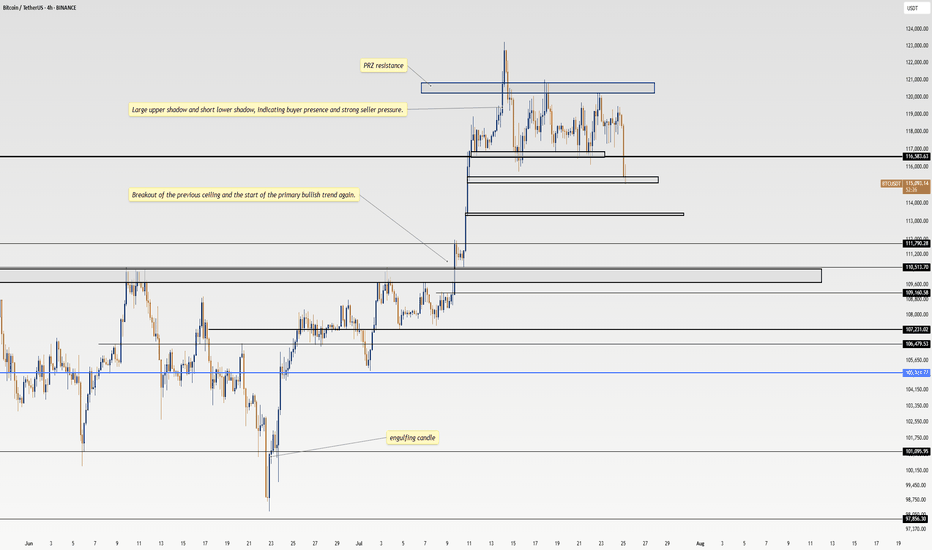

WE HAVE PREDICTED EVERY MOVE OF BITCOIN - HERE IS WHAT’S NEXT!! Yello Paradisers! we have predicted every single movement on Bitcoin in the past few months, and in this video, I will reveal to you what's going to happen next with the highest probability. Again, on the high time frame chart, we are seeing the ABC zigzag, and right now, we are trading inside of the C wave. Further in the video, we are zooming into the fourth wave.

On the medium time frame, we are seeing bearish divergence that is showcasing an absorption. We are describing Heron-Chorda's target and taking a look at the channel in which the zigzag is being formed. On the low time frame, we are analyzing the Elliott Wave Theory Triple Three pattern, and on the ultra-low time frame, we are analyzing the impulse.

We are describing what kind of conformations we are waiting for. Basically, it's a five ways to the downside. Then, we will be increasing our portfolio exposure on a corrective mode wave to the upside where we will be able to create a tight risk-to-reward ratio position and a high-probability trade setup. Trade smart, trade with a professional trading strategy, be tactical, and enjoy your weekend.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

Bitcoin (Cryptocurrency)

