Candlestick Analysis

USDCAD: Is That a Trap?! 🇺🇸🇨🇦

USDCAD may retrace from a key daily resistance.

I see a highly probable bullish trap on intraday time frames.

The pair may drop to 1.3835 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EU sale inside of monthly consolidation, stick to short swingsThe internal range movements are the best return right now. Trying to target long runs in this internal range liquidity is very difficult right now.

Until we close outside the mother range (highlighted) on the monthly candles, it will continue to have this struggle as none of the larger traders are willing to risk huge in this range.

That will never stop us from trading 1-4H internal range orderblocks for small wins. As we see now the daily is giving good amount of days in each direction. 2026 already locked-in. It's easy 🙏🏾

USD/JPY(20260109)Today's AnalysisMarket News:

On Tuesday, both the Dow Jones Industrial Average and the Dow Jones Transportation Average hit record closing highs, marking the first buy signal from Dow Theory in over a year.

Technical strategists believe this confirms the bull market that began in late 2022 remains firmly established, even as some previously high-performing AI-related stocks have recently faced pressure.

The Dow Jones Industrial Average's last record closing high was on January 5th, while the Dow Jones Transportation Average's record high was even further back. Dow Jones market data shows that the index's last record closing high was on November 25th, 2024.

Technical Analysis:

Today's Buy/Sell Threshold:

156.79

Support and Resistance Levels:

157.40

157.17

157.02

156.55

156.41

156.18

Trading Strategy:

If the price breaks above 157.02, consider buying with a first target price of 157.1.

If the price breaks below 156.79, consider selling with a first target price of 156.55.

Demand drawing price down before reversal longWith the early December FVG filled and traded through, the Demand zone at the base of that price leg is now acting as a magnet drawing price deeper in discount pricing. Price will either continue dropping impulsively before reversing as shown in blue, or retrace back up to pick up more liquidity before reaching the demand zone and ultimately reversing as shown in purple...assuming market makers intend to continue long-term bullish market conditions.

NZDJPY: Bullish After Trap 🇳🇿🇯🇵

NZDJPY will likely bounce after a false violation

of the underlined intraday horizontal support.

Expect a pullback to 90.33 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Nifty Analysis EOD – January 8, 2026 – Thursday🟢 Nifty Analysis EOD – January 8, 2026 – Thursday 🔴

Bears Rampage: 12-Session Gains Liquidated as Nifty Crashes 260 Points.

🗞 Nifty Summary

The Nifty opened with a 45-point Gap Down, and despite an initial attempt to fill the gap, the bearish intent was undeniable. Within minutes, the index breached 26,070 and the PDL, triggering a sustained cascade.

Bears confidently drove the index through the 25,930 ~ 25,920 zone, eventually testing the 25,890 support. After a three-hour period of sideways consolidation (12 PM – 3 PM), a final wave of selling broke the 25,890 floor to test the next support at 25,860.

Nifty concluded the session at 25,868.90, just 10 points above the day’s low. This massive 275-point expansion effectively wiped out 19 days (12 sessions) of accumulation, bringing the market back to its December 19th starting point.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The day was a masterclass in trend expansion. With the Gladiator range at 175.66 and the actual range hitting 275 points, the market moved into a clear “Imbalance” state.

The failed early gap-fill was the first warning; once the PDL and IB broke in unison at 10:10 AM, the floodgates opened. The three-hour pause between 12 PM and 3 PM acted merely as a distribution phase before the final breakdown to 25,860.

Sellers were in absolute control from start to finish, with almost no meaningful retracements.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 26,106.50

High: 26,133.20

Low: 25,858.45

Close: 25,876.85

Change: −263.90 (−1.01%)

🏗️ Structure Breakdown

Type: Strong Bearish Candle (Full Body).

Range (High–Low): ≈ 275 points → High intraday volatility/Expansion.

Body: ≈ 230 points → Reflects aggressive selling pressure and panic.

Upper Wick: ≈ 27 points → Failed early buying attempt near the open.

Lower Wick: ≈ 18 points → Almost no demand or absorption near the lows.

