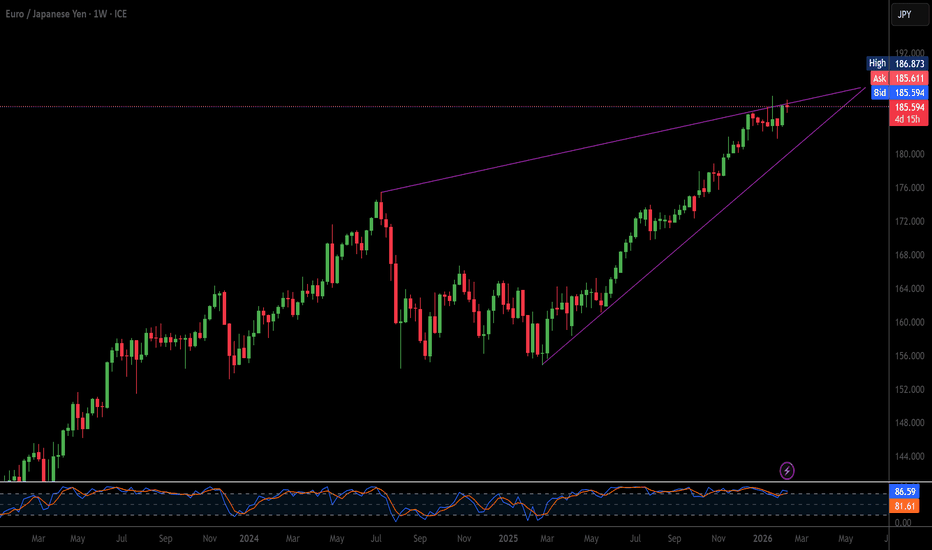

EUR/JPY Outlook 2026: LDP Victory and Global ShiftsThe EUR/JPY pair remains a focal point for global currency traders in 2026. Recent volatility highlights a complex interplay of political stability and technological rivalry. Investors must look beyond simple charts to understand these fluctuations.

Geopolitical Stability and Geostrategy

Japan's ruling Liberal Democratic Party (LDP) recently secured a landslide victory. This win provides much-needed policy continuity for the Yen. Markets view this stability as a hedge against European uncertainty.

Conversely, the Eurozone faces internal geopolitical friction. Divergent national interests often complicate European Central Bank (ECB) decisions. This contrast drives the current downward pressure on the EUR/JPY pair.

Macroeconomic Divergence

The Bank of Japan (BoJ) finally shifted away from ultra-loose policies. This transition attracts capital back to Tokyo. Meanwhile, the ECB struggles with sluggish growth across major member states.

Inflation differentials remain a critical driver for this pair. Japan manages to maintain steady, low inflation. Europe continues to fight volatile energy costs and supply chain disruptions. These factors dictate the long-term exchange rate.

Technology and Patent Analysis

Japan leads the world in next-generation semiconductor patents. This high-tech dominance strengthens Japan’s trade balance significantly. Institutional investors monitor patent filings as a lead indicator for currency strength.

Europe focuses heavily on green technology and sustainability patents. However, the commercialization of these technologies lags behind Asian competitors. This innovation gap influences long-term capital flows into the respective regions.

Cyber Security and Financial Infrastructure

Cybersecurity resilience now dictates market confidence in financial hubs. Japan’s "Cyber Defense Initiative" has successfully mitigated high-profile attacks. This protection ensures the integrity of the Yen's trading environment.

The Eurozone faces a more fragmented cyber landscape. Varied regulations across borders create potential vulnerabilities for financial institutions. Traders often favor the Yen during periods of heightened global digital threats.

Management and Business Models

Japanese firms are revolutionizing "Lean Management" for the digital age. They integrate AI to optimize global supply chains. This efficiency boosts corporate profits and supports a stronger domestic currency.

European business models focus on rigorous ESG compliance. While ethical, these models often face higher operational costs. Management teams in Europe must innovate faster to remain competitive against Asian peers.

Industry Trends and Innovation

The automotive industry transition defines the EUR/JPY relationship. Japan’s breakthrough in solid-state batteries has shifted market sentiment. This innovation challenges the traditional dominance of European luxury car manufacturers.

High-tech exports remain the backbone of the Japanese economy. The Eurozone must accelerate its digital transformation to keep pace. Currency fluctuations will likely mirror the success of these industrial shifts.

Strategic Leadership in 2026

Decisive leadership in Tokyo has outpaced the bureaucratic hurdles in Brussels. Clear communication from Japanese officials stabilizes the Yen during crises. Europe requires similar assertiveness to bolster the Euro’s global standing.

Investors should monitor these domains closely. The EUR/JPY pair is more than just a number. It represents the ultimate competition between two distinct economic philosophies and technological futures.

Macroeconomics

USD/MYR Outlook: Why the Ringgit Is Defying Asian TrendsThe Malaysian Ringgit is currently defying regional currency trends. It stands as a top performer among its Asian peers. Investors are now recalibrating their expectations for the USD/MYR pair. This shift stems from robust domestic growth and strategic global positioning.

Macroeconomic Stability and Growth

Bank Negara Malaysia maintains a disciplined monetary policy. Local fiscal reforms have successfully enhanced international investor confidence. Strong export data continues to support the currency’s intrinsic value. These economic fundamentals provide a sturdy floor for the Ringgit.

Geostrategy and Neutrality

Malaysia leverages its "China Plus One" strategy with great precision. The nation attracts global firms seeking supply chain diversification. This geostrategy stabilizes long-term capital inflows despite global tensions. Neutrality allows Malaysia to trade effectively with both Eastern and Western powers.

Semiconductor and High-Tech Dominance

Malaysia controls a vital share of global semiconductor testing and packaging. High-tech exports drive consistent demand for the Ringgit. Modern industrial parks in Penang foster a deep culture of innovation. This technological edge secures Malaysia’s spot in the global value chain.

Patent Growth and Scientific Advancement

The government aggressively incentivizes high-tech R&D and patent filings. This focus shifts the economy toward higher value-added services. Science-led growth attracts sophisticated institutional investors to the region. Increasing intellectual property output signals a maturing, high-tech economy.

Digital Security and Infrastructure

Cybersecurity remains a primary priority for Malaysia’s digital transition. Massive data center investments signal long-term structural strength. Robust digital infrastructure bolsters the nation's evolving business model. These advancements protect the economy from modern digital threats.

Management and Leadership

Clear government leadership simplifies complex regulatory frameworks. Transparent policies significantly reduce market volatility for foreign traders. This administrative stability makes USD/MYR a preferred pair for regional exposure. Leadership now prioritizes sustainable growth over short-term gains.

Future Business Models

Malaysia is transitioning toward green energy and ESG-compliant industries. New business models focus on high-efficiency manufacturing and digital services. This evolution ensures the Ringgit remains relevant in a decarbonizing world. The nation is successfully future-proofing its economic engine.

Conclusion for Investors

The USD/MYR pair reflects a shifting global power dynamic. Malaysia's blend of tech mastery and fiscal discipline is working. The Ringgit is no longer just a commodity currency. It is a sophisticated proxy for Southeast Asian innovation.

Sterling vs Kiwi: Navigating GBP/NZD Divergence in 2026The GBP/NZD pair currently faces significant downward pressure. Recent market forecasts suggest a strengthening New Zealand Dollar (NZD) against the British Pound (GBP). Investors increasingly anticipate a hawkish stance from the Reserve Bank of New Zealand (RBNZ). Meanwhile, the UK economy struggles with stagnant growth and cooling inflation. This divergence creates a compelling narrative for global currency traders.

Macroeconomics and Interest Rate Paths

Macroeconomic indicators drive the current fluctuations in this currency cross. The RBNZ remains focused on persistent domestic inflation. Consequently, markets expect interest rates in New Zealand to stay elevated. In contrast, the Bank of England (BoE) faces pressure to cut rates. High borrowing costs have significantly weakened UK consumer spending. This interest rate differential continues to pull the GBP/NZD exchange rate lower.