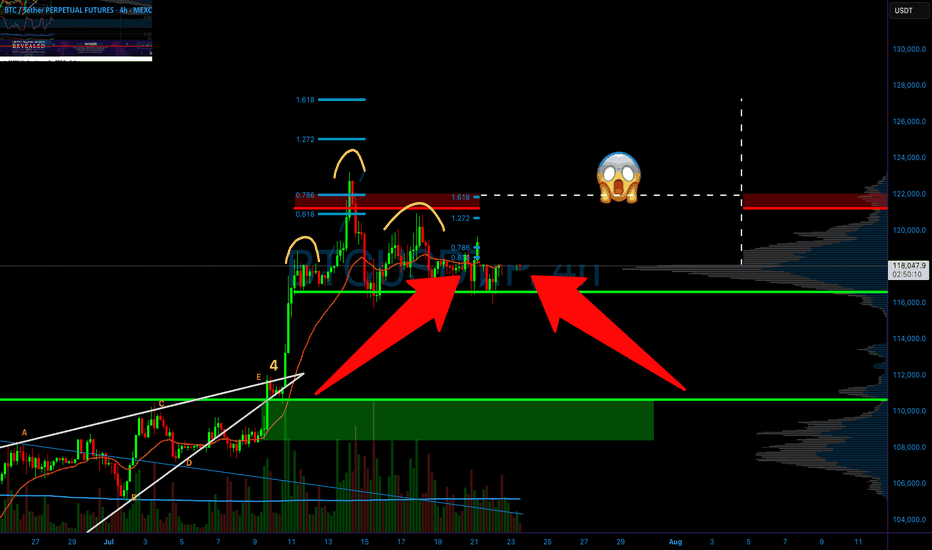

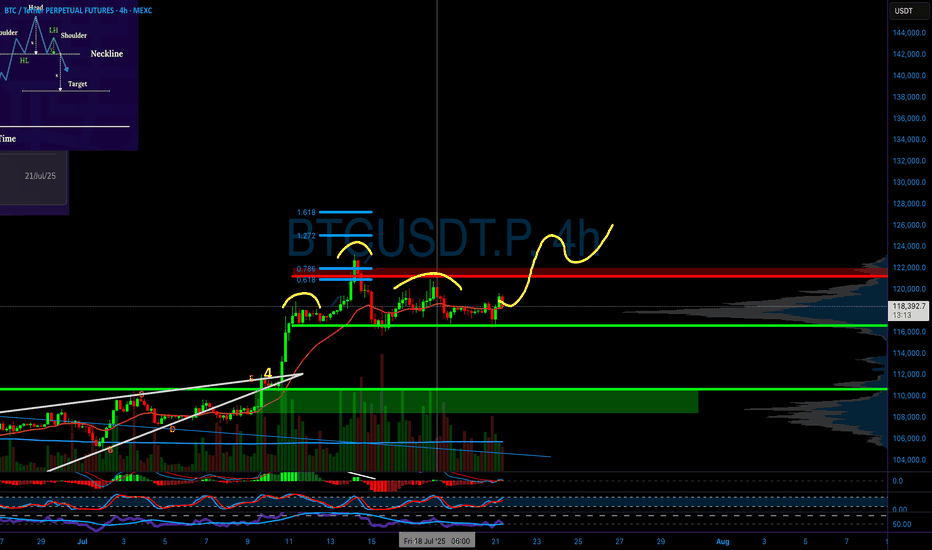

BITCOIN PREDICTION: a SECRET PATTERN is FORMING (watch out)!!!Yello paradisers! In this Bitcoin prediction, I'm updating you about the crash we predicted earlier in previous videos. I'm showing you on a high timeframe chart the ABC corrective mode wave; we are now forming the C wave. The C wave subdivides itself into five smaller waves because it's a motive mode wave. We are taking a look at the volume. We understand that bears are still in power, so we are waiting for some nice volume from bulls. We are spectating a bullish divergence on the MACD indicator. On RSI, there is exaggerated bullish divergence, and in stochastic RSI, we are in an oversold area.

Then, we are shifting our focus to a medium timeframe. We are zooming into the fourth wave, where we are making our sub-waves right now. On the medium timeframe, we are also spectating bearish divergence. We are waiting for the second booby that will basically increase the probabilities of absorption.

As we have seen previously, that helped us to predict that Bitcoin will be crashing. We are also taking a look at our head and shoulders target, which is at $109,000.

Then we are shifting our focus to a lower timeframe, where we are seeing the secret pattern, triple three. Right now, we are creating a sub-wave XX, which is forming itself as a possible zigzag. Paradisers, make sure that you are trading professionally, focus on long-term growth, and avoid get-rich-quick schemes. Any shortage in trading usually ends up sooner or later in bankruptcy.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

Why I think Chainlink is the best bet for the dayLooking to me like link has broken a daily down trend and may be attempting to establish some support. On the hourly levels it has broken a down trend and appears like it may want to begin building stairs. Looking at bitcoin I believe we have potential to also break a down trend and if so, we could have great momentum to attempt breaking into the previous range. I feel today will show us a lot about short term price action to come.

Where could Bitcoin and the rest of the market be headed?Just a brief overview of my thoughts on bitcoin and the rest of the market. We are currently sitting around the area that I had suspected may be our weekly low. Where we go from here is still unclear but I wanted to take time for a good overview and share my plans and how to trade it so that I could still be profitable even if we just chop for a while. Also, the potential for a true alt season may really be right around the corner. This is the type of term that has been thrown around so much lately but it has been years since we have had one. Alts have been lagging so I have some suspicion of what may happen next and share the things to look for to confirm this, and how I plan to trade accordingly.

BITCOIN CRASH PREDICTED! HERE’S WHAT HAPPENS NEXT! (scary)Yello Paradisers, Bitcoin crashed exactly as we predicted in the previous videos that it will happen with the highest probability.

In this video I am explaining to you what's gonna happen next.

