Bitcoin - More blood coming! Buy 57k (extremely strong support)Bitcoin is currently in a very sharp decline, because the price dropped in the past 4 months by 53%. A lot of people didn't expect such high volatility because they are even new to the market, or they thought that ETF would reduce the overall volatility of this market. The truth is that the market is still extremely volatile, and all ETF investors may be at a massive loss on their account later in 2026, when the price drops to the all-time low of these ETFs. What is my prediction in the short term, and why will Bitcoin probably continue to go down in the next days / weeks ?

I see 2 main issues with the current price of Bitcoin. The first is that Bitcoin still didn't hit the 0.618 Fibonacci retracement of the previous bull market (2022 - 2025) - this fibo sits at 57,772 USDT. That's the first magnet. The second issue is that Bitcoin still didn't hit the parallel channel's trendline (blue descending channel on the chart). Before any pumps, I would like to see at least 1 of these 2 conditions met, so either hit the trendline or hit the 0.618 fibo.

From the Elliott Wave perspective, these are corrective types of waves, even though they are very sharp. I am still missing the last (Y) wave of the complex corrective wave (W)(X)(Y). I would also like to see a bearish divergence on the RSI indicator. The RSI indicator is oversold, but there is still no divergence, so that's another issue with what I see on the current price of Bitcoin. I am bearish, and I think Bitcoin will hit 57k in the short term. The banks and huge institutions want liquidity as much as possible before a new all-time high, so they want to take all your stop losses.

Write a comment with your altcoin + hit the like button, and I will make an analysis for you in response. Trading is not hard if you have a good coach! I am very transparent with my trades. Thank you, and I wish you successful trades!

Elliott Wave

GOLD - Consolidation above 5000. Awaiting NFP...CAPITALCOM:GOLD consolidates above $5,000 in anticipation of key data from the US. Economic data may set the medium-term tone for the market. A long squeeze before the move cannot be ruled out...

Central banks continue to buy metal, expectations of a more dovish Fed policy weaken the dollar. Easing tensions in the Middle East and growing risk appetite in global markets support the gold trend.

Ahead of us are the Employment Report (NFP) on Wednesday and

Inflation Data (CPI) on Friday .

These data will determine further expectations for Fed rates and the direction of the dollar.

Gold is in a state of equilibrium ahead of the release of critical data. A sustained breakout from the current range ($5000-5100) is likely only after the release of US employment and inflation reports, which will clarify the trajectory of the Fed's monetary policy.

Resistance levels: 5047, 5098, 5100

Support levels: 4946, 4902, 4811

The zone of interest and liquidity within the current movement is the 4950-4940 area. There is a possibility that during the transition from the European to the US session, the market will test this area before growing. However, a premature breakout of 5047 and a close above 5050 could trigger a rally to 5150-5250.

Best regards, R. Linda!

Gold at Key Resistance — Is This the End of the Correction?Gold( OANDA:XAUUSD ) is currently moving near its resistance zone($5,191-$5,097).

From an Elliott Wave perspective, it appears Gold is completing the microwave 5 of the main wave C, with the corrective upward structure likely a Zigzag correction (ABC/5-3-5).

Also, we can see a negative Regular Divergence(RD-) between two consecutive peaks.

I expect that upon entering the resistance zone($5,191-$5,097), gold will likely resume its decline and reach at least the targets I’ve identified on the chart.

First Target: $4,953

Second Target: $4,827

Third Target: $4,703

Stop Loss(SL): $5,221

Points may shift as the market evolves

What’s your view on gold’s trend this week? I’d be happy if you share your thoughts in the comments!

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

BITCOIN - From the DISTRIBUTION phase to the CONSOLIDATION phaseBINANCE:BTCUSDT.P tested 60K during the current cycle and formed a fairly significant pullback to 70K. However, it is too early to talk about a bullish trend; this is just a reaction to liquidation. The cycle continues...

At the moment, the decline is 52%, which is historically within acceptable limits and is a relatively average indicator.

Fundamentally, there is no support for the crypto market, and Friday's pullback was supported by the recovery of the US stock market.

Global and local trends are bearish, and local spikes in volume and bullish impulses are possible in the hunt for liquidity, which should be viewed conservatively.

The price has entered the key trading channel of 53K - 73K and is likely to stop within the current cycle and form another trading range, which may subsequently reinforce the reversal momentum. Key liquidity zones have not yet been tested: 59650 - 53330.

