USCCI - Consumer Confidence Index - Recession is HereThe US Consumer Confidence Index (USCCI) does not look so good.

Consumers (normal people) are feeling anxious about their future, and they have good reasons for that.

The Bull Market did not last long after the Covid Pandemic and people don't feel optimistic about their future spending or wealth.

If you don't know what the CCI is, no worries, I will briefly explain, so that a 12 year old will know.

A very well-known university in Michigan started doing some surveys a long time ago.

They were asking people how they feel about their future, about their spending confidence, etc.

Basically, you can also ask yourself:

Can you afford a new car now?

Are you making more money now then you were 2 years ago?

Do you have financial stability? How do you feel about that?

Are you thinking of moving into a new, nicer home?

For me it's a NO for most questions above.

Not sure about you...

Now, if I may continue, I will tell you this: people are scared.

In fact, Covid shocked the world as we know it.

We got used to being bullied by the higher, running forces in the world.

Anyway, there are many factors for which Consumers are pessimistic at these times:

- War & Tensions: Ukraine vs. Russia

- Inflation Spike

- Energy Crisis

- Federal Reserve (FED) Interest Rate Hike

- Surging Prices

- Bear Market Fears

- Recession Talks

Remember this: WINTER IS COMING!

No joke, many will suffer.

The media plays a major role with inflicting sentiments in your mind.

As for me, I'm more of a technical guy, so I go with what my technical analysis tells me.

Until now I mentioned my personal fundamental analysis take.

I'm not optimistic about the markets.

The FED messed it all up. They overreacted with that Quantitative Easing (QE).

Artificial (fake & printed) money was injected, and of course it lost its value.

Because of that, Inflation skyrocketed, and of course they're surprised.

NO! It's the oldest trick in the book. They are controlling the global economy.

It's actually them who are causing inflation or stagflation, and also them who are switching bullish and bearish gears.

But enough about that. I'm gonna' switch to the Technical Side.

I just wanted to get that off my chest. LOL

So, I'm an Elliottician. That means I trade by using the Elliott Wave Theory.

It proven to me over the years that it works.

The Market's price movements are simply suman beings buy & sell emotions, as a herd.

Yeah, they're all sheep, and most indicators are based those herd emotions.

So, on this USCCI chart, which is coming from 1953, I'm labeling my Elliott Wave Count.

What I see is a Triple Three Complex Correction, in a very BIG degree.

TradingView calls it: Elliott Triple Combo Wave (WXYXZ).

Based on that Wave Count, I am suspecting more down-side to this chart.

In a nutshell, I'm anticipating a RECESSION.

How big it will be and how long it will last, that depends.

For what I know, the Bear Market has already started for Indices globally.

My VIX (Volatility Index) idea backs this up.

Short and simple: the USCCI would tag the 61.8% Fibonacci Retracement of Wave A (white).

That's a point of interest for bulls, because it reflects the Golden Ratio.

If it breaches and goes lower than that, then it's not just a Recession anymore, it's gonna' be more like a Depression.

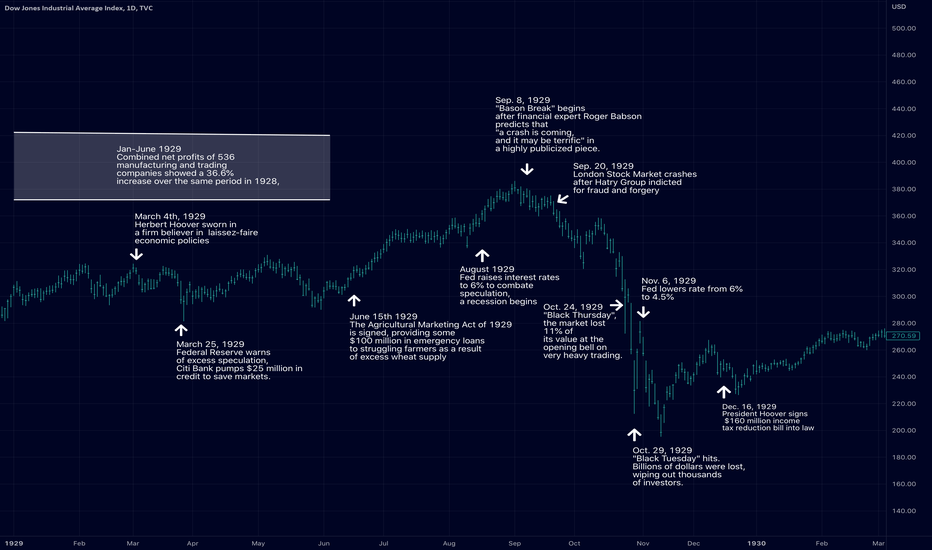

1929 all over again. Funny how these Cycles come into play...