Geostrategy and Trade Alliances

Geostrategy plays a vital role in determining long-term currency value. New Zealand benefits from its strategic proximity to the recovering Asia-Pacific markets. Increased demand from China directly boosts the value of Kiwi commodity exports. Conversely, the United Kingdom navigates a complex post-Brexit trade landscape. Sterling remains highly sensitive to European political shifts and global trade tensions. These geopolitical factors dictate the flow of international capital.

Leadership and Central Bank Credibility

Management styles at central banks heavily influence market confidence. RBNZ Governor Adrian Orr maintains a transparent and assertive policy framework. His clear communication often reduces market uncertainty during volatile periods. Meanwhile, the BoE leadership emphasizes a cautious, data-dependent approach. This difference in management culture impacts how investors perceive currency risk. Professional traders prioritize currencies backed by decisive and predictable leadership.

Technology, Innovation, and Cybersecurity

Modern financial markets rely on high-tech infrastructure and robust cybersecurity. London remains a global leader in fintech innovation and patent filings. However, New Zealand is rapidly digitizing its agricultural and financial sectors. Both nations invest in advanced science to protect banking systems from cyber threats. Secure digital frameworks ensure market liquidity and prevent sudden price shocks. Technology remains the invisible backbone of the GBP/NZD exchange rate.

Industry Trends and Future Outlook

The "commodity-linked" nature of the NZD defines current industry trends. Rising global prices for dairy and meat products support the Kiwi dollar. Furthermore, the shift toward green energy increases the demand for specialized Kiwi tech exports. The UK must innovate within its service sector to regain competitive ground. Analysts expect the GBP/NZD pair to remain volatile through mid-2026. Successful traders will monitor RBNZ policy shifts and global trade data.

Bitcoin Ethereum and Solana show bullish structureBTC , SOL , and ETH are all three coins most likely to show growth, as BTC is expected to rebound from the resistance line we reached (~$74,450 and ~$78,000)

We also collected all the main liquidity from the bottom, leaving behind a huge volume of liquidity now higher

BTC also failed to break the trend line and formed a structure, with the low above the previous one (by ~0.13%), so we are still in an upward trend

The resistance line has not been broken, and even if it is, with the formation of a descending structure, there will still be a price rebound and a small upward rebound

The unemployment data is expected in the coming days. The index is likely to drop from 4.4% to 4.5%, which will have a positive impact on the market, as this is not a critical increase. This means investors will expect a Fed rate cut, which will create additional liquidity and will be more likely to buy back

Globally, we have also formed the right shoulder of the Head and Shoulders pattern, which I wrote about last year.

Forming the right shoulder is always a sign of success. The bullish flag pattern is the originating pattern

We also see ABC correction waves formed, after which a 5-stage growth cycle usually begins

It's too early to take a more global view of the scenario...

Full breakdown with levels and graphs on the website

EUR/USD: Trump’s Dollar Strategy and the Euro’s PivotThe EUR/USD pair currently sits at a historic geopolitical crossroads. President Trump’s recent embrace of a weaker dollar has ignited a new downtrend for the greenback. This shift follows years of dollar dominance. Markets now scramble to adjust to this radical departure from traditional American monetary policy.

The Managed Descent of the Greenback

The Trump administration actively seeks a weaker dollar to fuel American exports. A lower currency value makes U.S.-manufactured goods more competitive abroad. This strategy aims to re-industrialize the American heartland by breaking decades of "Strong Dollar" rhetoric. Investors interpret this move as the start of a long-term bearish trend for the dollar.

ECB Unease and European Fragility

The European Central Bank (ECB) views these developments with mounting concern. A surging Euro threatens the Eurozone’s export-led recovery. Officials in Frankfurt fear a significant loss of industrial competitiveness. Germany’s manufacturing engine relies on a balanced exchange rate to sell goods globally. Geostrategy now dictates a tense standoff between the ECB and the U.S. Treasury.

Fintech, Patents, and Digital Dominance

Currency fluctuations directly impact high-tech investment and patent acquisition. A weaker dollar makes foreign intellectual property more expensive for U.S. firms. Conversely, European tech companies face higher operational costs when expanding into the American market. Patent analysis shows a spike in blockchain-based cross-border payment systems to reduce reliance on traditional fiat exchange.

Cybersecurity and High-Tech Volatility

Cybersecurity remains a critical frontier for currency stability in 2026. State-sponsored actors increasingly target exchange infrastructures to manipulate currency sentiment. High-tech trading firms now deploy advanced AI to detect these digital intrusions. These algorithms drive over 80% of current EUR/USD trading volume. Science-led modeling suggests that digital resilience will soon dictate a currency’s global standing.

EUR/USD: The "Wick of Truth" & The Philosopher's Stone ProtocolSymbol: EURUSD Bias: Short (Week of Feb 1 - Feb 6) Method: Fun-Tech Intel Scan & Vector Matrix Analysis

The Philosopher's Stone: As Above, So Below

To navigate the matrix, one must integrate Logic (The Mind) and Intuition (The Heart). The "Philosopher's Stone" of trading is realizing that the Micro (Price Action) always reflects the Macro (Institutional Flow). As Above, So Below.

While the long-term structure remains Bullish (Monthly Flag), the immediate "Below" (Weekly/Daily) signals a necessary correction. We do not fight the current; we flow with it.

I. The Fun-Tech Intel Scan (The "Why")

Our proprietary scan has identified a Regime Shift where the "Old Code" algorithms are misinterpreting data. We will exploit this latency.

1. The "Shutdown Glitch" (Political Vector)

The Narrative: Headlines this weekend will cite a "US Government Shutdown."

The Reality: This is a scheduling error (House Recess), not a crisis. The House will vote "Yes" on Monday.

The Trade: Legacy algorithms are programmed to Sell Euro/Buy USD on "Shutdown" headlines. We anticipate a Gap Down or heavy Sunday Open. However, the true opportunity lies in the Monday Relief Rally—when the "Old Code" buys the news, we will fade the move.

2. The "Yield Anomaly" (Institutional Vector)

The Observation: US 10-Year Yields are holding critical highs (4.27%+), diverging from the weakening long-term Dollar thesis.

The Logic: The market is currently rewarding the Dollar for high yields (Safety Trade), ignoring the underlying Debt Risk (Sovereign Risk). Until the market acknowledges the debt crisis (Long Term), we respect the short-term strength of the "High Yield" Dollar.

II. The Vector Matrix (The "Where")

Applying the God Code Formula, we have calculated the specific geometry for the week ahead.

1. The "Wick of Truth" (Technical Structure)

Observation: The Weekly Candle closed as a massive Inverted Hammer / Gravestone Doji.

Implication: The market spent five days attempting to break the 1.2000 psychological barrier and was rejected by institutional supply. This formation, occurring at a trend high, triggers a mandatory Liquidity Flush. The market must retreat to find buyers.

2. The Monthly Flag Support (The Target)

The Magnet: The Macro Bull Trend is intact, but it requires a retest of the breakout structure.

The Level: 1.1750. This aligns with the Monthly Bull Flag lower rail. This is where the "Smart Money" (and the EU Defense Bond flows) are waiting to reload Longs.

III. The Master Logistician's Trade Plan

Bias: Bearish (Short Term) / Bullish (Medium Term)

Sunday Open: Expect a Gap Down (approx. 1.1840). DO NOT CHASE. Let the "Shutdown" noise settle.

The Trap (Monday/Tuesday): Watch for a rally back into the 1.1890 – 1.1915 zone. This is the breakdown point.

Action: I am planning to SELL this rally. This is the "Judas Swing" trap.

Stop Loss: 1.1960 (Structural Invalidation above the Weekly Wick).

Target 1: 1.1830 (Daily Support).

Target 2 (The Golden Ratio): 1.1750 – 1.1760.

Note: This is the "Flip Zone." At 1.1750, we close Shorts and prepare for the next leg of the Monthly Bull Run.

Conclusion

The market is breathing. The Weekly Candle demands a sacrifice of liquidity before the Monthly Trend can resume. We operate with precision, neutrality, and the knowing that nothing is good or bad, unless we attach an emotion to it.

