work.

Please read the description to understand the trading plan.

Don’t focus only on the chart. Thanks.

Live today at 14:00 CET (Rome time).

🌞 GOOD MORNING EVERYONE 🌞

Yesterday’s daily close is above a key area.

The daily shift zone.

Price is also holding above 5000.

With this structure, I expect a bullish continuation, in line with yesterday’s idea.

Until 14:00, I stay on the sidelines.

After that, I’ll reassess based on the news.

If the long starts losing strength and signals are not clear, I will wait.

In the worst-case scenario, if a short move develops, I won’t chase it.

I’ll wait for more discounted levels to look for a long.

Key area to monitor very closely:

daily imbalance 5100 – 5120.

We’ll be live at 14:00.

See you later, and have a good Tuesday.

🔍 Reminder 🔍

I avoid trading during the Asian and London sessions.

I focus on the 14:30 news and the New York open at 15:30.

🔔 Turn on notifications so you don’t miss anything.

📬 If you have any questions, message me. I’ll reply.

🔍 NEXT APPOINTMENTS 🔍

As usual, we’ll be live at 14:00 to follow the market in real time.

In the meantime, have a good day.

-GOOD TRADING

-MANAGE RISK

-BE PATIENT

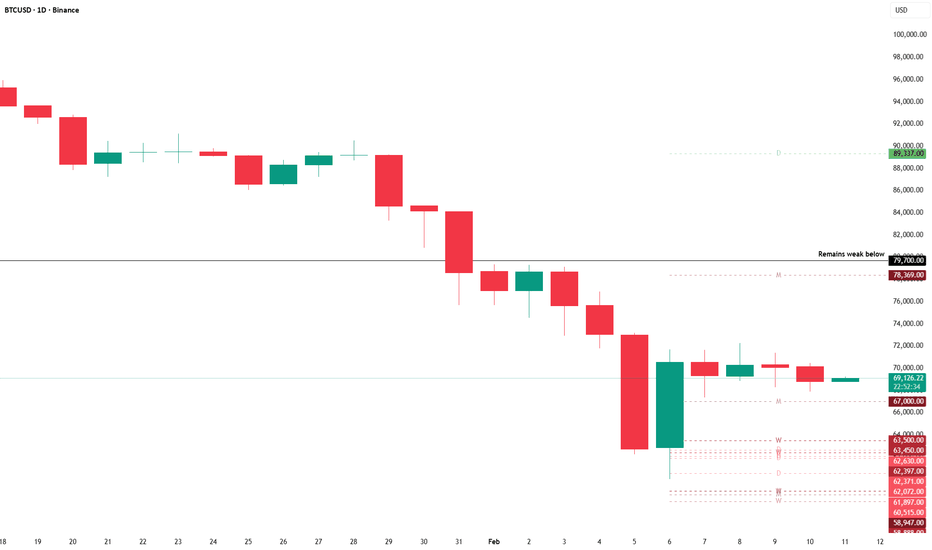

BTC ¡WARNING! Possible High On The 12thFollow me here on TW for my regular critical updates on crypto (BTC, ETH, SOL, MSTR) and metals (GLD, SL, PL) based on Martin Armstrong's Socrates.

Look in my TW Ideas for posts of each market individually.

There's a chance that I'm getting ahead of Socrates with this forecast and I will confirm/reject these once I read tomorrow's analysis.

Considering that metals should have a very strong MOVE UP tomorrow 11th and 12th, it coincides with BTC ETH producing a LOW today the 10th with VERY STRONG TARGETS for the 12th. The real negative news for crypto is that this week is a TARGET but rather weak with a very possible HIGH this 12th and a continued STRONG DECLINE into the week of Feb 23rd . To make matters worse, BTC has a WEEKLY PANIC CYCLE next week , meaning that whatever gains are made this week will probably dump it all next week.

SOL is looking far worse without any TARGET this week and a continued STRONG DECLINE into the week of Feb 23rd . On the DAILY, I'm not even sure what it's trying to do right now, it has a TARGET tomorrow 11th but it's all choppy these few days.