Resistance levels: 71,900, 73,800, 82,200

Support levels: 65,000, 59,650, 53,330

How can we tell that the market is ready to reverse? Technically, the reversal phase does not come immediately after distribution, the cycle of which is still ongoing. The market must enter a consolidation phase with the gradual formation of sequentially rising lows/highs. The breakdown of local structures + the market holding above key resistance levels will hint at a positive market sentiment.

Thus, we are waiting for the formation of an intermediate bottom and a change in the market phase from distributive to consolidation...

Best regards, R. Linda!

EURUSD - Breakthrough of consolidation resistance. Growth?FX:EURUSD is ending its correction. A breakout of resistance and bullish momentum are forming. If the market maintains its current direction, the price could reach 1.197-1.210 in the medium term.

The dollar is falling due to the rise of the Japanese yen after early parliamentary elections, the impact of which may be medium-term.

After the dump, the currency pair formed a consolidation that stopped the local downtrend. The weakening of the dollar triggered a breakout of resistance. The exit from consolidation and the bearish wedge is a fairly strong bullish signal. The market may form a retest of 1.1829 before breaking through 1.1875. If the bulls break through resistance, the medium-term bullish trend may continue.

Resistance levels: 1.1875, 1.1972

Support levels: 171829, 1.1778, 1.1769

After consolidation, the market has entered a distribution phase. Given the current trend, the weak dollar, and the current market phase, there is potential for continued growth.

Best regards, R. Linda!

The Wave B Rally is Here! Massive Bull Trap?🏆 Hello Gold Fellas FX_IDC:XAUUSD ! 🏆

The last couple of days since that "Red Friday" 🔴📉 have sparked plenty of rumors about where we are headed next. While the big picture is still coming into focus, things are starting to look much clearer—we just need a little more patience! ⏳🔍

🎭 The Story So Far: Wedge Breakouts & Geopolitics

To understand where we are, we have to look at how we got here. Last week, Gold was trapped in a Falling Wedge 📉📐, looking for a reason to move. That reason arrived on Wednesday the 26th! 📰💥

Initially, news broke that the US had canceled planned talks with Iran 🚫🇮🇷. However, in a classic market "plot twist," they stepped back shortly after, and the talks were ultimately held this past Friday. 🤝🔄

The Bulls 🐂 seized this moment of volatility and headline confusion to smash through the upper border of the Wedge. This triggered a bias change and set the stage for the current momentum we are seeing! 💥🚀

🌊 Elliott Wave (H1/M15/M5)

I’ve just completed a analysis on the H1 timeframe, breaking down the M15 and M5 subwaves. 🌊📊 My conclusion? Gold is likely navigating Wave B 🌊⬆️. Specifically, Subwaves (c) and (v) are currently finding their way up.

But the big question is: How far will this rally lead? 🤔💸

📈 The Weekend Gap & Asia Bias

Depending on the bias for the Monday Asia Session, we are already seeing strong signals for a GAP up! 🚀 Since the market closed on Friday at $4,967, Gold has already increased by +$50 over the weekend 💵✨ (as of this writing, two hours before the Asia open). 🌏🔓

🎯 Technical Targets & Fibonacci Levels

The upward direction should lead us to these key levels:

61.8% Fibonacci at $5,142 🎯✅

78.6% Fibonacci at $5,342 🏔️🚀

(Overshooting these levels is definitely on the table!) 📈🔥

🐻 The Wave C Warning

Once Wave B is fully executed, stay sharp! ⚠️ We will likely enter a sideways phase 🦀 with plenty of false breakouts 🤡 designed to trap late buyers before the market gets stomped into the ground by Wave C. 📉💥

The A Wave was a clean (i) to (v) move 📉📏. I expect Wave C to follow suit with a clean impulsive move down. 📉📉 This will take time—perhaps later this week, or slightly later. 🗓️🐚

⚡ The Failure Scenario

If Wave B fails and the price cannot break above the 78.6% Fibonacci level, prepare for a very quick move down ⚡📉. My ultimate target in that scenario is below $4,200. 🌑📉

Let’s see what Monday brings! ☕💹 Good luck and happy trading! 🍀💸🚀

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

SOL, Finding support for a bottom?CRYPTOCAP:SOL took a hit last week on the capitulation event, printing a strong bottoming candle with a long lower wick.