Head and shoulders, neckline, is be breaking to the downside, we need a clear confirmation of a reclaim Our channel on high timeframe is getting breakout to the downside and confirmation was that a reclaim was already successful.

In this video I'm sharing with you Elliott Way theory on low timeframe and what needs to be done for confirmation perspective in order for us to continue to go to the downside or have a reversal to the upside.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

Okay, Let's Take a Live Look Into the Market 📺⚡ Okay, Let's Take a Live Look Into the Market 💹🔥

Important levels across S&P 500, Bitcoin, and XRP are all flashing 🔴 right now. Here's what I'm seeing in real-time:

📈 S&P 500 Futures – 6,351 Is Everything

The 6,351 level marks the midpoint of the rising channel.

On Friday, I flagged 6,430 as critical resistance — price rejected perfectly.

Now we’re attempting a rebound, but we’re stuck at mid-channel.

⚠️ A confirmed breakout above 6,351 could reignite upside momentum.

👉 Yes, this is a 1-minute chart, but precision matters when watching key structural levels — especially in legacy indices.

💥 BTC – 115,700: The Grandmaster Level

Zoom out and see the massive yellow horizontal on the chart: 115,700.

It’s not just any number — this is the ultimate resistance-turned-support battleground.

We’re currently under it, which keeps pressure to the downside.

A reclaim flips the structure bullish and opens room for trend continuation.

📌 Until we’re above it, this remains the dominant resistance across the entire crypto macro framework.

🧩 XRP – Still Facing Rejection

On the 2H/3H chart, XRP continues to flirt with resistance but fails to confirm strength.

This aligns with both the S&P 500 stalling at 6,351 and Bitcoin being capped at 115.7K.

📉 When multiple assets respect key levels in sync, it signals market-wide hesitation.

🔄 Cross-Market Confluence

It’s fascinating to watch:

A TradFi index (S&P)

A macro crypto asset (BTC)

A mid-tier alt (XRP)

...all pivoting around hyper-precise structural resistance at the same time.

✅ These aren’t coincidences. They’re systemic correlations.

🔮 What’s Next?

If S&P 500 breaks above 6,351, it could act as a risk-on signal.

That momentum could help BTC flip 115,700 — a massive deal.

And if that happens, XRP could finally follow with a stronger move.

Until then? We respect resistance and wait for confirmation. 📊🔍

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

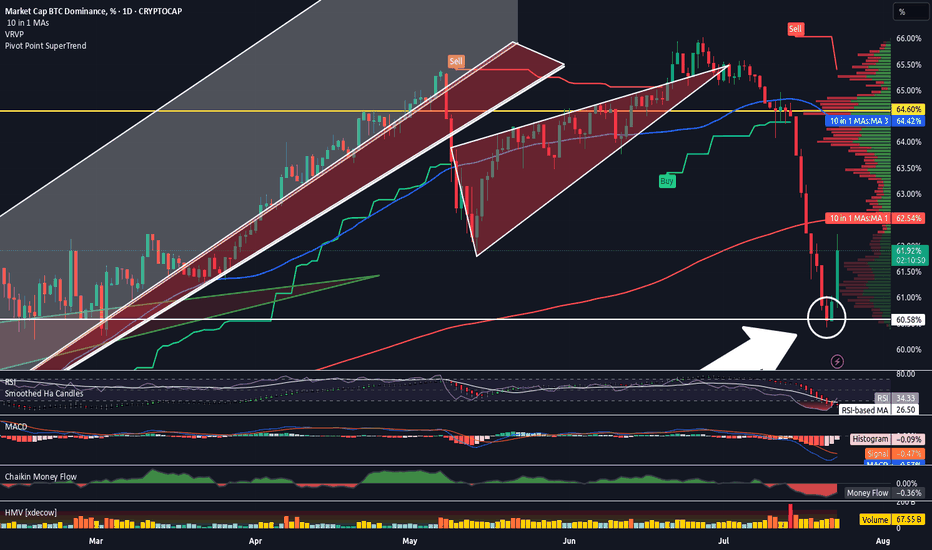

Bitcoin Dominance & The Fall of AltcoinsBitcoin has sold off sharply in recent session.

Allowing alt coins to capture small percentages of bitcoins liquidity which resulted in epic bullish moves.

Now that Bitcoin is retesting a major moving average (50 MA) we might see BTC recapture some of that crypto dominance.

Other alt coins are well off of their 50 day moving average making them a riskier buy.

When BTC dominance starts to take leadership we often see alt coins and the total market cap sell off.