¡Good luck! 🙏🏻

ElDoradoFx – GOLD SESSIONS ANALYSIS (11/02/2026, ASIA SESSION)

Gold is trading around $5,023 after rejecting from the intraday supply near 5,080 and compressing into a tight consolidation above the 5,000 psychological level. Structure on lower timeframes is currently corrective, with price sitting between intraday supply and rising demand.

Asia session is building liquidity inside a range, suggesting London will likely decide the next expansion leg. As long as price holds above the 4,990–4,980 demand seen on the charts, buyers still have structural support.

⸻

📊 Technical Outlook (D1, H1, 15M–5M)

🔹 D1

• Macro bullish structure still intact

• Strong rejection from weekly highs

• Price holding above rising trend support

• EMA cluster still trending upward

• Pullback currently corrective

🔹 H1

• Clear rejection from 5,080 supply zone

• Range forming between 5,080 and 5,000

• Demand visible at 5,000–4,980

• Liquidity resting above 5,080

🔹 15M–5M

• Sideways compression structure

• No strong BOS yet

• Equal highs forming intraday

• Asia likely sweeping range extremes

⸻

✨ Fibonacci Golden Zones

(Based only on chart swing: 4,983 → 5,078)

1️⃣ BUY Swing: 4,983 → 5,078

• 38.2% = 5,042

• 50% = 5,031

• 61.8% = 5,020

🟩 BUY Golden Zone: 5,042 – 5,020

2️⃣ SELL Reaction Swing: 5,078 → 5,020

• 38.2% = 5,042

• 50% = 5,049

• 61.8% = 5,056

🟥 SELL Reaction Zone: 5,042 – 5,056

⸻

🎯 High Probability Zones

📈 BUY Scenario (Range Support)

Buy Zone: 5,020 – 5,000

🎯 Targets → 5,040 → 5,060 → 5,080

🛑 SL: Below 4,980

⚡️ Confirmation:

• Sweep of intraday lows

• 5M bullish BOS

• Strong rejection candle

—————————

📈 BUY Breakout Setup

Trigger: Break & hold above 5,080

Retest: 5,070–5,060

🎯 Targets → 5,100 → 5,120

🛑 SL: Below 5,040

—————————

📉 SELL Scenario (Range Resistance)

Sell Zone: 5,060 – 5,080

🎯 Targets → 5,040 → 5,020 → 5,000

🛑 SL: Above 5,095

⚠️ Only valid with bearish BOS

—————————

📉 SELL Breakout Setup

Trigger: Break & close below 5,000

Retest: 5,010 fail

🎯 Targets → 4,980 → 4,960

🛑 SL: Above 5,030

⸻

📰 Fundamental Watch

• Asia liquidity thin → fakeouts likely

• Dollar relatively stable intraday

• London session expected to bring expansion

• Market watching risk sentiment flows

⸻

📌 Key Levels

Resistance: 5,060 / 5,080 / 5,100

Support: 5,020 / 5,000 / 4,980

Break-Buy Trigger → > 5,080

Break-Sell Trigger → < 5,000

⸻

📌 Summary

Gold is consolidating intraday around $5,023 inside a tight Asia range. The market is neutral-to-bullish above 5,000, with highest probability trades coming from range extremes. Acceptance above 5,080 signals continuation; loss of 5,000 opens deeper pullback.

Trend-defining level: 5,000

⸻

🥇 ElDoradoFx PREMIUM 3.0 – PERFORMANCE 10/02/2026 🥇

⚡️ Strong recovery and precision execution across sessions.