Price has now reached my wave 4 ytarget of the 0.382 Fibonacci retracement at the major High Volume Node support, between the S1 nd S2 pivot.

Daily RSI hit oversold, but with no divergence. The trend remains down, below the daily pivot and daily 200EMA, but could be finding a bottom soon.

Safe trading

CLSK Still in a triangle, nothing change on the weekly/macroNASDAQ:CLSK remains firmly in the macro triangle boundaries and has not penetrated wave E on last weeks dumping price action.

In fact, wave (2) is still alive and now printing weekly bullish divergence!

Fib depths for the triangle remain deep 0.786+ which is a characteristic of triangle.

Price left a long lower wick and Friday closed at the high of a 22% bullish engulfing daily candle. Closing at the high on a Friday is a significant move as it shows investors are confident in holding over the weekend news cycle and Bitcoin price action.

The goal is still to break wave D to end the triangle and thrust us in our final move to take profits around $40. This will be highly likely one we get back above the weekly pivot and 200EMA ~£14.

Safe trading

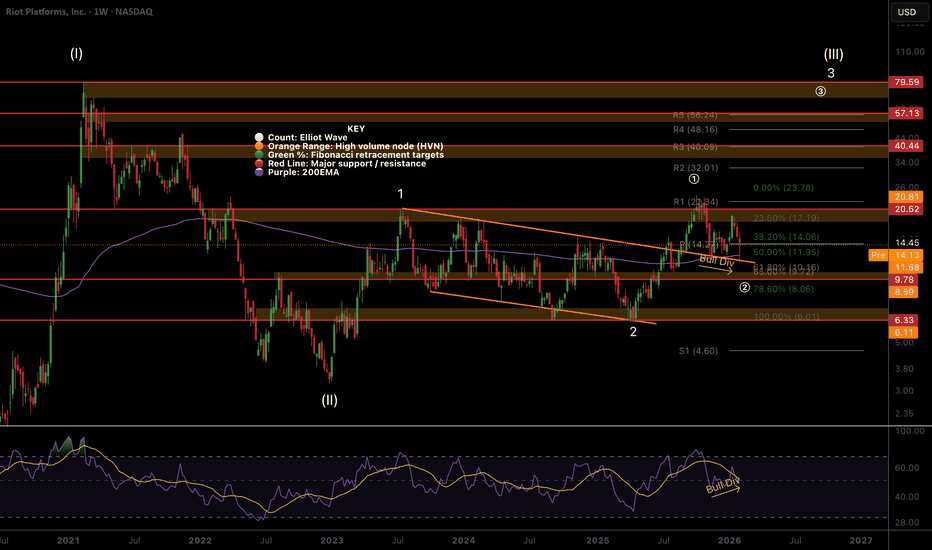

RIOT entering Wave (3) of 3 of III?This will be crazy if so...NASDAQ:RIOT has been trying to go on a tear for months, but keeps getting knocked back by broader economic and BTC uncertainty.

Price is testing the weekly 200EMA and previous range trend-line with RSI printing bullish divergence at the EQ, a bullish sign. Price recovered the weekly pivot, leaving a long lower, bottoming wick. All of this is just above the golden pocket Fibonacci retracement.

It closed Friday at the high of a 20% candle. Closing at the high on a Friday is a significant move as it shows investors are confident in holding over the weekend news cycle and Bitcoin price action.

Elliot Wave (3) of 3 of III will be crazy fast and bullish, hitting my $80 target at the very least.

Safe trading

HBAR Macro Chart, Wave 2 complete, ATH incoming?CRYPTOCAP:HBAR wave C of 2 ended in the expected area, the 0.786 Fibonacci retracement of wave 1, at a high volume node. This is the altCoin golden pocket where low-caps have the highest probability of reversing from. A long weekly lower wick was left on daily bullish engulfing candles.

If that was wave 1 then wave 3 should be powerful and take price into all-time high and beyond, with targets of the weekly R3-R5 pivots, $0.6-$0.8.

Weekly RSI has a little room to push lower into oversold but also gives it roo to produce a weekly bullish divergence. First target s the weekly pivot at $0.2.

Safe trading

Bitcoin Breaks Major Support — Extreme Fear or Another Leg Down?Bitcoin ( BINANCE:BTCUSDT ), as I highlighted in my previous weekly idea , started its decline. The drop came with higher momentum than expected, surprising many, and it successfully broke the heavy support zone($78,260-$64,850).