Bitcoin dominance is hitting a multi year trendline and looks poised to capture some of the alt liquidity.

We still think BTC can sell off and go lower, but on a relative basis it should hold up better than other alt coins & Ethereum.

There are some key nuances that are building and shaping up for a very similar topping formation that occurred in 2021.

BITCOIN PREDICTION: NOBODY IS WATCHING THIS PATTERN !!!(warning)Yello Paradisers, I'm updating you about the current Bitcoin situation, which is extremely dangerous for crypto noobs that will get rekt again very soon!

It's going to be a big move soon. I'm telling you on a high timeframe chart we are doing multi-time frame analysis and on a high timeframe chart I'm updating you about the RSI indicator, the bearish divergence, the moving average reclaim, and the channel reclaim that we are having right now.

We are observing a shooting star candlestick pattern, which is a reversal sign, and I'm telling you what confirmations I'm waiting for to make sure that I can say with the highest probability that we are going to the downside. On a medium timeframe, I'm showing you two patterns: one is a head and shoulders pattern, then a contracting triangle, and on a low time frame, I'm sharing with you the ending diagonal because on a high time frame chart, we are either creating ABC or impulse, and I'm telling you what the probabilities are for the zigzag, which is a corrective mode wave, or the impulse, which is a motive mode wave.

I'm sharing with you what's going to happen next with the highest probability. Please make sure that you are trading with a proper trading strategy and tactics, and that's the only way you can be long-term profitable.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

ETH - BTC ETF News: What It Means for the Market+ China Rumors 🚨 ETH - BTC ETF News: What It Means for the Market + China Rumors 💥🌐

July just ended with a crypto bombshell 💣 — and the market is barely reacting.

Let’s break it down:

🧠 One part hard news.

🌀 One part geopolitical smoke.

🎯 All parts worth watching if you care about macro market shifts.

🏛️ SEC Approves Real BTC & ETH for ETF Flows (July 29)

Say goodbye to the cash-only ETF model.

The SEC now allows direct in-kind creation/redemption of Bitcoin and Ethereum in ETFs.

That means providers like BlackRock, Fidelity, VanEck can now use actual BTC/ETH, not just synthetic tracking.

✅ Bullish Impact:

💰 Real Spot Demand: ETF inflows = real crypto buying

🔄 Efficient Arbitrage: No middle step via cash = faster flows

🧱 TradFi + Crypto Merge: ETFs now settle with crypto — not just track it

🎯 Better Price Accuracy: Spot ETFs reflect true market value more cleanly

📉 The market reaction? Mild.

But don’t get it twisted — this is a structural reset, not a meme pump.

⚠️ But There’s a Bearish Angle:

🏦 Centralized Custody: Crypto now lives in Coinbase, Fireblocks vaults

⚠️ Network Risks: ETF performance now tied to ETH/BTC uptime

🧑⚖️ Regulatory Overreach: More hooks into validator networks, MEV relays

🌊 Volatility Risk: Panic redemptions = real BTC/ETH sold into open markets

Still, this is good news for Ethereum in particular.

Why? Because ETH isn’t just money — it’s infrastructure.

And now Wall Street is finally using it, not just watching it.

🇨🇳 And Then There’s China… Rumor or Tumor?

Crypto Twitter is swirling with unconfirmed whispers from July 29 that China may be prepping a major Bitcoin statement ahead of the BRICS summit.

But let’s be clear:

🚨 It’s a rumor. Or a tumor. 🧠

And like many tumors in crypto — there’s a 40% chance it brings bad news. 🤕

Still, here’s what’s being floated:

🧠 Speculations Include:

🔓 BTC re-legalization in “special finance zones” (HK-style)

🏦 BTC in national reserves (!)

🤖 CBDC integration or smart contract interoperability

⚒️ Return of official state-backed Bitcoin mining

🧯 But no official sources. Just geopolitics + timing.

China’s FUD/FOMO pattern is Bitcoin tradition — don’t get trapped by hopium.

But if even half of it is true... buckle up.

