Moving Averages

The Swing Strategy, I been usingZone‑to‑Zone Trading

1.1 Drawing the Zones

What is a zone?

A price area (not a single line) where the market repeatedly reacts: flips from support→resistance (S/R) or resistance→support (R/S), stalls, or coils.

Priority by timeframe:

Monthly ≥ Weekly ≥ Daily ≥ Hourly. Higher‑timeframe zones carry more weight.

How to mark zones

Start on monthly, and highlight obvious S/R bands.

Drill down to weekly, refine, or add.

Drill down to daily, refine, or add.

Drill down to hourly for tactical entries.

Clues for a quality zone

Prior breakout level that later flips to S/R on retest and consolidates before resolution.

Clear historical reaction clusters (wicks, bodies, or gaps).

Visible “sensitivity” (multiple rejections/holds in the same area).

1.2 Trading the Zones

Entry: Wait for local consolidation near a zone, then take the breakout.

Stops:

Conservative: Below the box low (consolidation floor).

Tight: Mid‑box (accept higher stop‑out rate, better R).

Filter:

Longs only above 50 SMA, shorts only below 50 SMA (trend filter).

1.3 Range vs. Exact Level

Treat zones as bands, not one price tick. I would take the pivot close to the opening of the first red candle if it's a bullish pivot.

At times a single line is acceptable (e.g., clean, repeated close‑basis pivot), but default to ranges.

2) Box System

2.1 Market Phases

Sideways (consolidation) → build energy (boxes form between zones).

Trending → series of HH/HL (up) or LH/LL (down).

2.2 Trend Structure

Trends breathe via consolidation → expansion → consolidation.

Breakouts can:

Go with no retest

Retest the boundary and go

Brief incursion back into box, then full resolve

The first inner zone inside the box is critical: if a new uptrend is valid, the price shouldn’t revisit below it.

Stops: below that first inner zone.

Note: Zone‑to‑Zone shines in non‑trendy markets (FX, many dividend names).

2.3 Types of Boxes

MA roles (fractal):

9 SMA → short‑term momentum

50 SMA → intermediate momentum

21 SMA → the inflection between 9 and 50; often reacts first

2.3.1 Base Box

Both the 9 & 50 SMA flatten for an extended period.

Highest stored energy; breakouts can start major trends.

2.3.2 50 SMA Box

Sideways price, 9 SMA flat, 50 SMA rising/falling into price as dynamic S/R.

Breakout after the 50 SMA reaches the box.

2.3.3 9 SMA Box

Shorter coil (≈ 3–4 candles).

9 SMA catches up; breakout follows.

Shortest consolidation; quicker moves.

2.3.4 9 vs 50 Comparison

9 SMA trend: 2× HH/HL supported by 9. Parabolic (≈20% of cases): each candle’s low should not undercut the prior candle’s low.

9 SMA box: brief sideways until 9 SMA “tags” price → quick reaction.

50 SMA boxes: longer coil; 50 “arrives,” 9 often flat.

Base box: 50 is inside & flat; price crossed above/below multiple times.

2.4 System Objectives Checklist

Trend-following or mean-reversion?

Entry conditions?

Exit logic?

System expectancy?

Risk model?

Entries

Box breakout (bullish): Prefer consolidation at the top‑right of the box before break → higher probability.

Zone‑to‑Zone: Look for a lower‑TF coil at a higher‑TF zone → break of coil for entry.

Profit & Exits

Next zone target; or

Exit when an uptrend fails to make an HL (i.e., breaks prior swing low).

Stops

Box breakout: Below the first inner zone or box low.

Zone‑to‑Zone: Based on the lower‑TF coil used for entry.

Position Size = 4% per trade or less.

2.5 Trading the Boxes

Four box archetypes: 9 SMA, 21 SMA, 50 SMA, and Base.

Base Box

More false starts; longest runs when it goes.

Prefer equity or bull‑put spreads; ride while price > 50 SMA.

50 SMA Box

The first 50‑box after a base is the most reliable.

Daily 50‑box usually follows 3–4 weeks of coil; expect ≈1.5–2 weeks of trend leg.

Tactics: Stock and swing options (expiry ≈ coil length or slightly more).