Now, here are the fundamental reasons for Bitcoin’s movement in the last 24-48 hours, as well as the general context:

•Global Risk-Off Sentiment: Investors moved away from high-risk assets as global equity markets—especially tech stocks—came under heavy selling pressure.

•Lack of Strong Spot Demand: There was no meaningful inflow of fresh capital to absorb selling pressure at key support levels.

•Institutional Pressure & Unrealized Losses: Large BTC holders and public companies with Bitcoin on their balance sheets reported increased unrealized losses, weakening market confidence.

•Correlation With Traditional Markets: Bitcoin continued to trade as a risk asset, following the downside momentum of global financial markets.

•Forced Liquidations: High leverage across the market led to cascading liquidations, accelerating the downside move.

Bitcoin Fear & Greed Index is currently at 9 — marked as “Extreme Fear”.

This is the lowest reading since June 2022, when the market sentiment collapsed following major events like the Terra crash.

Historically, when the Fear & Greed Index dropped this low, Bitcoin experienced prolonged selling pressure and volatility, followed by eventual stabilization as fear subsided. Extreme Fear readings often coincide with market bottoms or oversold conditions, but they do not guarantee an immediate price reversal.

In short: Extreme fear can signal that market participants are overly pessimistic — possibly a contrarian buying environment — but confirmation from price action and other indicators is crucial before assuming a trend reversal.

Now, let’s take a quick look at Bitcoin’s 4-hour chart to assess the current situation.

It appears that Bitcoin, given its momentum, has successfully broken the heavy support zone($78,260-$64,850) and is currently pulling back toward that zone.

From an Elliott Wave perspective, it seems we are in the final stages of the main wave 4. After this pullback near Fibonacci levels, we anticipate another decline. Since the drop’s momentum has been strong, wave 5 could potentially be truncated.

I expect Bitcoin to resume its drop from one of the Fibonacci levels or Cumulative Short Liquidation Leverage($68,900-$67,200), targeting at least $64,123.

First Target: $64,123

Second Target: $62,103

Stop Loss(SL): $72,033

Points may shift as the market evolves

Cumulative Long Liquidation Leverage: $60,000-$58,000

CME Gap: $84,560-$79,660

CME Gap: $54,545-$52,980

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

USDJPY Buy Zone ActiveToday, I want to share with you a long position on the USDJPY ( FX:USDJPY ) currency pair. In this idea, I will analyze USDJPY from a fundamental and technical perspective .

Stay with me.

This long isn’t just technical for me — the fundamentals still lean USD-positive vs JPY.

1) Yield/rate gap = the core driver

As long as US yields stay meaningfully above Japan’s, capital flows tend to favor USD, and USDJPY reflects that divergence very cleanly.

2) JPY remains structurally fragile

Japan’s policy stance is still relatively accommodative, while growth/inflation dynamics keep the yen sensitive — so when USD firms up, JPY often underperforms.

3) Key US data week = upside catalyst

With major US releases this week, any upside surprise can revive the “higher-for-longer” narrative — typically supportive for USDJPY longs.

Bottom line:

As long as the US retains a yield advantage and Japan stays cautious, the fundamental backdrop supports a bullish USDJPY bias.

--------------

Now let's take a look at the USDJPY chart on the 4-hour time frame.

USDJPY is currently moving near the support zone(155.100 JPY-154.120 JPY) and the Potential Reversal Zone(PRZ) .

From the Elliott wave theory perspective, USDJPY seems to have completed the corrective Zigzag wave(ABC/5-3-5), and we can expect the next impulse wave.

I expect USDJPY to continue to move up in the coming hours and at least increase to the resistance zone(157.900 JPY-157.400 JPY).

What is your opinion on USDJPY this week?

First Target: resistance zone(157.900 JPY-157.400 JPY)

Second Target: 158.81 JPY.

Stop Loss(SL): 154.51 JPY.

Points may shift as the market evolves

Please respect each other's ideas and express them politely if you agree or disagree.

📌 U.S. Dollar/Japanese Yen Analyze (USDJPY), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

$COIN: reached 200 W SMA. Looking to $260 resistanceNASDAQ:COIN : Buying at 200W SMA for a long term position should pay off well.