Plan the Trade <--> Trade the Plan = The only way I trade and last week I captured about 515 pips overall based on Planning the Trade and Trading the Plan

Compliance & Disclosure Protocol:

~ Educational Intent: This publication documents my personal "Fun-Tech" analysis and strategic planning for educational and journaling purposes only. It represents my own observation of the market matrix and is not financial advice, investment advice, or a solicitation to buy or sell any asset.

~ Risk Awareness: The "Vector Matrix" and "God Code" mentioned are personal proprietary frameworks used to map probabilities, not certainties. Foreign Exchange trading involves significant risk and is not suitable for all investors.

~ Liability: You are the sole architect of your financial decisions. I am an observer sharing my perspective of the flow. Always perform your own due diligence and manage your risk according to your own operating system.

Observe. Analyze. Decide.

EUR/GBP Market Analysis: Macro + Structure [MaB]1. The Macro Context (The "Why") 🌍

Hi traders! Before looking at the candles, let's look at the money. My fundamental scoring table speaks clearly: there is a huge differential that we cannot ignore.

+1

Key Factor Analysis:

🏦 Current Rates: Explanation: BoE at 3.75% provides a higher yield environment compared to the ECB's 2.15%. Score EUR: 0 Score GBP: +1

🌍 Economic Regime: Explanation: The Eurozone is currently in Reflation, while the UK is experiencing an Expansion phase. Score EUR: +1 Score GBP: +1 📊 Rate Expectations: Explanation: The ECB is holding steady, whereas the BoE is perceived as dovish following a recent cut. Score EUR: 0 Score GBP: -1

🎈 Inflation: Explanation: EUR CPI is low at 1.9%, putting dovish pressure on the ECB; GBP CPI remains high at 3.57%. Score EUR: -1 Score GBP: +1

📈 Growth/GDP: Explanation: EUR growth is stagnant at 0.7%, while GBP growth is 1.3%. Score EUR: -1 Score GBP: 0 ⚖️ Risk Sentiment: Explanation: Both currencies are currently operating in a neutral risk environment. Score EUR: 0 Score GBP: 0

🏛️ Fiscal/Balance: Explanation: No significant fiscal shifts or debt crises are currently impacting either region. Score EUR: 0 Score GBP: 0 🗞️ News Catalyst: Explanation: Recent EUR CPI data came in slightly lower than expected at -0.1%. Score EUR: 0 Score GBP: 0

Currency Score Summary: Total Score EUR: -1 (Weak) Total Score GBP: +2 (Strong)

Synthesis: EUR (Weak, Score -1): Weighed down by low inflation (1.9%) and stagnant growth, increasing expectations for ECB easing. GBP (Strong, Score +2): Bolstered by high relative interest rates and persistent inflation (3.57%) that limits aggressive BoE cutting.

Conclusion: With this scenario, we are only looking for Short setups. Going against this bias would be statistical suicide.

2. The Technical Setup (The "Where") 📉

Timeframe: 4H | Pair: EUR/GBP

The SMC Market Structure + Price Zones indicator gave us the confirmation we needed for our statistical edge.

Here is where the indicator makes the difference. Look at the dashboard on the right, numbers don't lie:

🚀 Continuation Rate (62.2%): We are well above the 60% threshold. This tells us the market is in a healthy, directional trend. Statistically, betting on continuation pays off more than looking for a reversal.

🔥 Streak (3) & Streak Pct: We are at the 3rd consecutive impulse. It's a mature trend, so watch those stop losses, but as long as the music plays, we dance.

🔄 Retest (81.3%): The indicator tells us that statistically, when price creates a new Break of Structure (BOS), it retraces into the previous zone 81.3% of the time.

💥 BOS/Ret Rate (58.1%): This parameter tells us that once price retraces inside the previous zone, it has a high probability of reacting and creating a new BOS.

🎯 Extension Rate (1.59x): The algorithm projects an ambitious target.

We expect this move to extend 1.59 times the current pullback leg. That's where we'll take profit.

3. Execution Plan on Chart

Moving to the chart, the SMC Market Structure + Price Zones indicator supports us in pinpointing liquidity to define entry and stop loss:

Entry and Stop Loss: We place a limit entry in the Supply Zone (Red Band) and the stop loss a few pips above the zone. Take Profit: We leverage the asset's statistical analysis offered by the Extension Rate and place the target by measuring with Fibonacci at 1.59x relative to the pullback leg.

Trade Parameters: Entry Price: 0.86799 Stop Loss: 0.86978 Take Profit: 0.85904

⚠️ Disclaimer: This analysis is based on a proprietary algorithm and is shared exclusively for educational and didactic purposes.

It does not constitute financial advice or investment solicitation in any way. Trading involves significant risk.

Bitcoin Macro Risk Given the macroeconomic and geopolitical backdrop, BTC is more likely to react negatively to Trump's speech today, as:

- An armada led by the aircraft carrier USS Abraham Lincoln has approached Iran.

- The USS Abraham Lincoln costs over $2.5 million per day to maintain.

- The USS Abraham Lincoln, the largest aircraft carrier in the world, costs the US approximately $1 billion to maintain.

- Trump's man is more likely to be the Fed's choice, meaning there's room for maneuver while Jerome Powell, who has a poor relationship with Trump, is in office, as Powell doesn't want to lower rates. Without rate cuts, the market is simply suffocating. It's also worth considering that Trump is a money-smart guy, and such spending is likely to trigger certain events.

- We have over $100 million in liquidity accumulated in BTC, which needs to be collected.

- Many are now expecting growth, so downward manipulation is more likely. Today's speech is more likely to disrupt all patterns and structures with its manipulative downward movement.

Full breakdown with levels and graphs on the website

USD/JPY Plunges: Intervention & Market AnalysisA multi-domain dissection of the Japanese Yen’s sudden resurgence and its global impact.

The Macroeconomic Shift: Hawkish Signals

The Japanese Yen (JPY) staged a dramatic recovery this week, surging 3.6% against the US Dollar in just two sessions. The catalyst was the Bank of Japan’s (BoJ) January 2026 policy meeting. While the BoJ held interest rates at 0.75%, the accompanying report was decidedly hawkish. The central bank raised inflation forecasts for fiscal 2026 and 2027, signaling a commitment to policy normalization. This shift creates a critical divergence: as the US Federal Reserve stabilizes, Japan is tightening, narrowing the interest rate differential that historically suppressed the yen.

Management and Leadership: A Break from Consensus

A significant cultural shift is occurring within Japan’s monetary leadership. The BoJ’s decision featured a rare 8-1 vote split, with one board member dissenting in favor of an immediate hike to 1.0%. This deviation from traditional Japanese corporate consensus culture signals a new era of aggressive policy debate. Furthermore, Prime Minister Sanae Takaichi has staked her political capital on stabilizing the currency, warning of "bold action" against abnormal movements. This alignment between political will and central bank policy empowers the Ministry of Finance to act decisively.

Geopolitics and Geostrategy: The Global Risk Matrix

Currency markets are reacting to a heightened geostrategic risk profile. The recent US escalation regarding Greenland and associated tariff threats have injected volatility into the Atlantic alliance, driving capital toward safe-haven assets. This follows earlier instability involving US-Venezuela relations. In times of acute geopolitical stress, the yen historically competes with the US Dollar and Swiss Franc as a refuge. The current "triple threat" of trade wars, military posturing, and monetary tightening is accelerating yen repatriation.

Technology and High-Frequency Trading

The mechanics of the recent move suggest algorithmic involvement. Reports indicate the Federal Reserve conducted "rate checks" inquiries into bank position sizes at the London close on Friday. In the world of high-frequency trading (HFT), this acts as a digital signal flare. Algorithms interpret these checks as a precursor to physical intervention, triggering cascading sell orders on USD/JPY. This highlights the cyber-sensitivity of modern FX markets, where regulatory signaling can execute market corrections faster than actual capital deployment.

