Mastering RSI: A Complete Guide to Momentum🔵 Mastering RSI: A Complete Guide to Momentum, Regimes, Reversals & Professional Signals

Difficulty: 🐳🐳🐳🐳🐋 (Advanced)

This article goes far beyond the basic idea of “RSI = overbought/oversold.” If you want to truly master RSI as a momentum gauge, trend filter, reversal tool, and structure confirmation model, this guide is for you.

🔵 WHY MOST TRADERS MISUSE RSI

Most traders use RSI in the simplest way:

RSI above 70 = sell

RSI below 30 = buy

This leads to shorting strong trends and catching falling knives.

RSI is not a reversal button. RSI is a momentum translator.

To master RSI, you must understand:

Trend regimes

Momentum pressure

Acceleration and deceleration

Failure swings

Divergences

Trend vs range behavior

Multi-timeframe alignment

Structure confirmation

RSI shows the strength behind price, not just extremes.

🔵 1. RSI TREND REGIMES (CORE FOUNDATION)

RSI moves in predictable zones depending on the type of market environment.

Bullish RSI Regime

RSI holds between 40 and 80

Pullbacks bottom around 40–50

Breaks above 60 show trend acceleration

Bearish RSI Regime

RSI holds between 20 and 60

Pullback tops form around 50–60

Breaks below 40 confirm bearish dominance

These regimes tell you who controls the market before you even look at candles.

🔵 2. MOMENTUM PRESSURE (RSI AS A SPEEDOMETER)

RSI measures the speed and pressure of price movement.

Rising RSI with rising price = trend acceleration

Falling RSI with rising price = momentum weakening

Rising RSI with falling price = early strength

Falling RSI with falling price = continuation pressure

This is not divergence. It is momentum pressure, the earliest sign of trend shift.

🔵 3. FAILURE SWINGS (THE MOST RELIABLE RSI REVERSAL SIGNAL)

Failure swings are powerful because they show internal momentum breaking before price reacts.

Bullish Failure Swing

RSI makes a low

RSI rallies

RSI dips again but stays above previous low

RSI breaks the previous high

Bearish Failure Swing

RSI makes a high

RSI pulls back

RSI rallies but fails to break the previous high

RSI breaks the previous low

Failure swings often appear at trend tops and bottoms before candles reveal anything.

🔵 4. DIVERGENCES (REGULAR AND HIDDEN)

Regular Divergence: Reversal Clue

Bullish: price lower low, RSI higher low

Bearish: price higher high, RSI lower high

Hidden Divergence: Trend Continuation

Bullish hidden: price higher low, RSI lower low

Bearish hidden: price lower high, RSI higher high

Hidden divergence is more powerful than regular because it confirms trend continuation.

🔵 5. RANGE RSI VS TREND RSI

RSI behaves very differently in ranges versus trends.

Range Environment

RSI oscillates between 30 and 70

Reversals at extremes have high accuracy

RSI 50 is the equilibrium

Trend Environment

RSI stays above 50 in bullish trends

RSI stays below 50 in bearish trends

30 and 70 extremes lose meaning

Always identify environment first. RSI signals change depending on regime.

🔵 6. RSI AS A STRUCTURE FILTER

RSI combined with structure improves trade selection dramatically.

Price makes higher highs + RSI rising = healthy trend

Price makes higher highs + RSI flat = weak breakout

Price makes higher highs + RSI dropping = exhaustion

Support retest + RSI 40–50 = strong continuation potential

Most false breakouts are avoided simply by checking RSI pressure.

🔵 7. MULTI-TIMEFRAME RSI ALIGNMENT

Use higher timeframe RSI to validate lower timeframe setups.

HTF RSI bullish + LTF RSI pullback = high-quality entry

HTF RSI bearish + LTF RSI bounce = premium short area

HTF RSI crossing 50 = long-term regime shift

This is one of the most powerful RSI confluences.

🔵 EXAMPLE TRADING FRAMEWORK

Bullish Setup Checklist

RSI in bullish regime (above 50)

Pullback into 40–50 zone

Hidden bullish divergence or failure swing

Structure forms a higher low

Bearish Setup Checklist

RSI in bearish regime

Rejection from 50–60 zone

Hidden bearish divergence or failure swing

Structure forms a lower high

🔵 COMMON RSI MISTAKES

Trading RSI extremes without trend context

Ignoring RSI regimes

Entering on regular divergences in strong trends

Not using RSI midline (50) as a regime filter

Relying only on overbought/oversold signals

🔵 CONCLUSION

RSI is one of the most powerful indicators when used correctly. It provides a complete framework for:

Reading trend strength

Tracking momentum pressure

Identifying early reversals

Trading continuation setups

Filtering breakout strength

Aligning multi-timeframe bias

Master RSI, and you gain a clearer view of momentum than most traders ever experience.

How do you use RSI? Do you prefer divergences, trend zones, or failure swings? Share your approach below!