We finished a 5-wave sequence before the downtrend for a Wave II. We've had a 3-wave sequence to the bottom. This can be all of the Wave II or only A of Wave II. I believe it'll bounce in a Wave B or a new 5-wave sequence. Either way, the next wave is up.

I'll be watching the 38.2% retracement at around $260. My plan is to trim my position a bit at this level with the intention of buying them back in a pullback to lower my average cost.

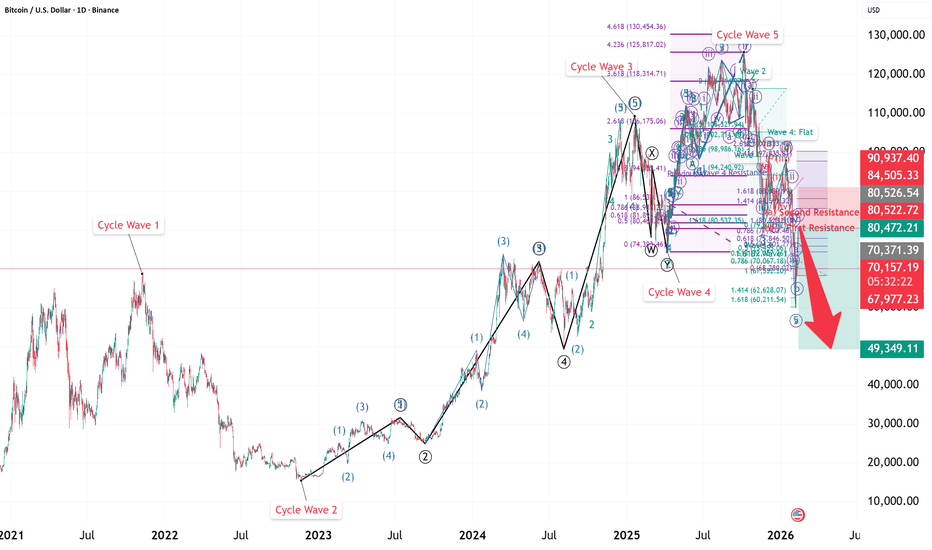

Bitcoin Short-term Long and Long-term ShortIn this video, I gave a walkthrough on the wave counts for bitcoin, revising on the big picture cycle level count, and then go into details on the 5-waves breakdown of the down move in Bitcoin.

I believe that Bitcoin will rally in a correction and move up to $80,472, the first resistance set by the previous wave 3 low and then go down for a wave C with the first target of $49,350. But that is not the ultimate target. The ultimate target sees Bitcoin falling to around $15,000, which is the cycle wave 2 low.

Good luck!

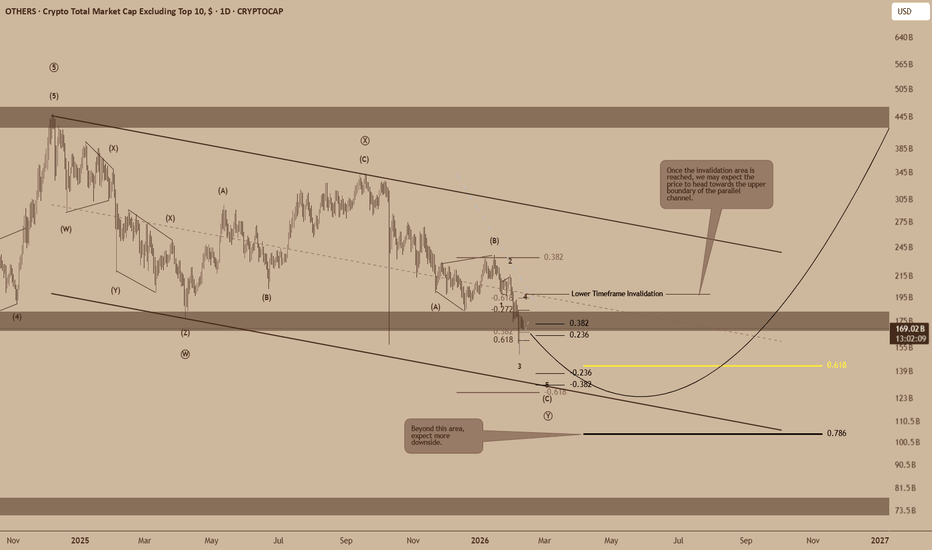

OTHERS: Structural Weakness Remains Despite Short-Term Relief The broader cryptocurrency market (excluding the top 10) continues to display structural weakness, with price action favoring additional downside before any sustainable recovery can be considered. While short-term relief remains possible, the dominant Elliott Wave structure and Fibonacci confluence suggest that bearish targets are still active at the macro level.

