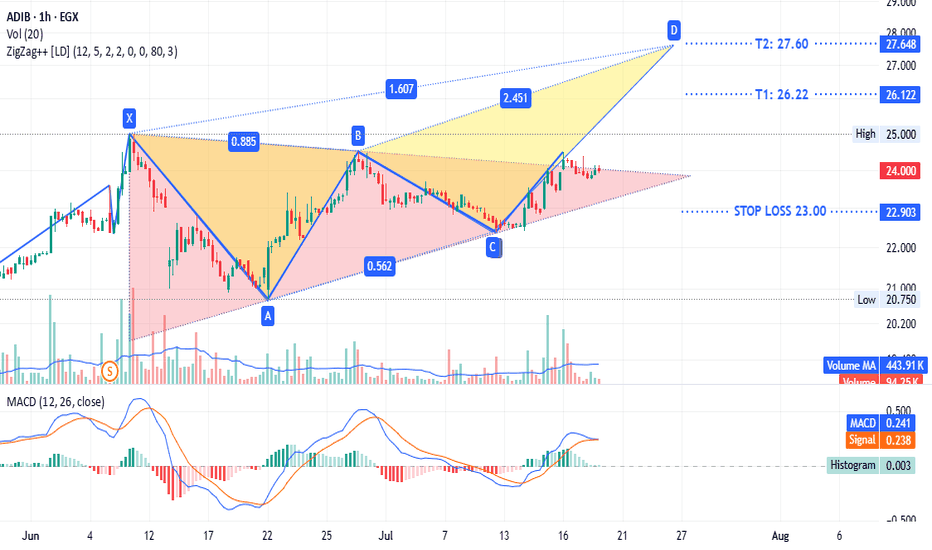

ADIB - same $comi patternADX:ADIB timeframe 1 hour

Is showing a triangle pattern with a potential bearish trend. It is currently testing the upper line of the triangle. The stop loss is at 23.00, and the target sell point ranges from 26.22 to 27.60.

This is not investment advice, only my analysis based on the chart data. Consult your account manager before making any investment decisions. Good luck.

Butterfly

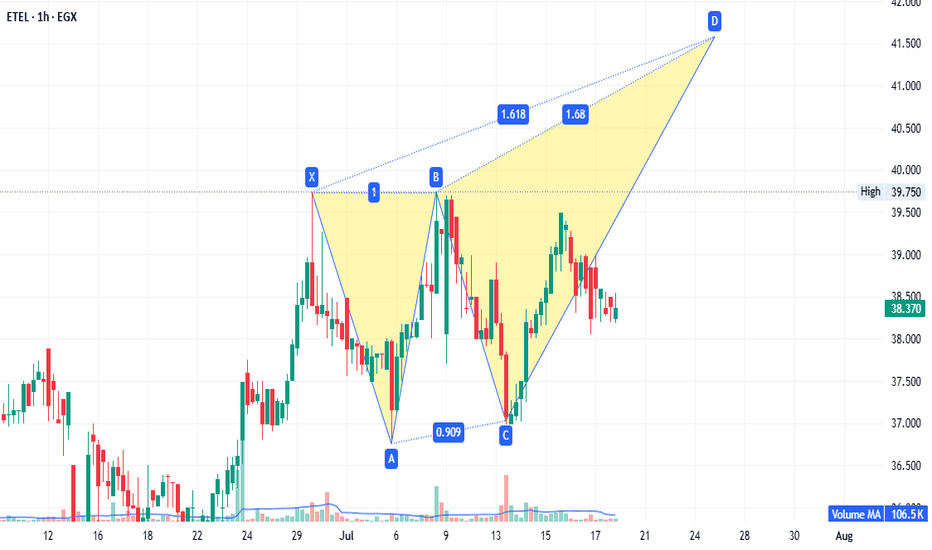

ETEL - strong fundamentals.EGX:ETEL 1-hour timeframe:

A potential bearish Gartley pattern targets 41.50. If prices reach 41.55 (without breaking 37.00), it becomes a sell point with targets at 39.73 and 38.60. Conversely, if prices continue rising and close above 42.70, rebuy what was sold at 41.50, targeting 52.00. This setup is both strategic and supported by strong fundamentals.

Disclaimer: This is not financial advice, only our analysis based on chart data. Consult your account manager before investing.

GOLD SHORT TRADEAronnoFX will not accept any liability for loss or damage as a result of

reliance on the information contained within this channel including

data, quotes, charts and buy/sell signals.

