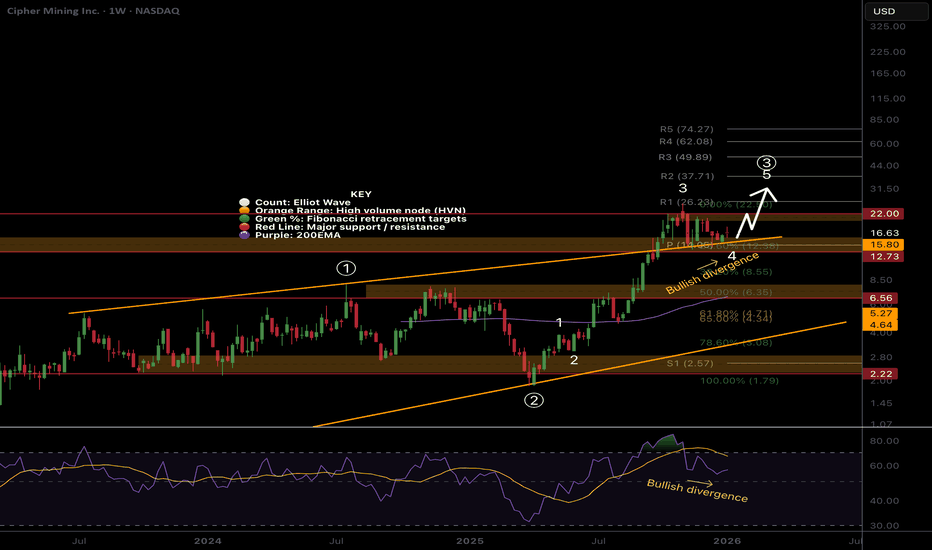

CIFR Macro analysis | The bigger picture | Long-term holdersNASDAQ:CIFR

🎯 CIFR remains in a wave (4) of 3 range, near the all-time high. Wave 4s are expected to be drawn out, often being a triangle or flat correction, where most traders give their money back to the market due to whipsaw and fakeouts.

📈 Weekly RSI has printed bullish divergence above the EQ, but with no strong reaction yet. This can take months to play out sometimes. Falling below the orange trend line will negate this divergence.

👉 Analysis is invalidated if price falls below the 0.5 Fibonacci retracement at $6.35

Safe trading

Cypher

CIFR Short-term analysis | Trading and expectationsNASDAQ:CIFR

🎯 Wave d of the triangle may still be underway, wave e is expected to end at the daily pivot where price currently sits, above the daily 200EMA, showing the uptrend is still intact but flattening.

📈 Daily RSI bullish divergence has failed to play out, showing the bears are in control.

👉 Analysis is invalidated if price falls below wave C, $12.50, suggesting a deeper retracement

Safe trading

Newmont Corporation (NEM) – Short Setup Technical AnalysisNewmont Corporation (NEM) – Short Setup Technical Analysis

NEM is currently trading well above the 3rd Anchored VWAP band, reflecting a significant price–value dislocation and elevated mean-reversion risk. At this level of deviation, upside continuation typically becomes inefficient and increasingly dependent on late participation.

This overextension coincides with the formation of a bearish Cypher harmonic pattern, which often develops near exhaustion points within extended moves. The Cypher completion zone defines a technically sensitive area where bullish momentum frequently deteriorates and distribution risk increases.

From a tactical perspective, this setup favors a mean-reversion short rather than trend continuation. A rejection from the current level or loss of acceptance above the upper VWAP band would confirm bearish control and increase the probability of a rotation back toward the Anchored VWAP and prior value area.

Bias: Short on rejection above the 3rd VWAP band

Target: Mean reversion toward Anchored VWAP

Invalidation: Sustained acceptance above the Cypher completion zone

Context: Bearish Cypher completion + extreme VWAP deviation = asymmetric short opportunity

Pound Setup is still hanging around…The pound is still hanging around at the top of a possible triple zig zag that could target 127-128. While overall I believe the pound is going to move higher , this would give a low risk setup for a long position. I’d like to see all closes below 1.3375. Let’s see if this scenario plays out.

CIFR Ready for higher?NASDAQ:CIFR We got the pullback I was looking for from the last report. Locally, price appears to have completed wave (4) of 3 and looks ready for continued upside.

Wave (4) tested the previous trend-line, S1 pivot, 0.236 Fib and High Volume Node as support- a strong support area.

📈 Daily RSI has printed a confirmed bullish divergence from oversold.

👉 Continued downside has a target of the 200EMA at $11

USD/CHF – Bullish Cypher Pattern + RSI Divergence ConfirmationUSD/CHF – Bullish Cypher Pattern + RSI Divergence Confirmation

On the lower timeframes (M15), price has completed a Bullish Cypher Pattern into the PRZ (Potential Reversal Zone) with confluence:

XA retracement: B leg at 0.786

AB extension: C leg 1.272

PRZ completion: D at 0.786 of XC

Additional confirmation:

Bullish Divergence on RSI suggesting potential reversal momentum.

Market reacting off prior structure support.

Targets:

TP1 → 38.2% retracement of CD

TP2 → 61.8% retracement of CD

TP3 → 78.6% retracement of CD

This setup aligns with my structured approach: pattern recognition + confirmation + Fibonacci-based targets.

⚡ Lesson: Patterns provide opportunity, but confirmation and disciplined management determine success.

