$SOL / Solana to $300+?All things suggest a strong launch opportunity for Solana.

If $200 holds, it's a good accumulation level. RSI is at 50, in the Fibonacci Golden Zone, with a weekly demand level, and the $250 weekly resistance/supply level has been tested 3+ times.

Solana bulls have a solid chance to reach $300+ short-term, especially with potential ETF filings.

Heikin-ashi

Small Cap Portfolio Trading | $PD ( PagerDuty ) Starting a new position to my #SmallCaps Stock Portfolio:

NYSE:PD (PagerDuty) @ $15.83 bringing my average cost to $15.83 per share.

Short Term Target: $25.00 / 40%+ Gain Potential

Financials:

- Last two years of Free Cash Flow Growth of 50%+ with a projection upwards

- Net income, despite being negative, has improved consistently over the last 3 years.

- Shareholders equity has remained constant over the 3 last years.

- Revenue growth has remained in an upwards trajectory over the last 5 years.

Note: Buying and placed my first order into the Weekly Demand level below 50 RSI and showing a little life in this accumulation box. Also liquidity has been swept in that area. We still have to clear $20.00 for this move to happen though.

HA-RSI + Stochastic Ribbon: The Hidden Gem for Trend & MomentumNavigating volatile markets requires more than just raw price action. The Heikin Ashi RSI Oscillator blends the power of smoothed candlesticks with momentum insights to give traders a clearer picture of trend strength and reversals.

At Xuantify , we use the Heikin Ashi RSI Oscillator as a hybrid momentum and trend tool. While the indicator calculations are based on Heikin Ashi values to smooth out noise and better capture trend dynamics, the chart itself displays standard candlesticks (real price data) . This ensures that all signals are aligned with actual market structure, making it easier to execute trades with confidence and clarity.

This dual-layer approach gives us the best of both worlds: clarity from smoothing and precision from real price action. MEXC:SOLUSDT.P

🧠 How We Use It at Xuantify

At Xuantify , we integrate the Heikin Ashi RSI Oscillator into our multi-layered strategy framework. It acts as a trend confirmation filter and a momentum divergence detector , helping us avoid false breakouts and time entries with greater precision. We pair it with volume and volatility metrics to validate signals and reduce noise. Note the Stochastic Ribbon Overlay as shown in the chart, very accurate for momentum.

⭐ Key Features

Heikin Ashi Smoothing : Filters out market noise for clearer trend visualization.

RSI-Based Oscillation : Measures momentum shifts with precision.

Color-Coded Bars : Instantly identify bullish/bearish momentum.

Dynamic Signal Zones : Customizable overbought/oversold thresholds.

Stochastic Ribbon Overlay : A powerful multi-line stochastic system that enhances momentum analysis and trend continuation signals.

💡 Benefits Compared to Other Indicators

Less Whipsaw : Heikin Ashi smoothing reduces false signals common in traditional RSI.

Dual Insight : Combines trend and momentum in one visual.

Better Divergence Detection : Easier to spot hidden and regular divergences.

Visual Simplicity : Clean, intuitive design for faster decision-making.

⚙️ Settings That Matter

RSI Length : Default is 14, but we often test 10 or 21 for different timeframes.

Smoothing Type : EMA vs. SMA – EMA reacts faster, SMA is smoother.

Overbought/Oversold Levels : 70/30 is standard, but 80/20 can reduce noise in trending markets.

📊 Enhancing Signal Accuracy

Combine with Volume Oscillators to confirm momentum strength.

Use Price Action Zones to validate oscillator signals.

Look for Divergences between price and oscillator for early reversal clues.

🧩 Best Combinations with This Indicator

MACD : For cross-confirmation of momentum shifts.

Bollinger Bands : To identify volatility squeezes and breakouts.

Support/Resistance Levels : For contextual trade entries and exits.

⚠️ What to Watch Out For

Lag in Strong Trends : Like all smoothed indicators, it may react slightly late.

Over-Optimization : Avoid curve-fitting settings to past data.

Standalone Use : Best used in conjunction with other tools, not in isolation.

🚀 Final Thoughts

The Heikin Ashi RSI Oscillator is a powerful hybrid tool that simplifies complex market behavior into actionable insights. At Xuantify, it’s a core part of our strategy toolkit, helping us stay ahead of the curve with clarity and confidence.

🔔 Follow us for more educational insights and strategy breakdowns!

We regularly share deep dives into indicators, trading psychology, and backtested strategies. Stay tuned and level up your trading game with us!