Hiddendivergence

Tue 1st Apr 2025 Daily Forex Charts: 4x New Trade SetupsGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified 4x new trade setups this morning. As usual, you can read my notes on the charts for my thoughts on these setups. The trades being a CAD/JPY Sell, GBP/CAD Buy, EUR/AUD Buy & a USD/CAD Buy. I also discuss some trade management. Enjoy the day all. Cheers. Jim

Bullish Divergence on Monthly TF.Bullish Divergence on Monthly TF.

Weekly Support seems to be around 30.

& Important Resistance is around 32-33.

Though a re-testing of breakout done. but

Important to Sustain 24.90

As of now, Stock is in sideways movement;

& it will be Bullish once it will cross 36.

A positive point is that there are multiple

bullish / hidden bullish divergences on

different time frames.

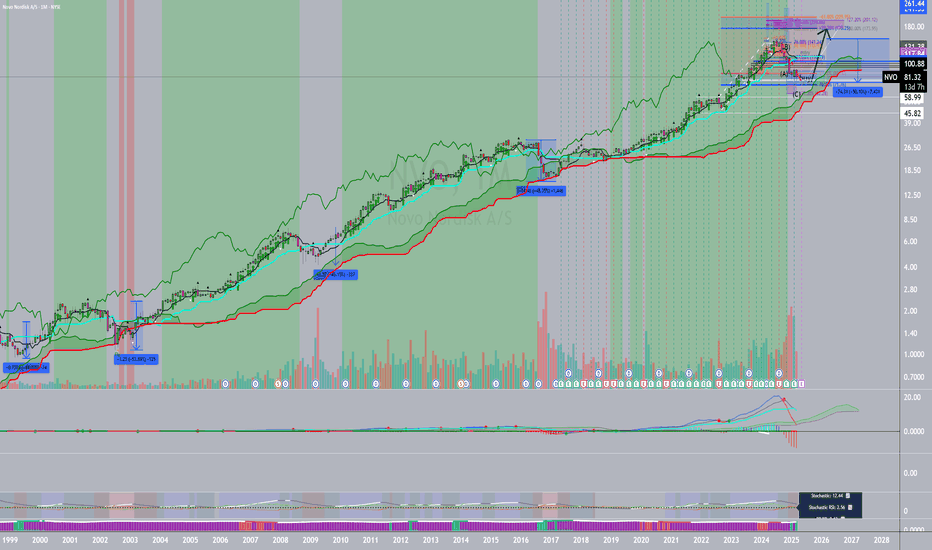

Novo Nordisk: 50% Drops Lead to Amazing GrowthFundamentals :

Take a look at NVO in 1999-2000, 2003, 2008, 2016 and June 20024-2025. Every time it dropped about 50%, that lead to a huge rally for years! NVO has secured contracts with Medicaid for their diabetes and other drugs. It is not going anywhere. It has fallen 50%. We either hold or buy more.

Technicals :

uHd + extreme indicator +u3 volume last month +horizontal support + a-b-c + key fib pb

Projection: 200 to 250 within two years, tentatively.

Thu 6th Mar 2025 Daily Forex Charts: 4x New Trade SetupsGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified 4x new trade setups this morning. As usual, you can read my notes on the charts for my thoughts on these setups. The trades being a AUD/USD Buy, AUD/CHF Buy, NZD/USD Buy & a USD/CAD Sell. I also discuss some trade management. Enjoy the day all. Cheers. Jim

Fri 31st Jan 2025 Daily Forex Charts: 3x New Trade SetupsGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified 3x new trade setups this morning. As usual, you can read my notes on the charts for my thoughts on these setups. The trades being a EUR/USD Sell, NZD/USD Sell & a USD/SGD Buy. I also discuss some trade management. Enjoy the day all. Cheers. Jim

SILVER Outlook after the Dip. What to expect NOW?As you can see, the price has repeatedly hit the trendline and then increased. This time, the same situation has occurred, so the trendline can be relied upon. Additionally, a hidden bullish divergence is visible, indicating a potential price increase.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

The last bullish chance of BITCOIN in short-term !!BTC is attempting to break through resistance of ascending triangle pattern after bouncing off support. Wait for a decisive breakout above the ma 200 to confirm the continuation of the bullish trend . Up we go if we do breakout , also a bullish hidden Divergence (HD+) on MACD which shows Positive Signs for BTC.

The price can increase as much as the measured price movement ( AB=CD ) .

The break out needed for increasing further has not happened but it should happen pretty soon.

✨Traders, if you liked this idea or have your opinion on it, write in the comments, We will be glad.

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!

Nothing !!!Hello

COINEX:NOTUSDT

As you can see, Notcoin is in a bullish flag, which means that if the price can break the flag, the price can rise. Also, the Bullish hidden divergence supports this signal.

❗ Note that if the Pennant is broken down with the power of descending candles, our analysis will fail.

Traders, if you liked this idea or have your opinion on it, write in the comments, We will be glad.

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

NOTHING !!Hi.

COINEX:NOTUSDT

The price has reached the top of the channel and continues to climb after a small correction.

🟢HIDDEN BULLISH Divergence is positive thing to increase the the price.

Traders, if you liked this idea or have your opinion on it, write in the comments, We will be glad.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Hidden Divergence to decline the price of USDT.DHello

As you see in the chart there is negative hidden divergence in USDT.D and everything is prepared for a dump in USDT.D which will cause a severe pump in crypto specially in the altcoins that have been straggled from market pumps

What do you think?

