GOLD: Bullish-Neutral. Wait For Valid Buy Long Setups!In this Weekly Market Forecast, we will analyze Gold for the week of Feb. 16-20th.

Gold is still bullish, but it is ranging sideways. Last week closed an indecisive week with a doji candle. Not great, but the integrity of the overall uptrend is still intact, despite the flash crash last month.

Look for price to respect the bullish discount arrays, and wait patiently for the buy models to form.

There is no reason to take shorts, as there has not been a bearish BOS event.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GC1! (Gold Futures)

Gold Update 16FEB2026: Wave 4 Visualization of Triangle Wave 4 is in progress and it will take long time to unfold after very large impulse

There is a visualization of potential Triangle pattern that frequently appears in fourth waves

Let's live and see what model would actually play out in the chart

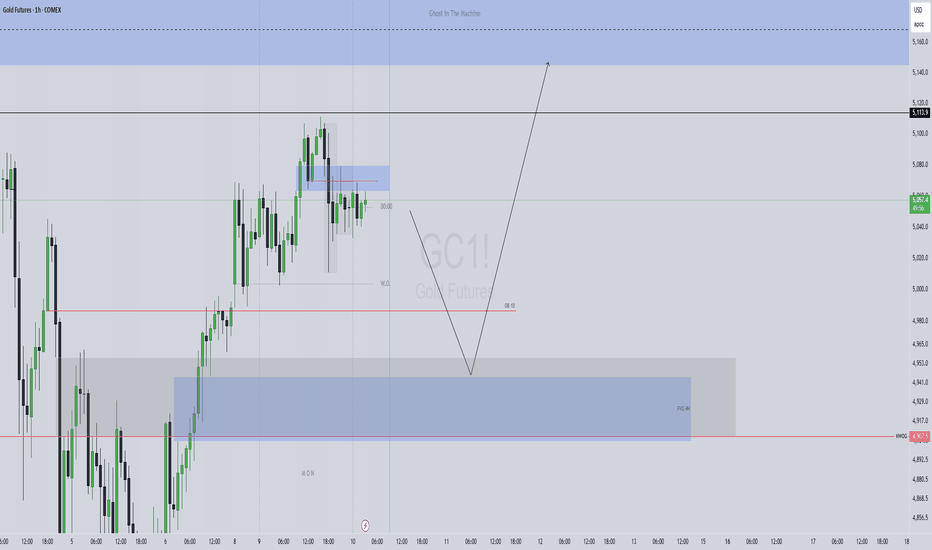

XAUUSD | Perfect day! what does tomorrow bring? Whats going on Gold Gang ... a great day was had on the gold chart today catching gold buys up before the breakout using the 5m timeframe. Its important to use the smaller time frames to reduce that drawdown as these moves are insane! SNIPER ENTRIES ONLY lolol

Last nights analysis played out with the break and retest above the high but came late in the day, which is common in todays market. Myself and the TG group got the buy early afternoon and rode it up for a nice profit.

If we can get a close on the 1h or 4h above 5085 then its pretty clear up to the sell zone. if we reject here and start making LL and LH .. id switch to bearish and look at sells for the rest of the week.

Buys at 4897 still valid too. I will get a precise entry around the time. follow the TG

Thanks for your likes and boosts on the last post. I havent posted on here for a year so im happy to be back. Spread the word!

Tommy

XAUUSD Triangle targeting 4730Gold (XAUUSD) has been trading within a short-term Triangle pattern, with the 1H MA200 (orange trend-line) as its Resistance and the 4H MA200 (red trend-line) as its Support. Having hit the 1H MA200 right on the Lower Highs trend-line, we expect the pattern to start now its new Bearish Leg.

Based on the previous one it could hit the 0.886 Fibonacci retracement level, which falls under the 4H MA200. Our Target is a potential contact with the latter at $4730.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XAUUSD Will it get rejected on the 4H MA50?Gold (XAUUSD) has already hit its 1D MA50 (red trend-line) following our Sell Signal last week and is rebounding strongly since yesterday. The first technical Resistance is the 0.5 Fibonacci level - 4H MA50 (blue trend-line) Zone, which is where the October 21 2025 rebound was rejected, a similar correction fractal to today's.