My chart has labels and infographic stuff.

Write a comment if you want, give a like if you give a :poop: :D

Good luck!

Depression

The Deflationary SpiralAll credit booms brought about by Central Bank-induced artificially low interest rates and loose lending standards end in busts. In the recessionary phase that follows the boom, credit becomes much harder to attain and many over-leveraged businesses end up going bankrupt. The recessionary phase reveals the malinvestments and unsound business decisions that were made during the economic boom. Businesses & Consumers deleverage their balance sheets either through paying down debt or through bankruptcy. As loan demand falls & credit conditions tighten, debt issuance falls, which reduces the supply of money into the economy because the vast majority of currency that enters the economy is loaned into existence. When credit growths slows and begins contracting alongside a falling money supply, inventory piles up and profits & margins fall while consumer spending falls. Businesses are then forced to sell at discounted rates to liquidate inventory in anticipation of weak future demand, which further reduces profits & margins and leads to increased unemployment and weaker levels of consumption. The “Deflationary Spiral” subsides and an economic recovery can take place once balance sheets are back to healthy levels which can support debt accumulation, capital investment recovers, and once large amounts of the “bad” debts taken on during the economic boom have been deleveraged.

US M2 Money Supply is currently down -4.2% YoY using March 2023 data, the largest monetary contraction in the USA since the Great Depression. Using data going back to 1870, every time the money supply contracted by over 1% YoY the stock market had a large correction and the economy fell into a severe & lengthy contraction with unemployment reaching at least 7%. A banking panic always accompanied those contractions as well. Commercial bank deposits are currently down around -5% YoY, the most since the Great Depression. Total commercial bank deposits didn’t even contract during the early 1990s Savings & Loan Crisis. With money supply shrinking and the majority of banks unable to pay competitive rates on deposits, deposits will continue falling and more bank failures will occur. The large amounts of unrealized losses on bank balance sheets represent another impediment to loan growth and banks have continued to raise reserves for multiple quarters in response to rising default rates.

Fed research from the Fed Bank of Saint Louis show bank lending conditions (measured by percentage of banks tightening lending conditions) are comparable to early 2008 & late 2000. Bank lending conditions are a leading indicator for unemployment. The unemployment rate currently is still below 4%, but with the Conference Board’s Leading Economic Indicators index currently at -7.2% and the bond yield curve still inverted, many reliable economic datapoints show that the economy is closer to the beginning of this business cycle downturn and debt deleveraging than the end. Yield curve inversions & Conference Board LEI’s have been some of the best leading indicators for a recession since the 1970s. Since 1968, any Conference Board LEI contraction of more than -2% YoY has never yielded a false positive in regards to a coming recession. The Credit Managers’ Index newly released data for April showed that the index for rejection of new credit applications (within the service sector) was 45.9, its lowest level since March 2009.

The US Consumer is beginning to run dry on savings. The majority of Americans are living paycheck to paycheck and consumer credit growth (which had been expanding rapidly in 2022) has slowed markedly. Total consumer credit growth has fallen about 50% YoY (using the 3 month average of data from December - February). After falling below 3.2% in the summer of 2022, the US savings rate is still low by historic standards, currently 5.1%. Announced job cuts for the month of March were 89.7K, higher than the first 3 months of the 2008 recession. US large corporate bankruptcy filings (Bankruptcies of companies with over $50M in liabilities) from Jan-April totaled 70, seven more than during the same length of time in 2008. Student loan debt payments are set to resume again this summer, which will further reduce consumer spending. US Consumer sentiment levels measured by University of Michigan hit the lowest levels ever (going back to 1952) in the summer of 2022, and they have been fluctuating around 2H 2008 & 1H 2009 levels ever since. Delinquency rates on things like automobiles, credit cards, and commercial real estate loans are soaring. Cox Automotive found 1.89% of auto loans in January were "severely delinquent" and at least 60 days behind payment, the highest rate since the data series began in 2006. In March, the percentage of subprime auto borrowers who were at least 60 days late on their bills was 5.3%, up from a seven-year low of 2.58% in May 2021 and higher than in 2009, the peak of the financial crisis, according to data from Fitch Ratings.

