QE is Back, Why?When he said, 'cease the balance sheet runoff,' it means the Fed plans to keep its balance sheet stable — basically, to stop their balance sheet from shrinking any further under quantitative tightening. But that doesn’t mean they’re starting quantitative easing again.

10 Year Yield Futures

Ticker: 10Y

Minimum fluctuation:

0.001 Index points (1/10th basis point per annum) = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

FOMC conference transcript on 29 Oct 25 pertaining to Fed's balance sheet:

"We also decided to conclude the reduction of our aggregate securities holdings as of December 1.

At today’s meeting, the Committee also decided to conclude the reduction of our aggregate securities holdings as of December 1. Our long-stated plan has been to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions. Signs have clearly emerged that we have reached that standard. In money markets, repo rates have moved up relative to our administered rates, and we have seen more notable pressures on selected dates along with more use of our standing repo facility. In addition, the effective federal funds rate has begun to move up relative to the rate of interest on reserve balances. These developments are what we expected to see as the size of our balance sheet declined and warrant today’s decision to cease runoff.

Over the 3-1/2 years that we have been shrinking our balance sheet, our securities holdings have declined by $2.2 trillion. As a share of nominal GDP, our balance sheet has fallen from 35 percent to about 21 percent. In December, we will enter the next phase of our normalization plans by holding the size of our balance sheet steady for a time while reserve balances continue to move gradually lower as other non-reserve liabilities such as currency keep growing. We will continue to allow agency securities to run off our balance sheet and will reinvest the proceeds from those securities in Treasury bills, furthering progress toward a portfolio consisting primarily of Treasury securities. This reinvestment strategy will also help move the weighted average maturity of our portfolio closer to that of the outstanding stock of Treasury securities, thus furthering the normalization of the composition of our balance sheet.

CLAIRE JONES. Can I just ask you a quick follow-up on QT? How much of the fund impressions we've seen in money markets are related to the U.S. Treasury issuing more shortterm debt?

CHAIR POWELL. That could be one of the factors, but the reality is that we've seen --the things that we've seen, higher repo rates in the federal funds rate moving up, these are the very things that we -- that we look for. We actually have a framework for looking at the place we're trying to reach. What we said for a long time now is that when we feel like we're a little bit, or a bit above what we consider a level that's ample, that we would freeze the size of the balance sheet. Of course reserves will continue to decline from that point forward, as non-reserve liabilities grow. So this happened, some of it -- some things have been happening for some time now, showing a gradual tightening in money market conditions, really in the last, call it three weeks or so, you've seen more significant tightening, and I think a clear assessment that we're at that place. The other thing is, we're -- the balance sheet is shrinking at a very, very slow pace now. We've reduced it by half twice, and so there's not a lot of benefit to be, to be holding on for it to get the last few dollars, because again, when the balance sheet -- reserves are going to continue to shrink as non-reserves grow. So there was support on the Committee, as we thought about it, to go ahead with this and announce effective December 1 that we will be freezing the size of the balance sheet. And the December 1 date gives the markets a little bit of time to adapt.

STEVE LIESMAN. Just a follow-up on the balance sheet, if you stop it, the runoff now, does that mean you have to go back to actually adding assets sometime next year so that the balance sheet doesn't shrink as a percent of GDP and become a tightening factor?

CHAIR POWELL. So, you're right, the place we'll be on December 1 is that the size of the balance sheet is frozen, and as mortgage-backed securities mature, we'll reinvest those in treasury bills, which will foster both a more treasury balance sheet, and also a shorter duration.

