Bitcoin (Cryptocurrency)

New era: 'The Bitcoin Trust Flow Cycles'🏆 The Bitcoin Trust Flow Cycles™ by FXPROFESSOR

Friends, today I’m sharing what may be the most important Bitcoin framework of 2025.

Forget the broken halving expectations. Forget the chaos of macro headlines.

What if the real signal has been here all along?

What if Bitcoin’s true rhythm follows the capital rotation between itself and the U.S. Treasury market?

📊 Introducing: The Bitcoin Trust Flow Cycles™

This is not a model of where Bitcoin could go (like Stock-to-Flow)…

This is a model of when and why it moves — based on the trust rotation between U.S. Treasury Bonds (TLT) and Bitcoin.

What I’ve found is a repeating structure — not based on supply or halvings, but on macro trust dynamics .

🔁 The Two Core Phases:

• Correlated Periods 🟦 (Blue zones): BTC and TLT move together — both rising or falling

• Inverted Periods 🟩 (Green zones): BTC and TLT move in opposite directions

These aren't random — they're structural rotations that occur at key technical levels in the bond market.

🧠 The Cycle Timeline:

Jan 2019 – Feb 2020 → Correlated (pre-COVID calm)

Feb 2020 – Sep 2021 → Inverted (Fed QE, Bitcoin moon)

Sep 2021 – Nov 2022 → Correlated (everything dumps)

Nov 2022 – Oct 2023 → Inverted (TLT collapse, BTC recovers)

Nov 2023 – Aug 2024 → Correlated (sideways digestion)

Aug 2024 – Now (Apr 2025) → Inverted again — and compressing fast

We're now in Period 6 — an Inverted Period — but all signs point to an upcoming Reversion.

📉 What Happens at Each Flip?

These transitions tend to occur when:

• TLT hits major channel support or resistance

• Macro fear or liquidity shocks drive trust shifts

• Smart money starts reallocating across asset classes

Right now, TLT is at channel support — a zone that has previously triggered reversions into correlated periods.

📌 What Comes Next:

According to the Bitcoin Trust Flow Cycles™ :

→ We are statistically due for a reversion** back into correlation

→ If TLT bounces from 76–71 zone… BTC may follow — not fight

→ The target remains: BTC breaking above 115 resistance

This flip — from inverse to correlated — has historically marked breakout windows for Bitcoin.

🔮 This Is Bigger Than a Halving

Plan B’s Stock-to-Flow gave us valuable insight into long-term valuation.

But it doesn’t explain timing.

This model isn’t about supply mechanics.

It’s about macro trust mechanics .

When institutional confidence leaves Treasuries…

And enters Bitcoin…

That’s the rotation we track.

That’s what moves the chart now.

🎯 Watchlist: • TLT support: 76 → 71 zone = reversal signal

• BTC breakout trigger: 115 resistance

• Cycle shift: Reversion = Bitcoin joining TLT upside

If this plays out, it could mark the most important trust cycle breakout we’ve seen since the COVID inversion.

Bitcoin doesn’t need permission anymore.

It just needs a macro trigger. And this model helps us spot it.

One Love,

The FXPROFESSOR 💙

📌 Missed the full credit market breakdown? Check my recent posts on BKLN, HYG, LQD, and TLT to understand the full Trust Flow rotation.

Market Update - This Stock Market Analysis Aligns With Bitcoin..What if I told you that the stock market’s pattern could actually reveal what’s coming next for Bitcoin—would you stick around and watch the entire video? That’s exactly what I’m diving into here. I didn’t force this analysis to fit; somehow, over the past week, it just lined up this way.

In this video, I break down exactly why the next market move could be more severe than anything we’ve seen in our lifetime—yet it’s not the end of the world. In fact, if approached correctly, this could be the opportunity of a lifetime. The rebound that follows could be massive.

I’ve always had a gut feeling about this, but now the patterns are speaking loud and clear. This is the reason I created AriasWave—and this is exactly where we are right now.

This also aligns with my latest Euro analysis linked below in related ideas.

The Charts Wall Street Watches – And Why Crypto Should Too📉 Crisis or Rotation? Understanding Bonds Before the Bitcoin Reveal 🔍

Hi everyone 👋

Before we dive into the next major Bitcoin post (the 'Bitcoin Reveal' is coming up, yes!), let's take a moment to unpack something critical most crypto traders overlook — the world of bonds .

Why does this matter? Because the bond market often signals risk... before crypto even reacts.