9 SMA Boxes

Breakout leg ≈2–3 days, then another coil.

Tactics: Scalps with 1–1.5 weeks to expiry; 1–2 OTM strikes.

Quick Summary

Base: most power, least timing precision.

50: first after base = best reliability; second is weaker.

9: short, sharp, tactical.

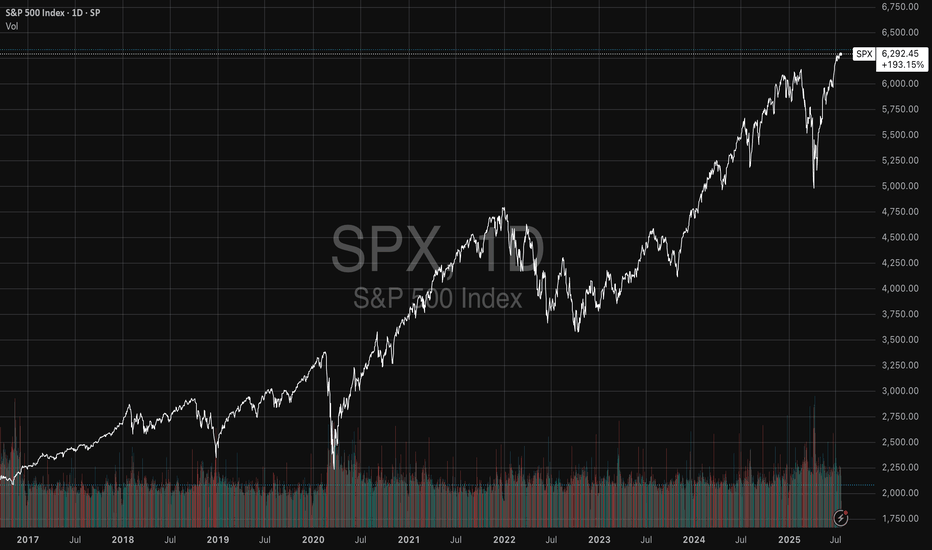

2.6 Overall Market Environment

If indices trend up above the latest daily zone, 8/10 breakouts can succeed.

If indices chop under the latest daily zone, expect ≈5/10 to work.

Compare QQQ vs. SPY strength to gauge risk‑on/off.

Rules of thumb

Upside bias: Index above the latest daily zone (or proxy 9 SMA if approximating).

Scalping bias: Above the latest hourly zone.

2.7 Box System & Long‑Term Investing (LTI)

Markets are fractal; weekly = daily = hourly in pattern, not speed.

Trend rule: in an uptrend, price should not break prior swing low (mirror for downtrend).

Trailing stop logic

Uptrend: trail to recent swing low once confirmed.

Downtrend: trail to recent swing high.

MA benchmarks:

Hard breaks of 9 SMA → likely consolidation.

50 SMA for longer bias.

Caveat: large‑cap growth rarely trends cleanly down (index dependency & fund flows).

2.8 Watchlist Creation

Three steps

Scan sectors for consolidations (boxes).

Check relative strength vs. SPY (e.g., XLK/SPY).

Review the top 10–20 holdings.

Tiers

A‑List: Box about to break + high options liquidity.

B‑List: Box about to break but low options liquidity.

C‑List: Boxes are still developing.

2.9 Role of the 21 SMA

Acts as the inflection between 9 and 50.

The highest failed‑break probability occurs at 21 boxes.

After a 9‑trend ends, watch 21 for the reaction:

Back to recent highs and breaks, or

Failed break; or

Reject at 9 after 21 reactions.

2.10 SPX Intraday Scalp Pattern

Don’t chase the open; wait 1–2 hours for the market to form an intraday box (2–3 h coil).

Enter as the range breaks: you benefit from direction and rising IV (“double whammy”).

2.11 SQUEEZE Pro Indicator (SQZPRO)

Concept: A squeeze occurs when Bollinger Bands compress inside the Keltner Channels (BB inside KC) → energy building.

Dot codes (suggested):

Green: No squeeze

Black: Mild squeeze (BB within 2 ATR KC)

Red: Tight squeeze (BB within 1.5 ATR KC)

Yellow: Very tight (best odds for expansion)

Heuristic: The tighter the compression, the stronger the potential release.