So that's -- in the meantime, if you freeze the size of the balance sheet, the non-reserve liabilities, currency for example, they're going to continue to grow organically and because the size of the balance sheet is frozen, you have further shrinkage in reserves. And reserves is the thing that we're -- that we're managing that has to be ample. So, that'll happen for a time, but not a tremendously long time. We don't know exactly how long, but at a certain point, you'll want to start -- you'll want to start reserves to start gradually growing to keep up with the size of the banking system and the size of the economy. So we'll be adding reserves at a certain point, and that's the last point. Even then we'll be -- we didn't make decisions about this today, but we did talk today about the composition of the balance sheet. And there's a desire that the balance sheet be -- right now it's got a lot more duration than the outstanding universe of treasury securities and we want to move to a place where we're closer to that duration. That'll take some time. We haven't made a decision about the ultimate endpoint, but we all agree that we want to move more in the direction of a balance sheet that more closely reflects the outstanding treasuries. And that means a shorter duration balance sheet. Now, this is something that's going to be -- take a long time and move very, very gradually and I don't think you'll notice it in market conditions. But that's the direction of things.

Jeromepowell

BTCUSDT – Hawkish Fed Sends Bitcoin to Test Its 200‑Day LineBitcoin extended losses this week as Fed Chair Jerome Powell’s hawkish tone cooled expectations for another rate cut. The move left traders torn between short-term risk-off signals and long-term technical support.

The Fed’s second straight 25-basis-point cut was widely expected, but Powell’s comments hinted that the central bank may pause before easing further. That shift strengthened the dollar and Treasury yields, weighing on crypto and risk assets. Bitcoin slipped around 3% to below $108 000 before finding temporary footing.

🔹 Macro & Sentiment

Powell’s message was clear: the committee remains divided, and caution may prevail into year-end. That triggered profit-taking across risk markets. Meanwhile, Trump’s “amazing” meeting with Xi Jinping and a new trade truce added volatility, but digital assets lagged the optimism seen in equities — a sign of hesitation among crypto traders.

🔹 Chart & Levels

BTC is now testing its 200-day moving average near $110 000, a level that has defined the broader uptrend since summer. Below that, key support sits at $107 000 and $100 000. Resistance remains around $120 000–$127 000. A clean bounce from the 200-day line could restore bullish momentum, while a break beneath it would expose the lower range.

As long as $110 k holds, bias stays cautiously bullish toward $120 k+. Below $110 k, the outlook turns more corrective.

🧾 The Takeaway

Fed caution has slowed Bitcoin’s momentum but not yet reversed its trend. The next major move depends on whether the 200-day line can hold under the pressure of a stronger dollar and shifting rate expectations.

Off to you: Will Bitcoin COINBASE:BTCUSD defend its 200-day support or roll over for a deeper correction?

Today's Market Wrap: Fed, Gold, and Earnings – 29/10/2025The Federal Reserve cut interest rates by 25 basis points, marking the lowest level since 2022. However, Fed Chair Jerome Powell hinted at a possible pause in further rate cuts for the rest of the year. Still, the S&P 500 gained 0.2%, and the Nasdaq gained 1%, both hitting fresh record highs.

Gold remained flat at $3,950 an ounce after Powell warned that a December rate cut is not guaranteed. Potential progress on the US-China trade framework has also reduced some safe-haven demand.

In corporate earnings, Microsoft beat expectations but saw a ~2.5% drop in after-hours trading due to a slight miss in cloud revenue. Meta posted strong results but fell ~8% after hours, driven by concerns over capital expenditure. Alphabet exceeded earnings and revenue forecasts, with strong performance across Search, YouTube, and Cloud, sending shares up ~5% in after-hours trading.

USDCHF Watching 0.80900 Resistance as Downtrend ExtendsHey Traders,

In today’s session, we’re monitoring USDCHF for a selling opportunity around the 0.80900 zone. The pair remains in a clear downtrend, with price currently in a corrective phase approaching a key resistance area near 0.80900.

A rejection from this level could reaffirm bearish momentum, potentially opening the door for another leg lower in line with the prevailing trend.

Trade safe,

Joe.

Powell Signals the End of QT — Relief Rally or the Calm Before?First, let’s look at the key points from Powell’s remarks at the 67th Annual Meeting of the National Association for Business Economics (NABE):

* The future path of monetary policy will depend on the assessment of data and risks.