📚 Interpretation

This is a high-conviction Bearish Marubozu-Style candle. Closing near the absolute low of a 275-point range indicates strong distribution. By closing below the December 19th lows, the market has invalidated the entire holiday rally. The lack of a lower wick suggests that the sell-off was not a “stop-run” but actual portfolio liquidations.

🕯 Candle Type

Bearish Breakdown Candle — Signals powerful bearish momentum; continuation is likely unless a significant “V-shape” reversal occurs at the major 25,840 support.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 175.66

IB Range: 83.35 → Medium

Market Structure: ImBalanced

Trade Highlights:

09:29 Short Trade: SL Hit (Early Volatility)

10:10 Short Trade: Target Hit (1:4.45) (PDL + IB Breakout)

Trade Summary: After an initial stop-loss during the volatile opening minutes, the strategy performed exceptionally well. The 10:10 AM signal provided a high-conviction entry at the confluence of the PDL and IBL. The sustained trend allowed for a massive 1:4.45 R:R win, capturing the meat of the 230-point body move.

🧱 Support & Resistance Levels

Resistance Zones:

25985

26030

26070

26104

Support Zones:

25860 ~ 25840 (Current Critical Support)

25800 (Psychological)

25740 ~ 25715 (Ultimate Support Zone)

🧠 Final Thoughts

“We are back to square one.”

The market is at a massive crossroads at the 25,840 ~ 25,860 support zone. After such a violent fall, we must prepare for two scenarios:

A ‘Dead Cat Bounce’ toward the 25,985 zone which will likely be sold into.

A bearish continuation that tests the ultimate support zone of 25,740 ~ 25,715.

I will strictly wait for the Initial Balance (IB) to form tomorrow before approaching the market, as today’s momentum might lead to a volatile opening gap.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

US 100 Index – Facing the Test of Non-Farm Payrolls While the US 100 has made a solid start to 2026, registering a 1% gain in its first 5 days of trading, it has yet to surpass its previous record high of 26277 hit on October 30th. This contrasts with the US 500 and US 30 which both hit new peaks on Tuesday, January 6th, with both popular indices seeming to have benefitted from a broadening of the rally away from AI into other sectors of the economy.

Whether this trend continues into the weekend and early next week could now depend on the outcome of tomorrow’s US Non-farm payrolls release which may help traders determine not only the current health of the labour market and US economy, but more importantly, impact their expectations for the next series of Federal Reserve interest rate decisions.

A stronger than expected payrolls release, while good news for the economy, could weigh on technology stocks in the US 100, as it could imply the Fed may delay further rate cuts until later in 2026, while a weaker than expected number could mean the opposite.

In this regard, the price action post the payrolls release may well be crucial tomorrow. Early moves at the start of a new year can often be wrong, as traders rush to deploy new capital before the wider market gets to assess the macro-outlook. Currently, market expectations are for 2 further interest rate cuts from the Federal Reserve in 2026, which contrasts with Fed policymakers which only see 1. Tomorrow’s data could help clarify which is more likely with a potential knock-on impact for the direction of the US 100.

Technical Update: Decision Making Process Dominates Start of 2026

After the sharp 9.30% drop in the US 100 index from the October 30th high at 26277 to the November 21st low of 23834, the market has mostly moved sideways. These two levels have continued to hold prices in place, indicating a more balanced trading assessment for the past two and a half months.

As the chart above shows, the US 100 index has been making lower highs and higher lows in price since the October/November decline. This means sellers are willing to sell at slightly lower levels each time, while buyers are stepping in sooner on each dip. When prices start to converge like this, it forms what technical analysts call a “Symmetrical Triangle.”

Some traders might say this type of pattern usually continues the previous trend, which for the US 100 index was upward. However, trying to guess the direction of a breakout in advance can be risky. With this kind of pattern in place, it can be a safer option to wait for the price to move above the previous high or below the previous low to determine which directional bias may be emerging.

Potential Resistance Levels:

The most recent high that price strength failed at was 25844, which was set on December 10th. This potentially is the first key resistance level to watch in upcoming sessions. While prices stay below 25844, the triangle pattern can continue. However, if the market were to close above 25844, it could lead to a further phase of price strength.

If the market starts to show potential for further upside, a close above 25844 could shift traders’ attention to the next resistance at 26277, which is the high from October 30th, possibly further if this level in turn is breached.

