RUSSELL 17-year Channel Up starting a correction.Two weeks ago (January 23, see chart below) we gave a Sell Signal on Russell 2000 (RUT) that turned out to be very timely and is about to hit our 2550 short-term Target:

Today we move back to the macro setting on the 1M time-frame as the market seems overheated on the long-term following a flawless rally of successive green candles since the April 2025 Low. That Low was on the 1M MA100 (green trend-line), the long-term Support trend-line that also priced the October 2023 Low and since October 2011 it only broke during the March 2020 COVID crash.

As you can see, the 1M RSI is just below a long-term Lower Highs trend-line (Bearish Divergence) and every time the market peaked, it corrected back to at least its 1M MA50 (blue trend-line) and its 0.382 Fibonacci retracement level. This has taken place 4 times out of 4 within the dominant 17-year Channel Up.

As a result, we expect 2026 to be a year of correction for Russell, targeting the 0.382 Fib and 1M MA50 (at least) at 2245.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Harmonic Patterns

SLV Gamma Squeeze Setup — AI Targets Explosive UpsideSLV QuantSignals V4 Weekly 2026-02-06

Instrument: $70 CALL

Expiry: Feb 6, 2026

Entry Zone: $4.25 – $4.45

Stop Loss: $3.30 (-25%)

🎯 Targets

Target 1: $5.50 (+25%)

Target 2: $7.00 (+60%+)

🧠 Quant Thesis

SLV is trading below its 50-Day MA and Weekly VWAP, creating a stretched condition ripe for a rebound. Institutional options flow is heavily skewed toward calls, signaling accumulation ahead of a potential upside repricing.

Katy AI projects a powerful revaluation driven by the emerging “Metals Momentum Wave,” with a key trigger sitting at $70 — a level that could spark a gamma-driven acceleration if reclaimed.

Risk Factors

A strengthening US Dollar (DXY) could cap silver.

Failure to reclaim the 50-Day MA (~$69.50) weakens momentum.

Close below $67 invalidates the thesis.

🎯 Tactical Insight (Important)

This is a momentum trigger trade, not a slow swing.

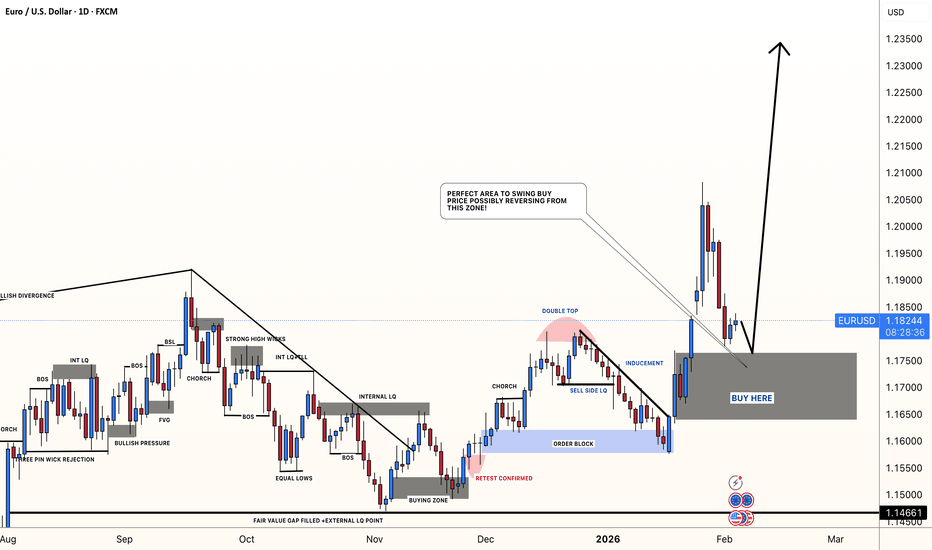

TheGrove | EURUSD buy | Idea Trading AnalysisEURUSD broke through multiple Support level and is now holding above the trendline and key level zone. The current pullback toward the marked support cluster suggests a potential continuation of the bullish move, provided price holds this structure.