* The balance sheet remains a vital tool of monetary policy.

* Fed officials will discuss the composition of the balance sheet.

* Balance sheet reduction (QT) could come to an end in the coming months.

* Inflation remains on an upward trajectory.

* The labor market shows signs of notable downside risks.

From this set of statements, my conclusion is that if the Fed and Powell start speaking more decisively about ending QT and halting balance sheet reduction, it would be highly significant.

It would indicate that the Fed is becoming increasingly concerned about the future of the labor market — and likely signals more aggressive and deeper rate cuts ahead.

Halting the balance sheet reduction while simultaneously cutting rates could provide some support to the U.S. economy and ease pressure on equities and financial markets.

However, if QT is paused but unemployment continues to rise, we should expect a sharp downturn in financial and equity markets.

Overall, given Powell’s dovish tone, my trading bias remains bearish, unless a strong technical reversal emerges.

That said, the U.S.–China trade tensions currently carry even greater importance in shaping market direction.

The countdown is on for the most anticipated Fed decision The Federal Reserve is widely expected to cut rates by 25bps to 4.00–4.25, with 105 of 107 economists surveyed by Reuters forecasting that outcome.

Still, the decision may not be unanimous. Some Committee members are not fully aligned on a September cut. Fed’s Goolsbee and Schmid could dissent in favour of leaving rates unchanged.

There is also a possibility of a larger move. If the U.S. Senate confirms Stephen Miran’s nomination to the Fed Board on Monday, he could be sworn in just in time for the meeting, and some speculate he may vote for a 50bps cut. Governors Bowman and Waller, who have previously dissented dovishly, may also support a larger reduction.

Fed rate cut timing: September or October? The Jackson Hole Symposium has set the stage for renewed downside pressure on the U.S. dollar, as investors increasingly position for a 25-basis point Fed rate cut in September.

However, Morgan Stanley assigns only a 50% probability to such a move, suggesting that a September cut is far from guaranteed.

Market focus is also turning to the prospects of a rate cut in October too. The market is assigning only a small chance of two cuts in a row by the Fed.

Perhaps Morgan Stanely’s outlook implies the Fed may delay the widely expected September cut until October instead.

In practice, the market impact could be similar either way. With a softer dollar and stronger equities if Powell signals in September that easing is on the way the following month.

Powell’s Jackson Hole speech: Key risks for SPX, DXY, and goldTraders are watching and waiting for Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Symposium.

The baseline expectation is that Powell will avoid committing to any move at the September meeting. Instead, he is likely to repeat that decisions will depend on the full set of economic data released between now and then.

If Powell were to even weakly signal a rate cut in September, the S&P 500 could rally. However, the reaction may be limited since markets are already pricing in a high probability of easing. According to CME’s FedWatch tool, traders see a 71% chance of a quarter-point cut in September.

Looking beyond September, a hint of rate cuts in October, November, or December could weaken the U.S. dollar and provide support for gold.

IWM Appears Due for a Minimum 40-60% Downside CorrectionOn the lower timeframes IWM has been treating $223 as short term support with much sold put leverage building at $220 and recently IWM has begun to retrace back down into those levels putting those sold puts at risk of expanding the volatility and of squeezing through these short puts as a result.

The short term the loss of this zone could likely squeeze down to $200.

However in the longer term we have been trading within this much larger parallel channel since the peak and bottom of 2008-2009 GFC and have started to form a potential peak paired with a Bearish Shark. I think that if we were to start to see some serious downside the IWM could trade back down to not just the bottom of the channel but down to one of the 3 major horizontal supports I have plotted on the cart down at $121, $85.74, or even $41.11 if things get real bad.

Personally I will be targeting one of the 2 upper horizontal supports in the longer dated positioning while targeting the $210-$200 levels in the short term.