We're going to walk through 4 charts I've posted recently — not the usual BTC or altcoin setups, but key pieces of the credit puzzle . So here’s a simple breakdown:

1️⃣ BKLN – Leveraged Loans = Floating Risk 🟠

These are loans to risky companies with floating interest rates.

When rates go up and liquidity is flowing, these do well.

But when the economy weakens? They’re often the first to fall.

📌 Key level: $20.31

This level held in COVID (2020), the 2022 bank scare... and now again in 2025.

⚠️ Watch for a breakdown here = real credit stress.

Right now? Concerned, but no panic.

2️⃣ HYG – Junk Bonds = Risk Appetite Tracker 🔴

Junk bonds are fixed-rate debt from companies with poor credit.

They pay high interest — if they survive.

When HYG bounces, it means investors still want risk.

📌 Fear line: 75.72

Held in 2008, 2020 (COVID), and again now.

Price rebounded — suggesting risk appetite is trying to return .

3️⃣ LQD – Investment Grade = Quality Credit 💼

LQD holds bonds from blue-chip companies like Apple, Microsoft, Johnson & Johnson.

These are lower-risk and seen as safer during stress.

📊 Chart still shows an ascending structure since 2003, with recent pressure on support.

📌 Support: 103.81

Holding well. Rebound looks solid.

Unless we break 100, this says: "No panic here."

4️⃣ TLT – U.S. Treasuries = Trust in the Government 🇺🇸

This is the BIG one.

TLT = Long-term U.S. bonds (20+ yrs) = safe haven assets .

But since 2022, that trust has been visibly broken .

A key trendline going back to 2004 was lost — and is now resistance.

📉 Price is in a clear descending channel .

📌 My expectation: One final flush to $76 or even $71–68

…before a potential macro reversal toward $112–115

🔍 The Big Picture – What Are Bonds Telling Us?

| Chart | Risk Level | Signal |

|--------|------------|--------|

| BKLN | High | Credit stress rising, but support holding |

| HYG | High | Risk appetite bouncing at a key level |

| LQD | Medium | Rotation into quality, no panic |

| TLT | Low | Trust in Treasuries fading, support being tested |

If BKLN breaks $20...

If HYG fails to hold 75.72...

If LQD dips under 100...

If TLT falls to all-time lows...

That’s your crisis signal .

Until then — the system is still rotating, not collapsing.

So, Should We Panic? 🧠

Not yet.

But we’re watching closely.

Next: We add Bitcoin to the chart.

Because if the traditional system starts breaking... 🟧 Bitcoin is the alternative.

One Love,

The FXPROFESSOR 💙

📌 Next Post:

BTC vs Treasuries – The Inversion Nobody Saw Coming

Because if the system is shaking… Bitcoin is Plan B.

Stay ready.

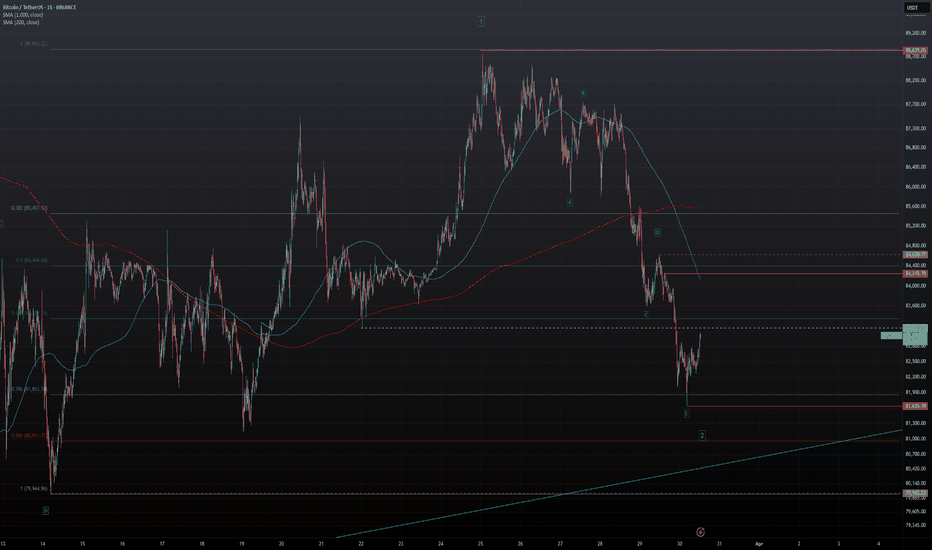

Where Can Bitcoin Go? $59K or $115K Test Incoming?Part 1:

Same chart. Same structure. New tension.