EUR/USD is trading within a rising channel, with price holding above the ascending support line after a clear bullish and is moving on Resistance LEVEL.

Hello Traders, here is the full analysis.

GOOD LUCK! Great BUY opportunity EURUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

QS V4 Elite: Tesla Approaches Critical Gamma Inflection⚡ QS V4 ELITE | TSLA Weekly Tactical Setup

Neutral → Volatility Expansion Likely

Tesla is approaching a critical decision zone where conflicting institutional flows suggest a large directional move is near.

Direction: CALLS

Instrument: $415 Call

Expiry: Feb 06, 2026

Entry Zone: $7.35 – $7.50

Target 1: $9.30 (+25%)

Target 2: $11.90 (+60%)

Stop Loss: $5.50 (-25%)

🎯 Trade Thesis

Broad market strength supports risk assets

Weak dollar + risk-on volatility regime

Oversold momentum favors a tactical bounce

Katy AI projects a move toward $427

👉 Trigger: Reclaim of the $410–$411 VWAP zone

Risk Grade: MODERATE (Speculative positioning recommended)

QS V4 Intelligence:

⚡ Discordant signals typically precede high-velocity moves. Prepare for volatility.

QS V4 Elite: Institutional Positioning Signals VIX Reversion⚡ QS V4 ELITE — VIX Weekly Volatility Setup

Trade Thesis

Despite strong equities, the VIX is refusing to compress further — often an early signal that smart money is positioning for turbulence.

Direction: CALLS (Speculative)

Conviction: Low–Moderate

Alpha Score: 62

Time Horizon: Weekly

👉 This is a tactical, small-size opportunity — not a high-conviction swing.

🎯 Tactical Game Plan

Instrument: $19 CALL

Entry Zone: $1.13 – $1.33

Target 1: $1.66 (+25%)

Target 2: $2.10 (+60%+)

Stop Loss: $0.85 (-30%)

🔑 Key Market Signals

Heavy institutional call flow

Large open interest at $20 acting as a price magnet

Trading below Weekly VWAP → stretched condition

Volatility Explosion: AI Flags IREN for Sharp Drop🚀 QuantSignals Katy AI Stock Analysis

📈 IREN Analysis

Current Price: $39.33

Final Prediction: $37.20 (-5.42%)

30min Target: $36.26 (-7.80%)

Trend: BEARISH

Confidence: 65.0%

Volatility: 280.8%

🎯 TRADE SIGNAL:

Direction: PUT

Entry: $39.33

Target: $37.62

Stop Loss: $39.92

Expected Move: -5.42%

Summary: Generated 1 trade signals from 1 successful analyses out of 1 symbols.

EURUSD P Action Analysis|Buy the Support or Trade the BreakoutHello and respect to all TradingView followers 👋

Hope you’re all doing great and trading safely 🌱

🔵 Symbol: EURUSD (Euro / US Dollar)

EURUSD is one of the most important and liquid pairs in the Forex market. Due to its strong connection with macroeconomic data from the Eurozone and the monetary policy of the Federal Reserve, this pair offers high technical reliability and great trading opportunities.

📊 Technical Analysis Based on the Chart

According to the current price structure, we can see that after a strong bullish move, the market has entered a range (consolidation) phase.

At the moment, price is moving between a clearly defined support level and a marked resistance zone, showing market indecision before the next major move.

🟡 Support Zone:

The lower support area plays a key role in maintaining the bullish structure and has shown strong reactions in previous price movements.

🟠 Resistance Zone:

The upper range and resistance zone act as the main trigger for the next directional move. A valid breakout above this area could start a new bullish leg.

🚀 Possible Scenarios (Bullish Bias – Stronger Scenario)

✅ Scenario 1 – Buy from Support

If price revisits the support zone and forms valid bullish reversal candles (such as Pin Bar or Engulfing patterns), we can look for low-risk buy opportunities.

✅ Scenario 2 – Buy After Range Breakout

If price breaks above the range high with strong momentum and confirmation, a pullback to the broken resistance can provide a high-probability buy setup.

📈 Mid-Term & Long-Term Trades

After a confirmed breakout of the range high or low, traders can consider mid-term to long-term positions, following the new market structure.