I'd suspect this decline to come especially as Fed Rate cut expectations are completely priced out of the market, it is worth mentioning that fed funds futures around the start of the month dropped their expectations of rate cuts for the September meeting down to 0 and we may now be on the path to pricing in rate hikes as seen in the chart below.

Alternatively the expectations for rates going into the end of December has been on a fast trajectory of pricing out rate cuts as well, starting at 90BPS of rate cuts at the start of the year, now pricing in only 37.5BPS in rate cuts:

This ongoing shift in these fed futures spreads from positive to negative signifies the amount that Fed Funds Futures are expecting the Fed to hike rates with both the instance of rate hikes and rate cuts likely to cause a collapse in credit spreads as the bond market yield shift higher leaving the interest rate sensitive IWM to be one of the most negatively affected.

Dissent inside the Fed ahead of Jackson HoleThe Federal Reserve’s last meeting kept interest rates unchanged, but two board members, Christopher Waller and Michelle Bowman disagreed. Their dissents will be a key focus when the Fed releases the minutes this week.

Those same members are scheduled to speak at this week's Jackson Hole Symposium. Both are seen as possible successors to Chair Jerome Powell, whose position is under political pressure from President Trump. Waller and Bowman’s remarks will be closely watched.

Powell will also deliver his keynote on August 22. At the same time, he may need to defend the Fed’s independence as the administration pushes for sharp rate cuts.

AUD/USD tests uptrend as Trump targets Powell at Fed siteThe US dollar is trading mixed after President Trump made a rare appearance at the Federal Reserve’s renovation site, in an attempt to distract from you know what.

While the visit had no formal policy announcements, Trump did try to further undermine Chair Jerome Powell by erroneously claiming the renovation cost had blown out to 3.1 billion by adding the cost of a building finished 5 years ago.

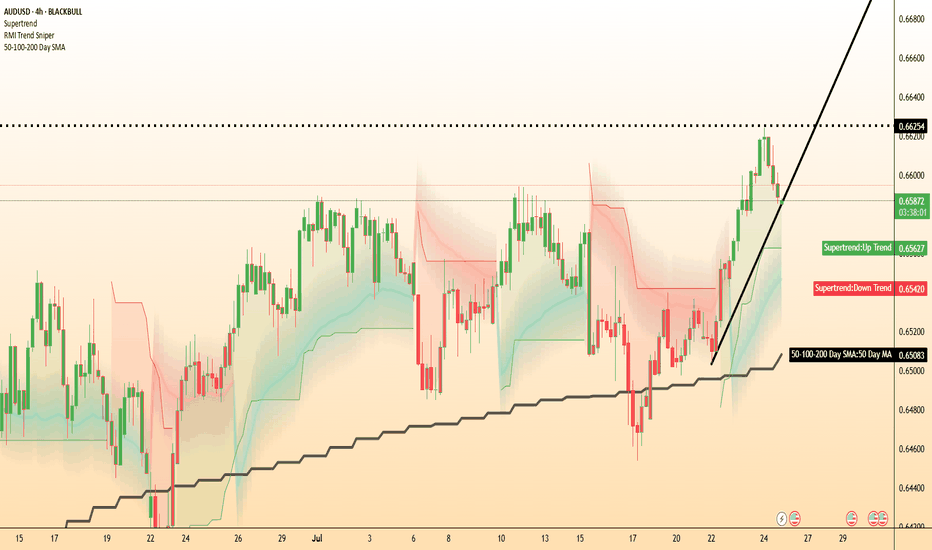

Meanwhile, AUD/USD could be of the most interest. Traders might like to watch to see if it can hold its uptrend after its downside breakout from yesterday. AUD/USD remains potentially supported above its 50-DMA, with momentum pointing to potential further upside beyond 0.6625.

What Happens the Day Jerome Powell Is Fired or Quits?A sudden exit by Fed Chair Jerome Powell would create both a political and monetary shock.