This is Part 7 of my ongoing series “Where Can Bitcoin Go?” — and this chart has been with us since the Dec 2020 breakout . Every level continues to hold weight, and now we’re back in a decision zone.

🧭 What’s In Play Right Now?

We just came off the second rejection from massive structural resistance — no surprise.

Now we hover just above support with two clear paths:

🟢 70% chance: BTC holds → heads to 115K (3rd test breakout)

🔴 30% chance: We dip to 59K — the historical support turned S/R zone

📌 Key support right now:

79,412

74,394

59,170 (Major ascending structural support)

📌 Resistance zones:

88–89K

111–115K (untouched 3rd test)

🧠 Keep Perspective

You can blame the move on Trump, tariffs, CPI, or altcoin noise…

But I say this every time:

Stick to the levels. Ignore the noise.

This same chart gave us:

✅ The 2020 breakout

✅ The 2021 blow-off tops

✅ The delayed breakout in Feb 2024

✅ Long re-entry at support

It’s all here — and it’s still working.

🕒 So... When?

If breakout comes: June–July is my watch window.

If not: Don’t panic — 60K is a valid support and part of the playbook .

My stance?

Still long. Always long BTC.

Short altcoins if you must.

But Bitcoin is still the king of this game — and structure still favors upside.

The third test might just be the breakout. Or it might be the trap.

Either way — the structure is the strategy.

One Love,

The FXPROFESSOR 💙

BTC | BEARISH Cycle Begins | $71KThere are a few tell signs that BTC has entered the bearish market.

If the price fails to maintain closing daily candles ABOVE the 70k area, there is a likelihood for a nasty Head and Shoulders pattern to form.

A key point to watch are the Bollinger Bands, which gives you an indication of the next possible zone to watch.

_____________________

BINANCE:BTCUSDT

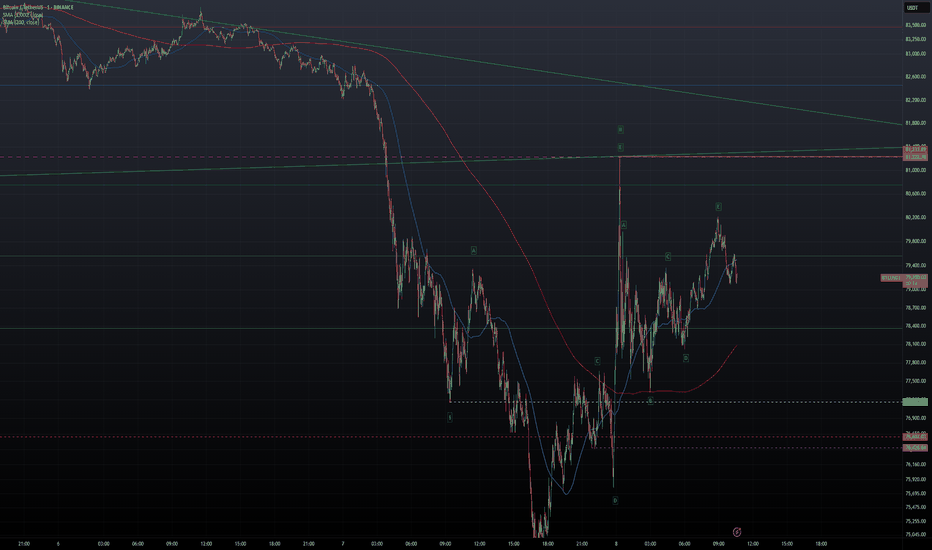

BITCOIN - Short Trade Idea Update - Wave ii Looks Complete...In this video, I break down what I woke up to this morning regarding the wave structure.

With wave ii appearing to be complete, I’m looking to add to my short position and adjust my stop level down to 81,223—creating another potential entry point for the short trade.

Recognizing and understanding these developing patterns is essential if you want to stay in the game.

BITCOIN - Price Could Be Heading Towards 60K...After multiple rejections at higher price levels, the most recent major rejection—followed by a break of the lows—suggests that the corrective move we've seen since the end of February may have concluded.

In this video, I outline the key reasons why a larger upside move no longer appears likely.

With the potential end of the corrective wave combinations now in sight, I'm shifting to a bearish outlook, targeting a potential move down to $61K. To validate this view, we need to see a break below $81,222, confirming the start of a deeper breakdown.