2.12 Backtesting & Strategy Creation

Use TradingView Replay. Segment by regime (bull, bear, or chop).

Test entries, exits, and risk variants.

Purpose: build statistical confidence to keep your “monkey brain” from hijacking.

2.13 QQQ vs SPY for Intraday

SPY: S&P 500 (market‑cap weighted, broader economy).

QQQ: NASDAQ‑100 ex‑financials (tech‑heavy, risk‑on).

Scenarios

Bullish clean: QQQ > SPY, and both above hourly 9.

Bearish clean: QQQ < SPY, and both below hourly 9.

Chop, green day: Market up but QQQ < SPY → grindy.

Chop, red day: Market down and SPY < QQQ → grindy.

Read strength: Compare % change vs prior close.

2.14 Gaps: What & Why

Markets aren’t 24/7; exogenous events (earnings, geopolitics) reset expectations → open ≠ prior close.

How to trade gaps

Treat the gap range as support (gap‑up) or resistance (gap‑down); draw a gap box.

Unfilled gaps are potent S/R. Above, a bullish gap favors continuation until filled.

If the gap is huge, rely on historic zones to seed new levels within.

2.15 Scalps vs Swings

Scalps: minutes–hours; TF ≤ 1h.

Swings: days–weeks; TF ≥ 1h (prefer daily baseline).

Drill down one TF for refined entries; manage to the anchor TF.

Expiration (rules of thumb)

Stocks (scalps): Mon/Tue → same‑week; Wed/Thu/Fri → next‑week.

Indices (scalps): 1–2 DTE, 1–2 OTM.

Swings: Expiry ≥ consolidation length (often 1–1.5× coil duration).

2.16 Which Timeframe Should You Trade?

Real Trading Hours, 1-2 HR → Day trading & scalps (≤1h TF).

After Hours, 1–2 hr → Swings (≥1 hr, ideally daily).

Less than 1 HR → Multi‑week swings or LTI (weekly charts).

How to Trade with MACD in TradingViewMaster the MACD indicator using TradingView’s charting tools in this comprehensive tutorial from Optimus Futures.

The Moving Average Convergence Divergence (MACD) is a momentum and trend-following indicator that helps traders identify shifts in market direction and momentum strength. It measures the relationship between two exponential moving averages (EMAs) to reveal when momentum may be building or fading.

What You’ll Learn:

Understanding MACD as a tool that tracks the convergence and divergence of moving averages

How the MACD line is calculated as the difference between the 12-period and 26-period EMAs

How the Signal line acts as a 9-period EMA of the MACD line and serves as a trigger for potential buy or sell signals

How the Histogram visualizes the distance between the MACD line and Signal line to show momentum strength

Recognizing bullish and bearish crossovers between the MACD and Signal lines

How to interpret the Zero Line as a momentum baseline — above zero suggests an uptrend, below zero suggests a downtrend

Identifying bullish and bearish divergences between MACD and price to anticipate potential reversals

Why crossovers and divergences should be confirmed with price action and trend structure, not used in isolation

How to add MACD to a TradingView chart via the Indicators menu

Understanding the default settings (12, 26, 9) and how adjusting them changes responsiveness

Practical examples on the E-mini S&P 500 futures chart to illustrate MACD signals in real market conditions

Applying MACD across multiple timeframes — daily, weekly, or intraday — for higher-confidence confirmations

This tutorial will benefit futures traders, swing traders, and technical analysts who want to incorporate MACD into their trading process.

The concepts covered may help you identify trend changes, momentum shifts, and potential entry or exit points across different markets and timeframes.

Learn more about futures trading with TradingView:

optimusfutures.com

Disclaimer

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only.

Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools — not forecasting instruments.

Profitable Gold XAUUSD Indicator Trading Strategy Explained

To profitably trade a massive bullish rally on Gold , you don't need a complicated system.

In this article, I will teach you an easy indicator strategy for trend-following trading XAUUSD.

It is based on 2 default technical indicators that are available on any trading platform: Mt4, Mt5, TradingView, etc.

You will get a complete trading plan:

exact entry signal,

smart stop loss placement,

trade management rules.