Retail sales are an economic metric that track consumer demand for finished goods. US real retail sales down -2.1% and EU real retail sales are -9.9%. German real retail sales for the month of march just came in at -15.8% YoY! According to Bloomberg, Global PC shipments are down close to 30% YoY & Apple computer shipments are down about 40% YoY. In the past 50 years, US Gross fixed capital formation has only gone negative in the US before and during recessions. It is now negative and there has never been a false positive. Data from the Mortgage bankers association showed a -39% YoY decline in Mortgage purchase applications, a decline to its lowest levels in over 26 years. US Building Permits are down -24% YoY. Housing Starts YoY are down -17% YoY. Existing Home Sales are down -22%. Every national housing downturn in the past 45 years has taken at least 4 years from peak to trough prices, indicating that the current housing downturn is likely to continue for at least 2-3 years.

Every FED Regional bank report on manufacturing (using a 3 month average of the data) is in a contraction. The April Philadelphia FED Manufacturing index came in at -31.3. Since 1969, Every reading under -30 was either in a recession or a few months away from one. April Richmond FED Service Sector Index registered a -23, the same number as in Nov 2008 & Feb 2009 & worse than Jan 2009 which was -20 (August and September 2008 were -10 for reference). US manufacturing production is down -.5% YoY. March 2023 ISM PMI data was also very insightful. USA ISM Manufacturing PMI (March) was 46.3, its lowest level since June 2009 (excl. H1 2020). For reference, in the 08 recession, it wasn’t until October 2008 that the ISM manufacturing PMI fell under 46.3, over 9 months into that recession. USA ISM Manufacturing New Orders (March) was 44.3, its lowest level since March 2009 (excl. January 2023 & H1 2020), USA ISM Non-Manufacturing PMI (March) came in at 51.2, its lowest level since Jan. 2010 (excl. H1 2020).

The US Stock market is trading at one of the highest Shiller PE ratios & stock market capitalization to GDP ratios in history. Present day stock market valuations are rivaled only by the Roaring 20s Bubble (1929), The Nifty-Fifty Bubble (late 1960s/early 1970s) & the 1999/2000 Dot-com Bubble. All 3 of those examples were followed by the most negative 10 year real returns in USA stock market history going back to 1913. Over 40% of businesses in the Russell2000 are unprofitable and over 1/5 of the S&P500 are zombie companies. Clearly, the stock markets as of April 2023 are still in bubble levels of overvaluation.

Looking at the data in aggregate, I believe that a recession is currently occurring. Assuming earnings fall by about 30% peak to trough, using a conservative average from the past 4 US recessions, I assume S&P annualized earnings will fall to around 155. Using a conservative valuation multiple of 14, that gives a target price of about 2,200 for the S&P500 that is likely to be hit in Q4 2023 or 2024.

Thank you for reading,

Alexander Charles Lambert

XDB rest of 2023 prediction. Depression before lambo!This is my expectation for how the XDB/USDT chart will play out for the rest of the year. As you can see, I am expecting an extended period of depression, giving us some huge buying opportunities. Somewhere between July/August we might hit the peak of this depression and capitulation, where we could see prices as low as $0.0004 at the absolute bottom. Then in September we might see a big 10x pump to $0.004, before dropping back to the $0.001 area again, and then we may pump to $0.01 before the end of the year, 25x from the bottom. The targets of my previous article are still in play long-term. This means that if you could catch the bottom in the $0.0004 - $0.0008 range, and hold it to the long-term target of $0.07, you could potentially make up to 150x your investment. Obviously, anything under $0.001 is a strong buy, but you need to keep in mind that it could go as deep as $0.0004.

An interesting rest of the year ahead!

BTC Global SHORTI don't want to explain u +100500 reasons , why do we cannot go parabolic uptrend from now. (because i don't need too and i don't WANT to help u survive ) I just want this Vision to be Published.

Just too much FOMO, too much people waiting TO THE MOON when the big Depression is very close.

U can believe me or nor - I DON'T CARE

I've closed ALL Longs from 16k here as it is my first Target (30k)

It is always hard to SHORT when most of people are laughing at BEARS, think they've died , BUT THEY ARE NOT.

Futures Setup (1x-10x):

Entry : 30k

SL : 33000

Take :

25000

20500

16600

10000

6000

Futures Setup (1-4x):

Entry : 30k

SL : 37500

Take :

25000

20000

15000

10000

5000

ETH - UnTiL wHeRe tHe BuLL RaLLy WiLL gO ?Greetings traders!

I am sharing to you today one of my COINBASE:ETHUSD Elliott Waves analysis.

