Fibonacci

HUT Short-term analysis | Trading and expectationsNASDAQ:HUT

🎯 Price jumped back up following my path. Wave 4 of V was indeed complete at the 0.382 Fibonacci retracement and High Volume Node just above the daily 200EMA. The daily R1 pivot has been claimed. The uptrend is well intact.

📈 Daily RSI is showing bearish divergence as price falters

👉 Analysis is invalidated if we close below wave 4, $30

Volatility analysis | Expected range & extremities

🎯 Hut is in the SD+2 overheated zone, where it is expected to spend <5% of the time. Price has a tendency to rally above the SD+3 threshold before being rejected, characteristic of low-cap assets. Price is well above fv, traders should be cautious

👉Fair value is ~$20

Safe trading

COIN Short-term analysis | Trading and expectationsNASDAQ:COIN

🎯 Price continued lower, ignoring all bullish divergences, though another is forming. Price has filled the gap and sits in the golden pocket. The bears are in control.

📈 Daily RSI has printed bullish divergence from oversold, a strong bottoming signal.

👉 Analysis is invalidated above $263, suggesting a major bottom is in

Volatility analysis | Expected range & extremities

🎯COIN behaving as expected. Price tested the SD+2 threshold 3 times and was rejected to fv each time. No momentum took hold despite COIN’s big run. Price is at fv.

👉Fair value is ~$225

Safe trading

CLSK Short-term analysis | Trading and expectationsNASDAQ:CLSK

🎯 Price is back at the daily 200EMA and above the pivot, below major resistance after finding support at the orange trend line and golden pocket. The direction is ambiguous, but I am leaning to further upside this week

📈 Daily RSI sits at the EW, flipped bullish but with no divergence.