The first indicator that you will need to trade this strategy is Moving Average.

We will use a combination of 2 Moving Averages: Exponential Moving Average EMA with 20 length and a Simple Moving Average SMA with 9 length.

Our entry signal will be a crossover of 2 MA's on a 4H time frame.

SMA and EMA should meet first.

SMA should break through EMA to the upside to confirm a bullish signal.

With a high probability, Gold price will rise significantly then.

The main nuance of this strategy is to wait for a confirmed crossover and avoid the traps.

Patiently wait for a touch of 2 moving averages first.

After that, you will need to wait for a close of one more 4H candle to make sure that SMA stays above EMA.

You can see that though 2 Moving Averages met, SMA failed to break through EMA.

That is how a valid buy signal looks: SMA stays above EMA after a close of the next 4H candle.

After you identified a valid crossover, it is your signal to open BUY trade on Gold .

Your entry should be exactly after a close of a 4H candle.

Stop loss will be based on another popular free indicator - Average True Range ATR with default 14 length settings.

Your safe stop loss should be 2 ATR from the entry.

In our example, ATR is 145 pips.

2 ATR will be 190 pips.

That will be our stop loss.

With this trading strategy, we will not use a fixed Take Profit TP and use trailing stop loss instead.

It will help us to catch extended bullish waves on Gold.

Once the market starts rising, updating the highs, trail your stop loss based on EMA and keep it 1 ATR below that.

Make sure that you move your stop loss only when EMA and Gold price are rising . Once Gold price or EMA start moving in sideways or go down, do not lower your stop loss.

Using this strategy consistently, you will be able to catch significant bullish waves.

In Autumn trading season of 2025, this strategy provided, 3100+ pips entry signal.

What I like about this strategy is that being very simple, you can easily backtest that and measure its objective trading performance.

Easy entry, confirmation, and trade management rules make this strategy appropriate for beginners in Gold trading and will help to not miss a current extraordinary trend.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Is the Bitcoin market bearish?📊 Bitcoin Market Psychology Analysis

Market psychology analysis is one of the most fascinating and practical approaches to understanding Bitcoin's current position! 🎯

🎭 Market Psychology Cycle Phases:

1. Hope Phase 🟦

Likely the current point for many assets

· 📈 Description: After a panic-driven crash, the market stabilizes and consolidates within a relatively stable range

· 💰 Price hasn't returned to previous lows and shows occasional small positive breakouts

· 😌 Sentiment: Fatigue from the downturn, but quiet hope for gradual improvement

· 👴 Experienced investors accumulate while newcomers remain cautious

· 📊 Indicator: Moderate trading volume typically

2. Optimism & Belief Phase 🟩

· 🚀 Description: Price begins breaking key resistance levels

· 📰 Media gradually starts paying attention again

· 😨 Sentiment: FOMO (Fear Of Missing Out) among experienced investors

· 😞 Regret over selling at the bottom

· 📈 Indicator: Beginning of increasing trading volume

3. Greed & Euphoria Phase 🟨

· 📈 Description: Full-blown bullish phase - price rises consistently and rapidly

· 🗞️ Positive news dominates everywhere

· 👥 Friends and acquaintances talk about massive profits

· 💭 Sentiment: Belief that "this time it's different" and "price only goes up"

· 💸 Greed for more profits and borrowing to buy

· 📊 Indicator: Very high trading volume and positive media coverage

4. Denial Phase 🟧 - Danger Point!

· 📉 Description: Price falls from the peak

· 🤦 Many investors consider this just a "temporary correction"

· 🔮 Expect a return to the peak

· ❌ Sentiment: Strong denial

· 🛒 Buying during the decline hoping for recovery

· 📊 Indicator: Trading volume remains high

5. Fear, Panic & Capitulation Phase 🟥

· 🚨 Description: Sharp and rapid decline

· 📉 Price experiences consecutive breakdowns

· 😱 Sentiment: Intense fear, panic selling

· 💔 Acceptance of heavy losses - absolute despair

· 📊 Indicator: Very high selling volume

6. Apathy & Depression Phase ⬜

· 😴 Description: Market remains stagnant with low volatility for extended periods

· 💤 Prices are low and boring

· 🚫 Sentiment: Complete disinterest in the market

· 👋 Most people have accepted defeat and exited the market

· ☠️ Talk of "Bitcoin's death" resurfaces

· 📊 Indicator: Very low trading volume and minimal media attention

---

💡 Golden Insight:

Understanding these phases can help you make the best trading decisions! ✨

---

📌 Market Psychology + Technical Analysis = Trading Success 🚀

---

💬 Let's Interact!

