BTCUSD Daily Timeframe Analysis (03.02.26)There exists :

- Fair Value Gap on the daily,

- Previous Days high and low, and

- Weekly to daily fair value gap range below price.

Price is has taken out the previous days low, tapped into the upper half of the weekly - daily fair value gap range, and rejected

There is still an open range of the fair value gap from the weekly timeframe transposed to the daily.

Daily Timeframe analysis

Candlestick Analysis

Balkrishna Industries Ltd (NSE) — Positional Long Setup | 1DPrice: ₹2,571

Timeframe: Daily

Trend Type: Medium-term bullish reversal / retracement continuation

🔍 Technical Overview

Balkrishna Industries has completed a major corrective phase and is now trading within a well-defined Fibonacci retracement zone, indicating accumulation after a prolonged downtrend.

Key observations:

Price has respected the 0.5–0.618 Fibonacci retracement support zone (₹2,405–₹2,535), suggesting strong demand.

Formation of higher lows indicates gradual trend reversal.

RSI is turning upward from lower levels, signaling improving momentum.

Volume expansion near the base supports accumulation behavior.

📐 Key Levels (Fibonacci Based)

Strong Support Zone: ₹2,405 – ₹2,535 (0.5–0.618 retracement)

Immediate Resistance: ₹2,745

Target 1: ₹2,956 (-0.382 Fib extension)

Target 2: ₹3,081 (-0.618 Fib extension)

Extended Target: ₹3,375 (previous supply / range high)

🎯 Trade Plan (Positional)

Entry:

Buy on dips near ₹2,520–₹2,560

Or on a daily close above ₹2,745 for confirmation

Targets:

🎯 T1: ₹2,956

🎯 T2: ₹3,081

🎯 T3 (Positional): ₹3,350+

📌 Conclusion

Balkrishna Industries is showing early signs of a trend reversal after a deep correction. As long as price holds above the ₹2,405 support, the structure remains bullish, with upside potential toward ₹3,000+ in the coming months.

⚠️ Wait for confirmation and manage risk as per your trading plan.

How to Trade Price Action Patterns in TradingViewHow to Trade Price Action Patterns in TradingView

Master price action pattern recognition using TradingView's charting tools in this comprehensive tutorial from Optimus Futures.

Price action patterns are among the most time-tested technical analysis methods available.

They help traders identify potential reversals, continuations, and high-probability entry points directly from candlestick formations.

What You'll Learn:

Understanding price action patterns: reading market psychology through candlestick formations

The two main pattern categories: reversal patterns and continuation patterns

Essential reversal patterns: pin bars, engulfing candles, and double tops/bottoms

How pin bar wicks reveal price rejection at key levels

Bullish and bearish engulfing patterns for identifying shifts in control

Double tops and bottoms as significant turning point signals

Key continuation patterns: flags, triangles, and inside bars

Using TradingView's built-in candlestick pattern recognition indicators

Manual pattern identification techniques and optimal timeframes

Practicing with TradingView's bar replay feature

The importance of context: trading patterns at support and resistance zones

Entry timing: waiting for confirmation candles

Stop placement strategies for different pattern types

Calculating measured move targets for profit-taking

Multiple timeframe analysis for added conviction

Combining price action with volume analysis for confluence

Aligning patterns with Fibonacci levels and prior swing points

This tutorial may benefit futures traders, swing traders, and technical analysts who want to read price action directly without indicator lag.

The concepts covered could help you recognize high-probability setups, time entries more precisely, and understand the buyer/seller dynamics behind each candlestick formation.

Learn more about futures trading with TradingView: optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools, not forecasting instruments.

TECHM bullish breakout above. Resistance Buliish breakout above, resistance, Price has confirmed a bullish breakout above a key resistance zone, indicating a potential shift in short-term trend. The breakout is supported by a strong reversal from the Fibonacci 0.5 retracement level, which previously acted as a demand area.