If you like this idea, do not forget to support with a like and follow.

Traders, if you like this idea or have your own opinion, please feel free command me.

TRG LongTRG has made a perfect bullish harmonic pattern where it has retraced to exact 127.2% of its last top and now will move till 161.8% of its all-time high which is nearly 295. This is not a buy/sell call, its just my own analysis and you may disagree. However, I'd urge you to study bullish and bearish harmonic patterns which are not so common in Pakistani market but some international players often run a stock through this pattern. Similar patterns can be noticed in GHNI and GAL as well.

EURUSD ||| '' W '' PATTERN IDENTIFIED . ✅ Harmonic Formation (Bearish Potential)

⚠️ Selling Bias forming soon

---

🧩 Pattern Breakdown:

A Bearish Harmonic Pattern (likely Butterfly or Deep Crab) has been identified and is now nearing completion at the D point.

Current price is approaching key resistance / reversal zone, precisely around the 0.786 - 0.886 fib area (highlighted red).

The Risk-to-Reward is clearly mapped:

🔺 Stop Loss: 1.19405

✅ Entry Zone: Around 1.17106

🎯 Target: 1.09588

Potential short setup if price respects the harmonic symmetry and fails to break above resistance.

GBPAUD BearishUpon examining the daily chart for GBPAUD, the outlook appears to be bearish, bolstered by the presence of bearish butterfly harmonics that affirm this trend. As I assess the market conditions for the coming week, I am contemplating entering a short position.

For this trade, I am setting my take-profit levels as follows:

- TP1 at 2.06

- TP2 at 2.05

- TP3 at 2.03

To manage risk, I will place my stop-loss at 2.11. This strategy aims to capitalize on the anticipated downward movement while safeguarding against potential reversals.

EUR/USD Weekly Outlook | Harmonic Butterfly PatternHere is a professional TradingView publish description for your EUR/USD Weekly Butterfly Pattern Analysis:

---

🦋 EUR/USD Weekly Outlook | Harmonic Butterfly Pattern

Pair: EUR/USD

Timeframe: 1W (Weekly)

Strategy: Harmonic Pattern Recognition – Butterfly Pattern

Bias: Bearish Reversal Setup

---

🔍 Pattern Analysis:

Butterfly Harmonic Pattern completed with precision at the 1.272–1.414 extension zone, forming the critical D-point near 1.14700.

Price has reacted sharply from the PRZ (Potential Reversal Zone), aligning with a historical supply zone.

Confluence from Fibonacci extensions:

AB = 0.786 retracement

BC = 0.382 to 0.886 retracement

CD = 1.618 to 2.618 extension

📉 Bearish rejection expected from this high-probability reversal zone.

---

📌 Key Levels:

PRZ (Potential Reversal Zone): 1.14500 – 1.15000

First Target Zone (Support Block): 1.11500 – 1.10500

Invalidation (Pattern Failure): Close above 1.15500

---

📅 Projection: This weekly harmonic butterfly suggests a potential trend reversal or deep pullback. We may see EUR/USD targeting lower support as D-point gets respected. Watch for signs of weakness such as long-wick rejections, bearish engulfing patterns, or RSI divergence confirmation.

---

💡 Conclusion: EUR/USD is at a critical juncture. If the butterfly holds, this could be a high RR short opportunity for swing traders. Patience is key—confirmation on lower timeframes will validate entry.

---

📊 #EURUSD #ButterflyPattern #HarmonicTrading #ForexAnalysis #TechnicalAnalysis #SwingTradeSetup

Analysis of GBP/USD PriceThe possibility of the GBP/USD exchange rate dropping from the 1.36 USD level has been highlighted, based on the harmonic Butterfly pattern.

This analysis points towards potential movement towards predetermined target levels.

Keep an eye on these developments if you're following the currency market closely, as patterns like this can provide valuable insights for decision-making.

Technical Analysis for NIL/USDT (1H Chart)The NIL/USDT pair is currently trading at $0.4662, showing signs of bullish momentum with a +4.06% gain in the latest hourly session.

A confirmed breakout above this previous high (HH) would signal a potential bullish continuation, targeting the next resistance around $0.5602. RSI is trending upwards, currently at 45.89, suggesting building momentum.