I'd love to hear your thoughts! 👇

· 🤔 Which phase do you think we're currently in?

· 📊 What's your market outlook for the coming months?

· 💭 Share your technical analysis perspective

· 🎯 Have you used market psychology in your trading strategy?

· 📉 What indicators do you find most reliable?

· 💡 Any successful trades based on market sentiment?

· 🔮 Where do you see Bitcoin in the next 6 months?

Let's learn from each other! Share your comments and analysis below 👇

Your experience and insights are valuable - let's build our trading knowledge together! 🌟

Feel free to ask any questions or share your trading experiences! 💪

How to Use Moving Averages in TradingViewMaster moving averages using TradingView's charting tools in this comprehensive tutorial from Optimus Futures.

Moving averages are among the most versatile technical analysis tools available, helping traders analyze trends, identify overbought/oversold conditions, and create tradeable support and resistance levels.

What You'll Learn:

Understanding moving averages: lagging indicators with multiple applications

Simple moving average basics: calculating price averages over set periods

Key configuration choices: lookback periods, price inputs, and timeframes

How to select optimal lookback periods (like 200-day) for different trading styles

Using different price inputs: close, open, high, or low prices

Applying moving averages across all timeframes from daily to 5-minute charts

Analyzing price relative to moving averages for trend identification

Using 50-day and 200-day moving averages for trend analysis on E-Mini S&P 500

Mean reversion trading: how price tends to return to moving averages

Trend direction analysis using moving average slopes

Famous crossover signals: "Death Cross" and "Golden Cross" explained

Trading moving averages as dynamic support and resistance levels

Advanced moving average types: weighted and exponential moving averages

Applying moving averages to other indicators like MACD and Stochastics

Balancing sensitivity vs. noise when choosing periods

This tutorial may benefit futures traders, swing traders, and technical analysts who want to incorporate moving averages into their trading strategies.

The concepts covered could help you identify trend direction, potential reversal points, and dynamic trading levels across multiple timeframes.

Learn more about futures trading with TradingView:

optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting

Super Trend Strategies: Mastering Breakouts & RetracementsSuper Trend Unleashed: Mastering Breakouts & Retracements

Hey, fellow traders! Ever wished for a straightforward tool to cut through market noise and identify trends with precision? ✨ Meet the Super Trend indicator – a dynamic, trend-following marvel designed to simplify your trading decisions and highlight high-probability entry points. Understanding this indicator can significantly enhance your market analysis.

Understanding the Super Trend: Your Trend Compass 🧭

At its core, the Super Trend isn’t just another line on your chart; it's a powerful derivative of the Average True Range (ATR) and a multiplier factor. 🧠 The ATR measures market volatility, helping the Super Trend dynamically adjust its distance from the price, ensuring it stays relevant across varying market conditions.

The indicator paints a vibrant line directly on your price chart, switching between green (bullish 🟢) and red (bearish 🔴) to signal the prevailing trend direction.

Interpreting the Signals – The Color Code:

Green Line (Below Price): When the Super Trend line turns green and positions itself below the price candles, it signals an established uptrend. This often suggests a favorable environment for long positions, acting as a dynamic support level. 📈

Red Line (Above Price): Conversely, when the line shifts to red and appears above the price candles, it indicates a downtrend is in play. This typically implies caution for longs or potential shorting opportunities, serving as dynamic resistance. 📉

The Flip 🔄: The real magic happens when the color flips! A change from red to green often serves as a potential buy signal, while a green to red flip can indicate a sell signal.