⏳ Important Trading Notes

🔹 Patience is a trader’s greatest edge

🔹 Always apply proper risk and money management

🔹 Never enter a trade without confirmation

⚠️ Disclaimer

This analysis is for educational and informational purposes only. All trading decisions and risks remain the responsibility of the trader.

📊 Poll – What’s Your Bias?

❓ What do you think will happen next on EURUSD?

🔘 Bullish breakout and continuation 🚀

🔘 Deeper pullback toward support 📉

🏷 Tags:

#EURUSD

#Forex

#TechnicalAnalysis

#PriceAction

#SupportResistance

#RangeMarket

#TradingView

#FXTrading

#SmartMoney

Prospects for movement on ZEC!Hello everyone 👋🏼

Many people in private messages ✉️ ask about further movement on ZEC

📌 Today we will look at what prices will be interesting for purchases and to what values the coin may still fall.

❕ Here I want to immediately indicate that the main timeframes are currently in a downward trend

▫️ During the month, the price adjusted to a large imbalance zone, covering 50%

Last month was too aggressive, and the current one also shows a tendency for the seller to prevail. 📉

Below there is another small imb zone at around $74 - $46 (I don't think they will let us buy at such prices, but I mean there is an imbalance)

▫️ On the daily timeframe, the price is under an uptrend, which has already been reacted to before the growth

At this stage, I am considering the option of forming a sideways movement or correction within the framework of a descending wave.

If the market shows weakness again, then seeing the coin in the range of $120 would be a good buying point, since in the future I consider this asset at around $1000

💡 The chart shows one of the movement options that I am considering within the framework of the current market behavior. Everything can change in a moment. For growth, I focus on the price going beyond the downward trend or after the accumulation phase.

Have a good trade and profit, everyone 💵

Please leave🚀 and write in the comments which coins you would like to see 🔎 at the next showdown.

CADJPY possible bearish for 112.5023rd january daily key reversal bar made a new high closed on the low. daily supply zone is much bigger, melt down into smaller time frame to find out inner supply zone in smaller time frame. 115.05 2hour supply zone. stop loss: 115.60, target: 112.50 even expecting further down.

PAXG (Gold) TRADE BUY SETUP Long from $4878PAXG (Gold) TRADE

BUY SETUP

Long from $4878

Currently $4878

Targeting $4928 or Above

(Trading plan IF PAXG

go up to $4820 will add more longs)

Follow the notes for updates

In the event of an early exit,

this analysis will be updated.

Its not a Financial advice

$SOLUSDT Weekly Chart Analysis Solana ( BINANCE:SOLUSDT ) is currently trading at a critical weekly demand zone between $91.41 and $78.54, a region that has historically acted as a major accumulation and reversal area. Price has dropped aggressively into this zone after a prolonged downtrend, suggesting sell-side exhaustion and increasing probability of a high-timeframe bullish reaction.

The chart clearly highlights an entry region around $92.46, aligned with prior structural support and strong horizontal demand. As long as SOL holds above this weekly support band, the broader bullish market structure remains valid. A sustained bounce from this zone could trigger a mean reversion rally toward the first upside resistance at $149.25 (Target 1), followed by a higher expansion move toward $242.46 (Target 2), which aligns with previous distribution levels.

Risk is well-defined with a hard invalidation below $62.46, where a clean break would negate the demand-zone thesis and confirm deeper bearish continuation. Volume compression near support further strengthens the case for an upcoming volatility expansion, favoring the upside if buyers step in.

Summary:

Trend Context: HTF pullback into major weekly support

Bias: Bullish reversal from demand

Entry Zone: ~$92

Targets: $149 → $242

Invalidation: Below $62

This setup presents a high-risk, reward long opportunity for swing and position traders watching weekly structure and demand-based reversals.

SPX500 | Futures Rebound After AI-Driven SelloffSPX500 | Futures Rebound as AI Selloff Triggers Market Repricing

U.S. equity futures rebounded after steep losses, as markets reassessed the recent AI-driven selloff that wiped nearly $1 trillion from the S&P 500 software and services sector. Investors are shifting from broad enthusiasm toward a more selective approach, focusing on winners and losers of the AI revolution rather than assuming all tech will benefit.