Industry Trends and Patent Analysis

The volatility in USD/JPY critically impacts Japan’s high-tech export sector. Companies like Sony and Toyota rely on stable exchange rates to fund long-term R&D and patent filings. A rapidly strengthening yen squeezes repatriated profits, potentially forcing a contraction in innovation budgets. Patent analysis suggests that Japanese firms maintain a "defensive moat" of intellectual property; however, maintaining this advantage requires consistent capital flow. If the yen appreciates too rapidly, it risks eroding the profit margins that fuel Japan’s science and technology leadership.

Economics and Commodity Correlation

The currency shock has spilled over into commodity markets. Silver surged 6% to reach $110/oz, driven by the weaker dollar and the unwinding of the "carry trade." When the yen strengthens, global investors who borrowed cheaply in yen to buy assets like silver or stocks are forced to sell those assets to repay loans. This "unwind" creates a correlation where a stronger yen often leads to temporary liquidity shocks in other sectors, threatening the stability of equity markets like the Nikkei 225.

Future Outlook: The Intervention Cap

Goldman Sachs analysts argue that "intervention risk" now acts as a soft cap on USD/JPY upside. While the currency may technically warrant weakness based on fundamental fiscal risks, the threat of state action limits speculative shorting. Traders must now navigate a market where price discovery is driven not just by economics, but by the looming threat of coordinated government suppression.

Gold at $7,000? The Strategic Case for the Next Historic LeapGold has shattered the psychological glass ceiling. With spot prices piercing the $5,000 mark in January 2026, the yellow metal has entered uncharted territory. While UBS forecasts a consolidation around $5,000, a growing chorus of institutional voices now identifies a credible path to $7,000 per ounce. This trajectory is not merely speculative; it is the mathematical output of a fractured global order. The following analysis dissects the structural drivers propelling gold toward this new paradigm.

Geopolitics: The Chaos Premium

The "fear trade" has evolved into a permanent "chaos premium." Markets are pricing in the unpredictability of the U.S. administration, where foreign policy is increasingly used as a transactional lever. President Trump’s recent threats regarding Greenland’s status and tariffs on European allies have injected unprecedented volatility into the Atlantic alliance. Simultaneously, U.S. military maneuvers involving Venezuela and escalating tensions with Iran have dismantled the traditional assumption that U.S. assets are the ultimate safe haven. Investors are fleeing this geopolitical instability, utilizing gold not just as insurance, but as a non-sovereign store of value immune to sanctions or diplomatic seizure.

Geostrategy: The Sovereign Pivot

A quiet revolution is occurring in central bank vaults. The global monetary architecture is shifting away from a dollar-centric system, driven by the weaponization of finance. Central banks are aggressively diversifying reserves, with official purchases forecast to reach 950 tonnes in 2026. This is a strategic realignment, not a tactical trade. Nations like China and others in the Global South are systematically replacing U.S. Treasuries with gold to inoculate their economies against potential asset freezes. This "sovereign bid" creates a price floor, effectively removing massive quantities of bullion from the circulating supply and tightening the market structure.

Macroeconomics: The Debasement Trade

The most potent catalyst for $7,000 gold lies in the erosion of fiat currency credibility. The "debasement trade" is accelerating as investors confront the reality of U.S. fiscal sustainability. With national debt exceeding $324 trillion globally and U.S. deficits widening, the Federal Reserve faces immense pressure to monetize debt. Real yields are expected to remain subdued or negative, reducing the opportunity cost of holding non-yielding assets. As the Fed potentially moves toward a more dovish stance to support labor markets, the dollar’s purchasing power declines, mathematically necessitating a higher gold price to value the world’s outstanding liabilities.

Industry Trends & Technology: The Scarcity Engine

Physical constraints are colliding with algorithmic demand. Fibonacci extension models used by technical analysts now identify $7,040 as a major target zone, driven by momentum trading and high-frequency algorithms chasing the breakout. On the supply side, the industry faces a geological plateau. New major discoveries are rare, and ore grades are deteriorating, making extraction more expensive and technically challenging. This scarcity is compounded by a structural deficit in silver, which often leads gold in precious metal bull markets. The combination of finite supply and infinite monetary expansion creates a powerful engine for price appreciation.

Conclusion

The ascent to $7,000 is no longer a fringe theory but a plausible outcome of converging crises. Gold has transitioned from a cyclical commodity to a strategic necessity for preserving capital. As faith in political institutions wavers and the global debt burden swells, the market is actively repricing the world’s oldest form of money.

Trading the Fed: How Interest Rates Move BitcoinAs we approach the critical January 27-28 FOMC meeting, the crypto market is holding its breath. If you have been trading Bitcoin ( CRYPTOCAP:BTC ) through the volatility of 2025 and into early 2026, you’ve likely noticed a frustrating pattern: technical analysis works perfectly one day, and fails completely the next.

Why? Because in the current economic cycle, Price action is no longer just about Halving Cycles—it is about the Cost of Money.

Today, we are stripping away the noise to master the single most important correlation in modern finance: The Federal Reserve vs. Bitcoin.

1. The Mechanism: Why Rates dictate the Trend

Many retail traders view the Fed Funds Rate as just a boring number. But "Smart Money" (Institutions, Hedge Funds) views it as the "Risk-Free Hurdle."

Here is the simple logic institutional algorithms use:

The "Risk-Free" Choice: When the Fed raises interest rates, you can buy a US Treasury Bond and get a guaranteed, risk-free return (currently ~4% in short-term yields).

The "Risky" Choice: To justify buying a volatile asset like Bitcoin, the potential return must be significantly higher than that 4%.

The Cycle of Money:

Low Interest Rates (0-2%): Banks and Funds can borrow money for almost free. Since Bonds pay nothing (0%), they are forced to chase "Risk Assets" like Tech Stocks and Crypto to find profit.

Result: Bitcoin Moons (e.g., The 2020-2021 Bull Run).

High Interest Rates (3.5%+): Borrowing money is expensive. Why risk millions on Bitcoin when you can get a guaranteed 4% yield for doing nothing? Capital flows OUT of Crypto and INTO Bonds.

Result: Liquidity dries up, and Bitcoin chops or bleeds (e.g., The 2022 Crash).

2. Historical Context: Proof in the Charts

To understand where we are going in 2026, we have to look at the undeniable proof from the last 4 years.

2020 (The Expansion): The Fed cut rates to 0%. The Dollar Index (DXY) crashed. Bitcoin went from $3,000 to $69,000. This was "Easy Mode."

2022 (The Contraction): The Fed aggressively raised rates from 0% to 5%+. The Dollar soared. Bitcoin collapsed from $69,000 to $15,000. This was "Hard Mode."

The Lesson: You cannot have a sustained "Super Cycle" in crypto while the Fed is aggressively tightening or keeping rates restrictively high.

3. The Current Standoff (January 2026)

We are currently in a unique "limbo" phase.

The Fed Funds Rate is hovering in the 3.50% – 3.75% range. While this is lower than the 2023 peaks, it is still high enough to restrict the flow of fresh liquidity into the crypto market.

The Problem: Inflation has proven "sticky" around 3%.

The Result: The Fed refuses to cut rates aggressively. This leaves Bitcoin stuck in a choppy range below the $90k region (hypothetical). Until the "faucet" of cheap money is turned back on, Bitcoin is fighting an uphill battle.

4. The Indicator to Watch: DXY (U.S. Dollar Index)

If you are trading Bitcoin without looking at the DXY chart, you are trading blind. Bitcoin is priced in Dollars (BTC/USD). This creates a mathematical see-saw:

When the Dollar gets Stronger (DXY Up): It takes fewer dollars to buy 1 Bitcoin. Price goes Down.

When the Dollar gets Weaker (DXY Down): It takes more dollars to buy 1 Bitcoin. Price goes Up.

Your Trading Signal: During the FOMC meeting, keep the DXY chart open on the 15-minute timeframe.

If DXY spikes above 103.50: The market interprets the Fed as "Hawkish." Sell or Short.

