Trading as per price action and Fibonacci - 178 points captured BTST trade carried based on S/R levels as per the Option chain, further identified "M" pattern in smaller time frame to have a view for trading. Was able to confidently carry the trade on weekend as per the support level and was sure for gap up opening today on Monday. Full video of this trade is already uploaded in part 1 & 2.

Click on link below in related ideas.

Fibonacci Retracement

Trading as per price action and Fibonacci - 178 points capturedBTST trade carried based on S/R levels as per the Option chain, further identified "M" pattern in smaller time frame to have a view for trading. Was able to confidently carry the trade on weekend as per the support level and was sure for gap up opening today on Monday. Full video of this trade is already uploaded in part 1 & 2.

Click on link below in related ideas.

How to double your small ($250) trading account trading Bitcoin How to Double your Small ($250) Trading Account Trading Bitcoin

I started a degen account with $250 and almost doubled it in 4 days making about 6 trades. This strategy is not Financial advice and I'm only illustrating what I have learnt trading this way. This is the first video in the series and I'll be continuing the series , updating you on progress, winners, losses, my trading journal and some live trading, so make sure to Sub, like comment and share.

I show you how I entered my current trade, where I am looking to take profits and show you my pnl on Bybit.

Not Financial Advice. DYOR. Papertrade before trading with real money.

Hope you have a profitable trading day!

Shawn

ET Stock Analysis(bullish)I feel pretty good about ET, never 100% but pretty good, here are some of the reasons why:

breakout of multiple bottom structure

all EMA's below and the last day closed above 200 on 2hr

no clear resistance until later point

BT cloud flip

Lower TF's already confirming bullish

has been increasing net income

energy sector performing the best

The YTD, yearly performance, and 3 month performace has all been returning great, only this month has been bad

holding trendline support as well

holding golden zone on fib

more bull volume than bear volume in this zone

more flow orders on Bull trades towards bull

RSI curling above 50

MACD crossover as well(forgot to put in video)

TTM Squeeze showing decrease in bear volume(also forgot to put in video)

LTTSHello & welcome to this analysis

LTTS from May 2021 lows formed a Bullish Harmonic Bat in July 2022. From there it has almost given a 62% retracement to now form a Bearish ABCD Pattern suggesting some consolidation to pullback till 3900 until it starts sustaining above 4400.

Not an area to go aggressive fresh long right now, more of a pullback for entry and then a likely rally for 5400 and more.

Hope this analysis is of help to both traders and investors

Will Bitcoin hold $16000-Falling knife or Swing failure pattern?CME:BTC1! BTCUSD.P BINANCE:BTCUSDT

Will Bitcoin hold $16000-Falling knife or Swing failure pattern?

Is taking a long trade here a good idea or will we lose $16K?

I look at price action as it happens and what levels to look out for if we lose $16000. If this is a Swing Failure pattern playing out, I explain how I will trade it

Not Financial advice

Trade with paper money before using real money.

Safe trading!

Shawn

The CoffeeShopCrypto Fibonacci Tool SetupWelcome to the coffee shop everybody once again. This is your host and baristo Eric and I have a number of strategies to put up for you but I realized that you guys are going to need some help with that. In a few of my previous videos you have seen me using my Fibonacci Retracement tool but the question always arises why does mine look different than yours.

So I want to post this quick video so that you can have the information and the visual of what your Fibonacci tool should look like as well as being able to copy my settings into your Fibonacci tool.

Make sure that at the end of applying these settings you go down to the bottom of the Fibonacci tool settings and you click save as then give it a template name because this is going to be used as a template setting so you can switch it on and switch it off.

The purpose of setting your Fibonacci tool this way gives you a more clearly defined area of take profit 1 take profit two and take profit 3.

So while the settings may not seem to make sense right off the bat, once you start using these strategies you'll understand more clearly what the settings are for.

Fibonacci Retracement Tool Settings

Trend line = on

extend left / right = off

Scale values:

Column 1

0 GREEN

0.382 WHITE

0.5 YELLOW

0.618 YELLOW

0.764 ORANGE

Column 2

0.88 RED

-0.618 Green

-0.25 Green

1 Light Blue

Background = off

Prices

levels = on (values)

Labels = Right / Top

Font Size = 12

Fib levels based on log scale = off

Under template click SAVE AS

and name it "The Coffeshop"

3% Take Profit.Missed one trade and got to another. Buying at almost premium.

From the moment I missed the trade, I was waiting for FVG creation. Price did retrace to FVG but consolidated for some time. It tool longer then I anticipated but in the end, everything worked out.

Please share your thoughts.

GBPAUD - Fibo levels & Fake breakoutHere we explain further an analysis we dropped yesterday on GBPAUD.

We said that the pair is showing bearish behavior and mentioned that it should go further down to buyers liquidity level, however the pair rebounded upward shortly after. We immediately updated that it was a mere correction and this video explains how and why.

We hope you find this useful.

Love, Lacasafxfamily

End of Day Trading using Price Action Daily ChartsHey Traders here is a quick video that explains how to use End of Day Trading in your trading strategy. Learning to trade without emotions getting involved during the trade is important for developing discipline. I think that learning to trade when the market is closed is one of the best ways to achieve this. Also using japanese candlesticks with support and resistance, trends can very important. In order to find the best entry on the chart I think it is best to wait until the market has closed. That way you can see clearly the market psychology for the day. Taking the loss too soon or taking profit too soon are all mistakes that I think can be avoided by also using End of Day trading.

Enjoy!