📈 Ethereum Leads the Charge — But Watch These Alts:

If ETFs go fully crypto-native, some sectors light up 🔥

🔹 1. Ethereum Layer 2s (ARB, OP, BASE)

→ ETF gas pressure = L2 scaling demand

🔹 2. DeFi Protocols (UNI, AAVE, LDO)

→ TradFi liquidity meets on-chain utility

🔹 3. ETH Staking Derivatives (LDO, RPL)

→ Institutions want yield = LSD narrative grows

🔹 4. Oracles (LINK)

→ ETFs need trusted on-chain data = Chainlink shines

🔹 5. BTC on ETH Bridges (ThorChain, tBTC)

→ If BTC flows into ETH-based ETFs, bridges light up

🚫 What I will Avoid:

❌ Memecoins – zero relevance to ETF flows

❌ GameFi – not part of TradFi’s roadmap

❌ Ghost Layer 1s – no users, no narrative, no pump

🧠 My Take:

ETH is building momentum toward $4,092 — the third breakout attempt on your 1-2-3 model.

🔥 The fuse is lit. Target? $6,036

Timing? Unknown. But structure is in place.

Meanwhile, Bitcoin Dominance is rising.

ETH is shining.

Solana — while powerful — continues paying the price for memecoin madness 💀

We’re entering a new phase — where ETFs settle with real crypto , China watches the stage, and macro money is warming up behind the curtain.

So stack smart.

Study the flows.

Don’t let silence fool you — the biggest moves come after the news fades.

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Bitcoin - The cycle is just starting!⚔️Bitcoin ( CRYPTO:BTCUSD ) just created new highs:

🔎Analysis summary:

Bitcoin is currently - especially with the new all time high breakout - just perfectly following previous cycle behavior. Since there is no real resistance above current price, apart from psychological levels, I do expect a substantial rally back to the upper channel resistance trendline.

📝Levels to watch:

$300.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader

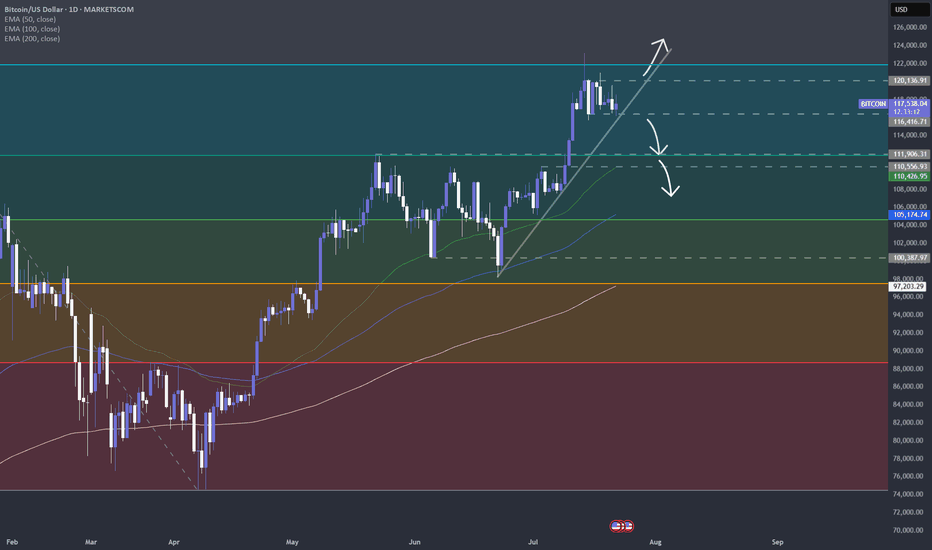

BITCOIN PREDICTION - MASSIVE CANDLE INCOMING!!! (WARNING) Watch this Bitcoin Prediction video now, you will love it!

Yello, Paradisers! Big warning sign: #Bitcoin is about to liquidate more traders soon if we get these confirmations that I'm sharing with you in this video. Loads of people will get wrecked again. Be careful not to get trapped into fakeouts.

In this video, I'm describing exactly what I'm seeing on Bitcoin, what patterns I'm waiting to form, and what confirmations I want to see before being able to say with 100% accuracy guaranteed that MARKETSCOM:BITCOIN is moving in that direction.

I'm sharing with you all the important targets and also how professional trading works: how risk-reward proper ratio trading works, and how high-probability trading depends a lot on how you choose to create your trades.

Watch this Bitcoin prediction to understand what I'm seeing right now on the chart and how I'm acting and making my decisions.

BITCOIN PREDICTION: HUGE BREAKOUT SOON!! (watch this level) Yello Paradisers! I'm sharing with you multi-timeframe analysis on Bitcoin, levels to watch out for, confirmations we are waiting for, and everything needed for successful professional trading that is being profitable in the long run.