While the Chair is technically protected from arbitrary removal. Recent reports confirm that President Trump and his allies are scrutinising the Fed’s $2.5 billion renovation project—potentially laying the groundwork for a “for cause” dismissal.

A surprise departure would undermine confidence in the Fed’s independence. The U.S. dollar could fall sharply across major pairs.

USD/JPY could fall toward ¥145, with safe-haven demand favouring the yen. However, the reaction may be less severe than in pairs like Swiss franc which we have noted in the past is the potentially preferred safe haven. A panic selloff could extend to 142.20—a prior consolidation floor.

GBP/USD could surge as traders anticipate a more dovish Fed stance under the new Trump-stooge Fed Chair. From a technical perspective, GBP/USD is maybe already oversold and potentially poised for a potential rebound anyway—Powell’s resignation or firing could potentially exacerbate this. The first level to watch being a return to 1.3700, assuming the likely expectation of Fed rate cuts rise.

Mr. LATE drop the RATE!!"Jerome Powell aspires to be remembered as a heroic Federal Reserve chair, akin to Tall Paul #VOLKER.

However, Volker was largely unpopular during much of his tenure.

The primary function of the Federal Reserve is to finance the federal #government and ensure liquidity in US capital markets.

Controlling price inflation should not rely on costly credit.

Instead, it should be achieved by stimulating growth and productivity through innovation and by rewarding companies that wisely allocate capital, ultimately leading to robust cash flows... innovation thrives on affordable capital.

While innovation can lead to misallocations and speculative errors, this is a normal aspect of the process.

(BUT it is crucial that deposits and savings are always insured and kept separate from investment capital.)

By maintaining higher interest rates for longer than necessary, J POW is negatively impacting innovators, capital allocators, small businesses that need cheap capital to function effectively, job creators, and the overall growth environment.

Addressing price inflation is a far more favorable situation than allowing unemployment to soar to intolerable levels.

"Losing my job feels like a depression".

But if I have to pay more for eggs, I can always opt for oats.

BIG BIG weekI think 7 FED speakers,

A lot of tension in the markets, tops mean polarisation, considering reflexivity theory extreme volatility will ensue.

A lot of people might think the -0.786 ATH we got before the holidays is the top. I think they are mistaken as seen in the analysis below.

There is still legroom for higher, this is a big bet on my part.

I have a few contracts on the mag7 (GOOGL, TSLA and META) focusing on GOOGL since they seem to be in the same headwind as S&P

Let's see how this plays out

EURUSD SHORTNFP came in lower than expected but unemployment rate declined. The next event coming up is US CPI, which is expected to go up. I am still maintaining a sell position because any higher than expected CPI will force the FED to continue holding. Also with the Trump's tariff threats I still anticipate the EURO to remain under pressure. Those with no entries watch for 1.03500 and go short.

Bitcoin Hits $100K: What Does It Mean for Gold?Bitcoin’s historic surge past $100K has reignited debates about its role in the financial world. Fed Chair Jerome Powell weighed in, calling Bitcoin a "speculative asset," likening it to virtual gold rather than a competitor to the dollar:

"It's highly volatile, not a store of value or form of payment. It's really a competitor for gold."

With Bitcoin soaring, many are asking: Could this mark the beginning of a stronger correlation between Bitcoin and gold, or are they destined to move on separate paths?

Gold Faces Its Own Test

While Bitcoin grabs the headlines, gold prices slipped below $2,630 per ounce, pressured by firming U.S. Treasury yields. Benchmark 10-year yields rose 0.6%, as markets anticipate today’s U.S. Non-Farm Payrolls (NFP) report, expected to show 200,000 new jobs. A weaker report could lift gold, especially as traders assign a 74% chance of a 25-basis-point Fed rate cut in December.

Fed Chair Jerome Powell has emphasized caution, acknowledged the economy’s resilience but signaling a careful approach to rate cuts. Gold, often a winner in low-rate environments, now finds itself at a critical juncture.