That one is bullish until the summer '23

Fibonacci Extention from the bottom of the orange W to the orange X in order to find the orange Y

Fibonacci Retracement of the purple WXY, in order to know where the objectives converges to be more precise

Fibonacci Extention of the blue (ABC) to find the blue (C)

Fibonacci Extention to find the green extention 3 wave

Fibonacci Retracement to find the green extention 4 wave

Fibonacci Extention to find the green extention 5 wave

*

*

BTW, I am selling a PDF , regrouping all the knowledge I have found on Elliott Waves, from the greatest analysts books, into a clear, simple and explicative way,

Contact me in private if you are interested

*

*

Don't hesitate to comment and check my other idea

ETH - While the masses are BULLISH, Elliott tells you to SHORTTTHey guys,

Been a long time isn't it?

I'm back for new analysis.

Don't worry, the bull rally isn't over, we are just shorting hard in order to have a 50% of bullish variation just after.

I will upload my Elliott Wave long term vision for the different chart that I analyse: SP:SPX ; NYMEX:CL1! ; COINBASE:BTCUSD ; COINBASE:ETHUSD ; FOREXCOM:XAUUSD

I will explain how I count my waves and I found my objectives

FOLLOW ME TO NOT MISS ANY OF MY FUTURE PLANS

*

*

BTW, I am selling a PDF , regrouping all the knowledge I have found on Elliott Waves , from the greatest analysts books, into a clear, simple and explicative way,

Contact me in private, or in comment if you don't have enough reputation point if you are interested

*

*

Don't hesitate to comment and check my other idea

ETHUSDT Movement Analysis from February 2023 to October 2024ETHUSDT prediction analysis using distances between important pivots and fibonacci retracement of ETHUSDT last cycle in the current cycle and the Wall Street Psychology of Market Cycle.

We are currently in the Depression phase.

Is Disbelief around the corner or in 2024?

I think it is in 2024.

A Pause on Consumerism Christmas

Personal Savings are at a historic low, Consumer Credit at highs, and Inflation hasn't popped. The United Kingdom and other leading Eurozone parties have proclaimed their Recession, as the Federal Reserve, BEA, and Executive Branch fight against Wall Street Banks, Wall Street Megacompanies, and basic economic equations contradict each other regarding the US's. Q3 GDP came in positive due to a massive decline in imports caused by overstocking through the first half of the year as every company listened to Jerome Powell and bought inventory. Inventory that is now looking to start hitting sales prices on the back of continued consumer weakness starting hardcore in September, a massive deflation in shipping costs, some energy costs, and a big tick down in demand. Still, the money isn't there for American consumers amid high usage of credit cards in the environment of an ever-inflating cost of living.

This analyst believes the most likely outcome is a continued destruction of consumerism, feeling especially heavy on the back of a great Q4 Holiday season in 2020 and 2021 - bigly in thanks to monetary inflation. Lower wage workers have been struggling through the regular life costs amid continuously weak consumer and manufacturing surveys, even with a massive surge in domestic manufacturing construction. Mid-line income earners are in an environment of increasing recession expectations as big Tech are reducing numbers. And while the BLS stick to claims that there are two jobs for every one person looking for work, the underlying environment dispels this illusion. Failed banks aren't the only ones firing workers. Twitter was among the most successful social media companies and hasn't made a profit in history. Amazon's Alexa is being touted as one of the biggest tech failures in modern history, with 10k workers set to bite the dust on the first go from a company that has become the quickest to lose $1 Trillion in Market Cap. The rest of the tech industry is sitting in their own layoffs in the early days of a recession that not all can agree on.

The increased probability of a weak Holiday sales period carries increased chances of continued layoffs from core business units and non-core. Amazon's Alexa might be one of the most unprofitable elements of a business that is now looking at dramatically reduced online-consumer spend after a year of reducing warehouse space and inventory while Unionization boomed. Google has shut down most of it's "Moonshot"/incubator projects along with peers, meaning they aren't seeing the Profit in business ventures they don't already master, hinting at a bad look for the space. Congruent to the destruction of the active economy, Stock market valuation deterioration hits at savings and spending now-on. Mortgage rates doubling stresses an already-dubious common ability to buy, thus reducing an already thin depth of bid.

I believe we will continue to see degrading macroeconomic environments with a mix of good and bad news for the future as various international economies start to rotate through the current trends and into their future. A mix of extreme pessimism and optimism as the loudest Bulls and Bears continue screaming before the Holiday season, volatility will continue to be high. With a higher skew towards downward pressure, expect some strong similarities and contrasts to last year. The New Year Bump and Drag will likely be a big repeat, with potentially compounded effects. From a socio-psychological stance, I believe the consumer environment is primed for less push on fancy gifts as the narrative grows on Corporate Profit Greed being the greatest pusher of inflation - which is correct in the context that the Federal Reserve and an out-of-depth Government enabled and allowed it.