I'm sharing with you zig-zag from the Elliot Wave pattern formation. I'm also sharing a possible impulse we are going through, a head and shoulders pattern and its target, and the next major resistance and support levels.

I'm sharing with you a contracting triangle setup and how to trade it, along with an ending diagonal setup and how to trade it. Watch out for confirmations and how the price is developing based on what I have been talking about in this video, then trade it as a professional trader should.

Make sure that you have a great risk management, trading strategy, and tactic for entering the trades. I have explained some tactics that I'm watching for in this video, but make sure that all these tactics are well within your larger trading strategy and that you're approaching the market professionally. Don't try to get rich quick.

Make sure that you are focusing on long-term profitability and survival. This is the only way you can make it in crypto trading!

Understanding Wedge Patterns - A Real Bitcoin Case Study🎓📊 Understanding Wedge Patterns - A Real Bitcoin Case Study 🧠📈

Hi everyone, FXPROFESSOR here 👨🏫

From this moment forward, I will no longer be posting targets or trade setups here on TradingView. Instead, I’ll be focusing 100% on education only for here in Tradinfview.

Why? Because over time I’ve learned that even when traders receive the right charts, most still struggle to trade them effectively. So, from now on, FX Professor Crypto content here will be strictly educational — designed to teach you how to read and react to the markets like a professional. Unfortunately I cannot be posting on Tradingview frequent updates like I do all day. Education is always better for you guys. And i am very happy to share here with you what matters the most.

🧩 In today’s post, we dive into one of the most misunderstood formations: the wedge pattern.

Most resources show wedges breaking cleanly up or down — but real price action is messier.

🎥 I recorded a video a few days ago showing exactly how BTC respected a wedge formation.

⚠️ Note: Unfortunately, TradingView doesn’t play the audio of that clip — apologies that you can’t hear the live commentary — but the visuals are clear enough to follow the logic. (there is no advertising of any kind on the video so i hope i don't get banned again - i did make a mistake the last time and will avoid it-the community here is awesome and needs to stay clean and within the rules of TV).

Here’s what happened:

🔸 A clean wedge formed over several days

🔸 We anticipated a fake move to the downside, grabbing liquidity

🔸 BTC rebounded off support around a level marked in advance

🔸 Then price re-entered the wedge, flipping support into resistance

The lesson?

📉 Often price will exit the wedge in the wrong direction first — trapping retail traders — before making the real move. This is a classic liquidity trap strategy, exercised by the 'market'.

💡 Remember:

Wedges often compress price until it "runs out of space"

The initial breakout is often a trap

The true move tends to come after liquidity is taken

The timing of the 'exit' has a lot to do with the direction. In the future we will cover more examples so pay attention.

I stayed long throughout this move because the overall market context remained bullish — and patience paid off.

Let this be a reminder: it’s not about guessing the direction — it’s about understanding the mechanics.

More educational breakdowns to come — keep learning, keep growing.

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Bitcoin’s Epic Run from 80K to 120K: What’s Next for BTC?Yo traders, it’s Skeptic from Skeptic Lab! 🩵 Diving into Bitcoin’s wild ride from 80K to 120K—breaking down the key supports, resistances, and what’s next for BTC.

From the $76k bounce to smashing $110K, we’re eyeing the $120K PRZ. Will it correct or keep soaring? Check the video for the full scoop! Drop your thoughts or coin requests in the comments, boost if it vibes & Let’s grow together!

BITCOIN IS CREATING A SECRET PATTERN! (Huge move incoming?!)Yello paradisers! I'm describing to you what's going on with Bitcoin right now. We are creating a secret pattern that is forming, and once its neckline is reclaimed, we are going to have a huge movement.

In this video, I'm sharing with you the most important support and resistances on multiple time frames. We are describing Elliott wave theory wave count, and taking a look at candlestick patterns. We are talking about confirmations necessary for bullish and bearish cases. I'm explaining to you what the professional trading signals need for long-term profitability.

Some of the points are great risk-reward ratios. I'm talking about that in the video. One of them is taking only the highest probability trade setups, and having the patience and discipline to wait for them.