If DXY drops below 102.00: The market sees "weakness." This is the green light for a Bitcoin rally.

5. Actionable Strategy: "Don't Fight the Fed"

We are currently in a "Trader's Market," not a "Holder's Market." The "Up Only" phase is paused until rates drop significantly.

The Q1 2026 Playbook:

Sit on Your Hands During the Speech: Volatility during Jerome Powell’s speech (2:30 PM ET) is high-frequency algorithm noise. It is designed to liquidate over-leveraged traders. Stay flat (in cash) until the daily candle closes.

Watch the 2-Year Treasury Yield ( TVC:US02Y ): This is the leading indicator. If the 2-Year yield starts dropping aggressively, it means the bond market "knows" cuts are coming. This is your signal to start accumulating Spot BTC.

Spot vs. Leverage: In a high-rate environment, funding rates on Perpetual Futures can eat your profits alive. Stick to Spot Bitcoin to avoid the "chop."

Conclusion

Bitcoin is technically bullish but macro-economically capped. The technology hasn't changed, but the monetary environment has.

Until the Fed signals a clear path to 3.0% or lower, we must respect the range.

Watch the DXY.

Watch the Yields.

And never fight the Fed.

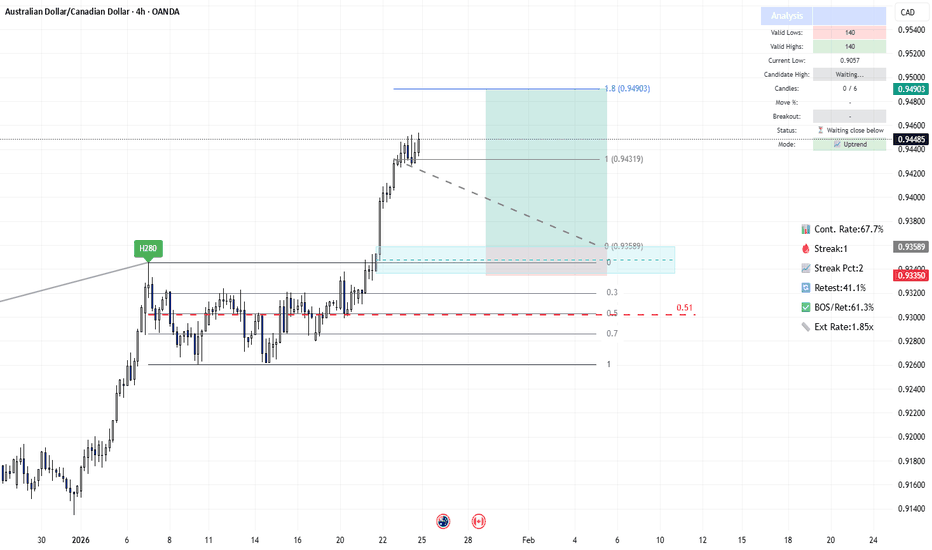

[AUD/CAD] Market Analysis: Macro + Structure [MaB]1. The Macro Context (The "Why") 🌍 Hi traders! Before looking at the candles, let's look at the money. My fundamental scoring table speaks clearly: there is a significant differential here that we cannot ignore for the upcoming sessions.

Key Factor Analysis:

🏦 Rate Expectations: The RBA maintains a neutral but relatively high rate at 3.6%, offering a carry advantage. Conversely, the BOC is showing a dovish tilt following their October cut, despite the current pause. Score AUD: +1 Score CAD: -1

🎈 Inflation: Australian inflation remains sticky at 3.4% (above target), while Canadian inflation has cooled to 2.22%, approaching the Bank of Canada's comfort zone. Score AUD: +1 Score CAD: 0

📈 Growth/GDP: Australia is showing resilient growth at 2.3%, outpacing the Canadian GDP of 1.6%. Score AUD: 0 Score CAD: 0

🏭 PMI Data: Both regions show expansionary signals; Australia's weighted PMI is at 51.8, while Canada's Ivey PMI saw a strong jump to 51.9. Score AUD: +1 Score CAD: +1

⚖️ Risk Sentiment: The current market regime is neutral for both cyclical currencies. Score AUD: 0 Score CAD: 0

🗞️ News Catalyst: No major disruptive news for either pair, keeping the focus on structural data. Score AUD: 0 Score CAD: 0

Currency Score Summary: Total Score AUD: +3 (Strong) | Total Score CAD: 0 (Neutral)

Synthesis: With a net differential of +3 in favor of the Aussie, we are looking exclusively for LONG setups. The fundamental divergence suggests that any dip in AUD/CAD should be viewed as a buying opportunity.

2. The Technical Setup (The "Where") 📉 Timeframe: 4H Pair: AUD/CAD

The SMC Market Structure +Zones indicator has confirmed the bullish bias on the 4H chart. Looking at the dashboard, the statistical edge is clear:

🚀 Continuation Rate (67.7%): We are well above the 60% threshold. This indicates a high-probability trending environment where following the established structure is mathematically superior to picking tops.

🔥 Streak (1): We are currently on the first impulse of this sequence, meaning the move is fresh and likely has significant room to run.

🔄 Retest (41.1%): The indicator shows that price retraces into the previous zone only 41.1% of the time. This suggests we should look for entries at the top of the demand zone to avoid being left behind.

💥 BOS/Ret Rate (61.3%): Once price reaches our zone, there is a 61.3% probability of a successful reaction resulting in a new Break of Structure (BOS).

🎯 Extension Rate (1.85x): The algorithm projects an extension of 1.85 times the current pullback leg, giving us a very clear and ambitious target for our Take Profit.

3. Execution Plan on Chart Moving to the chart, the indicator supports us in pinpointing liquidity to define entry and stop loss:

Entry and Stop Loss: We are placing a limit entry at the top of the Demand Zone (Blue Band) . The stop loss is tucked safely below the structural low of the zone. Take Profit: We leverage the asset's statistical analysis offered by the Extension Rate and place the target at 1.85x relative to the pullback leg.

Trade Parameters: Entry Price: 0.93589 Stop Loss: 0.93350 Take Profit: 0.94903

⚠️ Disclaimer: This analysis is based on a proprietary algorithm and is shared exclusively for educational and didactic purposes. It does not constitute financial advice or investment solicitation in any way. Trading involves significant risk.

"Macro Maps" - Most Underrated TradingView ToolThis Tool is called "Macro Maps", and have never seen anyone cover this gem on yt or anywhere else. So thanks to Macro Maps, you can view multiple macroeconomic indicators such as interest rates, inflation, or unemployment on the world map without spending any time researching for each individual country. You just have to hover through each country and it will pop up the current, for example, interest rate of that specific country. In addition, it can even show third world countries which are really hard to find on Google through your own research. As such, as day traders, as investors, or as any participant in the financial markets, this map is very important as in seconds, you can find out the interest rate, the inflation rate, or the GDP, or even the unemployment rate of any country on the world map. Of course, there are some exceptions like maybe North Korea, as some countries are secluded. Lastly, what you can also do is compare the change in inflation and other metrics through time. So the map allows you to go from 2025 and compare those metrics, for example, to 1980s for all the countries on the world map. And that's very useful as it helps us not waste time searching for all these macroeconomic metrics.

Disclaimer:

This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Asset prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not a licensed financial advisor or professional trader. I am not personally liable for your own losses; this is not financial advice.

Unemployment Rate Danger Zone🚨 The Unemployment Inflection Point Investors Ignore

This chart isn’t about high unemployment.

It’s about the turn.

Across post-war history, U.S. recessions don’t start when unemployment is elevated. They start when unemployment:

• bottoms

• stops improving

• begins to rise from a low base

Those red markers indicate the same pattern has been repeating for over 70+ years.

Why the inflection matters

Unemployment is a lagging indicator — but its rate of change isn’t.

When unemployment turns up:

• Hiring freezes appear first

• margins compress next

• credit demand weakens

• earnings expectations lag reality

By the time job losses are obvious, markets have already repriced.

The current setup

Unemployment remains historically low — precisely when investors feel safest.

But the trend has turned.