Mastering Super Trend Strategies: Insights from the BTCUSDT Daily Chart

Let's dissect the BTCUSDT Daily chart to understand Four powerful strategies utilizing the Super Trend indicator:

Strategy 1: The Breakout Blast-Off 🚀

Our BTCUSDT Daily chart beautifully illustrates a classic Super Trend application: The Breakout Trade. Observe the initial period where price consolidated below a clear resistance level, marked as the "Breakout" line. 🚧 This horizontal line represented a significant ceiling that price struggled to surmount.

A powerful surge saw BTC breaking decisively above this resistance. Crucially, at the exact moment of this breakout, the Super Trend line simultaneously flipped from red to a vibrant green and moved to position itself below the price. 🟣 This confluence of strong price action (a clean breakout) and the Super Trend signal (a bullish flip) provides robust confirmation for a long entry. Initiating a trade at this point capitalizes on the momentum generated by the breakout and the confirmed initiation of a new upward trend. It's an aggressive yet calculated entry, based on prior price action providing the foundation.

Same way there was a shorting opportunity using this Breakout Strategy as shown in the chart.

Strategy 2: The Retracement Rebound 🎯

Even after a significant upward move, markets rarely ascend in a straight line. They often retrace or pull back to 'refuel' before continuing their journey. The Super Trend indicator is exceptional at identifying these high-probability pullback opportunities, offering a more conservative entry point. 🌊

Observe how, after the initial breakout and subsequent rally, the BTCUSDT price pulls back towards the active green Super Trend line. This line effectively acts as dynamic support during an uptrend. The key here is patience and confirmation: wait for a confirmation candle (like the strong green candle highlighted within the second purple circle 🟣) that clearly closes above the Super Trend or shows strong rejection from it. This 'bounce' off the Super Trend, coupled with the indicator remaining green (signaling the underlying uptrend is still intact), provides an ideal opportunity to initiate or add to a long position, riding the continuation of the prevailing trend. This strategy minimizes risk by waiting for the market to prove its intent to continue upwards from a key support level.

Strategy 3 Confluence Power: How Price Action & Super Trend Confirm Uptrends! 🤝

Let's turn our attention to the BTCUSDT Daily chart to dissect a powerful entry strategy where price action and the Super Trend align perfectly.

1.Initial Downtrend/Consolidation: Observe the left side of the chart. Initially, the Super Trend is red 🔴, indicating a bearish phase or period of consolidation. Price action might be characterized by lower lows or range-bound movement.

2.The First Hint of a Shift (L to HL): The market begins to show signs of life. After establishing a clear 'L' (Low), the price then forms a 'HL' (Higher Low). This is a crucial early signal from price action – buyers are now defending a higher level than before.

3.The Super Trend Flip: Simultaneously, or very shortly after the price establishes this first Higher Low, the Super Trend indicator performs its critical flip, transitioning from red to vibrant green 🟢. This tells us that the underlying trend, as calculated by the indicator, is potentially shifting.

4.The Confluence Point: Price Action + Super Trend Green Entry! 🚀

The sweet spot, highlighted by the yellow box and arrow labeled "Price action + SuperTrend Green" 🌟, occurs precisely when the price breaks above the previous swing high to establish a new Higher High (HH), and the Super Trend is firmly established as green 🟢.

Why is this a high-conviction entry? It's not just an indicator giving a buy signal; it's the market structure itself confirming a shift in momentum. The sequence of HHs and HLs unequivocally demonstrates that buyers are in control and are pushing prices higher. The green Super Trend acts as a powerful validating filter, confirming the strength and sustainability of this newfound bullish trend. 🤝

The Power of Validation: Initiating a trade at this point capitalizes on a dual confirmation: the market is telling you it's going up through its price structure, and the Super Trend is validating this intent by aligning its trend signal. This significantly reduces the likelihood of false breakouts or whipsaws.

Riding the Trend: Post-Entry Confirmation ✅

Following this confirmed entry, we observe a sustained upward movement in BTCUSDT. The Super Trend line continues to trail below the price, maintaining its green hue 🟢. This serves as a dynamic support level, and as long as the price remains above it, the uptrend is considered intact.