I'm talking about proper strategy which is needed, and systemology in your overall trading and how important it is. Here on TradingView, I'm describing to you the overall bias I have on Bitcoin right now.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

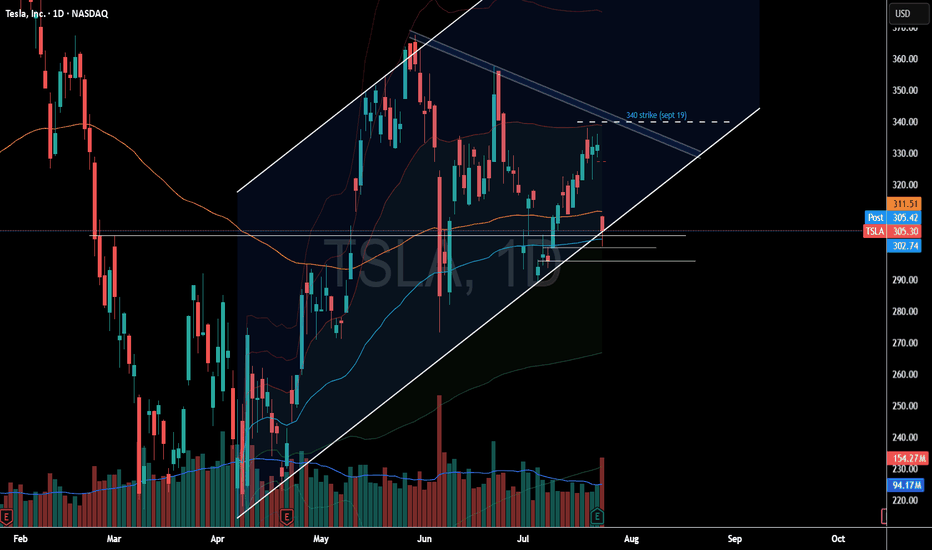

Bitcoin, SPX, Ethereum, Tesla: Whats Next? BTC appears to be showing distribution signs.

I do believe BTC local top is in, but alt coins like Ethereum can still push a bit higher.

Ethereum short around 3900-4000 looks promising

Tesla fell sharply on the back of cash flow burn and expenditures.

Investors are also fearful of sales decline and loss of EV credits.

SPX hit major long term resistance today. Coupling this with a depressed Vix we are likely setting up for a pullback in the market.

Small caps saw distribution today on the back of rising yields. A failed breakout observed on IWM chart.

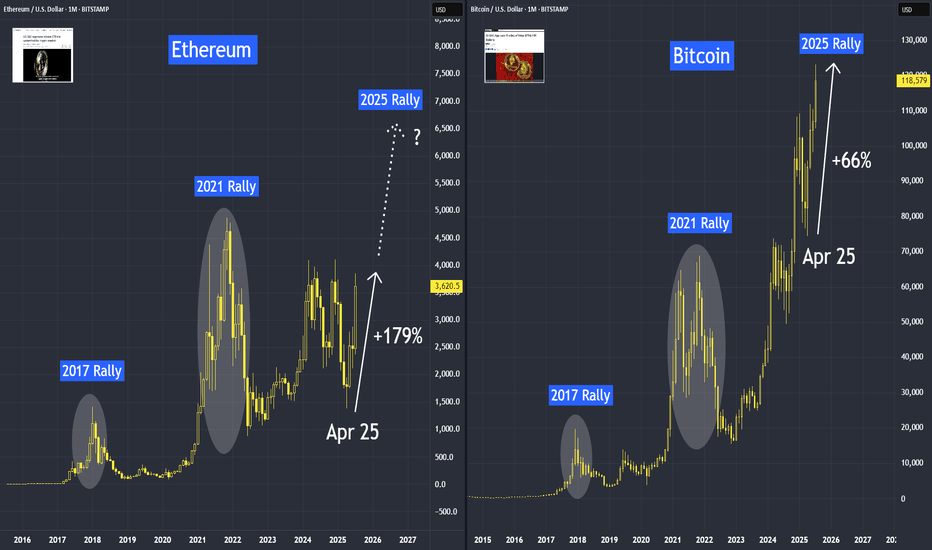

Ethereum is Trending HigherSince April trough, Ethereum has risen by 179%, delivering a higher rate of return than Bitcoin at 66%. But most of our attention is on Bitcoin, breaking above the 120,000 level.

Why is Ethereum quietly gaining ground —and what does the future hold for Ethereum?

Mirco Bitcoin Futures and Options

Ticker: MET

Minimum fluctuation:

$0.50 per ether = $0.05 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Altcoin Season Has Started. And A Quick Look At The Stock MarketHey Traders,

Time for me to catch you up on the latest price action in both the stock market and crypto as well as touch upon a few changes on my platform and subscription services and what I plan for the future.