That’s the danger zone.

Markets don’t break when conditions look bad.

They break when they stop getting better.

Investor takeaway

This isn’t a timing tool.

It’s a risk-regime signal.

Historically, this inflection has preceded:

• higher volatility

• weaker earnings

• tighter financial conditions

Low unemployment = low risk.

Watch the direction. Not the level.

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

EUR/USD: The Fiscal Dominance Breakout (Einstein Vector)Title: The "Einstein Vector" Protocol: Why the Dollar is Dying at 4.3% Yields

Author: Brian Armbruster, Principal Trader, Armbruster Capital

Date: January 22, 2026

Abstract:

While the mainstream financial media (Reuters, Bloomberg) focused on the "TACO" (Trump Always Chickens Out) narrative regarding Greenland tariffs, the structural reality of the market told a darker story. Using proprietary Fun-Tech Einstein Vector Analysis, Armbruster Capital correctly forecasted the EUR/USD gap open with 98.3% precision (1.7 pip variance) and identified the "Fiscal Dominance" divergence before institutional desks.

The Core Thesis: The global financial system has entered a new phase of "Interpretive Asymmetry."

The Old Rule: Strong GDP (4.4%) + High Yields (4.25%) = Strong Dollar.

The Einstein Reality: Strong GDP + High Yields + Record Gold ($4,900) = Sovereign Debt Rejection.

Key Vectors Identified (Sunday - Thursday):

The "Tokyo Walkout" (Liquidity Void): We identified that Asian central banks had ceased purchasing US Treasuries, creating a "Liquidity Void" that forced the Fed to act as the buyer of last resort. This explains why the Dollar fell despite US 10-Year Yields spiking to 4.3%.

The "Greenland" Distraction (The Magician's Hand): We correctly identified the "Greenland Tariff" threat as a geopolitical negotiation tactic (noise), not a trade policy (signal). The subsequent "walk-back" was predicted as a liquidity injection event, not a trend change.

The "Gold Signal" (The Truth): While equities celebrated the "TACO" relief rally, Gold hitting $4,900/oz confirmed that "Smart Money" is fleeing the Dollar system entirely. The correlation between Yields and the Dollar has inverted.

Conclusion:

The market is no longer trading on price; it is trading on Time and Solvency. The "Relief Rally" is a trap. The structural move is a devaluation of the US Dollar to manage the $38 Trillion debt load. EUR/USD targeting 1.1850+ is not speculation; it is mathematical necessity.

Profits Rising, Credit Failing = CRASH!The Private Sector Isn’t Leveraging for Growth — So Why Are You Buying?

This chart cuts straight to the engine of the bull run in the stock market.

The blue line represents commercial and industrial loans relative to the money supply — a proxy for productive private-sector credit creation.

When it rises, businesses borrow to expand.

When it falls, they don’t.

Right now, "They Don't" it’s falling.

What history shows

A rollover in business credit efficiency precedes every recession:

Not GDP.

Not jobs.

Not inflation.

Credit moves first.

The structural issue

Each recovery now requires:

More money

More leverage

For less productive growth

That’s the law of diminishing returns to credit — and the long-term trend is down.

Why 2020 didn’t fix this

The post-COVID spike was emergency borrowing, not expansion. Once it passed, credit efficiency collapsed to new lows and never recovered.

That’s the tell:

The private sector isn’t willing to leverage for growth.

Why policy can’t save it

The Fed can cut rates and add reserves.

It can’t create profitable opportunities.

When ROI falls, borrowing stops — regardless of policy.

Bottom line

Expansions don’t end when rates rise.

They end when businesses stop borrowing productively.

If the private sector won’t leverage for growth,

Ask yourself what you’re buying.

#FAFO GTFO & STFO!

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

Macroeconomic Indicator: Gold-Copper SpreadMacroeconomic Indicator: Gold-to-Copper Spread

The Gold-to-Copper Spread (Gold-to-Copper Ratio) is the ratio between the price of gold and the price of copper, expressed by the formula:

Gold–Copper Ratio = Price of Gold / Price of Copper

This indicator shows how much the price of gold exceeds or lags behind the price of copper at a given point in time. It is often used to analyze market sentiment, assess economic stability, and identify investor preferences.

Gold

Gold is traditionally considered a safe-haven asset. Its price generally rises during periods of economic and financial uncertainty, when investors seek to preserve capital and reduce risk.

Additionally, gold may receive support in the following conditions:

weakening of the US dollar

rising inflation expectations

declining real interest rates

increasing geopolitical risks

growing demand from central banks

Copper

Copper is often called “the doctor of the economy” due to its high sensitivity to industrial production and economic growth. The price of copper typically rises during phases of economic expansion, when demand for commodities and risk assets increases.

The spread reflects only the relationship between the two assets and does not account for other factors such as exchange rates, geopolitics, or changes in monetary policy.

Copper may also rise under the following conditions:

supply deficits (strikes, logistical disruptions, declining production)

structural growth in demand (electric vehicles, energy transition, data centers)

monetary stimulus and growth in global liquidity

weakening of the US dollar

speculative phases in commodity markets

stimulus measures from China

Rising Gold/Copper Ratio

Typically signals:

increase in risk-off sentiment

deterioration in economic expectations

growing demand for safe-haven assets

expectations of recession or slowdown

intensification of geopolitical risks

decline in real interest rates

This is usually accompanied by weakness in equity markets, cyclical sectors, and industrial commodities.

Falling Gold/Copper Ratio

Typically indicates:

strengthening of risk-on sentiment

improving expectations for economic growth

growth in industrial activity

capital inflows into risk assets

the beginning or middle of an economic expansion

It often correlates with rising equity indices, industrial metals (in a “healthy” risk-on regime, copper should rise not alone but together with aluminum, nickel, and zinc), oil, industrial ETFs (XLI), equity indices, PMI, macro data, and bond yields.

The Spread Cannot Be Analyzed in Isolation

Key indicators without which this indicator should not be interpreted:

Real rates

DXY (US dollar)

S&P 500, Russell 2000, Industrial ETF (XLI), oil (WTI, Brent), aluminum, zinc, nickel, CRB Index / GSCI

China: real demand or illusion — declining or growing

Geopolitics

All these metrics can be found on TradingView. It is recommended to create a separate watchlist and monitor them there.

The Spread Is Falling

This means copper is stronger than gold. The base hypothesis is that the market is shifting into risk-on mode. We then verify this using other indicators.

1. Real Rates

Real rates are rising - gold is under pressure, the spread falls for a “healthy” reason.

This confirms that the market truly expects economic growth.

Real rates are falling, but the spread is still falling - copper is rising too aggressively.

This is not a macro growth signal, but rather a sign of copper supply deficit or speculative acceleration.

Conclusion:

If the spread falls while real yields are rising, this is a strong, clean risk-on signal.

If it falls while real yields are declining, distortions are already present.

2. DXY (US Dollar)

DXY is falling - supportive for commodities, copper’s strength looks logical.

This confirms a risk-on environment.

DXY is rising, but the spread is still falling - copper is rising despite currency pressure.

This is often a sign of a local copper deficit or an artificial squeeze.

Conclusion:

A falling spread with a weak dollar is a normal macro scenario.

A falling spread with a strong dollar is a reason to be cautious.

3. What Should Happen in Other Markets

If the decline in the spread reflects true risk-on, typically:

S&P 500 is rising

Russell 2000 is rising faster than S&P (increased risk appetite)

Industrial ETF (XLI) is in an uptrend

Oil (WTI, Brent) is strengthening

Aluminum, zinc, and nickel are rising together with copper

CRB / GSCI commodity indices are moving higher

Key point:

Copper should not rise alone. If you see copper rising, equities flat, oil weak, metals not confirming then this is almost always mean that not macro growth, but a local copper story (supply shock, squeeze, speculation).

4. China: Real Demand or Illusion

Copper is almost impossible to interpret without China.