Disclaimer

This is in no way, shape or form, fluid and function, an analytical, qualitative or intelligent compte rendu. The function of this essay is the maddening diatribe of a curious mind, and how this one manages micro- and macro-economic data for a critical investigation into the micro- and macro-economic world. This text is not suitable for direct consumption, and should never be used as a primary or secondary source. The contents of this text are often illogical and offensive, and great care should be given to the reader's personal qualifications and senses. This text is delivered on TradingView, where the userbase is expected to have a level of financial and investigative understanding that would enable them to query appropriate thoughts and abdicate nonsense to the void. May whatever sovereign and omnipotent being you believe in, guide you through this.

The Great Reset!!!CAUTION ONLY BIG BRAINS FROM HERE ON OUT!!!

White: US 10 Year Bond Yield

Orange: US Debt to GDP

Blue: US yoy inflation

"Inflation transfers wealth from creditors to borrowers for all sorts of nominal debt, not just government debt." -- Christopher J. Neely, Vice President at St. Louis Fed.

What is the Great Reset? Is it a new 1929 Crash, a new Great Depression? No. The real Great Reset is the controlled writing down of US debt-to-GDP which has reached unsustainable levels and surpassed those at the end of WW2. In fact this chart only shows government debt (orange), in truth when you add corporate and all other forms of private debt, you get a figure currently in excess of 700% of GDP.

People believe inflation is the problem, they don't understand that in most of the world it is a tool for writing down debt. This was also the case in the US after WW2.

How do you write down debt measured against a country's productive output? Well, the easiest way is to increase GDP, but because in reality growth is limited (in some cases almost zero), it's easiest to do this by increasing the nominal value of GDP by ramping up inflation:

Nominal GDP = Real GDP * inflation factor

So by increasing inflation we increase GDP nominally and we decrease our debt with respect to productivity.

So what does this have to do with the chart? Look what happened after WW2, when bond yields bottomed and debt-to-GDP peaked. These two reversed over the next 40 years until 1980, when they reversed again. Look what happened to the long-term inflation in that same 1945 to 1980 period: ignoring the many short-term spikes (known as surprise inflation), the curve slopes exponentially upwards, gently at first until culminating in the inflationary spial of the late 1970s. This same process is beginning again. We will see many short-term inflation spikes in the coming years (surprise inflation) but they will mask an underlying increase in long-term inflation. What does this mean? It means your savings will be wiped out with respect to purchasing power. It means diversify into bitcoin and other dead (non-productivity related) assets over the coming decade and decouple from the fiat.

The same principle applies to Eurozone and other so-called developed countries with excessive debt-to-gdp ratios.

Further reading:

St. Louis Fed blog entry "Inflation and the Real Value of Debt: A Double-edged Sword"

Russell Napier interview "We Will See the Return of Capital Investment on a Massive Scale"

The truth is wealth is being transferred from the creditors, i.e. the citizen, to pay down government debt: as your savings lose purchasing power, the value of debt also vanishes. This is really why we say inflation is a tax!

DXY has left the LAUNCHPAD... destination 160+DXY has left the LAUNCHPAD and is unlikely to return home until its surpassed 160!

From the chart we can see that DXY has...

- Emerged from the falling wedge with a measured move target of +72, taking us upto 160 OR BEYOND

- Has retested the falling wedge trend line and created a double bottom support

- DXY has performed these feats before (1980-1985) and is showing a similar emerging shape in the chart pattern and RSI

- If history repeats, we can expect this trend to continue through to Approx. 2025

Once these trends establish themselves its highly UNLIKELY that they do not go on to fulfil their potential. TIME IS RUNNING OUT for the DXY to get off this trajectory.

CONCLUSION: Long the DXY, Hold your DOLLARS

GOLD is a BIGGER BUBBLE than the S&P500?? Look away gold bugsThis chart shows GOLD and S&P500 on the same % change axis since 1965.

Based on this timescale, GOLD has had a GREATER % rise in price than the S&P 500.

But hang on, isn't GOLD price supressed and is the only asset class NOT in the EVERYTHING BUBBLE?

FALSE NARRATIVE!! Zoom out to this longer time scale and see that GOLD has also ascended into NOSE BLEED BUBBLE TERRITORY, its just timed its climbs different to equities. +++ It gets worse.... GOLD has painted a HUMUNGOUS double top which is now bearing down a top of the gold chart.