This confluence of resistance-turned-support and Fibonacci support strengthens the bullish bias. If price sustains above the breakout level, momentum continuation is likely.

📈 Trade Outlook

Bias: Bullish

Confirmation: Sustained price action above resistance

Upside Potential: 4–7% in the near term

Invalidation: Breakdown below the 0.5 Fibonacci support

Conclusion:

As long as price holds above the breakout zone, the structure favors buyers. A continuation move towards higher levels is expected, while failure to hold support may lead to consolidation or a pullback.

⚠️ Trade with proper risk management and confirmation from volume or momentum indicators.

Karur Vysya Bank Ltd (KARURVYSYA) – Weekly Chart AnalysisTrend: Strong Bullish

Timeframe: Weekly

CMP: ~₹296

🔍 Technical Overview

The stock is in a clear higher high–higher low structure, confirming a strong primary uptrend.

Price has decisively moved above the 0.382 Fibonacci retracement (~₹304) zone and is consolidating just below the 0.618 Fibonacci extension (~₹321–322).

The recent rally shows strong bullish momentum supported by volume expansion, indicating institutional participation.

Relative Strength vs NIFTY is rising, showing outperformance.

🟢 Key Levels

Immediate Support: ₹275–280 (Fib 0 level / demand zone)

Major Support: ₹245–250 (0.382 Fib retracement & prior breakout base)

Immediate Resistance: ₹320–322 (0.618 Fib extension)

Next Upside Targets:

🎯 Target 1: ₹320

🎯 Target 2: ₹340

🎯 Target 3: ₹360+ (on sustained breakout and retest)

📈 Trade Plan (Positional / Swing)

Buy on dips: ₹280–290 zone

Aggressive Buy: Weekly close above ₹322 with volume confirmation

⚠️ Risk Factors

Failure to break ₹320 may lead to short-term consolidation.

Broader market weakness could delay upside but structure remains bullish unless ₹270 breaks decisively.

🧠 Conclusion

KARURVYSYA is structurally strong on higher timeframes. As long as the price holds above the ₹275 support zone, the bias remains bullish with ₹320+ as the immediate breakout trigger. Suitable for positional traders and long-term investors tracking banking sector strength.

GOLD (XAU/USD) : Liquidity Grab & Bullish Confirmation Gold formed a liquidity grab following a test of significant intraday/daily support.

The formation of a cup and handle pattern, along with a violation of its neckline, offers a strong bullish confirmation.

I anticipate an upward movement now, at least to the 4935 level.

US30 – DAILY (SELL FROM SUPPLY)Price is reacting from a strong DAILY supply & resistance zone, with buyers showing exhaustion at highs.

🔻 Rejection from resistance

🔻 Weak bullish follow-through

🔻 Supply clearly defended

🎯 Targets: 49,000 → 48,300

🛑 Invalidation: Daily close above 49,650

Bias: Sellers to push price toward next demand.

Dollar Index - Don't Trust Relative Equal HighsObvious Highs Provides Opportunity For Those Who Short Dollar Over The Weekend To Place A 'Safe' Stop Loss With The Intention Of Targeting New Intra-Day Lows.

Sentiment Is Bearish Which Is, At Times A Breeding Ground For Low Resistance Liquidity Run.

Targeting 97.348 (75% Quadrant NWOG Range) As The 1st Point Of Interest.

97.546 - 97.738 Is My Terminus

Check Out My GBPUSD And EURUSD Analysis. All Aligns Up Perfectly.

Dollar Index - Aiming For Low Hanging FruitsThe Question Many Will Ask Is... When Is The Bottom Of The Market For Dollar?

Right Now, I See The Potential For Short-Term Rallies Up to Previous Highs, With 97.348 Being A High Probability Zone For The Algorithm To Reprice Up to.