This evolving market dynamic suggests rising sector dispersion and continued volatility across equities.

Technical Outlook

The index dropped 2.6%, falling from 6940 to 6745 as previously outlined.

As long as price remains below the 6858 pivot, bearish pressure is expected toward 6820 and 6798.

A break below 6798 would extend losses toward 6771 and 6715.

A 1H candle close above 6858 would support a recovery toward 6877 and 6900.

Key Levels

• Pivot: 6858

• Support: 6798 – 6771 – 6713

• Resistance: 6877 – 6918 – 6940

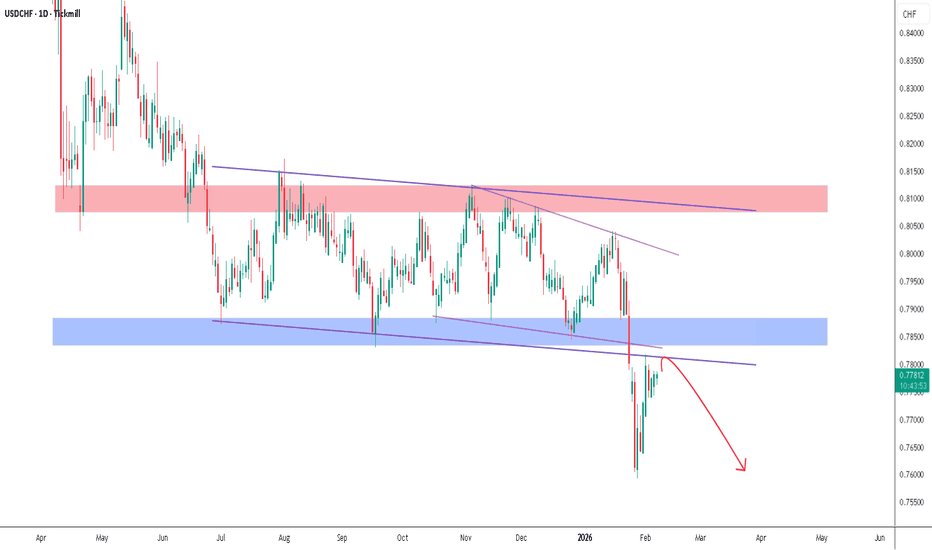

USDCHF - The Breakdown You Can’t Afford to IgnoreHello Traders! 👋

What are your thoughts on USDCHF?

This chart shows a bearish technical analysis for the USD/CHF (US Dollar vs. Swiss Franc) currency pair on a daily timeframe.

The overall sentiment is that the pair has broken below long-term support and is now showing signs of further weakness.

Key Takeaways

Bearish Breakdown: The price has fallen significantly below a long-standing consolidation range (the blue support zone around 0.7850).

Role Reversal: The previous "Support" (blue zone) is now acting as "Resistance." The red arrow indicates a "retest" of this level—a common technical pattern where price returns to a broken level before continuing lower.

Descending Trend: The purple lines highlight a series of "Lower Highs," indicating a sustained downward trend over the past several months.

Don’t forget to like and share your thoughts in the comments! ❤️

EURUSD: Is this a start of swing bullish move? Comment your viewThe EURUSD price is currently trading at a crucial level, potentially signalling a strong bullish reversal. We need to confirm a break of the bearish pressure trendline; once achieved, it will be a strong reversal signal. Enter with strict risk management.

If you like our idea, please like and comment below with your thoughts on this move.

Team Setupsfx_

Bearish momentum to continue?CAD/CHF has rejected off the pivot and could drop to the 1st support.

Pivot: 0.57101

1st Support: 0.56044

1st Resistance: 0.57579

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce?USD/ZAR is falling towards the pivot and could bounce to the 1st resistance, which is a pullback resistance.