CONCLUSION: Gold is every much as part of the everything bubble as STOCKS and REAL ESTATE. GOLD will not be a safe haven and will fall in a similar way to stonks (MASSIVELY) in the coming depression

Gold is going to CRASH!! +++ Bitcoin chart proves itThis side by side comparison shows the similarity in the evolution of GOLD and BTC price.

Over a longer time span gold is painting EXACTLY the same DOUBLE TOP after parabolic rise as Bitcoin has done.

Gold price is up +4,600% since 1966. Compare this to the S&P500 which is up +4,300% over the same time span. Gold price has NOT been supressed, this is a false narrative.

The conclusion: GOLD is every much as part of the everything bubble as Stocks and Real Estate. Expect the coming depression to burst the bubble and for Gold to continue its rhyme of the Bitcoin rise and fall

SPX - A NEW BULL RALLY INCOMING ??Hey traders,

Looking at the chart thanks to the Elliott Waves analysis, I am able to have one of my plan to find a bullish rally in this bear market.

It has a lot of probability that it will arrive in order to do the orange X of the WXY of the blue Y .

It will be done when the orange W will touch the 50% of Fibonnacci retracement of the entire bullish trend from the march 2020.

The objectives are therefore:

1/ 3530-3480 (most probable before a massive bounce)

2/ 3442-3387

3/ 3322-3272

4/ 3230-3185

In my opinion, it is therefore possible that we will be ending this year on this bull rally, before dropping for the orange Y in the first months of 2023.

.

.

BTW, I am selling a PDF , regrouping all the knowledge I have found on Elliott Waves , from the greatest analysts books, into a clear, simple and explicative way,

Contact me in private, or in comment if you don't have enough reputation point if you are interested

.

.

Don't hesitate to comment and check my other idea

ASSETS /INFLATION DEFLATION JUST STARTED Since 1971 ALL ASSETS have inflated based on the start of M2 and the start of money velocity . it is just starting down housing BUBBLE is about 5 x of 2007 as is the pension system . when it is over it will be a very DARK TIME and a NEW System . FIXED money . CASH AND T BILLS ARE THE ONLY SAFE HAVEN !! I HAVE WARNED OF MAJOR CIVIL ARREST and having a good 1 yr of dry goods something to protect you and you family . and move as far away from any city or state thats BLUE

Fixed and Basic Income During Recessionary TimesThe talk of economists these days seem to be "Cash is King" (esp USD) vs "Cash is Trash". While it's true that a lot of people are liquidating their assets now in favor of dollars, given that our economies are interconnected more now than ever before, this might only last for a very short period of time.

While the market is likely to go into panic mode soon (the top-earners are finally getting a *tiny* taste of what people below them have been going through for years) it might help to take a step back and look at the bigger picture since most of the problems with the economy right now are existential, not technical.

Sort of a throwback to my #YangGang days with Andrew Yang, but UBI would have been pretty nice to have right about now. Yes, UBI does help alleviate poverty, but it also helps stabilize economies and labor markets during difficult transitions as well - that's what it was designed to do originally, and it is a brilliant idea that is literally good for *everyone*.

As stock/asset prices start to plummet, everyone is talking about moving their money to "fixed-income" sources now, to help stop the "bleeding". One of the silver linings of the recession is that there seems to be higher demand for labor, which could potentially increase wages and stabilize the economy that way - but people do need time to adjust and learn new skills to find new work. UBI does both in a simple and elegant way.

One of the big criticisms of UBI was that it would cause inflation since it would bring up the costs of everything. It's ironic to see how inflation became the talk of the town now despite the opposition coming from both sides of the political spectrum. Purchasing power is relative - the way to look at UBI from a budgeting standpoint is that you're dedicating a % of your total funds toward stabilizing the economy, which - again - should be good for everyone.

Hindsight is 20/20 and unfortunately we're now forced to work with what we did (and didn't) do thus far. Many economists - including major ones - have been eyeing cryptocurrencies as a potential "safe haven" during the market crash that's likely to continue well into 2023-24. How likely is it for people to turn to crypto during trying times?

Staking rewards are currently outperforming bank interest rates and may become more appealing over time, while crypto projects based around the concept of UBI may start to gain favor as the top-earners realize that these models are in their own interest, too. (It's a big *if*, but UBI-tokens might be the thing that ETH needs to revive its lackluster performance post-merge, imho.) Most investors are running towards cash for safety now but if that fails too, there will be no options left. That's when crypto may finally see its day - time will tell.

www.theguardian.com

The End of the Deflationary Asset EraDeflationary assets - aka artificial scarcity - is a product of the mediocre mind. Exponential growth and real social progress comes from the idea of "growing the pie". It's weird how people don't use that phrase anymore since it has become such a foreign concept at this point.