Ultimately, I Studying Dollar With The Belief That The Rally Could Be Stronger Than I Expect, Aiming For The 97.738 - 97.456 Daily IFVG

Euro - Can Your Set-Up Pay Bills? This Could...As A Scalper, I Jump All Over High Probability Opportunities, Even If It Only Yields A Small Pip Gain.

Patterns And Signatures Like This Play Out Every Single Day (Don't Take My Word For It, Check It Out Yourself)

1.18330 Is On My Radar As A Price Of Interest Going Into The First 2 Days Of The Week.

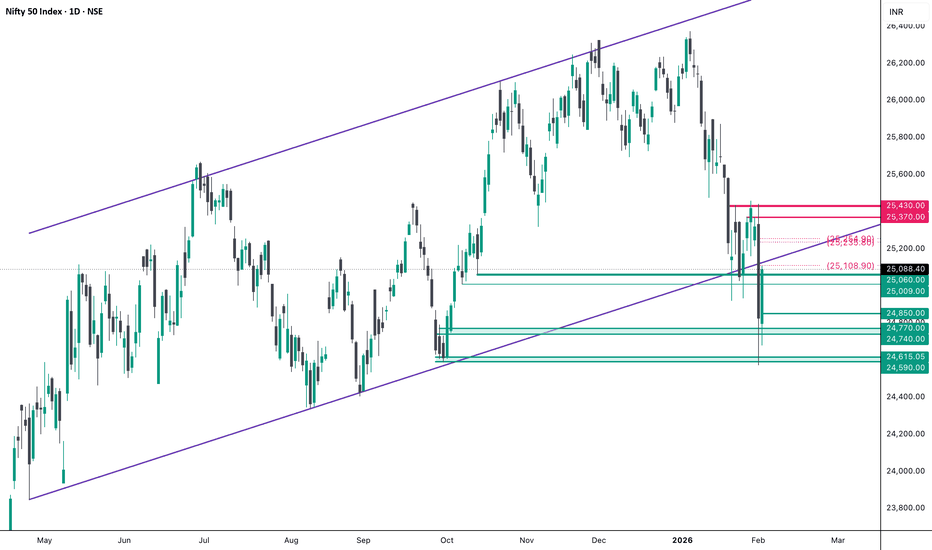

Nifty Analysis EOD – February 2, 2026 – Monday🟢 Nifty Analysis EOD – February 1, 2026 – Sunday 🔴

Here is Today's Nifty Movement Chart :

Hi everyone,

I will be on vacation for one week, so I will not be able to share the daily reports during this time.

I look forward to catching up when I return. I wish you all a great week of trading.

Best regards,

Kiran Zatakia

GBPCHF SHORTSMarket Structure bearish on HTFs 3

Entry at Daily AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection At AOi

Previous Daily Structure Point

Around Psychological Level 1.06000

Touching EMA H4

H4 Candlestick rejection

Rejection from Previous structure

TP: WHO KNOWS!

Entry 110%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

02.02.26 BTCUSD Chart AnalysisThere exists:

- The previous days' high and low,

- A fair value gap,

- A breaker Block.

Price is currently heading towards internal range liquidity in the form of the daily fair value gap.

From there, I believe price will head for external range liquidity which could be either the previous days high or the previous days low.

If Price is bullish, I believe price will retrace to the discount bullish fair value gap, respect it by closing within the range, create a stop hunt on the lower time frame, retest and expand bullishly.

Lets see,

Cheers.

British Pound - Never Trust Relative Equal LowsIt's More Obvious With GBP In Comparison To EUR When You Compare Both Prices To Each Other.

Euro Has Been Moving Whilst GBP Is The 'Sick Sister', Trailing Slowly Behind.

I Favour GBP Rather Than EUR As The Obvious Draw On Liquidity Is Evident.