Unveiling the Power of RSI's Hidden Bullish Divergence.Greetings, friends and speculators.

Let's take a moment to examine the Crypto King's relationship with the 2-month RSI indicator.

The RSI has proven itself as a powerful tool, accurately identifying the exact bottom on three separate occasions.

During the bear market lows of 2015, 2018, and 2022, a hidden bullish divergence emerged, signaling the conclusion of the downtrend and the initiation of a new "Mark Up" Phase.

Interestingly, there has been an approximately 20% increase in the duration between these hidden bullish divergences. If we extrapolate this trend to the current period, we might anticipate a market bottom around July 2027.

However, approach this prediction with caution, past performance does not guarantee future returns.

To confirm a valid Hidden Bullish Divergence, the bulls need to maintain the price above the 2022 lows while ensuring that the RSI makes a lower low.

Apart from indicating market bottoms, the RSI indicator also aids in pinpointing optimal exit points. Notably, RSI levels surpassing 90 historically denoted the conclusion of the bull run.

With the current RSI hovering around the 70 mark, it suggests that the bulls still possess plenty of ammunition as they advance further.

I should note that RSI has made a lower high during the last 2 market tops, one could assume that a lower high in this bull frenzy would fail to penetrate the 90+ level.

If you recall my BTC post from September 2021, I advised bulls to start dollar-cost averaging into positions. At that time, BTC was experiencing an "Accumulation" phase, and it's clear that we've transitioned into a "MarkUp" phase now.

As we approach the final Bitcoin halving, there is no doubt that an interesting time is upon us.

To all those who weathered the brutal bear market, I salute you.

Much Love & Good Luck!

SPECUALTIVE SETUP, DYOR + DD.

What is Hidden Bullish Divergence?

A hidden bullish divergence is a setup where the oscillator forms lower lows at the same time that the price is forming higher lows. This setup is frequently seen in situations where the price has been in consolidation or has performed a pullback from an uptrend.

What is RSI?

The Relative Strength Index, or RSI for short, is one of the most popular technical indicators among the trading community. It belongs to the family of oscillators, or technical tools used to determine overbought or oversold conditions. It’s used to gauge the market sentiment.

Developed by J. Welles Wilder, the RSI measures the speed and change of price movements.

A popular way of reading RSI values is to look for divergences that occur when a new high or a new low of the price isn’t confirmed by the RSI readings.

displays on a vertical range of 0 to 100.

Readings close to 0 are viewed as “oversold”, while those closer to 100 are a sign of “overbought” market conditions. Unlike some other momentum indicators, readings can’t go below 0 or higher than 100.

BTCUSD Hidden Bullish Divergence on the DailyIn the daily BTC/USD chart, we're observing a series of higher lows , indicative of a bullish sentiment underlying the current market movements. This upward trend in price contrasts with the Commodity Channel Index (CCI), which is showing lower lows . This divergence between price action and the CCI can be interpreted as a hidden bullish divergence , suggesting that the momentum behind the price increase is still strong despite the temporary pullbacks.

Adding to the bullish outlook is the behavior of the Moving Average Convergence Divergence (MACD) indicator. Recently, the MACD line crossed above the signal line , a bullish signal that often precedes upward price movements. This cross enhances the bullish sentiment and may signal upcoming price increases.

Further cementing the bullish perspective is the overarching trend identified through a linear regression channel, which shows that we're in an overall uptrend. This aligns with the observed price action and indicator signals, providing a broader context for the current market dynamics.

Considering these factors, there's a plausible scenario where the price could ascend towards the weekly pivot point at $68,930 in the coming days. This pivot point acts as a significant resistance level, and reaching it would confirm the strength of the current uptrend. It's crucial for traders to monitor these developments closely, as a successful breach of this level could open the door for further gains.

🚧DOTUSDT is Bullish now🚧 & many Traders don't see it 👀!!!Hi.

BINANCE:DOTUSDT

😊Today, I want to analyze DOT for you in a 1D time frame so that we can have a Mid-term view of DOT regarding the technical analysis. (Please ✌️respectfully✌️share if you have a different opinion from me or other analysts).

As you can see, the price is in an ascending channel. Also, the price has created a hidden divergence, which is a good sign for the price to rise.

✅ Due to the Ascending structure of the chart...

- High potential areas are clear in the chart.

-Hidden bullish Divergence

Stay awesome my friends.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

✅GTAI's Situation: What Shall we Expect, can ascend further?Hi every one

➡️ As you can see, GTAI has grown well since its introduction. After the broken of Falling Wedge, started 5 upward wave and successfully completed it, and then started a corrective wave, which it has now completed. Now it's time for it to start its upward wave, and considering that the price is now in an ascending triangle.

-Hidden divergence has occurred, this signal can be strong.

➡️ second scenario:

If the first scenario failed , we can look at the second scenario. In the second scenario, the price can form a bullish flag, which can have a good growth after breaking the price.

🤑Stay awesome my friends.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️ Like ❤️ and 🌟 Follow 🌟!