Bitcoin (and now Ethereum), NFTs, real-estate (both IRL and the metaverse), healthcare, education, and the economy as a whole has succumbed to the "scarcity mindset" and is in danger of collapsing on itself since it doesn't know how to grow its ecosystem from its base.

Those mythical 100000x returns doesn't come from flipping or nickle-and-diming individuals but from growing the ecosystem as a whole. To keep the good times going, the response should be to increase capacity, not try to ration out your existing stock.

Ethereum was particularly disappointing to watch this year because they had the capability to be so much more but chose the mediocre path when they started burning their own supply. Like Bitcoin, they put an expiration date on themselves and can now only expect modest returns from here on out.

To be fair, "growing the pie" is very difficult and requires a higher degree of creativity and ability to spot new win-win scenarios from seemingly thin air. But that's why we have geniuses and entrepreneurs to fill that role that typical biz-dev types are unable to do.

As the scarcity economies continues to do what it does - shrink - it's unfortunately going to take innocent bystanders with them. We're going to find that most of our tax dollars have been working to keep the illusion of sustainability rather than of real growth.

But the silver lining is that as the status quo continues to implode on itself, the opportunity to grow the pie once again becomes possible. It's a cycle that has happened before and will happen again. With that, it's at least possible to navigate through the chaos. Good luck, folks. 🤞

USD Index Recession Depression and TransgressionGood Morning All ,

It has been a long while since I posted, but it has also been along time since I have been active in trading as well. i squared off my positions and just been speculating and watching the craziness that continues to unfold. For some of the OG Traders out there you might have come across my stuff in the past, but for some of the new guys new to trading what a time to be alive. To re-itterate some points I have made in the past I am not political I consider myself a centralist with right sided tendencies. (because of my views about business and taxes) . this post will be rudimentary in aspects for people that live here in the US. So if not interested then skip the italicized section.

okay, what we have here is the dollar index, and its basically a measure of strength of the US' economy against 8 other countries. Now, I live in the US and here is a very basic political breakdown of our political system

republicans- it's the political conservatives of the country and business liberal. Meaning that they hold traditional values when it comes to policies and encourages borrowing for business growth and borrowing for political agenda.

Democrats- it's the political liberals of the country and business conservative. Meaning they hold progressive policy values and encourage high taxation to fund their political agenda.

We need both in the US to keep the balance to much right sided-ness we fall into a communists like state and too much left sided nss and we fall into the hands of socialism. so a health mix of both is needed to keep us in check.

Now, the world is coming into hard times because of the US' liberal fiduciary policies as of late and now we are trying to reel that back. The US is the world reserve and will continue to be for the foreseeable future, and the reason i say that is I don't see the world entrusting China to report the truth of the Yuan's value if it were to become the reserve currency of the world. I know a lot of people think that china is the next super power to rise and become the reserve status of the world, but until they become more transparent i don't see it happening. The only country I see rising to take that spot is the UK. They have the second largest FREE trade economy of the world, and could potentially return to the reserve status. The EU stands a chance, but I don't see Germany being able to support the world economy that would be required to make the EU possible. Basically, which demon do you want to deal with, because none of the options are ideal.

Now, if some of the EU countries that takes from the Euro really step their game up and produced for more the euro instead of take then they could become a viable option too, but as far as china I just don't see the world entrusting them to hold that type of power. I mean their housing market is currently a Ponzi Scheme, and their having to use military force to keep citizens from breaking into the banks to get their money back out. The US' SEC a year or two ago placed harsh restrictions and banned a lot of Chinese companies from the US open tradable market, because they were cooking their books and inflating earnings and deflating expenses, and rumor has it that the chinese government knew about it and allowed it, to continue to boost their economy via foreign monies.

Back to the Dollar, the Dollar index has an inverse relationship with the NASDAQ, S&P 500, and the Dow Jones Industrial Average.

Why?

Because, the DXY is a visual representation of the current status of the Economy. When the dollar was in the 8X's the last two years times were good, people were making a lot of monies while spending and living the good life?

Why? because the Fed made money cheap. So, the cost of doing business was cheap profits were just as large as the margins. So, business operations got fat in the sense of a CEO or C-Suite personnel needing 2-3 assistants and having bean counters to double check the primary bean counters. Now, Powell has consistently held to his target inflation rate of 2% its all over the FED's website and echoed in his speeches. which is the reason of his 75 base point interest rate hikes.