As it stands, I can no longer support a short-term bullish scenario unless we see a strong break above $84,715. However, given the recent sharp move to the downside, this seems unlikely and may, in fact, mark the beginning of a larger downward trend.

The market is shaking. But what is Bitcoin doing?Despite today's market turmoil, the crypto world remains somewhat calm with some minor drops across the major cryptocurrencies. At the time of analysis, CRYPTO:BTCUSD is moving slightly lower, but as if it is a regular day for it.

Let's dig in!

MARKETSCOM:BITCOIN

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

BITCOIN - Long Trade Price Action Update...In this video, I break down the latest price action while incorporating some AriasWave analysis along the way.

There's nothing unusual happening—just psychological reactions testing your patience.

Welcome to the world of trading lol, where you can be riding high one moment and facing losses the next, shifting between excitement and frustration.

Today, I dive into the psychology of trading—what drives a trader’s mindset, the balance between logic and mental discipline, and how mastering both can help grow your bank account. Everything begins in the mind, whether it’s knowledge or habit.

I remain bullish, and while the external picture hasn’t changed much, what about your internal one?

BITCOIN - Long Trade Update - Third-of-a-Third Wave Incoming...In this video, I share an update on the developments I've observed since yesterday as we prepare for a move higher in a third-of-a-third wave.

As price movements become smaller and sharper at lower degrees, identifying the correct count becomes more challenging.

That’s why I always consider bearish alternatives and play devil’s advocate. However, at the moment, I don’t see any conflicting signals, so it’s just a matter of waiting for the next upward thrust to begin from here.

Bearish Trend Meets Bullish Momentum: Is BTC Ready for a Rebound📉 Bitcoin is currently in a strong bearish trend on higher timeframes, but 📈 the 1-hour timeframe shows a break of structure and bullish momentum. This suggests a potential short-term pullback into the previous range, aligning with the 50% Fibonacci retracement level. 🔄 Additionally, there’s a bearish imbalance above that could be rebalanced. While this presents a possible buy opportunity, ⚠️ it’s a high-risk setup due to the overall bearish trend. Always trade with caution! 🚨

Disclaimer

⚠️ This is not financial advice. Trading involves significant risk, and you should only trade with funds you can afford to lose. Always do your own research and consult a professional if needed. 💡

BITCOIN - Long Trade Idea Update - We Could See One More Low...In this video, I discuss why Bitcoin may still make another low before the Wave 2 correction is fully complete.

Upon closer examination of Wave iv in the previous Wave 5 correction, it appears the level where Wave iv ended was slightly miscalculated.

Technically, Bitcoin should have dipped below the perceived low, but either its strength has prevented this, or the ongoing correction is nearing completion.

The key level to watch is $82,445—if Bitcoin breaks above this, we should continue higher.

However, it’s more likely that we first dip below $81,274 before experiencing a strong upward move.

Pay close attention when Bitcoin makes another low, as the reversal could be sharp, potentially piercing through $82,445, which would confirm the trend shift.

If we make a new low then I would suggest price would turn back up after tagging $81,071.

BITCOIN - Wave 3 of Wave C In Progress - Wave 2 Breakdown...In this video, I break down why I posted the earlier chart (linked below).

After studying this pattern for hours, I finally decoded the Wave 2 correction for Wave C—just in time to take a long trade at support.

A solid protective stop is around $81,274, while a break above $82,759 offers partial confirmation.

The key confirmation level, however, is $88,788. Since that’s still quite far, AriasWave allows for early entries if the analysis proves accurate. Given the large 1-2 formation, I anticipate price moving close to all-time highs, but I’ll keep you updated along the way.

BITCOIN - Key Levels To Watch If You Expect A Bounce...Due to the lack of sustained downward momentum overnight and the overall weak move, I have relabeled the decline from $88,839 as a sharp correction, potentially marking the end of Wave 2 in a Wave E corrective bounce.

Wave 1 appears to be a Type-2 Weak 5-Wave move that began at $79,962.

To confirm this bounce, we need a break above $84,630, with a protective stop set at the last low, currently $81,635, aligning with the 0.786 retracement level.

BITCOIN - Small Long Trade Within Wave iii Zig-Zag...In this video, I break down a straightforward long trade based on an internal corrective zig-zag pattern.

This setup demonstrates how to capitalize on short-term trades with a solid risk-reward ratio, securing profits before looking for a re-entry opportunity.

The trade aligns with the anticipation of Bitcoin approaching its recent highs, potentially forming a double top. Currently, the trade has a protective stop at $83,169 and a target of $89,176.