Our Trading Plan for Gold

Key levels to watch as we await the NFP report:

$2,630: Monitor for price reactions to this recent support.

$2,537–$2,530: Look for potential opportunities at this deeper support range.

The Bigger Picture

As Bitcoin claims new highs and challenges gold’s status as a store of value, gold continues to be swayed by macroeconomic forces. Will gold bounce back, or is it preparing for further dips as Bitcoin surges?

Let us know your thoughts—will Bitcoin and gold align as Powell suggests, or will their paths diverge further?

For more in-depth gold analysis and updates, stay tuned. And as always, happy trading!

Federal Reserve Cuts Interest Rates by 50 BPS, Crypto RalliesMarket Update - September 20th, 2024

Takeaways

The Federal Reserve cuts rates: The Federal Reserve announced Wednesday it will cut the federal benchmark interest rate by a half-percentage point (50 basis points), lowering the range to between 4.75% and 5%. Crypto markets responded well to the move, with the price of bitcoin pushing past $63,000.

US crypto legislation still possible this year: US senator Cynthia Lummis (R-WY) said in an interview Tuesday she thinks crypto legislation could be passed during the lame-duck session of Congress.

US spot bitcoin ETFs pull in $187 million in inflows: US spot bitcoin ETFs drew $187 million in inflows Tuesday, marking the fourth consecutive day of inflows after a significant drawdown.

Republicans ask for clarity on crypto airdrops: US representative Patrick McHenry (R-NC) and other top Republican lawmakers sent a letter to SEC chair Gary Gensler asking for clarity on crypto airdrops.

Federal Reserve Cuts Interest Rates by 50 BPS, Crypto Rallies

The Federal Reserve announced Wednesday it is lowering the benchmark federal funds rate by a half-percentage point (50 basis points) to between 4.75% and 5%. It marked the first interest rate cut in more than four years and signaled the Federal Reserve is ready to ease up on its fight against inflation.

The move marked the first time since 2008 the Federal Reserve had cut interest rates by 50 basis points at one meeting. Many analysts had expected a quarter-point percentage cut, but cooling inflation and a soft labor market allowed Federal Reserve chair Jerome Powell to be more aggressive. In August, the Consumer Price Index (CPI), a key inflation metric, dropped to 2.5% year-over-year, roughly hitting Powell’s 2% inflation target.

The long-anticipated move sparked the broader markets. And crypto prices also rallied, with bitcoin pushing to roughly $63,500 and ether increasing to roughly $2,350 respectively.

A low interest-rate environment is widely viewed as a greenshoot for risk assets including crypto, but it remains to be seen if a rate-cutting campaign will ultimately shoot bitcoin and other cryptocurrencies to all-time highs.

🌐 Topic of the week: Global Stablecoin Ecosystem

🫱 Read more here

SPY500 $SPY | RALLY AFTER FED RATE CUT - Sep. 19th, 2024SPY AMEX:SPY | RALLY AFTER FED RATE CUT - Sep. 19th, 2024

BUY/LONG ZONE (GREEN): $552.50 - $575.00

WEAKER BULLISH ZONE (PALE GREEN): $552.50 - $540.50

Weekly: Bullish

Daily: Bullish

4H: Bullish

This was my analysis for the end of the day yesterday, forgot to post it. Price has already rallied fairly well today. The Fed cut rates yesterday 50bps, down from 5.50 to 5.00. Here is what I was looking at as the market became volatile when reacting to the news. Despite the market already quickly moving in favor of the bullish zone, I still think we will reach the top of that zone before any form of reversal or significant pullback.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, spy, sp500, s&p, AMEX:SPY , fed, federalreserve, fedrate, fedratecut, interestrate, jeromepowell, fedchair, 50bps, volatile, volatility,

What to Expect at Jackson Hole Next Week? Traders will next hear from Federal Reserve Chair Jerome Powell during his highly anticipated address at the Jackson Hole Economic Symposium. The key question hanging over the market: Will Powell use this speech to pave the way for a potential interest rate cut in September?

