USDJPY breakout: Can the rally extend toward 155?The dollar-yen pair smashed through 150 with one of the strongest breakouts recently, confirming a new technical phase as it trades above the 61.8% Fib retracement. Here’s what’s fuelling the move and what traders should watch next:

Dollar strength returned as safe haven flows dominate, even with a US government shutdown, while Japan’s new prime minister’s dovish signals are sending the yen into freefall.

Key drivers

Safe haven flows : Investors seek shelter in the dollar as global uncertainty rises; DXY index hit a 6-week high.

Yield differentials : The Fed/BOJ spread powers further carry trade buying as Japanese rates remain ultra-low.

Japanese political shift : PM Takaichi’s win spurs fiscal stimulus and pushes back market hopes for BOJ tightening, deepening yen weakness.

Technical breakout : Clean break above multi-year resistance and 61.8% Fibonacci retracement; watch for support validation and continuation toward the next 78.6% Fib at 154.80.

What to watch

Holding above 150 and 61.8% Fib support sets the stage for a bullish continuation.

Profit taking is possible near 153.25–154.80, as RSI shows signs of overbought.

Tonight’s FOMC minutes, Thursday’s BoJ/Ueda speech, and political headlines could trigger sharp moves.

Cross-pair momentum : EURJPY at record highs, GBPJPY surging, confirming broad-based yen weakness.

The bulls are in control as long as USDJPY stays above 151.15–150.50. Pullbacks to support offer opportunities to buy dips, with 154.80 as the next bullish target. Keep stop losses disciplined, and don’t ignore the chance for sharp reversals if intervention or a dramatic shift in sentiment emerges.

For more actionable FX insight, follow ThinkMarkets.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Fibonacci Retracement

FINAL TRADE OF THE WEEK: CADJPY Follow-Through ExecutionSetup Analysis:

CADJPY formed a Momentum Low yesterday, followed by a sustained pullback/sideways pattern that established our structural point. This consolidation created the perfect setup for a continuation entry.

Trade Execution:

Entry triggered this afternoon after the break of the internal wave structure, confirming Sellers conviction and follow-through.

Trade Management:

Strong momentum immediately after entry

Target 2 (T2) achieved in under 2 hours

Profit: +50 pips

Exit Decision:

Position closed at T2 after price displayed strong reversal signals. This is mechanical trading—take profits when price action shows the move is exhausted.

Key Lesson:

The best trades are the ones where:

✅ Structure is clear

✅ Entry confirms momentum

✅ Price moves decisively in your favour

✅ You exit with discipline when reversal patterns emerge

This is the WavesOfSuccess methodology in action—patience for setup, precision on entry, discipline on exit.

Result: +50 pips in under 2 hours ✅

Have a blessed weekend! 🙏

👍 Hit the boost button if you found this valuable

👤 Follow for more educational trading content

Is Nasdaq Set for a Pullback? | Fibonacci Resistance Zone ahead!In this video I map out the idea of the Nasdaq being over extended and on route to approaching a key Fibonacci resistance level 27000 ,

This may set up a potential correction in the week ahead."

This is a counter-trend setup within a larger uptrend, so risk management is key. I'm not calling a top to the entire rally, but rather a healthy pullback to bring in new buyers."

I demonstrate how i see the price action moving forward over the course of the month ahead with valuable insights.

Tools used in this video Standard Fib , Fib Expansion, Fib extension + Anchored vwap and Volume profile and TPO chart

Bearish Momentum for Bitcoin!Looking at the Daily Time-frame, we can see that the market structure has been broken. The high formed in the 14th of July, where liquidity was resting, was taken out and immediately price began its down-ward spiral! Within a period of 9 days, the low formed on the 2nd of August was taken out, qualifying that level as a breaker, but a more decisive move took place on the 25th.

Thus we can see, by the unwillingness of price to go above the breaker level, that the market is bearish! Right now, I am waiting for price to reach the 111,855 level to see how price will react.

All the best with your trading.

Bearish USDThis pair has been in the same spot for some time but I think now it's just about ready to continue selling! The liquidity resting above the equal highs will drive price up, which is going to lead some unfortunate sheep to the slaughter.

Fibonacci level of 62% is the ideal price level to short this one, with a stop just above the recent high.

All the best.

EURUSDPrice recently plunged into the deep and has now returned for fair value. We are already in a significant area, on a higher time-frame(1D), so any moment from now they can collapse it, much like last week! Be on the look-out like a meerkat!