What I see coming is another Great Depression. Because for many of the technical traders in the world there is more to a company than numbers on a chart. Investors large and small make monetary contributions to these companies in return for returns. well during COVID-19 money flooded the market and business were able to continue to run. Since the beginning of COVID I knew a lot of businesses were in trouble because they were publicly reporting inflated numbers to the SEC, and the SEC TOOK THEM?!?! So it looked like these businesses were doing way better than they actually were, and now their board of directors and shareholders expect them to continue to run at that level.

Now, that money is drying up and these businesses are about to lose their funding from both ends. On one end their investors (already starting) are squaring off their positions. So, one way to prop up the facade of success is to do massive layoffs to trim the fat. Run the business very lean. That doesn't boost revenue that really just stabilizes the load. putting a plug in a hole on a boat as it were. These massive layoffs lead to lower GDP and two consecutive reports of shrinkage equals a recession.

The Fed Continues to raise interest rates making the dollar expensive to do business. When someone looks at a business' 10K and finds their balance sheet or earnings they will see massive amounts of debt. this debt is typically owed to a major lending institution. These loans, though not designed for the purpose, they are used to fund operations and growth. good businesses have cash on hand to pay off loans in times of hardship and inexperienced leaders are frivolous with the tax-free money. When this money becomes more expensive businesses can no longer afford to take loans out and are forced to remain the same, shrink, sell-out to a competitor, or go out of business all together.

part of the problem is that it now keeps people working because they lost 10-12 years out of their 401k due to the stock market correction, students coming out of college with massive amounts of student loan debt and are forced to take a job making 10-15 dollars an hour with student loan payments being around 300-1000$ a month which will lead to defaults because they cant afford to live alone, and are going to move back in with their parents. and hopefully their parents are not retired, because if so they're going to have to help their family with utility bills and mortgages and care less about their student loans. much less if their parents don't make the cut at work due to the layoffs.

Now, this causes a major problem because those once employed people are now jobless and can no longer keep their payments to their mortgage company. And now these mortgage backed securities are going to start imploding on the people that bought them and repeat 2008.

This is just the inherit fallout of these type of securities. I mean i understand their purpose, which is used to get back money to keep the velocity of money up, but no matter the credit score if a person loses their job and can not find work then payments are going to be missed.

this will ultimately lead to a depression.

what saved us last time from a depression was the US " FOUND " weapons of mass destruction and we launched an all-out attack on Iraq. and then when we finally "FOUND" said weapons we then decided to focus our attention on the people that attacked us on 9/11. But, this is not the only time the US used war to re-bound out of a depression, WW1 aka the great war ramped up our economy and we were magically out of a depression and then shortly aft Dub Dub 1 we found ourselves in Dub Dub 2. the pattern is repeated over and over in our history. the cold war got us out of the stink in the mid 80's with the cold war, and gulf war in the 90s.

will the US find Hillary Clinton's Emails in China and now we go to war with china? Who Knows. (this was sarcasm)

I think we need a business savvy executive whether man or woman to be elected as president and get the country back on the rails. We need good monetary policy in place, we need to support small business here in the states to keep big businesses from becoming monopolies and drive prices down. we need more diversity in the economy. Because a more diverse economy = a cheaper place to live.

with all of that being said I forsee dollar to continue to get more and more expensive with the minimum being 12X.xx, median being in the 14X.xx and the maximum being somewhere around 15X.xx. I see interest rates forcing everyone's hand to show what their hiding. I see weak businesses going under, smart strong businesses staying afloat and will grow exponentially when the storm passes.

another potential thing is that the FED might think they over extended and might bump interest rates down or keep them the same for a brief time (this is a temporary fix), but I still see them raising rates to get back to 2%.

this is not financial advice, but my play book is to continue to sit on liquid cash and I would say a good indicator for me to jump back in is to see 4 or 5 maybe even 6 Fed meetings where the interest rates remain unchanged or begin to drop consecutively. So gather all your pennies, begin to live lean, and when the fed begins to keep interest rates unchanged begin to look at who is still walking around Wall St. and think about investing with them.

i do think if the US votes with their intelligence and not their emotions we can avoid all of what I wrote. and I truly do hope I am wrong!

@TayFx crazy to see man how two years ago we were called perma-bears and crazy and now we look like Wall St. prophets. LOL Hope all is well bud! HMU when you get a chance!