👉 Analysis is invalidated if price falls below wave (2) at $9

Safe trading

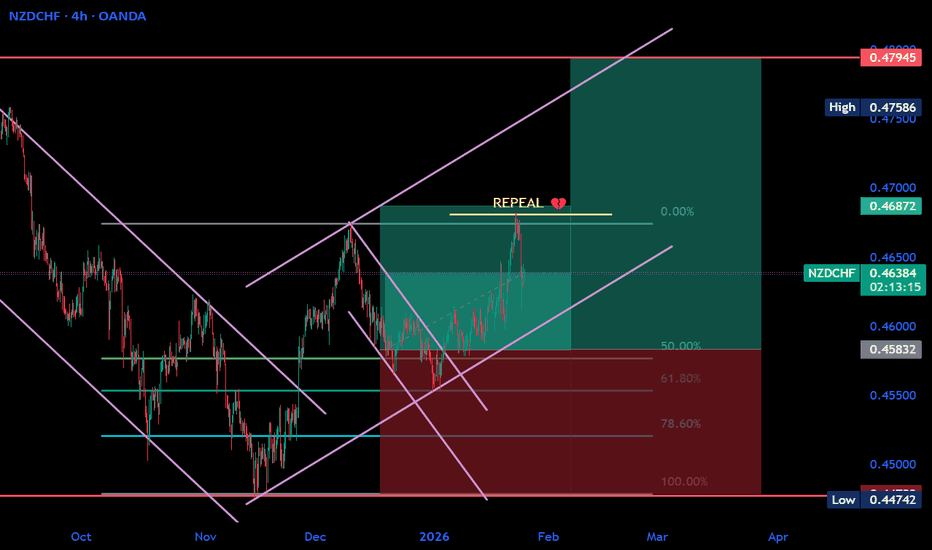

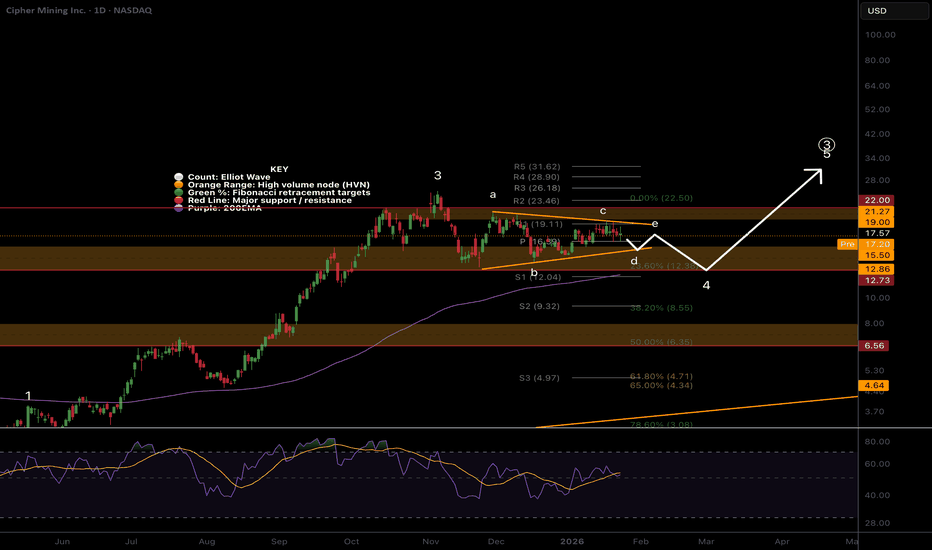

CIFR Short-term analysis | Trading and expectationsNASDAQ:CIFR

🎯 The triangle has flipped to a bearish-looking triangle. This is a penultimate pattern, we can expect price to thrust lower, test the daily 200EMA, end the correction and then makes its way to new highs. l pattern Wave d of the triangle may still be underway, wave e is expected to end at the daily pivot where price currently sits, above the daily 200EMA, showing the uptrend is still intact but flattening.

📈 Daily RSI is neutral, reflecting triangle dynamics

👉 Analysis is invalidated if price falls below wave b or above wave a.

Safe trading

BTDR Short-term analysis | Trading and expectationsNASDAQ:BTDR

🎯 Price overcame the daily 200EMA, major High Volume Node and Pivot, showing a strong bullish trend is in play. It has pulled back to test the 200EMA and support node, normal behaviour. Wave C looks underway toward the $25 target.

📈 Daily RSI printed bullish divergence.

👉 Analysis is invalidated if price falls below wave (B), 9.50, and the structure will start to look bearish.

Safe trading

EURUSD - Correction StartsThe move since November 2025 is viewed as a corrective wave B within the fifth wave of the larger structure.

The impulse that started in January 2026 is considered one of the internal impulses of wave B and now appears complete.

We are starting a correction of this impulse.

Main targets:

1.7721

1.7347

1.6972

A possible scenario is that the top of wave B has already been formed, and the market may begin a series of impulsive moves to the downside, forming wave C , as described in an earlier idea.

For now, however, it’s too early to draw conclusions.

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

US 100 Index – Navigating the Fed and Mega Tech EarningsIn a week packed with volatility for financial markets as traders rode the headline rollercoaster led mainly by President Trump’s ever-changing approach to foreign policy, trade issues with European allies, and fresh challenges to Federal Reserve independence, the US 100 outperformed many other global indices. Investors decided to rotate back into technology stocks on the dip, taking advantage of the gap open on Monday 19th January at 25289 and then the drop to a low of 24881 on Wednesday (21st), before eventually pushing the index higher to a close on Friday at 25546, which was a weekly gain of 1%.

Much of the positivity was driven by, yes you guessed it, AI and in particular NVIDIA, who as a company not only had a strong showing at the World Economic Forum in Davos, Switzerland but also benefitted from news that suggested Chinese authorities may have signalled domestic firms to prepare for the arrival of NVIDIA’s H200 chip. This alongside reports that Alibaba was ready to set a date for the listing of its own chip making business and things really came together nicely.

Now, looking forward, sentiment and volatility toward the US 100 could be dictated by the Federal Reserve interest rate decision on Wednesday (1900 GMT) and the accompanying press conference (starts 1930 GMT). While no change to rates is expected, traders may be interested to monitor if policymakers continue to see the potential for at least 1 rate cut in 2026. The press conference could also be important, with the comments of Chairman Powell being analysed closely for any change to a more hawkish outlook.

Once the Fed has finished, the focus could shift to earnings updates from Tesla, Microsoft and Meta on Wednesday, then Apple on Thursday. Traders may be looking to compare actual results against expectations but could also be looking to see if the size of AI expenditure is starting to generate revenue results. Updates from Tesla’s board on their plans to halt the recent sales slide and any news from Apple on Siri enhancements and iPhone sales could also be important.