1.1680 and 1.1720 are institutional price levels and price tends to have strong reactions in these areas. I expect to see that play out tomorrow.

The following reports will be used to trigger this move:

BoE Monetary Policy Report.

Continuing Jobless Claims 4-Week Average.

Initial Jobless Claims.

Unit Labour Costs.

Nonfarm Productivity.

Stay safe!

GBPUSD ANALYSISAfter seeing the previous day close and reject an area of resistance and a break below the trendline area of support on the lower timeframe, but with the daily still bearish the 4hr is pushing to the upside. A break of 4hr structure support could be a clear signal that sellers are now pushing price.

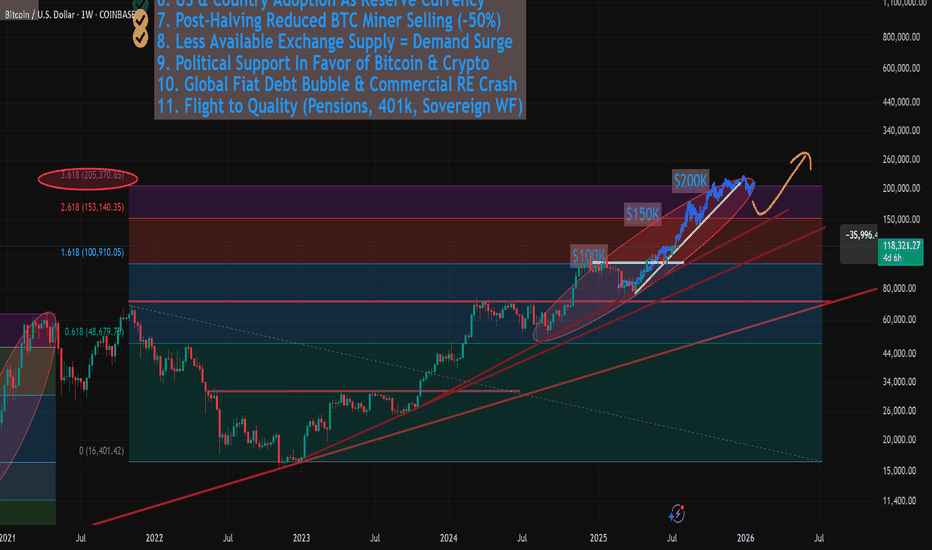

Revsiting $150k - $200k Bitcoin (AND Next Bear Market Bottom)In this video I revisit my 2-year old study showing the potential path for Bitcoin to $150k to $200k and not only how we might get there, but the 11 reasons WHY we can this cycle.

This is the same Fibonacci series that predicted the 2021 cycle high at the 3.618 (Log chart) and used the same way this cycle, with some interesting 2025 forecasts of:

1.618 - $100k

2.618 - $150k

3.618 - $200k

There are quite a few confluences that we get to $150k like the measured moves from both the recent mini bull flag, but also the larger one from earlier this year.

** Also I touch on revisiting my study from 2 years ago where I may have discovered the retracemebnt multiple that correctlty predicted and held the 2022 lowes around $16k. **

It's a VERY interesting number you all will recognize (buy may not agree with).

Let me know what you think.

Why you should WAIT for trades to come to YOU!In this video, we dive deep into one of the most underrated but powerful habits that separates consistently profitable traders from the rest: waiting for the trade to come to you.

It sounds simple, even obvious. But in reality, most traders—especially newer ones—feel the constant urge to do something. They scan for setups all day, jump in at the first sign of movement, and confuse activity with progress. That mindset usually leads to emotional trading, overtrading, and eventually burnout.

If you've ever felt the pressure to chase price, force trades, or trade just because you're bored… this video is for you.

I’ll walk you through:

1. Why chasing trades destroys your edge—even when the setup “kind of” looks right

2. How waiting allows you to trade from a position of strength, not desperation

3. The psychological shift that happens when you stop trading to feel busy and start trading to feel precise

4. How the pros use waiting as a weapon, not a weakness

The truth is, trading is a game of probabilities and precision. And that means you don’t need 10 trades a day—you need a few good ones a week that truly align with your plan.

Patience doesn’t mean doing nothing, it means doing the right thing at the right time. And when you develop the skill to sit back, trust your process, and wait for price to come to your level… everything changes. Your confidence grows. Your equity curve smooths out. And most importantly, your decision-making gets sharper.

So if you're tired of overtrading, feeling frustrated, or constantly second-guessing your entries—take a breath, slow it down, and start thinking like a sniper instead of a machine gun.

Let the market come to you. That’s where the real edge is.