Today is basically the first strong correction since that day, as shown by the 1D MACD, which is on a similar market peak Bearish Cross. As long as that Resistance Zone holds, we expect Gold to resume the downtrend and target at least its 1D MA100 (green trend-line) on the short-term at 4300. October's Target was even lower just above the 1.382 Fibonacci extension.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Day 101 — Blowing 5 Accounts: The "Storm" That Never CameEnded the day -$1,264.56 per account... a grim start to February. After an 8-day win streak last month, I had this nagging feeling that a "storm" was coming to hit my accounts, and today that self-fulfilling prophecy came true. I took what I thought was a high-probability trade at the 97 MOB, but the market didn't care—it broke right through and kept running. Between Friday and today, I’ve lost about 5 accounts. While the payouts year-to-date are still solid, the real cost here is the time lost building those accounts. Now, the grind to regrow the farm begins.

Day 101— Trading Only S&P 500 Futures

Daily P/L: -$1264.56

Sleep: 5 hours

Well-Being: Good

🔔News Highlights: *DOW NOTCHES BEST DAY IN NEARLY TWO WEEKS AS FEBRUARY BEGINS ON A STRONG NOTE

📈Key Levels for Tomorrow:

Above 6985= Bullish Level

Below 6980 = Bearish Level

Gold/Silver Ratio: Gold To Outperform Silverthis setup never gets old, so i’m sharing the long-term chart of the gold vs silver ratio

focus on the 40-year range that started back in 1986, when the ratio hit the 80 oz level and reversed lower

most of the time, the 47–80 oz range managed to contain the ratio

last year, silver outperformed gold as the ratio dropped like a fallen knife

when it recently hit the lower boundary of the range, it stalled there

the idea is simple: when the ratio reaches the bottom, one can expect a move toward the opposite side near 80 oz from the current 58 oz

this implies gold appreciating significantly against silver

this can happen through less weakness versus the dollar, or more strength versus the dollar, compared to silver since this is a pure comparative relationship between the two metals

Gold Update 02FEB2026: Rally Ain't Over, Only RetracementTwo market wisdoms proved here:

1. Bearish Divergence is not a sell trigger but a harbinger to watch as it can last longer than one can survive

2. Markets cannot rise or fall forever

3. The cost to produce 1 troy ounce of gold is below $2,000

This robust impulse to the upside changed the labeling of waves

The move is now marked as wave 3 and is considered complete

Next, Wave 4 started last Friday, erasing gains massively

This could be a zigzag with an initial sharp move down in wave A

I added the Fibonacci retracement area (38.2%-61.8%) in the pink box to highlight the target area between $4,200 and $3,300

Wave 4s are tricky as they can shape anything from a zigzag to a triangle

More importantly, they are time-consuming, which often leads to trader capitulation

RSI performed well, showing the Bearish Divergence far ahead

Usually, wave 4 hits support at the RSI 50 level and rarely collapses deeper

The rally is not over as another impulse up in wave 5 is pending

Stay tuned as commodities often have extended fifth waves ;-)

GOLD: Still Bullish? Buy This Massive Dip?In this Weekly Market Forecast, we will analyze Gold (XAUUSD) for the week of Feb. 2-6th.

Gold took a nosedive Friday after Trump's nomination for Fed Chair. The market reacted by a -14% drop, as investors moved funds from metals to the USD.

But is this an opportunity for savvy investors to enter this market at a discount?

Yes.

The market conditions that drove prices to ATHs are still in place. Nothing has changed. The uptrend has not been broken. So why not buy this dip?

Selling is not recommended for the reasons mentioned above.

Wait until the the market breaks structure to the upside on the HTFs, no less than the Daily TF, before entering new longs.

Outside of that, be patient, and let the market show its hand.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Gold Short Trade - IntradayThis intraday trade should be quick and short, as soon as Bulls starts to give up.

1. Price reached the orange CL

2. Price left the L-MLH

3. Pullback to L-MLH expected and fullfilled.

4. Price weakens after Test/Retest of L-MLH

Short with no doubt, just following the rules.

Subscribe for my Newsletter §8-)

GC Compression Under ATH — Break or Rotate 1/27/26🟡 GC (Gold Futures) 📊 | Premarket Trading Plan

🧲 Key Decision Zone

5,080 – 5,070

→ Prior rejection zone + range midpoint

This is the battle line between continuation and rotation.