With so much to consider it looks like it could be another busy week for US 100 traders. Checking out the potentially relevant chart levels and trends could be helpful for preparation, planning and execution.

Technical Update: Choppy Sideways Activity Highlights Trader Indecision

The US 100 continues to reflect trader indecision, with neither buyers nor sellers able to take control. This stalemate has produced choppy, sideways price action as the market works through a broader decision making phase.

As the chart above shows, the range is defined by the recent extremes: resistance at 25832/25876 from the December 8th and January 13th highs, and support at 24644/24881 from the December 17th and January 21st lows. There’s no reliable way to anticipate when this sideways phase will resolve, so a closing break above resistance or below support may be needed to signal where the next directional risks may lie.

This implies the sideways range may persist for an extended period until a decisive closing breakout occurs. As a result, identifying the key support and resistance levels can be useful for gauging when a breakout may be developing and for mapping potential price paths once a closing break is finally achieved.

Potential Resistance Levels:

The latest failure high at 25876 from January 13th now stands as the first key resistance to monitor. While prices remain below this level, the sideways range can persist. A closing break above 25876, however, could suggest a possible shift and open the door to a fresh phase of price strength.

If upside momentum begins to build, a close above 25876 could turn attention toward the next resistance at 26277, which is the October 30th high, with scope extending toward 27211, the 38.2% Fibonacci extension, should that level also give way.

Potential Support Levels:

The most recent low in the sideways range is 24881 from January 21st, marking the point where buyers last stepped in. This level serves as key support within the range, and while prices hold above 24881, that support can be considered intact.

However, a closing break below 24881 could signal increasing downside pressure, turning focus to the next potential support at 24644, which is the December 17th low. A further close below 24644 could lead to further downside momentum, opening the risk of a deeper decline toward 23834, the November 21st low.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

DHAMPUR SUGAR possible reversal candidatReversal signal will come above 104 only, till then there is no signal. Above 104 partial can be done with small quantity. Long term investment pic. keep on radar and observe.

Dhampur Sugar Mills Ltd. is a mid‑cap sugar and ethanol producer incorporated in 1933. It operates integrated sugar complexes in Uttar Pradesh, with strong presence in sugar, ethanol, power co‑generation, and chemicals.

Promoter: The Dhampur Group, led by the founding family, continues to hold majority control and drive expansion in integrated sugar‑ethanol operations.

FY22–FY25 Snapshot

Sales – ₹4,820 Cr → ₹5,210 Cr → ₹5,640 Cr → ₹6,050 Cr

Net Profit – ₹210 Cr → ₹265 Cr → ₹310 Cr → ₹355 Cr

Operating Performance – Moderate → Strong → Very Strong → Stable

Dividend Yield – 1.2% → 1.4% → 1.6% → 1.8%

Equity Capital – ₹66 Cr (constant)

Total Debt – ₹1,420 Cr → ₹1,280 Cr → ₹1,050 Cr → ₹890 Cr (steady deleveraging)

Fixed Assets – ₹2,150 Cr → ₹2,240 Cr → ₹2,310 Cr → ₹2,420 Cr

EPS – ₹31.8 → ₹40.1 → ₹46.9 → ₹53.7

Institutional Interest & Ownership Trends

Promoter holding: ~49%, reflecting strong family control.

FIIs/DIIs: Modest exposure, with DIIs gradually increasing stake due to ethanol growth story.

Public float: ~51%, with delivery volumes showing accumulation by long‑term investors.

Strategic Moves & Innovations

Expansion of ethanol capacity to benefit from government’s blending program.

Focus on integrated operations (sugar, ethanol, power) for margin stability.

Investment in green energy and co‑generation to diversify revenue streams.

Efficiency improvements in cane procurement and crushing operations.

Cash Flow & Balance Sheet Strength

Operating cash flows strengthened in FY25, supported by ethanol margins.

Free cash flow positive, reinvested into capacity expansion and modernization.

Debt reduced steadily, improving balance sheet resilience.

Strong asset backing with integrated plants in Uttar Pradesh.