China PMI rising + credit impulse rising + yuan strengthening

copper growth is fundamentally confirmed

a falling spread = healthy risk-on

China PMI falling + weak economy, but copper rising

this is not macro demand

it is either a supply deficit or speculative flows

Conclusion:

If China does not confirm copper’s move, the decline in the spread loses its macro meaning.

The Spread Is Rising

This means gold is stronger than copper. The base hypothesis is that the market is moving into defense (risk-off). But confirmation is still required.

1. Real Rates

Real rates are falling - gold rising is logical.

If equities and commodities weaken at the same time, this is true risk-off.

Real rates are rising, but gold is still rising - the driver is not monetary.

This is usually geopolitics or fear of systemic risks.

Conclusion:

Rising spread with falling real yields = classic macro risk-off.

Rising spread with rising real yields = the market is genuinely afraid.

2. DXY (US Dollar)

DXY is rising - pressure on commodities, support for gold - the rising spread looks logical.

DXY is falling, but the spread is still rising - gold is rising too strongly.

This is most often a sign of fear, geopolitics, or systemic hedging.

Conclusion:

Rising spread with a strong dollar = standard risk-off.

Rising spread with a weak dollar = a warning signal.

3. What Should Happen in Other Markets

If the rise in the spread reflects true risk-off, typically:

S&P 500 weakens or moves into correction

Russell 2000 falls faster than S&P

XLI (industrial sector) is under pressure

Oil weakens

Industrial metals fall

CRB / GSCI move lower

If instead gold is rising, equities are rising, oil is holding, commodities are not falling, then this is not classic risk-off. It means gold is rising for its own reasons (rates, geopolitics, hedging).

4. China (PMI)

Chinese data weakening + copper falling

the rise in the spread is fundamentally confirmed

the market truly expects a slowdown

Chinese data strong, but copper still weak

the issue is not demand, but other markets

the spread signal is distorted

Geopolitics in the Interpretation of the Gold/Copper Ratio and Markets

Geopolitics is a factor that breaks the normal macro logic of markets.

It is not directly linked to the economic cycle, but it sharply changes capital behavior.

If macro indicators reflect “slow” processes (rates, growth, inflation),

then geopolitics represents shock events that trigger fear, defensive positioning, risk aversion, increased demand for liquidity

That is why it is always considered separately from macroeconomics.

How Geopolitics Affects the Gold/Copper Spread

In most cases, geopolitics, strengthens demand for gold, weakly supports copper, therefore pushes the spread higher

But the key point is:

this is not because the economy is deteriorating,

but because investors are hedging against event risk.

That is why a geopolitically driven rise in the spread often is not confirmed by falling equities, is not accompanied by worsening PMI, does not coincide with changes in interest rates

Enjoy!

Velocity Of Money Rolling Over Again!The Real Interpretation

This chart is telling one story:

Money supply growth has massively outpaced real output for decades.

It lines up perfectly with:

Falling real productivity

Stagnant wages

Declining borrower quality

Rising debt-to-GDP

Asset inflation decoupling from fundamentals

The economy shifting from productive borrowing → consumption and asset speculation

You don't fix this with “policy choices.”

You fix it with real wealth creation, which requires creditworthy borrowers — not printing.

Forward-Looking View

Unless:

Productivity rises

Real output accelerates

Borrowers gain real income strength

Capital flows into productive sectors instead of financial games…this ratio won’t materially rise.

That means:

Every new dollar is buying less GDP

Long-term growth potential is fading

More money chasing fewer productive opportunities

More fragility in the credit system

It’s a classic late-cycle fiat symptom.

Here are questions to ask:

If “money creation” creates growth, why is GDP-per-dollar collapsing?

Why did 40 years of money expansion not produce proportional GDP?

If borrowers create loans, where are the new productive borrowers?

Why did QE cause asset inflation but no sustainable GDP boost?

If the system is “fine,” why does each new dollar buy less real output?

Perma Bulls, MMTers, Politicians etc.. can’t answer those without admitting the private-sector engine is weakening.

The less productive output per $ while the markets keep rising & rising will only produce less and less profit per share over time. No matter how much lipstick they put on that pig. Eventually, the economy & markets will CRASH! They always correct themselves in the end.

Perma Bulls have no exit strategy and will go down with the boat!

MMTers will want Gov to borrow and spend EVEN MORE! despite the empirical self-evident fact that print and play doesn't work!

Politicians will borrow and spend even more, claiming they will "STIMULATE THE ECONOMY"

I got all that from just one chart? NO! The entire spectrum of data.

Here is one

THANK YOU for getting me to 5,000 followers! 🙏🔥

Let’s keep climbing.

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in truth, not hype.

GDP Growth Illusion From Tariffs CAUTION!GDP Growth Can Rise When Imports Collapse

GDP is defined as:

GDP = C + I + G + (X − M)

Example:

C + I + G = 110

(X − M) = −10

GDP = 100

Now assume imports collapse while everything else stays the same:

C + I + G = 110 (unchanged)

(X − M) improves from −10 to −5

GDP = 105

That appears as a +5% GDP growth, despite no new production having occurred.

A drop in imports mechanically boosts GDP by improving (X − M). GDP rises on paper—even if the economy is actually weakening due to collapsing demand.

Translation:

GDP can look stronger because activity fell, not because value was created.

This important to understand bc it also influences the velocity of Money. Giving the illusion that it is increasing when it's not. See my previous post.

One more point I want to make for you.

👉GDP accounting does NOT force consumption (C) to fall when imports fall.

👉 But in the real economy, consumption of those specific goods can fall if tariffs remove availability or raise prices.

👉 Job loss created as a result will also drop (C); the effects are not noticeable at first in GDP.

🚨DON'T MAKE THE MISTAKE OF THINKING THIS IS REAL GROWTH AND GO OUT AND BET THE FARM TRADING/INVESTING!

This is not POLITICAL! This is COUNTING!

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

SPY & Macro HistoricalToday FED ended QN (Quantitative Normalizing NOT "T" = tightening. 1st, you normalize, then you tighten. Right??)

The Fed is continuing to let mortgage-backed securities roll off its balance sheet, while the U.S. Treasury increases T-bill issuance (cash-like instruments). That combination means more gov securities are hitting the market even as the Fed’s balance sheet stays roughly unchanged.

More Treasury supply + no Fed buying = higher yields and tighter liquidity. More MBS roll-off = higher mortgage rates and pressure on housing. Treasury bills soak up cash, while longer bonds suffer.

🔥 REALMACRO summary:

The Fed is doing this to:

Get out of the mortgage market.

Strengthen the Treasury bill market (the foundation of dollar liquidity).

Keep bank reserves “ample” without restarting QE.

This combo lets them tighten just enough to cool asset prices, without breaking the plumbing again like in 2019.

The success of this experiment will largely determine how long the Fed can avoid returning to QE. If liquidity tightens too far as the economy continues to weaken, they’ll be forced back into some form of balance sheet expansion sooner rather than later.

Lastly, let's check how right I was when I posted "MMT Everything."

As of April 2020, US debt was $ 24T. Today, it is $38T, representing a total increase of $14T in 5 years.

✅ CAGR ≈ 9.6% per year

✅ S&P 500 CAGR (Apr 2020 → Today): ~18.6% per year

Both are completely unsustainable growth rates.

I nailed that back in April 2020. Trump & MMT "print and play" will be the death of us! SIGH!

Lastly, the DOGE gimmick was a complete and total failure as expected. No reduction in deficit and no fraud found. Imagine that!

As I keep saying, " NEVER INVEST IN TOXIC PEOPLE! THEY WILL ALWAYS BURN YOU IN THE END!" It's not political it's a FACT!

THANK YOU for getting me to 5,000 followers! 🙏🔥

Let’s keep climbing.

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in truth, not hype.

SPX to Money Supply WARNING!If the charts aren’t showing bubble setups, I’m not going to invent them. I post what the data shows. So please don’t shoot the messenger when I say GTFO & STFO.

And just to keep the facts straight:

Brokerage, stock, and crypto accounts are not part of M2.

Why does M2 matter?

It’s the actual spendable money in the economy.