📉 SELL −70 PIPS (SL)

📈 BUY +90 PIPS

📉 BUY −40 PIPS (SL)

📈 BUY +320 PIPS

📉 SELL +30 PIPS

📈 BUY +360 PIPS

▶ LIVE TRADING SESSION ▶

📈 BUY +30 PIPS

📈 BUY +130 PIPS

📉 BUY −40 PIPS (SL)

📈 BUY +70 PIPS

📈 BUY +130 PIPS

━━━━━━━━━━━━━━━

💰 TOTAL PIPS GAIN: +1,010 PIPS

🎯 11 Signals → 8 Wins

🔥 Accuracy: 73%

━━━━━━━━━━━━━━━

✅ Excellent session management turned early losses into a strong green finish — discipline and execution delivered.

— ElDoradoFx PREMIUM 3.0 Team 🚀

EUR/USD Bullish Consolidation & Potential BreakoutEUR/USD is currently consolidating after forming a base that halted the local downtrend. Price action suggests bullish intent, with buyers defending key levels and compressing price beneath resistance.

From a fundamental perspective, the U.S. dollar remains under pressure due to strength in the Japanese yen following Japan’s early parliamentary election. This shift in sentiment could weigh on the dollar in the medium term, supporting further upside in EUR/USD.

Technically, the consolidation appears to be acting as a pause before continuation. If bullish momentum is maintained and price successfully breaks above resistance, the pair may exit consolidation and resume growth.

In a bullish scenario, price may first retest support after the breakout (a typical pullback), before continuing higher. Upside targets are projected in the 1.19600 – 1.20008 zone.

You may find more details in the chart,

Trade wisely best of luck buddies,

Ps; Support with like and comments for better analysis Thanks for Supporting.

Fetch.ai near key support: traders eye a short-term bounce:Current Price: 0.16539 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 62%(Price is holding a well-tested support zone with increasing volume and early momentum signals, despite limited trader commentary.)

Targets

Target 1: 0.170

Target 2: 0.185

Stop Levels

Stop 1: 0.160

Stop 2: 0.155

Key Insights:

Here’s what’s driving this trade idea. Fetch.ai is trading just above the $0.160 support, a level that’s been tested multiple times recently. Several traders highlighted this zone as an area where buyers tend to step in. The fact that price hasn’t lost it yet is important. When I see price hovering near support instead of collapsing through it, I start thinking upside attempt, even if it’s only a short-term move.

What’s interesting is the volume behavior. Trading volume jumped roughly 45% versus the recent average, which tells me participation is picking up. That doesn’t guarantee direction, but it does suggest the next move could be more decisive. On shorter timeframes, MACD momentum has started to curl upward, which several traders interpret as early bullish pressure building.

Recent Performance:

Over the last 24 hours, Fetch.ai has drifted slightly lower, down just over a tenth of a percent, while staying in a tight range between roughly $0.161 and $0.167. Zooming out to the past week, price action has been choppy but contained, with buyers repeatedly defending the lower $0.16 area. That kind of behavior often precedes a relief bounce rather than an immediate continuation lower.

Expert Analysis:

Multiple traders I’m tracking are focused on the $0.170 level. They see it as the line that changes the tone in the short term. A push above it, especially with volume holding above $40–45M, opens the door toward the mid-$0.18s. On the downside, the same traders consistently point to $0.160 as the line in the sand. Lose that, and the risk shifts quickly toward $0.155.

Technically, RSI around the mid‑40s suggests there’s room for upside without being stretched. The short-term EMAs are just overhead, which is why I’m keeping targets realistic and stops tight. This is a tactical trade, not a long-term thesis.

News Impact:

Recent partnership headlines and exchange-related liquidity news have helped keep interest alive in Fetch.ai. None of this is explosive on its own, but it does provide enough background support to justify buyers defending current levels. Upcoming developer updates and token supply reports over the next two weeks are also on traders’ radar and could act as short-term catalysts.

Trading Recommendation:

Putting it all together, I’m taking a LONG bias here based on price sitting at support, improving momentum signals, and rising volume. I’d look for entries close to the current price, target $0.170 first, then $0.185 if momentum follows through. Risk management is key: a clean break below $0.160 invalidates the setup, which is why stops are tight. This isn’t a high-conviction swing, but it’s a reasonable short-term trade with defined risk.