Trade Well

Clifford

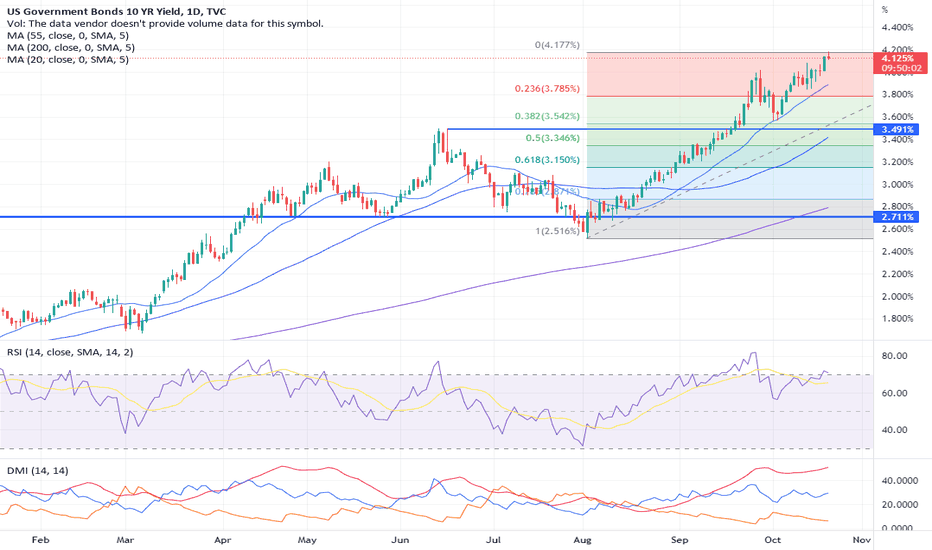

US 10Y yield convergence of resistance levels around 4.19/20We have a convergence of levels around the 4.19/4.20 zone of the chart, it is a long term double Fibonacci retracement and represents significant lows seen in 1998 and 2001.

Will be quite interested to see if the market pauses here in order to consolidate sharp gains that have been pretty relentless since August.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

S&P is seeing reversal from MAJOR supportWe saw the S&P reverse yesterday by almost 3% in one day! Not only was this a key day reversal/a bullish engulfing candle but the fact that we are seeing this market charting that kind of reversal from such a key zone on the chart is we think critical.

We have the 200-week ma, the 55-week ma and long-term Fibonacci retracement all coming in around the 35000 level and the low this week has been 3491.

If you have been selling this market, you might want to take those profits because I think this thing is going to bounce!

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Market Update 9/30/22 Off The Cliff We Go?TIMESTAMPS:

________________________________________

Intro 0:00

BTC 0:54

APPL Yesterday's Movements 9:23

APPL Today's Movements 11:12

APPL: When the Market Fell Off the Cliff 13:53

What We may See Monday and Issues of Dropping Further 18:06

Closing Statements 19:26

________________________________________

There is probably one thing that saves this, and I really doubt it will happen at this point.

I only go over BTC and APPL in this one: Focusing on the Kings. The buying and selling, more specifically the selling, was REALLY good today. Even when we were slightly oversold on the shorter timeframes, the price made sure not to drop too much until we had higher time frames start under the major trendline.

BTC starting the week under 18k is horrible, things look bad, but these last two trading days have had amazing price action. I think this is worse than better, because bad selling brings good buying, but good selling generally brings nothing but more selling.

The sell off at 11:29:45 (last 15 seconds before the 2HR, 1HR, and 30Min TimeFrame change to bring it just under 142.65 was really something. I pretty much knew what was coming the second I saw that on stream. I go over that moment in the video.

Anyway, see you all on Sunday around 19:30 EST for the Crypto Week Time Frame candle change.

Bearish trend to reach its end ?As we can see on the chart, Gold is struggling under dollar's pressure.

It is making lower highs and now a lower low on bigger timeframes.

RSI on the daily started showing bullish divergence.

However, wave 5 can be equal to wave 1 when we meet an extended wave 3. This length will be reached on 1635 level for Gold.

From another perspective, it can go to 1585 (1.25 Fib retracement, same as the previous bearish wave in 2021).

You can still think that we were in an overall bullish trend with an irregular correction ABC, extended to more than 100% fib retracement, so now we are in the wave C, formed by 12345, we meet the same fifth wave, and follow the same analysis.

Wait for buying setups near these critical levels.

Goodluck,

Joe.

An easy but effective strategy for buying Nasdaq (backtesting)Hello everyone,

Nasdaq has been trading down this year, but it has made a new swing high and a higher low on daily timeframe after reaching a key zone (explained in the video).

RSI is showing bullish signals on daily and H1 timeframes.

Buy on the m30, after candlestick signals on Fib levels, and catch your profits!

Goodluck,

Joe.

A last chance for the Euro ?Under the US dollar pressure, EURUSD has been making lower lows and lower highs recently. However, RSI on the monthly chart is oversold for the 3rd time in this century.

MACD is showing bullish divergence on multiple timeframes, and the EURUSD on H4 has just achieved a higher high this time with 5 impulse waves: the ABC correction is clear on the chart, wave C is nearly around 0.76 to 0.8 fib retracement. With today's good news on euro CPI and core CPI (higher than expected for both), we can give this currency a chance to retest the end of impulse wave 5, or even to make a higher high.

Stoploss can go below the impulse wave 2 for some people, or below the lowest low (the beginning of the impulse wave).

Note that on a long term perspective, USD is still stronger than EURO, we will just give eurusd a chance after the new high we saw lately.

Goodluck everyone,

Joe.