1.36357 Is The 1st Price I Am Targeting Going Into The Middle Of This Week.

Short trade Pair: BTCUSD

Bias: Sell-Side

Date: Sun 1st Feb 2026

Session: NY Session AM

Entry: 77,873.26

Target: 70,607.88 (−9.33%)

Stop: 78,210.51 (+0.43%)

RR: 21.54R

Target Logic:

HTF liquidity + value re-pricing + structural support magnet

BTCUSD Sell-Side trade idea (1D / NY Session AM),

🧠 Market Sentiment — BTCUSD (Sell-Side Bias | HTF + NY AM)

Market sentiment is bearish-to-risk-off, with Bitcoin operating in a macro distribution phase following a prolonged expansion cycle. Price action shows failure to sustain above prior value and HTF resistance, with rallies increasingly sold into rather than accepted. The daily structure reflects weak upside follow-through, suggesting that bullish momentum has transitioned into exhaustion and re-pricing lower.

On the 5-minute timeframe, sentiment is bearishly aligned, confirming lower-timeframe acceptance of sell-side delivery within a broader HTF distribution context.

Price action shows compression beneath prior resistance, with multiple failed attempts to reclaim the premium / 0.75–1.0 PD Array. Each rally is being sold into, indicating that upside is functioning as liquidity for short positioning, not continuation.

Key 5-minute sentiment signals:

Lower highs forming beneath intraday resistance

Buy-side liquidity induced and absorbed above minor highs

Bearish displacement following each sweep

Price respecting discount PD Arrays (0.25–0.50) as magnets

This behaviour reflects active distribution, where market participants fade strength rather than defend dips.

DOW JONES INDEX (US30): Bullish Move After Trap

US30 will likely rise after a false violation of an intraday

horizontal support.

A double bottom pattern and the formation of a buying

imbalance candle indicate a strong bullish sentiment.

Goal - 48837

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver – When Overextended Conditions Finally Become Too MuchLast week set several records for Silver. First, another new all-time high was registered at 121.625 on Thursday in a volatile day that saw prices fluctuate wildly in a $15 range. It wasn’t known at the time but that was just a precursor for an even bigger move on Friday. A day which set the record for the biggest drop in Silver’s long trading history. A move which at one point saw prices slump 37% from an early morning high of 118.45 to a low of 73.67, before recovering slightly to close the week at 85.026, a daily fall of 26%.

The catalyst for Friday’s move was the decision of President Trump to nominate Kevin Warsh as the next Federal Reserve Chair, a position which he would take up in May. Warsh is seen by traders as more hawkish than other candidates for the role, meaning he may be less likely to cut interest rates as had initially been expected moving through 2026. This gave the US dollar a boost which weighted on Silver and triggered a wave of profit taking and stop loss selling.

Looking at the early price action this morning, it seems it may be too early to suggest that the excessive volatility for Silver is over, with prices opening the week at 80.71, jumping to a high of 87.91, before slumping again, currently trading down 10.5% at 75.909 (0615 GMT).

In situations such as this, referring to the technical outlook can be helpful to gain perspective. To establish the impact of recent moves on the trend outlook, as well as to identify the potential key support and resistance levels that could have an influence on where Silver prices may move next.

Technical Update: When Overextension Finally Becomes Too Much

It’s highly possible that the past few months of trading in Silver will be remembered as a textbook example of how bullish euphoria can extend far longer than expected, with barely any meaningful corrections seen until sentiment suddenly shifts and a sharp sell‑off erupts.

With this in mind, let’s look at how Silver prices entered this extended phase of strength, how it became so overextended for so long, and then consider if there is ever a clear signal that the advance is ending?

Why Did Silver Accelerate So Sharply?

Silver’s surge has been fuelled by a powerful combination of structural and psychological drivers. A deepening global supply deficit, now several years in the making, has collided with booming industrial demand from solar, EVs, electronics, and AI‑related manufacturing. This tightening backdrop has been reinforced by geopolitical tensions and macro uncertainty, which pushed investors toward hard assets and boosted safe‑haven flows into Silver as well as other precious metals.