Pivot: 16.1268

1st Support: 16.01453

1st Resistance: 16.33042

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

BITCOIN 1HR PRICEACTION BITCOIN COULD TEST 70K-72K SUPPLY ROOF OF THE 1HE CHART ON THE DESCENDING TRENDLINE

THE WARNING WAS SENT ON MY LAST POST,I SAID WEEKLY BREAK OF WEEKLY LINE CHART CLOSE SUPPORT FLOOR WILL BE A BEARISH CONTINUATION AND 48K-47K ZONE WILL BE THE NEXT DESCENDING TRENDLINE RETEST DEMANDFLOOR .

Bitcoin (BTC) is the world's first decentralized cryptocurrency, created in 2009 by an anonymous person or group using the pseudonym Satoshi Nakamoto. It operates on a peer-to-peer network without central banks or governments, using blockchain technology—a public ledger recording all transactions cryptographically across thousands of computers worldwide.

Key Features:

Decentralized: No single entity controls Bitcoin; miners validate transactions via proof-of-work.

Limited Supply: Capped at 21 million coins (94% mined by 2026), creating scarcity like digital gold.

Transactions: Users send/receive BTC via digital wallets; irreversible once confirmed (10-60 minutes).

Security: Cryptographic keys ensure ownership; blockchain prevents double-spending.

Uses:

Store of Value: "Digital gold" hedge against inflation/currency devaluation.

Payments: Accepted by merchants (e.g., Tesla briefly, El Salvador legal tender).

Bitcoin hit ATH amid institutional adoption (ETFs, corporate treasuries), Trump pro-crypto policies, and halving cycle (April 2024 reduced rewards). Highly volatile; correlates with risk assets but increasingly viewed as macro hedge alongside your gold/silver interests.

#BITCOIN #BTCUSD

DAX Index – GER30 Analysis🕓 Timeframe: 4‑hour chart

🔹 Recent Price Action

• Price has recently bounced from the key support zone around 24,250

• The rebound aligns with the lower boundary of the main ascending channel

📊 Smaller Structure

• Price has broken above the minor descending channel with strong bullish momentum

• This breakout suggests a continuation of the upward movement

🎯 Expected Targets

1️⃣ 24,935

2️⃣ 25,580

✅ Bullish Outlook

The bullish scenario remains valid as long as price stays above the level:

→ (add your key support level here, e.g., 24,250 or the nearest higher support)

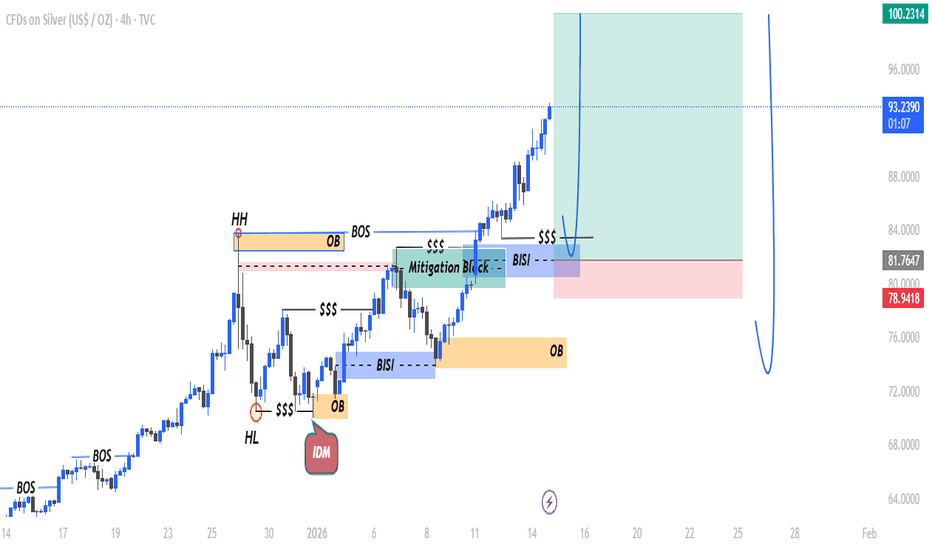

SILVER (XAGUSD) 4H — Smart Money Continuation Read Description.SILVER (XAGUSD) 4H

— Smart Money Continuation | BOS, Mitigation & Liquidity Roadmap

This Silver (XAGUSD) analysis is the result of deep structure reading, liquidity mapping and smart money execution logic — not random lines or assumptions.