Timestamps:

00:00 | Housekeeping - site changes, etc

04:35 | BTC Dominance

06:45 | DXY Dollar Chart

10:00 | SPY

14:25 | BTC Bitcoin Chart

15:45 | Bitcoin Liquidity Heatmap

17:30 | Solana

19:05 | Ethereum

20:20 | Crypto & Stock Trackers

24:25 | My Indicator

26:10 | Where I Went Wrong & How I Plan To Course Correct

✌️ Stew

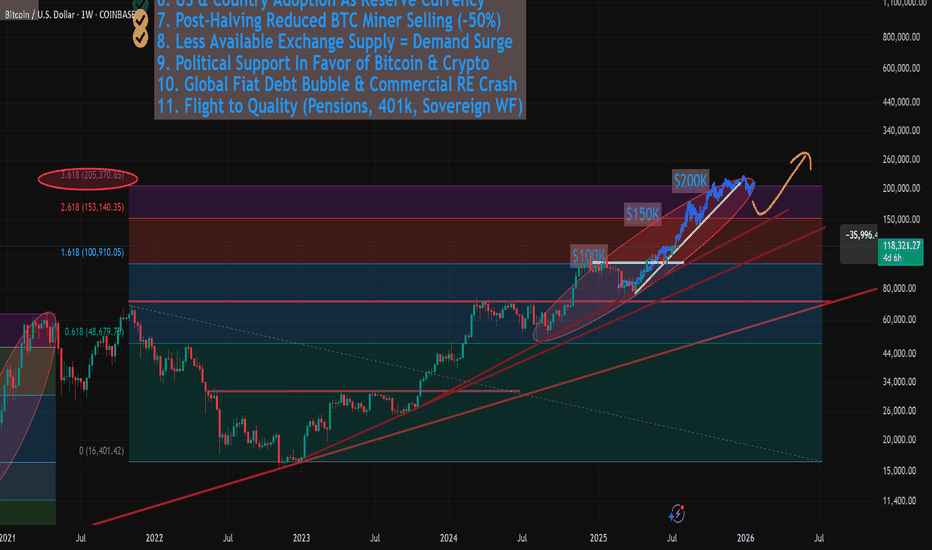

Revsiting $150k - $200k Bitcoin (AND Next Bear Market Bottom)In this video I revisit my 2-year old study showing the potential path for Bitcoin to $150k to $200k and not only how we might get there, but the 11 reasons WHY we can this cycle.

This is the same Fibonacci series that predicted the 2021 cycle high at the 3.618 (Log chart) and used the same way this cycle, with some interesting 2025 forecasts of:

1.618 - $100k

2.618 - $150k

3.618 - $200k

There are quite a few confluences that we get to $150k like the measured moves from both the recent mini bull flag, but also the larger one from earlier this year.

** Also I touch on revisiting my study from 2 years ago where I may have discovered the retracemebnt multiple that correctlty predicted and held the 2022 lowes around $16k. **

It's a VERY interesting number you all will recognize (buy may not agree with).

Let me know what you think.

Bitcoin - Trust the higher timeframe!⚔️Bitcoin ( CRYPTO:BTCUSD ) is still 100% bullish:

🔎Analysis summary:

For the past couple of months we have been seeing an overall consolidation on Bitcoin. But looking at the higher timeframe, Bitcoin remains in an underlying strong bullrun. Consolidations are always expected and no reason to freak out since everything is still bullish.

📝Levels to watch:

$100.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Will cryptos lose their appeal, as more regulation comes in?In this new world, where governments and financial institutions are getting more and more interested in cryptos, will those start losing their appeal?

Let's take a look at CRYPTO:BTCUSD

MARKETSCOM:BITCOIN

CRYPTO:ETHUSD

MARKETSCOM:RIPPLE

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

BITCOIN FINAL WARNING BEFORE HUGE MOVE!!! (urgent) Yello Paradisers! I am Sharing with you my idea about #Bitcoin of what's going on with Bitcoin right now: be very careful because the Fear and Greed Index, a special one, is at "Greed". We are seeing funding rates, the accumulated funding rates, as extremely positive. We are seeing bearish patterns forming.

In this video, I'm describing the confirmations we are waiting for that will confirm that Bitcoin is about to make a huge movement. Make sure that you are trading with professional trading strategies and that you are waiting for confirmations before any trade execution. Also, make sure that you have tight risk management because only the best, most professional traders will win long-term in this game.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.