The Green Organic Dutchman - W-MACD-CCI watchTGODF on weekly showing nearing entry point for MACD cross and CCI crossing 0. Keep watching here @Pokethebear.

TGODF , TLRY , NYSE:ACB , NYSE:CGC , NASDAQ:CRON , AMEX:HEXO

Macdcross

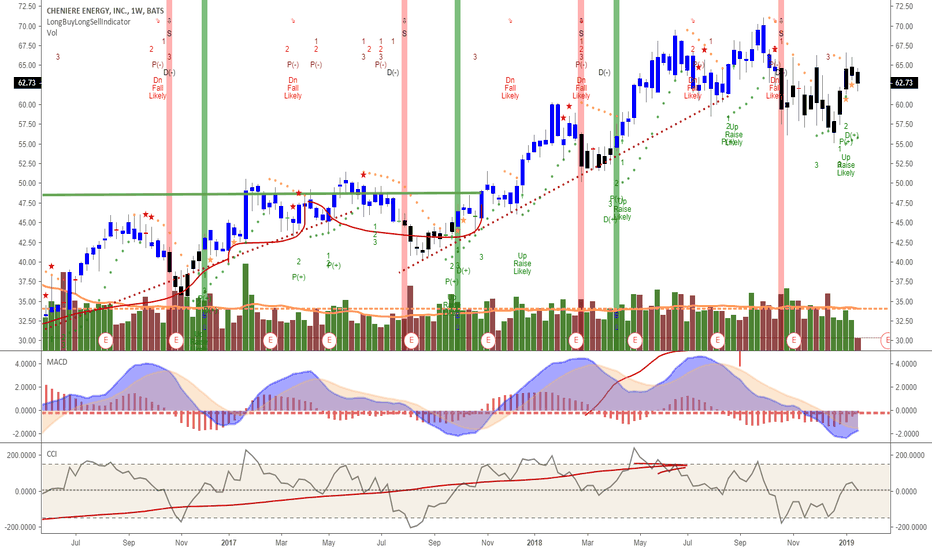

LNG winter fuel use time: MACD and CCI entry signalsOn weekly candlestick chart, MACD is shown crossing over and CCI at 0, but on downward slope at $62.73.

Await 2nd LNG port set-up and exports looking positive as cold weather driving use. LNG will also be a growing industrial energy fuel to replace coal and oil energy plants, as 30% lower CO2.

Nuclear and solar are only better ones and solar equipment costs not net zero CO2. Nuclear has proven solid long term CO2 near zero source (add CO2 output to make plant, deliver fuel).

Tilray nearing full retracement - daily MACD - CCI watch Tilray is currently $71.74/share and falling in this weeks sell off and good chance to drop near full retracement to $65-66 range. Great time to buy half and have standing order 8% below this for full retracement, or just wait.

$65.50 target with MACD cross-over on 12/26 and CCI about to cross positive.

EURUSD possible Long opportunityThe EURUSD is hitting recent Support area and Support line that has been created in the last month. Combined with the almost Oversold RSI and crossed MACD, this makes a great chance that the price will reverse and go bullish. I would suggest to move your stop below the last Support area and placing your limit below the Resistance line that has been created in the last 5 months.

Going up LONG? LTC:BTC 4th MACD Cross in 2 years, Weekly Candles

See image please.

***

Since Coinbase started trading the LTCBTC pair, the MACD on the Weekly Candles has only crossed 4 times, and the most recent was in October. We aren't seeing the volume or price increase this time, and I'm wondering if you all feel this latest MACD cross is going to be as significant as the prior three.

***

thank you for reading.

GinsengFarmer

EMA & MACD crossover, a potential early entry for Brent Crude?Trade set up - Enter on a daily close above the 10 day EMA with stops below the previous weekly low of 58.35 and a short-term price target of 70.00 - 71.00, looking to add to the position once broken above the downtrend channel.

Why we like this trade - Technically speaking, price looks to have found some support around the Feb 2017 high after the recent 33% onslaught of crude prices since late September. With a recent MACD crossover and bullish weekly close last week, it may be an early signal for a change in direction. We are looking for a close above the 10day EMA as an entry signal which seems to be holding true using the MACD crossover and oversold RSI for support in our conclusion.We've also seen a strong draw of 10m barrels in the weekly API crude inventory report, which gives us some confidence tonights official DoE report should follow suit.

That said, a break below the recent low could indicate further downside with the recent price support simply a rest for sellers looking to target $45-50 a barrel.

Disclaimer.

Trading leveraged products carries a high level of risk and may result in you losing substantially more than your initial investment. Pepperstone Group Limited is licensed and regulated by the Australian Securities and Investments Commission (AFSL 414530). Pepperstone Limited is authorised and regulated by the United Kingdom Financial Conduct Authority (FRN 684312). This information not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation

BITCOIN: Break Out The Red Panties - D4 Made Us Rich, Baby!Dear Friends!!

It's about time to call your wife: Break Out The Red Panties - D4rkEnergY Made Us Rich, Baby!

My forecast many days ago has held to the point. Ok, admitted - I was in doubt if we had one more wave down on the 5th subwave on the 5th Wave on A. But who cares.

We are now on my Wave B - we will continue up. We can go to anywhere from 4,9k-5,6k USD - It's the Tether BS-spikes that confuses me, why I have such a broad range - but we can figure that out when I get more confirmation on the 1st wave.

ALSO:

- Look at the bullish volume above MA20

- Incoming Bullish MACD-cross and the histogram shows us, how the bulls finally are greedy again!

What a day, my ladies and gentlemen. The Best Bitcoin Day since July - and 11 B USD went into the Global Market Cap, which now brings us up to 140B USD.