Scott Helfstein, head of investment strategy at Global X, argues that Powell should take this opportunity to celebrate the Fed's achievements and steer the market toward a 25-basis-point cut next month.

Powell is expected to continue the tradition of Fed chairs delivering opening remarks at the Jackson Hole conference, scheduled for Friday morning next week. Market participants are currently divided on whether the Fed will opt for a 25- or 50-basis-point reduction.

However, the true size of the cut could be influenced by the August jobs report, set to be released just a week after the Jackson Hole summit.

July Economic Calendar - IMPORTANT EventsIt’s going to be a busy month for the Chair of the Fed (Jerome Powell), who delivers a speech today and then will testify later this month in front of Congress to provide updates on monetary policy decisions. Will we gain clarity on the timing of potential rate cuts this year, and if they are even being considered?

Crypto in June - How BTC responds

June saw significant volatility across the crypto market. Bitcoin fluctuated between price highs above $70,000 and lows of around $60,000, with substantial movement around 4 June when Bitcoin peaked above $71,000, before declining on 6 June and continuing a downward trend and falling to levels last seen in May. ETH and altcoins followed along, with Ethereum down approximately 11% in June . Pulling it back to the US markets, some analysts argue that the fluctuations was largely driven by uncertainty surrounding inflation data. The drop to $60k could likely be due to the reducing likelihood of multiple interest rate cuts by the Federal Reserve Bank this year, contrary to earlier investor anticipations (causing hesitation and a cautious approach).

Upcoming Events that could Affect Markets:

❗ Tuesday, 2 July 📢 Jerome Powell speech

Federal Reserve Chair Jerome Powell will provide an economic overview today, outlining current monetary policies. He will answers questions and the outcome of this speech can significantly impact financial markets and investor sentiment.

❗Wednesday, 3 July 📢 Federal Open Market Committee (FOMC)

The upcoming FOMC minutes are expected to provide more details on the Federal Reserve's decision to keep interest rates unchanged, and its revised economic projections. Key points could include the reasons behind the more hawkish stance on rate cuts, and the implications of updated forecasts for unemployment and inflation.

❗Friday, 5 July📢 US Unemployment Rate

The US unemployment rate is a key indicator of economic health, influencing consumer spending, corporate profits and the social sentiment. During May the US jobs sector added 272,000 jobs, further casting doubt on the rate cuts in the US this year.

❗Tuesday, 9 July 📢 Fed Chair Powell testimony

Jerome Powell is set to discuss the state of the economy, monetary policy decisions, and also outline future policy intentions in his twice-a-year testimony in front of Congress.

❗Thursday, 11 July 📢 US Inflation Figures

The year-on-year and month-on-month inflation numbers provide crucial insights into purchasing power trends, influencing market expectations for interest rates and the overall economic outlook. The Consumer Price Index (CPI) climbed 0.2% in May, the smallest advance in core CPI since October 2023.

Take extra caution when over the next few weeks as volatility will be likely depending on the outcome of these events.

_______________________

ECONOMICS:USINTR FRED:UNRATE ECONOMICS:USIRYY

DXY ( US DOLLAR Index ) Analysis 19/05/24Scenario 01 : if the Federal Reserve raise interest rates : Probability of this to happend is lower in my opinion but could happend somehow

1. *Dixie (USD Index):* Typically, when interest rates rise, the value of the dollar strengthens. This is because higher interest rates attract foreign investment, increasing demand for the dollar. So, the Dixie would likely see an increase in value.

2. *U.S. Dollar Index:* If interest rates rise, the U.S. Dollar Index, which measures the value of the dollar against a basket of other major currencies, would likely see an uptick as well. Again, this is due to increased demand for the dollar from foreign investors seeking higher returns.