From the left side of the chart, price respected multiple BOS (Break of Structure), confirming a strong bullish market condition. Each BOS was followed by continuation, showing that buyers were in full control and weak sellers were consistently removed from the market.

After forming a clear Higher Low (HL), price expanded aggressively and created a Higher High (HH).

This expansion left behind clean inefficiencies (BISI) and order blocks (OB) — areas where institutions executed large positions and price moved with intention.

Price then returned into the mitigation block, where previous imbalance and liquidity aligned perfectly.

This is not a coincidence — smart money often revisits these zones to rebalance inefficiency before continuing the primary trend.

The repeated SSS (Sell-Side Liquidity) markings show how liquidity was engineered and collected step by step.

Once sell-side liquidity was absorbed, price had no reason to stay low — resulting in strong continuation to the upside.

The roadmap on the chart highlights the logic clearly: • Liquidity is taken first

• Imbalance is revisited and mitigated

• Order blocks act as re-accumulation zones

• After rebalancing, price seeks higher external liquidity

This is not a signal and not financial advice.

It is a story of how price is delivered by smart money, written directly on the chart for those who know how to read it.

Markets don’t move randomly —

they move to fill orders, rebalance inefficiencies, and hunt liquidity.

🧠 Final Thought

If you stop chasing candles and start understanding why price pulls back,

you stop trading emotionally and start trading logically.

👉 Do you agree with this bullish continuation narrative on Silver, or do you see a different liquidity draw?

Drop your perspective in the comments and share this idea if it added value — let’s grow by learning together.

EURUSD Outlook: Bearish Momentum Below 1.1835EUR/USD Technical Analysis

📅 Date: February 4, 2026

💵 Current Price: 1.1815 (Approx.)

📍 Pivot Point: 1.1835

📉 Bearish Scenario (Main Trend)

The price is currently trading below the pivot level of 1.1835. As long as it remains under this zone, the bearish momentum is expected to continue:

Target 1: Support level at 1.1790.

Target 2: If the price breaks 1.1790 and stabilizes below it with a 1-hour or 4-hour candle close, the downtrend will strengthen towards 1.1745.

📈 Bullish Scenario (Alternative Case)

If the price manages to break above the pivot level of 1.1835 and stabilizes:

Target: The trend will shift to bullish, aiming for 1.1900.

📍 Key Technical Levels

Resistance (Upside): 1.1900 | 1.1930

Support (Downside): 1.1790 | 1.1745

💡 Market Sentiment: The EUR/USD pair is facing pressure due to the recent strengthening of the US Dollar, influenced by expectations of a more hawkish Fed policy. Traders should watch for a confirmation close below 1.1790 to confirm the next leg of the sell-off.

DAX40 4HR CHARTThe DAX is Germany's primary stock market index, tracking the performance of the 40 largest and most liquid blue-chip companies listed on the Frankfurt Stock Exchange, such as Adidas, BMW, and Siemens. It serves as a key barometer for the German and broader European economy, representing about 80% of the exchange's market capitalization.

German 10-Year Bond Impact

The German 10-year Bund yield acts as a benchmark risk-free rate in the Eurozone, influencing DAX valuations through its effect on discount rates for future corporate earnings and borrowing costs. Rising Bond yields, like the recent jump to 2.65% amid fiscal spending plans, often pressure DAX stocks downward by making bonds more attractive relative to equities and increasing company financing expenses, though optimism from economic stimulus can drive simultaneous gains as seen when DAX rose 3.7% alongside a 20bps yield spike. Conversely, falling yields support higher stock multiples by lowering opportunity costs.

ECB Rate Decisions

ECB rate cuts typically boost the DAX by reducing borrowing costs for companies, stimulating economic activity, and weakening the euro to aid exporters in the index. For instance, anticipated 25bps reductions have propelled DAX toward record highs by easing monetary restrictions and supporting growth-sensitive sectors. Hawkish holds or hikes, however, can weigh on the index via higher yields and tighter financial conditions.

#GER40 #EU10Y #GER40 #GER30 #DAX