This analysis focuses on structure, alignment, and proportionality, rather than short-term price noise.

Price remains confined within a descending channel, respecting both its upper and lower boundaries with notable precision. The recent rejection from the channel’s upper half reinforces the idea that the prevailing trend is corrective rather than impulsive.

The broader pattern can be interpreted as a complex corrective structure, where price is currently developing the latter stages of a zigzag-style move. Despite intermittent bounces, market behavior continues to favor trend continuation to the downside.

ELLIOTT WAVE BREAKDOWN

At the macro level, the structure is unfolding as a corrective sequence, rather than the start of a new impulsive advance.

The larger move can be interpreted as a zigzag (A)–(B)–(C).

- Wave (A) completed with clear internal subdivision.

- Wave (B) retraced into Fibonacci resistance, failing to reclaim the prior structure decisively.

- Price is now progressing within wave (C), which itself subdivides cleanly into a five-wave structure.

Internal Structure

Within wave (C), the chart highlights:

- A clearly defined 1–2–3–4–5 sequence on the lower timeframe.

- The smaller, darker Fibonacci measurements correspond to this micro impulsive count, used to confirm momentum and internal symmetry.

- These internal waves align with the broader corrective expectation, reinforcing the bearish scenario rather than contradicting it.

Downside Expectation and Macro Targets

As long as price remains below the descending channel resistance, the expectation is for continuation toward the macro 0.618–0.786 retracement zone. These levels align with:

- Channel support

- Completion of wave (C)

- Fibonacci extensions of the broader corrective structure

A sustained move beyond the 0.786 region would signal further structural weakness and likely imply that the correction is not yet complete.

Lower Timeframe Invalidation: A Conditional Note

While the macro outlook remains bearish, the chart clearly highlights a lower timeframe invalidation level.

- A break above this level would suggest the possibility of a short-term uptrend or relief rally.

- Such a move would likely target the upper boundary of the parallel channel, rather than signal a full trend reversal.

- Importantly, this does not invalidate the macro bearish structure unless followed by impulsive continuation and structural confirmation.

In other words, any upside above the lower timeframe invalidation should be viewed as corrective unless proven otherwise.

CONCLUSION

The broader crypto market continues to trade within a corrective framework, with downside risk still dominant despite the possibility of temporary relief moves. Elliott Wave structure, Fibonacci symmetry, and channel dynamics all point toward lower levels being required before a meaningful macro reversal can occur.

What makes this analysis particularly compelling is the alignment across degrees, from micro wave counts to macro Fibonacci targets, where multiple measurements converge at similar bearish levels. This type of structural agreement strengthens confidence in the roadmap, even as short-term volatility persists.

As always, structure leads, and price confirms.

MSTR has likely found a bottomNASDAQ:MSTR has a huge bullish engulfing candle on Friday, 26% closing at the high. CLosing at the high on a Friday is a significant move as it shows investors are confident in holding over the weekend news cycle and Bitcoin price action.

Saylor continues buying weekly including today, now lowering his cost average as he below. He still has 2 years worth of USD to survive a pro-longed bear market and STRC continues to give him more capital.

Wave 4 hit the 0.5 Fibonacci retracement where it can not go beyond, per the rules. Any lower would invalidate the Elliot wave count and it would become wave 2. Which means wave 3, the most powerful is still to come....

Weekly RSI printed a huge bullish divergence at a major High Volume Node resistance in oversold, with a long lower wick being left. You cant get better bottoming signals than all of these confluences.

MSTR may be a good proxy for judging BTC bottoms moving forward, following institutional flows.

All of this said, the trend is down, the weekly 200EMA and pivot are lost. Don't fade the trend, wait for the reversal signal in price action. Overcoming these 2 areas is the first challenge to cement a new bullish trend in place.

Safe trading

COIN, Elliot wave degree changed, Wave 2 complete?NASDAQ:COIN has a larger sell off then expected completely falling out of its rising wedge. This suggests that the top was a wave 1, completing 5 wave ups diminishing with wave V, with a poke above all time high, IPO launch.