When M2 grows faster than real output (as it did in 2021), price pressure builds.

The economy runs on liquidity.

Retail, goods, services all of it requires money you can actually spend, not paper gains in a trading account.

When the S&P 500 disconnects massively from M2 — like during the dot-com bubble — revenue and profit growth can’t keep pace. Valuations expand purely on speculation, not on real, organic fundamentals. That’s how multiples stretch and bubbles form.

The problem? Most retail traders have no idea this is happening. They’re trading with their hair on fire, following cute social-media stories dressed up as “analysis,” using strategies that have never been tested in real markets.

And that’s exactly how bubbles are fed:

big players sell into retail euphoria, and retail ends up holding the bag of schitt!

Buy when stocks are cheap, not at all-time highs in euphoria land.

"Price is what you payt, VALUE is what you get!"

THANK YOU for getting me to 5,000 followers! 🙏🔥

Let’s keep climbing.

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in truth, not hype.

$XAU/USD - Gold's Q1 2026TVC:GOLD remains considerably Bullish until proven otherwise !

- Not only fundamentally speaking by Central Banks heavily accumulating it diversifying away from U.S Treasuries and a Weakening TVC:DXY Dollar ;

to plenty current Geo-Political Risks with unknown and uncertain future scenarios,

to worries of 'Sticky' Inflation and Interest Rates cuts.

This is an Structural Official World-Wide Demand !

Any Pullback seen on charts, will be just another excellent providing support floor to accumulate Gold while cheaper.

Leaving behind 2025 as one of its best performing years throughout history with an amazing rally ;

and entering 2026 on a strong note paired with other precious metals like TVC:SILVER

- TA speaking,

HH's and HL's continue printing, however, concerning for the time being is a bearish wedge pattern forming ,

flirting with the ceiling of 2025 Uprising Channel .

Bearish Wedge not yet confirmed having its measured move putting Gold's TA forecast to as low as 4.380$.

Other strong supports are there to be found as tests before 4.380$ is reached.

Conflicting Supports from PoC of last rally and EMA 50 aiming up and as well the prior week's Gap Break-Out which as not Filled yet.

Note that for the time being, Gold has found support on Previous ATH Level + 20EMA, leaving a Liquidity Wick Zone just below, increasing the probabilities of break-out gap being filled.

Aiming another Higher High creating a New All Time High;

its first test of resistance is the last ATH which can print a Double Top and down it goes to break the bearish wedge pattern confluencing with major news events of United States on 22 of January ;

Breaking ATH and above Uptrend Channel marked on white and Confirming it will Invalidate the Bearish Wedge Pattern.

Probabilities scream for a pullback, however is worth including the Gold's fundamental momentum and anything is to be expected.

NOTE THAT THIS IS NOT FINANCIAL ADVICE .

PLEASE DO YOUR OWN RESEARCH BEFORE PARTAKING ON ANY TRADING ACTIVITIES BASED SOLY ON THIS IDEA

PCE — What the market will see on Thursday (22 January 2026)Introduction

On Thursday, January 22, the Core Personal Consumption Expenditures (PCE) Price Index will be released in the United States. Ahead of the release, we decided to take a deeper dive into macroeconomic theory and revisit what PCE is and how its data influence financial markets.

The PCE (Personal Consumption Expenditures) Price Index is a comprehensive measure of inflation that tracks changes in prices for all goods and services consumed by households within the country, regardless of the source of funding. Its conceptual depth lies in the fact that it reflects the actual cost of consumption across the economy, not merely the out-of-pocket expenses of individual consumers.

The Federal Reserve views PCE as its primary gauge of inflationary pressure due to its deeper analytical structure and methodology, which is largely free from certain statistical distortions and explicitly accounts for behavioral aspects of consumer choice.

CPI vs. PCE

While CPI answers the question:

How much more expensive has life become for the average urban consumer?

PCE addresses a broader one:

How much more expensive has total final consumption in the economy become?

This makes PCE more macroeconomically representative. It includes not only household spending, but also expenditures by non-profit institutions serving households.

The core methodological difference between the two indices lies in how they treat consumer behavior.

CPI assumes relative rigidity in consumption habits:

its basket is updated with a lag

its calculation implies that households continue purchasing the same goods even as prices rise, simply paying the higher cost

PCE, by contrast, incorporates rational behavioral flexibility. The Fisher chain-weighted index used in its calculation reweights components on a quarterly basis, reflecting the natural shift in demand toward relatively more affordable substitutes. This substitution effect not only reduces the indicator’s volatility, but also aligns it more closely with real-world consumer spending dynamics, where price changes are a key driver of budget reallocation.

An important clarification regarding the relationship between CPI and PCE:

the two indicators are highly correlated

PCE typically prints slightly lower readings than CPI

this persistent gap is a structural result of methodological differences in how the indices are constructed

What to Focus on in the Release

When CPI data are released, the most reliable way to assess underlying inflation pressure is to focus on Core CPI.

The same logic applies to PCE.

The headline figure (Headline PCE) carries a significant risk of misinterpretation due to its elevated volatility, which can distort the perception of the underlying price trend. Core PCE, stripped of these destabilizing components, serves as a far more reliable compass, pointing to the deeper inflationary forces in the economy — precisely the forces that shape the long-term path of monetary policy.

With this framework in mind, we can move on to a more precise interpretation of the data.

When the report is released, greater emphasis should be placed on the monthly (m/m) Core PCE reading, as it is more sensitive to short-term changes in inflation. Even if inflation accelerates in the current month (a high MoM print), the year-over-year figure may continue to decline for several months due to base effects — comparisons against elevated readings from the prior year.

It is also important to pay close attention to revisions of the previous month’s data.

The market evaluates releases through the lens of trend, which is often just as important — if not more so — than a single data point.

For example, imagine that the current month’s Core PCE comes in exactly in line with consensus at 0.2%. At first glance, this looks benign. However, if the previous month’s figure is revised upward from 0.3% to 0.5%, the picture changes entirely. Such a revision would be inconsistent with the Fed’s 2% inflation target and would undermine the narrative of a smooth and sustained disinflationary trend.

Market Reaction

Market reaction to inflation data is fundamentally driven by expectations of future Federal Reserve actions. A sustained rise in inflation reinforces a hawkish scenario: the Fed is forced to maintain or tighten monetary policy, which leads to higher interest rates, a stronger dollar, rising Treasury yields, and downward pressure on equities.

Conversely, a consistent decline in inflation signals that the Fed’s measures are working and opens a dovish window for potential easing in the future. This implies the prospect of rate cuts, which typically acts as a catalyst for equity markets, while pushing Treasury yields lower and weakening the domestic currency.

However, accurate analysis is impossible without considering the broader macroeconomic context. For instance, if a prevailing trend has already been established by weak labor market data and a soft CPI report, even a neutral PCE release that comes in line with consensus is often interpreted as a confirmation of that trend. In such an environment, the absence of a negative surprise becomes a positive signal in itself, providing additional support for equities.

That said, the key element of analysis remains the probability of a fundamental surprise capable of breaking the existing trend built on earlier releases. Labor market data and CPI set the preliminary direction of expectations, but they do not carry finality. The PCE report, acting as a strategic “closing argument,” carries sufficient weight in the eyes of both the Fed and market participants to trigger a full reassessment of the priced-in scenario. A material deviation from consensus can do more than merely adjust expectations — it can invert the prevailing market logic altogether, leading to a regime shift across currency, bond, and equity markets.

Conclusion

Ultimately, market dynamics are a complex fusion of countless factors whose interactions often defy linear logic. This is precisely why outcomes so frequently diverge from even the most well-reasoned forecasts.

The only way—if not to tame, then at least to comprehend this force—is to develop your own analytical judgment. Critical thinking and the ability to construct an independent view of reality are the most valuable tools in a world with no guarantees and no ready-made solutions. Neither the forecasts of research desks nor the opinions of popular commentators can replace your personal ability to interpret data, weigh risks, and connect fragmented facts into a coherent hypothesis. This is the path from following noise to understanding signal.

Enjoy!