Potential Support Levels:

The most recent low in this possible triangular pattern is 25063, which was set on January 2nd. This is the level where buyers last stepped in, so it could be a key support area inside the Symmetrical Triangle. While prices stay above 25063, it can be suggested that the support remains in place.

However, if prices were to close below 25063, it could be a sign that downside pressure is building, with the next level to watch being 24644, the low from December 17th. If the US 100 were then to close below 24644 as well, it could point to an even deeper move down toward 23834, which is the low from November 21st.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

SILVER (XAG/USD): Pullback From Resistance📉SILVER is showing a bearish tendencies following its recent test of a significant daily resistance cluster, which is based on its all-time high.

Analyzing 4H time frame a head and shoulders pattern further confirms a local

bearish sentiment and indicates an overbought market condition.

It is possible that the price may continue to retrace, potentially reaching at least the 74.00 level.

Tokyo One-Hour Trap Resolution

One-Hour Timeframe Summary

On the one-hour timeframe, price is currently contained within a clearly defined trap zone formed by a swing high and a swing low. These boundaries represent the bullish and bearish zones that price must resolve to establish direction.

One-Hour Chart Highlights

• Swing high identified as the bullish boundary

• Swing low identified as the bearish boundary

• Price actively trading within the one-hour trap zone

One-Hour Trade Logic

• A confirmed close above the swing high triggers a buy opportunity targeting 10 basis points, while a confirmed close below the swing low triggers a sell opportunity targeting 10 basis points.

SPY Bull Trend Pauses at the Highs — Structure Still IntactSPY made it into new highs today but was not able to hold that level into the close. Not really a surprise considering that volume was below average and that volume overall has been heavily tilted towards selling since mid December.

Price range is still tightening and we keep working off the supply of shares for sale, while continuing to attempt to break through that 690 level.

I'm still bullish as usual. If todays candle had closed with high volume I'd be much more concerned, but considering that volume was relatively low, there's no reason to think that we don't just need more time to get SPY trending up again.

HCL Technologies Ltd | Fibonacci Reversal Aiming HigherHCL Technologies Ltd has shown a strong reversal from the 0.5 Fibonacci retracement level, indicating a healthy pullback within an ongoing trend. The stock is now resuming its upward move and is heading toward a key supply zone between 1696–1721.

This zone will act as an important hurdle. A decisive close above the supply zone with strong volume would confirm strength and signal the start of a fresh upward momentum phase. Such a breakout could open the path toward 1894, offering around 10% upside from current levels.

Outlook:

– Immediate focus on 1696–1721 supply zone

– Breakout and sustained close above this zone may trigger further upside toward 1894

Risk Management:

Failure to hold above the 0.5 Fibonacci level would weaken the bullish structure.

Disclaimer: This idea is for educational purposes only. Please manage risk accordingly.

CRUDE OIL (WTI): Bullish Movement Confirmed

WTI Crude Oil will likely continue rising

after a liquidity grab below the underlined horizontal support.

A consequent cup & handle pattern formation provides a strong

bullish confirmation.

Goal will be 57.41

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Nifty Analysis EOD – January 7, 2026 – Wednesday🟢 Nifty Analysis EOD – January 7, 2026 – Wednesday 🔴

The 26070 Rescue: Long-Lower-Wick Doji Signals Buyer Resilience.

🗞 Nifty Summary

The Nifty started the session with a 15-point Gap Down and faced immediate pressure, slipping a further 60 points to test the 26104 support level. After marking an initial low at 26,096.65, a sharp 90-point recovery attempt tested the PDC.

However, the index was unable to sustain above the PDC or IBH, facing a secondary rejection that pushed prices below the PDH and the 26104 level. A deeper test of the 26070 support zone followed, marking a new day low at 26,067.90.

In a showing of late-session strength, buyers stepped in aggressively, facilitating a 75-point recovery from the lows to close at 26,140.75 (-0.14%).

The resulting “Doji” structure confirms a state of equilibrium and intense base-building near the 26,100 territory.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The session was characterized by a triple-move sequence. First, an early breakdown that found a temporary floor at 26104. Second, a “bull trap” recovery that failed to hold above the PDC/IBH, leading to a capitulation toward the 26070 zone. Third, a high-conviction recovery in the final hour.