If the price fails to break the HH level, it may continue to range within the current structure

Understanding the Recent Rise and Preparing for a Potential Dip.In our previous analysis, we highlighted the initial stock decline of Netflix driven by concerns surrounding potential tariffs and anticipated a deeper correction.

However, investor greed ("The Greed Butterfly") took flight, pushing the stock upwards.

While this surge might seem positive, it's important to understand the market dynamics at play. This rapid ascent, fueled by speculative buying and the fear of missing out (FOMO), is likely unsustainable. Like a butterfly that has exhausted its energy, the stock needs a significant period of consolidation and rest.

This suggests that a deeper correction than initially anticipated is still possible. The "Greed Butterfly" needs to land and allow fundamentals to catch up.

SEYED.

LONG XAUUSDGold (XAU/USD) – Bullish Outlook Backed by Harmonic Structure and Market Fundamentals

We are currently anticipating a bullish continuation in XAU/USD, supported by a combination of technical signals and macroeconomic drivers.

On the technical side, the recent completion of a Bullish Butterfly Harmonic pattern suggests a potential reversal zone (PRZ) has been confirmed, indicating strong buying interest at the 3195 level. The symmetry within the XA, AB, BC, and CD legs of the harmonic structure aligns well with Fibonacci ratios, reinforcing the credibility of this bullish signal.

Additional confluence is found with:

Strong horizontal support near 3195

Positive divergence on momentum indicators (e.g., RSI )

Price action respecting the 50 EMA as dynamic support

On the fundamental front, growing market uncertainty, dovish expectations around global central bank policy, and sustained geopolitical tensions are likely to keep gold attractive as a safe-haven asset. Moreover, persistent inflation concerns and weaker global growth forecasts continue to support the upside potential for precious metals.

Trade Setup:

Entry: 3195

Take Profit 1: 3225

Take Profit 2: 3245

Stop Loss (Recommended): 3180

Risk Management Note: Proper risk-reward ratio and position sizing are advised, considering increased volatility due to upcoming economic releases and geopolitical developments.

Short on BTCUSDBitcoin (BTC/USD) – Bearish Outlook Amid Economic Uncertainty

We anticipate a short-term bearish trend for BTC/USD, driven by escalating economic concerns and the recent resurgence of trade tensions. The imposition of new tariffs has negatively impacted market sentiment, contributing to downward pressure on Bitcoin. The current price structure also suggests limited bullish momentum, favoring another potential sell-off.

From a technical perspective, forming a Bearish Butterfly Harmonic pattern further supports the expectation of a downward move.

Trade Setup:

Entry Level: 84,500

Take Profit 1: 78,500

Take Profit 2: 74,500

We recommend monitoring macroeconomic developments closely, as further deterioration could accelerate the bearish trend.

PHGC - Egyptian stock#PHGC timeframe 1 DAY

Created a bearish Gartley pattern

Sell point around 1.48 ( PRICE NOW 1.50 )

Stop loss / reentry 1.574 (estimated loss -6.35%)

First target at 1.267 (estimated profit 14.40%)

Second target 1.077 (estimated profit up to 27.63%)

NOTE: this data according to timeframe 1 DAY.

It's not an advice for investing, only my vision according to the data on chart.

Please consult your account manager before investing.

Thanks and good luck.

Fiery Butterfly of Natural Gas Price in 2025. In the previous analysis, we predicted the natural gas price trends from 2022 to the end of 2024 using harmonic patterns, which turned out to be highly profitable .

Now, in this idea, we aim to forecast the price movement for 2025 Based on the harmonic patterns, it seems likely that gas prices will rise and reach the golden level of the Butterfly pattern before experiencing a significant drop.

[Update ETH]: $1350-->$7000-->$800?I think we may go to retest the 0.75 level by the end of May, then blow off top very fast in Q4 to high 6000/low 7000. Then I think we gonna go slowly down <1000 until the end of this decade.

Mini bear market-> Fed will panic-pivot end of Q2 -> Final Blowoff top Q3/Q4-> Mega Recession

Effort of the Young Green Butterfly to Raise the Siemens Flagthe detail is shown in the above Chart.

I made this Idea based on Candlestick Analysis and Fibonacci Tool .

The Buyers' Crab could reach the highest point at the price of 167 euros.

The Bearish trend started and siemens flag is falling and approaching to the golden level of buyers crab .

The past trend of sellers' candles has formed a motivated green butterfly pattern

So we can expect this young Butterfly to raise the Siemens flag again.

Siemens Is Great .

Good luck.