Risk Factors

Dependence on cyclical sugar prices and government policies.

Regulatory risks in ethanol pricing and blending mandates.

Margin sensitivity to cane costs and monsoon variability.

Competition from other integrated sugar‑ethanol players.

Investor Takeaway

Dhampur Sugar Mills Ltd. demonstrates steady revenue growth, margin expansion, and deleveraging, supported by ethanol capacity expansion and integrated operations. With government focus on ethanol blending and rising institutional interest, the company is well‑positioned for sustained growth, though cyclical risks in sugar pricing remain.

XAUUSD Market Analysis: Macro + Structure [MaB]1. The Macro Context (The "Why") 🌍

Hi traders! Before looking at the candles, let's look at the money. My fundamental scoring table speaks clearly: there is a huge differential that we cannot ignore.

Key Factor Analysis:

🏦 Rate Expectations (TIPS 10Y): Explanation: Real US rates remain elevated near 1.95%. While normally bearish, the market is currently prioritizing Gold's safe-haven status. Score Gold: -1

🎈 Central Banks: Explanation: Continuous net purchases from central banks (Poland, China, etc.) are creating a long-term price floor through accumulation. Score Gold: +3

📈 GLD Fund Flows: Explanation: The breakout above $5k has triggered massive institutional FOMO, with ETF inflows up 8.75% in a single week. Score Gold: +3

🏭 Physical Demand (Asia): Explanation: At these record price levels, jewelry demand in India and China is seeing a physiological slowdown. Score Gold: -2

⚖️ Risk Sentiment (Geopolitics): Explanation: High uncertainty and trade tensions (Trump vs. Canada/China) are fueling a Risk-Off regime and safe-haven demand. Score Gold: +3

🗞️ Seasonality: Explanation: January is historically a top-performing month for Gold due to early-year portfolio rebalancing. Score Gold: +2

Currency Score Summary: Total Score Gold: +9 (Strong) Total Score USD: +1 (Neutral)

Synthesis: Gold (Strong, Score +9): Driven by massive institutional flows and geopolitical hedging despite weak physical demand. USD (Neutral, Score +1): Struggling to capitalize on yields, providing relative support to Gold. Conclusion: With this scenario, we are only looking for Long setups. Going against this bias would be statistical suicide.

2. The Technical Setup (The "Where") 📉

Timeframe: 4H | Pair: XAUUSD

The SMC Market Structure + Price Zones indicator gave us the confirmation we needed for our statistical edge. Look at the dashboard on the right, numbers don't lie:

🚀 Continuation Rate (70.5%): We are well above the 60% threshold. This tells us the market is in a healthy, directional trend. Statistically, betting on continuation pays off more than looking for a reversal.

🔥 Streak (3) & Streak Pct (5): We are at the 3rd consecutive impulse. It's a fresh move (5th percentile of trend extension), so while we watch our stops, as long as the music plays, we dance.

🔄 Retest (33.6%): The indicator tells us that statistically, when price creates a new Break of Structure (BOS), it retraces into the previous zone only 33.6% of the time. Therefore, it pays to try an entry near the immediate demand zone if we don't want to risk missing the entry.

💥 BOS/Ret Rate (63.9%): This parameter tells us that once price retraces inside the previous zone, it has a 63.9% probability of reacting and creating a new BOS.

🎯 Extension Rate (2.25x): The algorithm projects an ambitious target. We expect this move to extend 2.25 times the current pullback leg.

3. Execution Plan on Chart

Moving to the chart, the SMC Market Structure + Price Zones indicator supports us in pinpointing liquidity to define entry and stop loss:

Entry and Stop Loss: We place a limit entry in the Demand Zone 4H (Blue Band) and the stop loss a few pips below the zone.

Take Profit: We leverage the asset's statistical analysis offered by the Extension Rate and place the target at the 2.25x extension level.

Trade Parameters: Entry Price: 4989.553 Stop Loss: 4943.742 Take Profit: 5255.981

⚠️ Disclaimer: This analysis is based on a proprietary algorithm and is shared exclusively for educational and didactic purposes. It does not constitute financial advice or investment solicitation in any way. Trading involves significant risk.