Scenario 02 : if the Federal Reserve keeps interest rates the same:

1. *Dixie (USD Index):* If interest rates remain unchanged, the dollar's value might stay relatively stable. Without a change in interest rates to attract or deter investment, the Dixie may not experience significant fluctuations.

2. *U.S. Dollar Index:* Similarly, the U.S. Dollar Index could remain steady if interest rates are unchanged. It might experience some minor movements based on other economic factors, but overall, it's likely to maintain its current level.

Scenario 03 : if the Federal Reserve Cut / Lower interest rates: (Probability is High because of the inflation is high and Jerome Mentioned he might Cut rates in the next meeting)

1. *Dixie (USD Index):* Lowering interest rates usually leads to a decrease in the value of the dollar. This is because lower rates make it less attractive for foreign investors to hold onto dollars, as they can find higher returns elsewhere. So, the Dixie might depreciate.

2. *U.S. Dollar Index:* A cut in interest rates could lead to a decline in the U.S. Dollar Index as well. Lower rates could weaken the dollar's value relative to other currencies, causing the index to decrease.

In summary, changes in interest rates by the Federal Reserve can have significant impacts on both the Dixie and the U.S. Dollar Index, influencing their values in the foreign exchange market.

Market is Sensitive to what Jerome Powell is SayingAt the latest FOMC meeting on January 31st, Jerome Powell stated, 'The Fed is not ready to start cutting,' which immediately caused the yield to pivot higher. During an recent interview on Sunday, February 4th, he reiterated that the US central bank is not yet prepared to cut interest rates, resulting in another increase in the yield.

Today, we will discuss the direction of the yield or interest rates in the coming months, as well as why the Fed is carefully considering its decision to cut rates this time.

My name is Kon How, my work in this channel, as always, is to study behavioral science in finance, discover correlations between different markets, and uncover potential opportunities.

Micro 10-Year Yield Futures

Ticker: 10Y

0.001 Index points (1/10th basis point per annum) = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Bitcoin Above $42K Again as Fed Holds Interest Rates SteadyBitcoin gained some upward momentum, picking up 0.8% in the past hour, following an announcement from Federal Reserve officials that the central bank would leave interest rates unchanged.

At the time of writing, Bitcoin is trading for$43,119.95, according to CoinGecko. Ethereum also responded positively to the news, having picked up 1% in the past hour. It's currently changing trading for $2,234.

"The seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run," the FOMC said in a statement. "In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5.25% to 5.5%."

Federal Reserve Chairman Jerome Powell said during a press conference that the U.S. economic recovery "has progressed more quickly than generally expected, and forecasts from FOMC participants for economic growth this year have been revised up since our September Summary of Economic Projections."

"Even so," Powell added, "overall economic activity remains well below its level before the pandemic, and the path ahead remains highly uncertain."

Investors were expecting to hear that rates would be maintained. Ahead of the announcement, the CME FedWatch tool showed investors believe there's a 98% chance that the Federal Reserve would leave interest rates unchanged. The tool works by tracking the prices of Fed funds futures contracts, which investors use to speculate on or hedge against changes in rates.

Crypto investors tend to take the FOMC lowering rates or leaving them unchanged to be a bullish sign for markets.

That's because the Bitcoin (BTC) price has historically correlated with risk equities and central bank policy.

The more favorable credit conditions are in the economy, the more likely BTC is to pump. When interest rates are low, investors are more likely to take their dollars and put them into risk assets, such as stocks and crypto. When rates are high, investors flee back to dollars.

Notable Events: Bitcoin rose aggressively to new highs from March 2020 to early 2021 after the Federal Reserve lowered its benchmark interest rate to just 0.25%. And in July, traders breathed a sigh of relief while—despite news that the Fed planned to raise rates—Bitcoin and Ethereum didn't immediate take a dive.

The Fed started aggressively raising rates in 2022 to try and control 40-year high inflation. It hiked them by 75 basis points four times—which negatively impacted the value of stocks, equities and crypto.