The Elliot wave count is textbook. Wave C of 2 looks to have complete 5 waves down, just below the weekly 200EMA at the major High Volume Node support, 0.382 Fibonacci retracement. While the trend remains down and below the weekly pivot I think Friday was a capitulation event and we move up from here. Theres always a sweep of the lows possible first.

Friday closed at the daily candle high, showing investor confidence to hold over the weekend news and BTC price cycle.

Weekly RSI is tapping oversold, with slight hidden bullish divergence.

Safe trading

ONDO Wave 2 survived, just...LSE:ONDO is having a significant pullback compared to other alts despite the RWA narrative, which is frustrating.

It came just shy of making a lower low, but did not make one, keeping wave 2 alive.

A bottom is likely in on crypto, let's see if Ondo can come back to life or if it shows relative signs of weakness.

Safe trading

TTWO - Major CorrectionLet’s continue breaking down the corrective structure in Take-Two Interactive Software.

The peak was set back in January 2021, and the move since then is part of a broader correction.

Wave A finished in November 2022, and Wave B followed.

By October 2025, Wave B ended, a new high was made within the correction, and Wave C has kicked off.

This is an expanded flat correction.

Wave C is a five -wave impulse, which we are now tracking.

Here’s a look at the previous idea:

The start of the impulsive moves was marked correctly.

Current structure:

The move from October 2025 is the main impulsive wave

The move from late December 2025 is Wave 3 within that impulse

Right now, within wave 3 , a local pullback of 8-12% from the current level is possible:

After that, the impulse should continue:

Next comes a subwave correction:

Finally, the main impulse should complete:

The plan assumes 50-60% retracements, but in reality pullbacks can be smaller, around 38% .

Keep in mind: down moves are usually faster than up moves.

Key level to watch: 171

If it holds, the stock could still push higher and make new significant highs.

Conclusion:

Wave C is moving down

We’re navigating between the described corrections and targets.

Key targets:

128

105

Potential move from the current level: 33-46%

---

Subscribe and leave a comment.

You’ll get new ideas faster than anyone else.

---

EURUSD: Bullish Wave and Retest of TriangleFX:EURUSD

A five (5) wave bullish impulse was completed on July 1, 2025.

The market promptly entered into an ABCDE triangle consolidation with ABC sub waves within each consolidation wave.

At the end of the last corrective wave (wave E), price broke out of triangle consolidation.

The triangle was retested, ending at exactly the 61.8% Fibonacci retracement level, marking the new wave 2.

A bullish engulfing candle on the daily (1D) timeframe and a Double Bottom on the 4H timeframe, the neckline of which hasn't been broken yet, is observed.

Gold ABC Correction | Wave C to 3,652 $ if B Stays Below 0.618📊 Current Structure

Gold is developing a classic ABC correction on the 4H chart:

•Wave A: Completed (initial drop) ✅

•Wave B: Currently at peak retracement testing 0.618 Fibonacci (~5,100)

•Wave C: Projected target 3,652 USD

Wave B has an internal W-X-Y corrective structure and is now testing critical Fibonacci resistance levels.

🎯 Main Scenario: Wave C Projection (CONDITIONAL)

IF Wave B stays below 0.618 Fibonacci (~5,100):

•Target (Wave C): 3,652 USD

•Projected move: -1,386 points (~-28%)

•Key level: Price must reject at or below 0.618 for this scenario

⚠️ Alternative Scenarios

1.If 0.618 breaks → Wave B extends to 0.764 (~5,300) or 0.854 (~5,400)

2.If price breaks above 0.854 → Wave B invalidated, ABC structure fails (potential new bullish leg)

🔒 Risk Management

Conditional setup: Wave C is valid ONLY if 0.618 holds. Monitor price action at 5,100 closely. If broken, reassess for extended Wave B scenario.

📉 Not financial advice. Trade at your own risk.

Ethereum Wait to Short with Stop Loss at 2654.Over in this video, I updated the wave counts for Ethereum and explain talk about the primary count and alternate counts. I also explained why in terms of risk management, we have to use the primary count (the alternate count invalidates with new ATH).

Given that the risk-reward is not good at the time of publication, I recommend shorting only when either of these 2 conditions are fulfilled:

1. Price is near $2620 (the invalidation price of primary count).

2. When a clear 3-waves (e.g. 5-3-5) has unfolded.

The stop loss for any short will be above $2620, and I would put it at around $2654 just to make sure. Adjust your size accordingly.

Good luck!