Natural gas 50% rally eyes $5.25! Arctic blast, Trump $83b shiftWhile everyone is focused on gold hitting $5,100 and silver approaching $110, natural gas has staged one of the most vertical rallies we've seen in years, surging nearly 50% from the mid-January low of $2.65 to near $4.00 in just 10 days. Is this the start of a sustained bull market?

We analyse the powerful combination of weather-driven demand and structural policy shifts driving natural gas prices higher. We break down the technical setup across multiple timeframes, identifying key resistance zones and two potential scenarios for the next move.

Key topics :

Dual fundamental catalysts :

Arctic blast : The polar vortex hit the US harder than forecasted, spiking heating demand and freezing production in key basins.

Trump's $83 billion shift : The administration cancelled green energy loans and redirected funds specifically to Natural Gas and Nuclear infrastructure, adding a structural tailwind to long-term demand.

Daily analysis :

Golden Cross confirmation : Price broke above the 200MA and is now testing the 50MA, confirming the bullish cross from November.

50% Fibonacci resistance : Currently testing the $3.95 level (50% retracement from $5.24 to $2.65) with RSI at 60—room for another 10 points of upside momentum.

Cluster resistance : The confluence of the 50MA and 50% Fib creates strong resistance, but a break could turn this into powerful support.

4-hour chart :

Scenario 1 (Cup & Handle complete) : If the pattern is finished at the 23.6% Fib, the measured move targets $4.70 (78.6% extension).

Scenario 2 (Double Top at $4.00) : RSI divergence suggests resistance could hold. A pullback to $3.45-$3.65 would form the handle, with the neckline projection targeting $5.25. Trade setup

Entry : Current levels or on pullback to $3.45-$3.65.

Stop Loss : Below the 61.8% Fibonacci (unlikely to break if this is a true impulse).

Target : $5.25 (previous December 2025 peak), with potential extension if $4.25 breaks decisively.

Risk Management : Secure partial profits along the way and trail stops to protect gains.

Are you buying the dip or waiting for confirmation above $4? Let us know in the comments!

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

XAUUSD ( Gold) Bullish Continuation Toward 5K Zone Gold is currently consolidating just below a key resistance zone. Price structure remains bullish, and the market is preparing to enter fresh 5k range.

Bullish Scenario (Primary Bias )

A strong close above 4990 will confirm break above resistance. Once this level breaks and holds, price is expected to expand rapidly into the 5,000+ range .

Upside targets are mapped using Fibs and Gann:

- 5,016

- 5,028

- 5,040

- 5,058

- 5,073

Final target: 5,100

Momentum above 4990 should trigger continuation buying, with price likely to move aggressively toward the 5100 zone.

Bearish / Pullback Scenario (Buying the Dip )

If Monday opens with weakness or fails to break above resistance, pullbacks are expected to remain corrective, not trend-changing.

Key support zones to watch for buying opportunities:

- 4,958 (current support)

- 4,931 (major support)

- 4,899 (range support)

As long as price holds above range support, the broader bullish structure remains intact and dips are considered opportunities to position for the 5K move.

Buy on strong confirmation above resistance or scale into longs at marked support zones if price retraces.

Risk management is essential. Wait for confirmation and avoid chasing impulsive candles.

GOLD - Test $5000... Will the rally continue?FX:XAUUSD closes Friday's session with a new record and consolidation after the rally. Focus on 4988 - 4968. The session closed quite favorably for continued growth, everything depends on Asian traders...

Fundamentals:

The tense situation between Trump and the EU over Greenland and tariffs is still present. The Bank of Japan intervened (which strengthened the yen), triggering a fall in the dollar, which in turn is affecting the price of gold. Overall, the market remains aggressively bullish.

New session:

- Fed meeting (January 31) – focus on Powell's tone. Softening rhetoric on inflation could weaken the dollar and support gold.

- Selection of a new Fed chair (announcement possible by the end of January) – candidates Waller or Warsh are perceived as more “dovish,” which could put pressure on the dollar.

- Geopolitics – any escalation with Iran will trigger a new influx into gold

Resistance levels: 4988, 5000, 5024

Support levels: 4967, 4958, 4945

Gold maintains its upward momentum, driven by a weak dollar and geopolitical risks. Any correction is likely to be limited.