🔴 Resistance / Supply

5,095 – 5,108 → ATH supply / distribution cap

5,083 – 5,090 → Active seller zone (multiple rejections)

🟢 Support / Demand

5,000 – 4,990 → Prior week high + imbalance support

4,960 – 4,950 → Trend support / acceptance base

4,910 – 4,900 → Extreme downside / range low

🧭 Trade Thesis

🟢 Bull Case

Acceptance above 5,080 keeps GC in continuation mode

Holding 5,070 = dip buyers still active

Clean reclaim opens 5,095 → 5,108 (ATH test)

Break and hold ATH = price discovery

🔴 Bear Case

Rejection at 5,080–5,090 keeps GC range-bound

Acceptance below 5,050 opens rotation toward 5,000

Loss of 4,990 exposes 4,960 → 4,950

📌 Market Context (Why This Matters)

GC is extended but not breaking structure

Momentum slowing under ATH = compression

Expect reaction-based trades, not chasing

Best setups = acceptance or hard rejection, not chop

GOLD: Strong! Buy The Dips!In this Weekly Market Forecast, we will analyze Gold (XAUUSD) for the week of Jan. 26 - 30th.

Gold closed last week bullish, surging to ATHs. No reason to look for shorts. Waiting for dip buying opportunities is the best bet.

Look for the +FVGs on the LTFs to be tested for support. Those may be the opportunities to get in buy entries.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

XAUUSD Time to correct for the last time before $8000?Almost 5 months ago (September 05 2025, see chart below) we posted a multi-decade analysis on Gold (XAUUSD), making a case why $8000 was the long-term Target by late 2029:

Now as the price has almost reached the top of its Bull Cycle Channel Up (green) and it is time to start considering a multi-month technical correction.

That was what happened back in March 2008 when the price was almost at the exact point as today. At the top of its Bull Cycle Channel Up, just after the 0.786 Time Fibonacci level and just below the 0.236 Channel Fibonacci level. With just this month's rise (January 2026), Gold managed to reach the 0.236 Channel Fib just a month after it hit the current 0.786 Time Fib.

So that technical confluence initiated an 8-month correction that breached the 0.236 Horizontal Fib (orange), did the same to the 0.618 Channel Fib and just before it hit the 1M MA50 (blue trend-line), it bottomed.

On today's fractal we know where both the 0.618 Channel Fib and 1M MA50 are so what's left is to confirm where the price peaks and draw the 0.236 Fib. If we top a little higher, then the 0.236 Fib will be at 3600, so we can expect to fulfil the 2008 conditions a little lower.

In any case, the moment Gold approaches its 1M MA50 again (remember this is also where the market bottomed in November 2022 and this massive rally started), it will be our choice for a long-term buy again, targeting the top of this Cycle at $8000.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gold Update 22JAN2026: Check The Power Of TrendlinePrice follows the path posted last week and even broke out of small uptrend

How far it can go further up?

I switched to a weekly chart and added the trendline built through the peaks of waves 1 and 3

in yellow - it offers strong resistance in $4,950-5,000 area as price usually respects such large trendlines

I also checked the size of wave 5 compared to wave 1-3 distance - it reached whopping 1.618x of it compared to normal 0.618-1x

Indeed, commodities tend to have extended fifth waves and this extended size is still good

RSI on weekly as well as on daily shows Bearish Divergence, this is not the action alert but the

indicator of the final stage

Let's watch how the price reacts to the trendline as this is the only resistance at the moment

The breakdown point now is set at the bottom of the tiny wave 4 at $4,284

Gold, Silver, Copper Futures Positionings ComparedUsing the latest weekly Commitment of Traders (COT) data, I look at how futures traders are positioned in gold, silver and copper. Together, they tell three very different stories — one that looks undervalued, another that appears overextended, and a third that makes me nervous.

MS.

XAUUSD rallying on its new short-term Bullish Leg.Gold (XAUUSD) has been trading within a Channel Up exactly since the start of the new year. Friday's pull-back saw the price it the bottom of this Channel Up (Higher Lows trend-line), exactly on the 1H MA200 (orange trend-line) and the 0.382 Fibonacci retracement level from the last Higher High.

This is the exact same pattern it followed on the first Bullish Leg. As a result, we expect another +5.30% rise in total, targeting $4775 before another correction to the 1H MA200 (and 0.382 Fib) at $4685.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