The rejection from the PDC highlights that overhead supply is still capping immediate upside, but the massive lower wick proves that institutional buyers are protecting the 26070 ~ 26100 band with significant volume.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 26,143.10

High: 26,187.15

Low: 26,067.90

Close: 26,140.75

Change: −37.95 (−0.14%)

🏗️ Structure Breakdown

Type: Indecision candle (Doji)

Range (High–Low): ≈ 119 points — moderate intraday volatility.

Body: ≈ 2.35 points — almost zero net change between open and close, signaling total balance.

Upper Wick: ≈ 44 points — sellers rejecting prices near the 26,187 resistance.

Lower Wick: ≈ 73 points — Strong defense by buyers at the 26,068 level.

📚 Interpretation

The candle is a portrait of a classic market tug-of-war. The long lower wick is the dominant feature, showing that every attempt to crash the market below 26,100 was met with aggressive absorbing demand. However, the upper wick and the flat close suggest that bulls lack the momentum to initiate a trending move. This structure often precedes a base formation, indicating that the 26,070 level is currently the “floor” for the short-term trend.

🕯 Candle Type

Doji / Long-Lower-Wick Indecision Candle — Signals a potential pause and base formation at support; the breakout from today’s High/Low will determine the direction of the upcoming expiry.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 163.81

IB Range: 69.35 → Medium

Market Structure: Balanced

Trade Highlights:

11:54 Short Trade: Target Hit (1:1.48) (PDL Breakout)

Trade Summary: Strategy capitalised on the breakdown of the PDL during the second leg of the day’s decline. Although the market recovered later, the system’s focus on the structural breakdown below 26,104 provided a high-probability scalp before the lower-wick defence started.

🧱 Support & Resistance Levels

Resistance Zones:

26155

26220 ~ 26235 (Major Hurdle)

26275

Support Zones:

26104

26070 (Immediate Floor)

26030

25985

🧠 Final Thoughts

“The 26,070 line has been drawn in the sand.”

The market is in a state of high-tension equilibrium. The successful defense of 26,070 keeps the bullish hopes alive, but the inability to reclaim the PDC is a warning.

For the upcoming session: if Nifty sustains above 26,155, we target the 26,220 zone. However, if the 26,067 low is breached on a closing basis, the index will likely head toward the 26,030 and 25,985 zones rapidly.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Gold - Geopolitical and Economic Uncertainty Keeping Volatility n times of crisis, geo-political instability or economic uncertainty Gold is often a popular choice for investors as a safe haven portfolio hedge, and just 6 days into the new year there are already a lot of these types of events for traders to monitor and digest.

In terms of geo-political drivers, the list could include the weekend capture by US special forces of Venezuela’s President Maduro on drug charges, recent aggressive Chinese military drills around Taiwan, simmering tensions between two oil producing powerhouses, Saudi Arabia and the UAE over Yemen, as well as the on-going peace talks between the US, Russia and Ukraine that have yet to yield tangible results.

This all could have been a significant reason explaining yesterday’s 2.6% rally in Gold from opening levels around 4354 up to a high of 4456. However, remember that a slight change in any of these situations could have a knock-on impact for Gold price volatility.

When looking at economic uncertainty, it’s a big week ahead for tier 1 US economic data, with 4 updates on the current health of the US labour market in the form of ADP private sector payrolls (Wednesday 1315 GMT), JOLTs job openings (Wednesday 1500 GMT), weekly jobless claims (Thursday 1330 GMT), and then the all-important Non-farm payrolls on Friday at 1330 GMT.

The payrolls release includes the unemployment rate, which currently sits at 4.6%, and traders may be looking at where this number moves next as being crucial for Fed policymakers when deciding on their next interest rate move. As a rule, lower interest rates can help support precious metals, which are a non-interest-bearing asset, so the impact of these labour market updates on market expectations for Fed interest rate moves could have a big influence over Gold prices into the weekend.

If all this wasn’t enough, Gold traders also need to consider the potential of more volatility in precious metals markets when commodity indices are rebalanced, a process which starts on January 8th and can take as long as 2 weeks to complete.