CIFR Pullback time?NASDAQ:CIFR Locally, price continues into price discovery with big jumps suggesting wave 3 is still going Wave (5) of 3 appears to be underway which could end at any moment. I am still expecting a retracement to test the previous all time high and punish late investors who are chasing prices up, trapping them into capitulation later.

Wave 4 has a downside target of the 0.236 Fibonacci retracement, High Volume Node support + the trend-line retest, $14. This may also meet the ascending daily 200EMA.

Daily RSI has a series of bearish divergence from overbought which a strong signal for a reversal.

Continued upside could run the daily pivots to $38.

BTCUSDT (Weekly) – Cypher Harmonic Pattern Targeting Key Demand Bitcoin is currently forming a Cypher Harmonic Pattern on the weekly timeframe — a rare but reliable reversal setup that often appears near exhaustion phases of a macro move.

This structure aligns with potential mid-cycle correction before continuation, providing a clear roadmap for both bulls and bears.

Cypher Harmonic Structure

The Cypher pattern follows strict Fibonacci ratios:

XA leg: The initial impulsive wave defining trend direction.

AB retracement: Retraces between 0.382–0.618 of XA (here ~0.58).

BC extension: Expands to 1.13–1.414 of AB (here ~1.27).

CD completion: Extends to 0.786 retracement of the XC leg — this defines the potential reversal zone (PRZ).

In this setup:

X → A → B → C structure is complete.

Price is now heading toward point D, projected between $50,000–$65,000, the ideal PRZ for this Cypher.

The highlighted green box marks this completion and potential accumulation zone.

Technical Confluence

Weekly RSI Divergence

Bearish divergence appeared between point B and C — confirming a loss of upward momentum.

RSI now approaching mid-levels (40–45), aligning with a healthy reset within a broader bull structure.

Volume and Momentum Shift

Declining bullish volume since the C-leg high, typical before harmonic completion.

Short-term bearish bias persists until D-zone validation.

Fibonacci and Structure Alignment

The 0.786 retracement of XC overlaps with historical weekly demand.

This overlap reinforces the D-zone as a strong potential reversal point.

Scenario Planning

Base Case (Cypher Completion):

BTC retraces toward $55K–$60K (D-leg).

Price stabilizes within PRZ and confirms structure with bullish divergence on RSI.

Potential upside reaction back toward $90K+ over the next few quarters.

Alternative Case (Invalidation):

A weekly close below $50K would invalidate the Cypher completion and shift bias to extended correction territory.

Trading Considerations

Aggressive Entry: Scale into longs within the PRZ ($55K–$60K) once momentum indicators show exhaustion.

Conservative Entry: Wait for bullish confirmation on higher timeframes (weekly close above prior swing low).

Invalidation: Close below $50K zone.

Risk management is crucial — the Cypher is high-probability but not infallible.

Conclusion

The Cypher Harmonic Pattern suggests BTC may be in the latter stages of a mid-cycle correction.

If historical structure repeats, the D-point could serve as the macro reaccumulation zone before the next impulsive leg of the bull cycle.

Bias: Short-Term Bearish → Mid-Term Bullish

Pattern Type: Cypher Harmonic

Key Zone: $50K – $65K

Invalidation: Weekly Close < $50K

CIFR shallow pullback still on the cards!Price is in a macro wave 3, the strongest and most powerful move described as a “wonder to behold” by Ellioticians. When price is in a wave 3, pullbacks are shallow and few. Investors get overconfident and excited adding positioning without correct risk, swept up in the big move, aggravated by influencers and the media.

Testing the previous all time high at the 0.236 Fibonacci retracement and upper trend-line will be a strong support area and a place to look for a long, $14. While breaking out again into all time high could see price continuing its strong uptrend, this is doubtful as we have run the weekly pivots. Further downside has a target of the previous all time high and R1 pivot at $8.

📈 Weekly RSI is oversold with no divergence and can remain here for months as price keeps increasing.

👉 Analysis is invalidated below the weekly pivot and 200EMA ~$5

$BTCUSD Bullish CypherBITSTAMP:BTCUSD Bullish Cypher pattern: although prices can go down to test the spike low around $104K, there is a very good chance that the previous spike low of $104K has completed the pattern. This would mean that we are already in a uptrend and is currently doing a pullback on a lower timeframe. I believe $106K area is a strong support band.

DXYDaily structure pointing to an easing of price action in the near term. 5 bar fractals providing the extremes of the range. The bullish Cypher is obviously incomplete and a guess. But the bottom of the range and the shift in sentiment needs to be revisited before any upside. The Cypher would give us the wyckoff spring and upside taking out highs on the way to 💯.

EURJPY: Two Potential Advanced Patterns Setting UpWe’ve got a pretty interesting situation developing on the EURJPY, where not just one, but two potential advanced pattern formations setting up simultaneously. Opportunities like this don’t happen often, and they’re a great example of how structure and symmetry can align to give traders multiple reasons to get involved in the market.

Identifying the Dual Pattern Setup

What makes this chart particularly exciting is that the two patterns overlap within the same price zone, creating a powerful confluence area. When multiple patterns or Fibonacci-based setups complete around the same levels, it increases the probability of that zone acting as a significant turning point.

In the video, I’ll walk you through how to measure out each pattern step-by-step, showing you exactly where the completion points line up.

The Takeaway

Whether you’re an advanced pattern trader or simply looking to refine your technical analysis skills, this EURJPY setup is a great example of how disciplined pattern recognition can reveal high-probability opportunities.

I wish you guys a great week of trading!

Akil