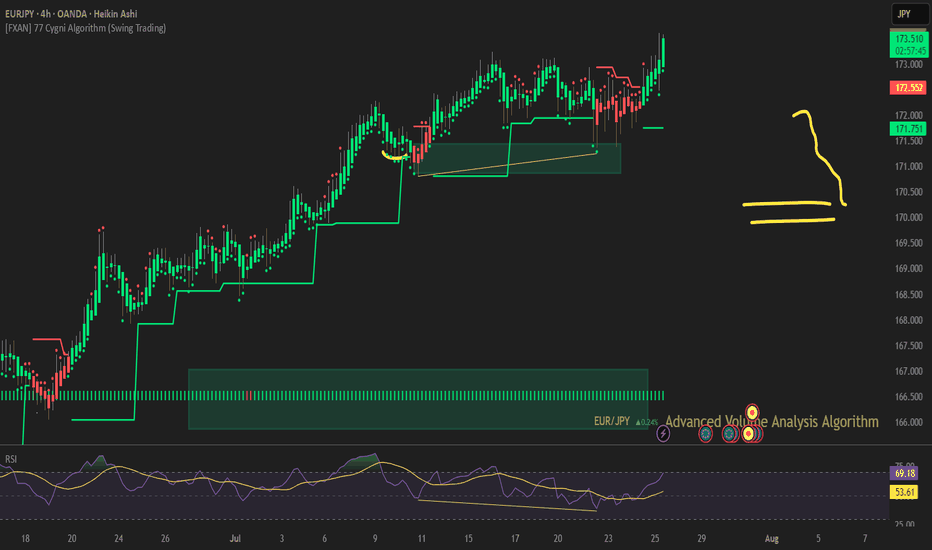

GBPCHF; FXAN & Heikin Ashi trade exampleOANDA:GBPCHF

In this video, I’ll be sharing my analysis of GBPCHF, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

$RBN | Showing glimpses of lifeAdded to my Altcoin Portfolio:

• COINBASE:RBNUSD @ $0.13876 bringing my average cost from $0.17 -> $0.1511

Notes/Thoughts: Typically I would wait until the Weekly Close for my buys as it’s only Tuesday but I like the market pump currently & perceived momentum plus price is still held in a Weekly Demand area without collapse.

$AAPL | $200 showed lifeThese are my levels I am most concerned with for NASDAQ:AAPL

Last week, $200 level showed life and buyers stepped in but that doesn't mean we are out of the woods and price currently is in semi "no man's land", kind of just hanging around the demand area.

One bright point is bullish price volume last week as well.

I would wait to see how this week turns out before putting money back into the iPhone company.

$ETH Next Move?Despite the FUD around Ethereum, I am focused on the charts and what they tell me.

I look at the downside that has brought us in this Weekly buying area. That downside was a clear move and looks great for a nice run back up.

I would still like to see a green candle present on this Weekly close to signify buyers but I think things are brewing for CRYPTOCAP:ETH

FXAN & Heikin Ashi Trade IdeaOANDA:AUDNZD

In this video, I’ll be sharing my analysis of AUDNZD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Ada strategic reserve idea Trump has single handedly turned Ada into a desirable digital asset, as he looks to add it to the U.S strategic reserve along side Bitcoin. Now if it actually happens I believe these fib levels and trend line are good targets. It's crazy how one man can turn vaporware into a desirable digital asset. All bets are off however if the strategic reserve does not get passed. Ada will most likely die then.

Master Trading with Heiken Ashi Candles in 11.32 minutes Let’s talk about how to DOMINATE the market using Heiken Ashi candles for perfect entries and exits! This is where your trading game levels up.

First, when those candles start turning smooth and green with no wicks at the bottom, that's your entry signal! It’s like the market saying, "Hop on, this train is about to take off!" You ride those green candles as long as they stay strong and wick-free at the bottom.

Now, here’s the key – watch for red candles starting to form with wicks on top! That’s your signal to EXIT! Don’t get greedy, secure those gains, and get out before the market turns against you.

With Heiken Ashi, you get smoother trends, cleaner signals, and better trades! Enter with confidence, exit with precision, and OWN the market!

That's it, fast and powerful! Now go crush those trades!

Mastering Market Trends: An Introduction to Heikin Ashi CandlesHeikin Ashi candles, originating from Japan, are a distinct type of candlestick chart used in technical analysis to identify market trends. The term "Heikin Ashi" translates to "average bar" in Japanese, which reflects their method of calculation

This video explains Heikin Ashi candles and how they can be used to improve entrances and exits.

You don't need Heikin AshiHeikin Ashi is a popular trend indicator.

The open values of Heikin Ashi point out the potential trend reverse price level.

However, not all chart services privide Heikin Ashi.

In fact, there is an another way to estimate the open values of Heikin Ashi.

It is SMMA.

William Alligator uses 3 SMMA at a time.

We can set

Offset = 0

Lips = 2

Teeth = 8

Jaw = 32

Lips , also SMMA(2), estimate the open values of Heikin Ashi of the current timeframe.

Teeth and Jaw are the preview of the open values of Heikin Ashi in higher timeframes.

Bullish Bounce on SE.

As you can see here on this daily chart, we are approaching this weekly support line. I am going to wait for a bounce off this line with high volume and a strong green Heikin Ashi candlestick. This is a great opportunity and the contracts are looking good. I would not trade this within the week of earnings because of the potential volatility so I would look for a move this upcoming week. Thank you for taking the time out of your day to look at my analysis.

Long USDJPYLast week USDJPY posted a green Heiken Ashi candle on the weekly time frame. This suggests to me that we may have another green week.

It is also the case that a green Heiken Ashi candle posted on the daily time frame after a red candle. This suggests to me that this could be the beginning of a muli-day bull run.

Using Heikin Ashi Candles to Exploit the BIG REVERSAL on $FAs you can see, on NYSE:F there is a large area of supply on the daily timeframe from 14.72-15.00. The blue dotted line at 14.55 is a point of control. I have started a small position short on NYSE:F 1-2 months out. Notice the 1 and 4 hour Heikin Ashi candles already showing the start of a bearish trend. I'd like for the daily candles to confirm the bearish trend before adding to this position. Let it dump, I never liked Ford vehicles anyway!