Against this backdrop being appraised of the technical trends as well as the important support and resistance levels to monitor could be useful for future trade preparation and planning.

Gold Technical Update: Does the Recent Uptrend Remain in Force?

As Gold moved into the New Year period, it slipped into a correction of more than 6%, unwinding part of the rally seen previously. This pullback naturally raises the question of whether it marks the start of a deeper phase of weakness, or, as predominantly seen through 2025, it is another brief dip before fresh upside momentum re‑emerges.

Looking forward to gauge where the next directional moves may materialise, traders may find it helpful to focus on identifying credible support and resistance levels.

Potential Resistance Levels:

Interestingly, the pre‑New Year pullback began just as prices approached a key resistance area at 4565, which aligns with the 38.2% Fibonacci extension. Given that selling interest has already emerged from this level once, any future upside shift in prices may now require a closing break above 4565.

If Gold prices can break and close above 4565, it could signal potential for the broader uptrend seen throughout last year to extend further. In that scenario, attention might shift toward 4683, which is the higher 61.8% extension level, as the next possible resistance.

Potential Support Levels:

While the 4565 level continues to cap attempts at price strength the risk remains for selling pressure to re‑emerge. This could lead to a retest of 4294, the 38.2% Fibonacci retracement support level that held on a closing basis last week. A more extended decline might now require closes below 4294 to suggest that further downside momentum is possible.

If confirmed on a closing basis, breaks below 4294 could signal scope for a deeper decline, initially toward 4217, the 50% Fibonacci retracement, and possibly further to 4139, which is the deeper 61.8% level.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

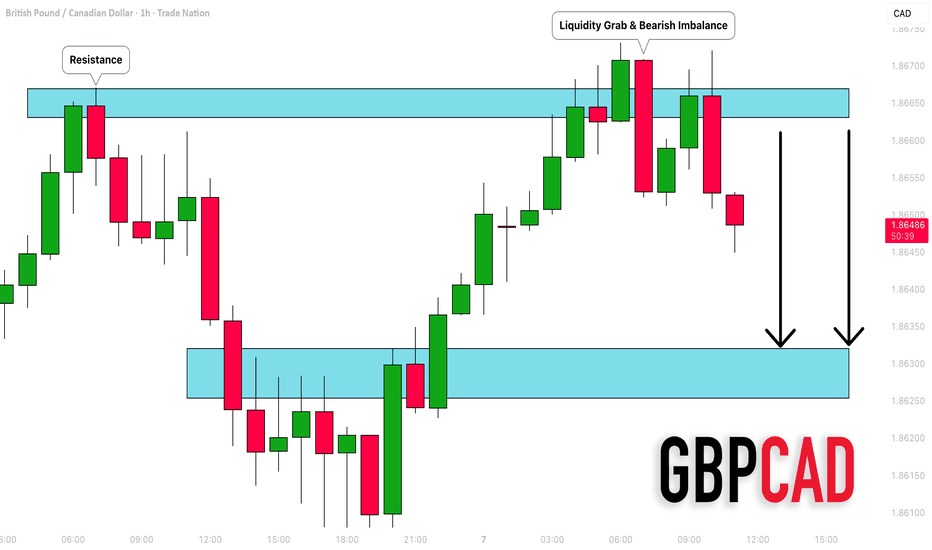

GBPCAD: Bearish Move After a Trap 🇬🇧🇨🇦

I took a short position on GBPCAD this morning

after the price made a false violation of the underlined resistance

and dropped, forming a selling imbalance candle.

I expect that the pair will drop more and reach 1.86323 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BITCOIN B T C U S D Bitcoin giving us an opportunity to the upside and shows that we will have a strong upside push as according to it’s structure and price plus candle stick anatomy , buy stop can be used and target tp is (94 7+)

However any profit made should be protected and trialed , stay tuned for more information and follow for me updates on

( Bitcoin / Gold / Eurjpy )

Gold BuyWe ended bullish yesterday ending a three day bullish momentum.

Expectation is for a bullish continuation.

Price dropped through Asia lows and yesterday NY lows to react at yesterday’s London exhaustion / lows, which was the S1 level.

Bullish rejection followed by a second bullish candle was the confirmation above the 50% low ADR.

Taking a 1:2 RR