Have a wonderful day - and say hello to your wife from D4!

D4 Loves You <3

PS. Remember to give a LIKE - much appreciated!

Incoming small pumpo?Took up a long here, 4hr BB squeeze, MACD cross, bull div, targeting the 786 from the double top down to the deep swing low. Simple set up, hopefully pans out.

Incoming small pumpo??Took up a long here, 4hr BB squeeze, MACD cross, bull div, targeting the 786 from the double top down to the deep swing low. Simple set up, hopefully pans out.

MACD | Gunbot trading strategyThis is an example of Gunbot trading with the MACD strategy. Gunbot is a multi platform crypto trading bot.

About this strategy

This strategy is based on MACD , taking advantage of signals that indicate momentum is likely changing.

A buy order is placed when the MACD line crosses up the signal line, a sell order is placed when the MACD line crosses down the signal line.

Settings used

This example uses the "pure" version of the MACD strategy, meaning both the buy method and sell method are set to use MACD . MFI is used as confirming indicator.

The following relevant settings were used, all other settings were set to the defaults:

PERIOD: 240

MACD_SHORT: 12

MACD_LONG: 29

MACD_SIGNAL: 9

MFI_ENABLED: true

MFI_BUY_LEVEL: 40

MFI_BUY_LEVEL: 20

MFI_PERIOD: 14

Full disclosure

I am the author the Gunbot wiki. This content is only meant as educational material to show an example of how Gunbot can be used, disclosing the full strategy settings used.

Disclaimer

While every effort has been made to ensure these simulations of Gunbot contain the same logic as Gunbot, they will not always buy or sell at the exact same time or prices as Gunbot (because of TradingView's inability to use ticker prices). This is close as you can get in TradingView to the real thing. Backtesting the past does NOT guarantee profit in the present or future.

Please don't use these exemplary settings without doing your own research. Results can vary depending on the chosen market and it's conditions.

SPN Long MACD Oscillator Superior Energy Services Long NYSE:SPN

MACD Oscillator .

Will go long at when MACD Oscillator crosses up most likely around the price $9.19 and limit order set for 3% above that price where MACD Oscillator will most likely cross back down.

15 Minute Chart Used for Superior Energy Services

Goldman Sachs: Most signs are pointing up This will be a short post because there is a lot of verbiage in the chart. Generally while I definitely see a few bearish signs in Goldmans chart most are relatively bullish. Keep in mind these are weekly candlesticks used to project what may happen in several weeks or potentially months time so don't infer anything about day to day movements from this analysis. Questions and criticisms welcome, thanks.

Digibyte - DGB - just made 100% in 2 weeks!Hi Guys!

As we described this coin 3 months ago in our analysis

“DIGIBYTE (DGB) - 3100% Earnings Possible” – Seriously we have finally a massive break out. 100 % in just 2 weeks and this is not the end of the story as we still have no supply and lots of demand.

Guys Digibyte is a great project.

So short summary of what actually is.

This is the most decentralized cryptocurrency in the world - 190 000 nodes.

5 mining algorythms.

Real-time diffiuclty adjustment.

15 second block time. We tested the speed of the transfer - From exchange to cold wallet less than 30 seconds.

560 transactions per second.

Strong team with strong leader - Jared Tate hk.linkedin.com

Many exchanges where you can buy DGB (Poloniex, Bittrex, OKEX, Cryptopia and many more).

Faster, cheaper than BTC , BTCcash, Litecoin - steemit.com

Technical analysis details:

Double bottom formation observed

Just crossed 0,5 at Fibonacci extension

MACD – very positive, strong trend with triple bottom

Wave – lots of demand and no supply so far

CMF - Chaikin Money Flow - very high demand on price

Fibonacci scale:

1. 0.00000400 (achieved)

2. 0.00000510 (achieved)

3. 0.00000599 (achieved)

4. 0.00000687

5. 0.00000813

6. 0.00000974

We may expect to have higher levels as those back in June 2017 when DGB obtained 2500 satoshi.

Waiting so long for such levels may take time and it is very risky but may pay off.

For the tim e being observe Weis Waves and level of 800st.

We will post update regarding this trade.

What do you thinks guys? Please do share your thoughts in the comment section.

Thank you for reading this! Don’t forget to follow and like. :)

Hugs!

Your WBM Team

$UUU Bottom Signaled UUU hit a 52 week low 2 days ago and has started to turn up with a 15% gain yesterday and a bullish engulfing candle. UUU is a micro cap with 2.3mil shares and has been trading since the 1970's. Recently we saw a spike above $3 without any catalyst and UUU has a history of huge swings. On the daily chart we can see the macd is crossing up, rsi is oversold and has curled up.

CHKE Very Strongly Oversold CHKE a marketer and manager of fasion portfolios of fashion brands, its brands are licensed with retail and wholesalers in 50 countries and about 9000 retails. After reaching a high of $29.75 in the summer of 2015 it has dropped to a low of $.65. Looking at the company financials reveals possible under evaluation by the market. With a market cap of about$13mil and an enterprise value (MRQ) of $56mil, total assets of $103.597mil and a new deal with Bearpaw Holding CHKE could be on its way back up. In the last 3 weeks we have seen CHKE spike to $1.30 and retreat. A break through of $1.30 could create a large move to the upside and we saw an all time high on volume two days ago. Watch this for a strong move to the upside, possible short squeeze.

GBPAUD 4H FLAG TRADESPair is in a 4H Bearish Flag pattern

Pair could have bearish continuation

Enter on a 15m break-hook-go of support breakout

Take Profit is equal distance of flag pole

Possible Bullish pullback

Macd is over sold

Watch for Macd to cross above Red signal line before entry

Price may return to 50 sma