Market psychology amplified the move. Once Silver began breaking major price milestones, momentum traders, retail speculators, and algorithmic funds all turned into aggressive buyers. Importantly, because Silver’s total market size is much smaller than Gold’s, these flows had an outsized impact on prices, creating a rally driven by confidence, momentum, and classic FOMO.

What This Meant for Silver’s Price Action

A combination of these forces produced a powerful, sustained advance. From the October 28th 2025 low to last Thursday’s high, Silver rallied 167% in an almost uninterrupted climb, reflected in the dominance of green candles throughout the move in the chart below.

During this phase, traditional “overbought” readings were ignored. Traders were willing to pay increasingly higher prices, unconcerned by how far the market had already run. Silver became a clear example of how overbought conditions can be dismissed if sentiment and trending measures remain firmly positive. Only when sentiment finally shifts do these stretched conditions matter, leading to the kind of violent snap‑back seen on Friday.

Was There Any Warning of a Sentiment Shift?

In truth, no.

The January 29th all‑time high at 121.625 didn’t result in a close above resistance at 120.973, the 261.8% Fibonacci extension. However, throughout the advance, several extension levels briefly slowed the trend before eventually giving way and triggering further upside. On its own, the inability to close above 120.973 wasn’t a meaningful warning, only Friday’s liquidation confirmed the shift.

Predicting the end of a euphoric phase like this is impossible. Only proactive risk management can protect traders.

That means monitoring price action closely and being willing to drop down to shorter‑term charts, such as the 1‑hour, to spot the earliest signs of a change in behaviour. Short‑term structures almost always highlight potential sentiment shifts first.

On the hourly chart above, the trend into the January 29th high was consistently positive, with each break above prior highs opening scope for further gains. Even when a new high temporarily capped the move, previous lows held as support, allowing the trend to resume.

The first real change came after the most recent record high at 121.625, when the sell‑off into Thursday’s lows at 106.71 was followed by a rally that failed to break the previous high and instead reversed lower. At that point, treating 106.71 as a key support, as it was now the last correction low in price, and placing stop losses just below it, would have been a prudent risk‑management step. No one could have predicted the speed of the subsequent collapse, but such an approach would have prevented exposure to the full extent of the decline.

What Is the Potential for Silver Now?

Looking forward to the week ahead, after a 39% drop from last Thursday’s all‑time high, uncertainty and volatility may continue to remain elevated, meaning adopting a more conservative approach to trading Silver could be sensible.

Friday’s sharp decline and activity so far this morning, is finding support at 74.530, which is the 61.8% retracement of the October 28th to January 29th advance. If this level holds on a closing basis and a recovery phase develops, traders may focus on resistance at 91.591, which is the 38.2% retracement of last week’s sell‑off. A closing break above this level could suggest scope for further upside.

If weakness resumes, closes below 74.530 may increase the risk of deeper declines, shifting attention to potential support to the December 31st low at 69.427 and possibly lower if that level fails.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

DXY (USD Basket) - Breakdown (Confirmation candle in progress)Expecting DXY to confirm the downtrend. We need a weekly candle close below the white trendline, which would mark a break of the trend that’s been intact since 2008. I expect this to be bullish for Bitcoin. Gold and silver have too much downside risk from here, in my opinion, while BTC/XAU looks more promising from a Risk/Reward perspective.

USD/JPY: Confirmed Change of CharacterThe USDJPY price violated a significant horizontal resistance level, specifically the most recent lower high within a minor bearish trend, and closed above it on a 4-hour timeframe.

This violation is considered a confirmed Change of Character, suggesting that the currency pair is returning to a bullish trend.

Further growth is now anticipated. The subsequent target is 154.72.

EURJPY: Morning Gap Trade 🇪🇺🇯🇵

EURJPY will most likely fill a gap up opening

after a confirmed bullish trap above an intraday resistance.

Goal - 183.48

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.