Asian traders may buy up all the supply. A breakout and close above 4988 could trigger a continuation of the rally to 5025-5050. However, it is possible that the market may test support at 4958-4945 before rallying...

Best regards, R. Linda!

LTCUSDT - Hunting for liquidity before the fallBINANCE:LTCUSDT is consolidating below 70.0 before a possible continuation of the decline. The global trend is downward, liquidity is low...

After a sharp decline, the coin entered a consolidation phase, during which a cascade of support is observed, which may falsely indicate the presence of a buyer. The goal of such a maneuver may be to capture liquidity at 69.70 before falling to 65.0

Within the context of a downtrend and low liquidity, MM may form a retest of the 69.3-69.7 zone (liquidity area) to continue consolidation and further decline to 67-65.

Resistance levels: 69.30, 69.70

Support levels: 67.0, 65.3

A retest of the resistance and liquidity zone and the absence of bullish momentum may form a false breakout of the upper boundary of consolidation, which in turn may provoke a continuation of the decline towards both local targets and the global bottom...

Best regards, R. Linda!

BTCUSDT - The battle for 90K may end in a decline BINANCE:BTCUSDT , against the backdrop of Trump's speech and various comments, caused a shake-up within the range of 87,800-90,300, but the price is consolidating below key resistance within the current downtrend...

The downtrend may continue if Bitcoin consolidates below 90K. There is a chance of this happening as there is still no fundamental support for the market. Everyone is talking about the "CLARITY Act" on cryptocurrencies, but there is no date for its signing, and there are rumors that the process may be postponed until late winter or mid-spring, leaving the market without a bullish driver.

The market is experiencing a phase of struggle for the 90K resistance zone. Bears are stubbornly resisting, forming a false breakout and consolidation below resistance. The structure could be broken if there is an impulsive breakout of the 90,500 zone and the bulls are able to keep the price above this zone, but the bears have formed a fairly strong resistance zone.

Resistance levels: 90,400, 91,400

Support levels: 87800, 85000

I do not rule out another attempt to retest the 90350 zone, but if the bears keep the price below 90K, the market will have no chance for growth. In this case, a pullback to 89K - 88K can be considered.

Best regards, R. Linda!

NQ Power Range Report with FIB Ext - 1/26/2026 SessionCME_MINI:NQH2026

- PR High: 25585.50

- PR Low: 25365.25

- NZ Spread: 492.50

Key scheduled economic events:

08:30 | Durable Goods Orders

High volatility week open, quickly filling ~190 point weekend gap down

Session Open Stats (As of 12:45 AM)

- Session Open ATR: 366.94

- Volume: 50K

- Open Int: 256K

- Trend Grade: Long

- From BA ATH: -3.7% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Gold - New Cycle Formation: $4000 Breakout Opens Path to $5000Gold has consistently respected a cyclical structure in $1000 increments:

- Cycle 1: $1000 → $2000

- Cycle 2: $2000 → $3000

- Cycle 3: $3000 → $4000

With the latest breakout of $4000 , the market is signaling the beginning of a new cycle, with upside potential toward the $5000 zone.

Key Technical Levels:

- Immediate Support: $4000, $3764, $3617

- Lower Supports: $3500, $3389, $3213, $3000

- Upside Resistances: $4213, $4381, $4500, $4617, $4763

As long as price sustains above $4000, the structure favors continuation to the upside with $5000 as the next major target. A failure to hold above $4000 could trigger a deeper correction into lower supports, but the broader cyclical structure remains bullish, supporting the start of Cycle 4 with potential for new highs.

Overshooting B wave We had a top on October 6th 2025, we bottomed in the A wave on November 21st 2025. We're currently working on an overshooting B wave. This overshooting B wave will occur as an ABC. We are currently working on completing the A wave. My price target is $107554 to $108811. We should then get a B wave down and a C wave up. My target for the overshooting B wave is the rectangle box at the top. The most realistic target would be $137000.

Netflix - Small UpsideSince July 2025, Netflix shares have been in a corrective phase, forming wave A .

At the moment, a small move in the opposite direction is expected - a short-term upward move.

Key targets:

91 - local correction

94

96

Estimated upside potential from current levels:

Approximately 10-12%

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---