Strategy 4: 4. The Art of Omission: Recognizing False Signals with Super Trend & Price Action. 🛑

In trading, knowing when not to trade is often as crucial as knowing when to enter. While indicators like the Super Trend are invaluable for identifying trends, a common pitfall is to blindly follow every signal. Today, we delve into a critical lesson: how discerning price action can help you avoid "green light, no go" scenarios, saving you from frustrating whipsaws and preserving your precious capital. 💰

1. Super Trend Turns Green: Around mid-May, the Super Trend flipped confidently to green 🟢, typically signaling a long entry. Price did rally initially.

2. Critical Price Action Test: Horizontal Resistance 🚧

As price rose, it hit a significant horizontal resistance around 72,000. Price rallied to this resistance, pulled back, and then tried again, but failed to make a decisive breakout above the previous peak. This formed a double top pattern or a clear ranging environment beneath the resistance.

3. The Disconnect: Green Super Trend vs. Unconfirmed Price Action ⚠️

Crucially, throughout this period, the Super Trend remained green 🟢. However, price action showed a clear lack of conviction to break out and establish new Higher Highs. The market was "chopping" or ranging, not trending.

4. The Verdict: "This Trade Can Be Avoided." 🛑

Despite the green Super Trend, the absence of a clear breakout or sustained bullish price action meant this trade should be avoided. Entering a long position here would be buying into resistance in a non-trending market, often leading to:

o Whipsaws: Repeated stop-loss hits.

o False Breakouts: Brief moves that quickly reverse.

o Trend Reversals: As seen, the lack of conviction eventually led to a downtrend, flipping the Super Trend back to red.

The Power of Confluence 🧘♀️

This example highlights why confluence is vital. Super Trend gives directional hints, but price action provides the ultimate confirmation (or denial) of that trend's strength.

Same for Shorting as well, use power of confluence:

Setting Up Your Super Trend on TradingView: A Quick Guide 🛠️

in.tradingview.com

Adding the Super Trend to your TradingView chart is simple:

1.Click on the 'Indicators' button at the top of your chart. 🔍

2.In the search bar, type 'Super Trend'. ⌨️

3.Select the official 'SuperTrend' by ‘Tradingview’ ✨

4.The indicator will appear on your chart, typically with default settings (Factor: 3, Period: 10).

Customizing for Peak Performance ⚙️

While the default settings are a great starting point, the beauty of Super Trend lies in its adaptability. You can adjust its sensitivity to better suit your trading style and the asset's volatility:

Factor (Multiplier): This adjusts how far the Super Trend line is from the price. A lower factor (e.g., 2) makes it more sensitive, resulting in more frequent flips and potentially earlier signals but also more false signals (whipsaws). A higher factor (e.g., 4 or 5) makes it smoother and less sensitive, leading to fewer signals but potentially confirming trends later.

Period (ATR Length): This determines the number of periods used for the Average True Range calculation. A longer period (e.g., 14 or 20) considers more data, resulting in a smoother ATR and less frequent signals. A shorter period (e.g., 7) makes it more responsive to recent price action.

Experiment to find what complements your trading style and the specific market conditions! 🧪

Important Considerations & Pro-Tips for Success ✅

Not a Standalone Indicator: Super Trend excels when used in conjunction with other analytical tools. Combine it with traditional support/resistance zones, volume analysis, candlestick patterns, or other indicators like RSI or MACD for higher probability trades. 🤝

Volatility Matters: In highly volatile markets, the Super Trend might produce more whipsaws. Be mindful of the market conditions and consider adjusting the settings or confirming with other indicators. 🌪️

Dynamic Stop-Loss Placement: The Super Trend line itself can often serve as an excellent dynamic stop-loss. If the price closes on the opposite side of the line after your entry, it could signal a trend reversal and a good point to exit. 🛑

Multi-Timeframe Analysis: Always check the Super Trend on higher timeframes (e.g., Weekly or Daily if trading H4) to confirm the overarching trend before taking trades on lower timeframes. This ensures you're trading in harmony with the dominant market direction. ⏱️

Conclusion: Your Ally in Trend Trading 💰📈

The Super Trend is an indispensable tool for traders looking to identify and ride market trends effectively. Whether you're catching explosive breakouts or entering patiently on retracements, its clear visual signals can provide invaluable clarity. Master its nuances, combine it with sound risk management, and you'll have a powerful ally in your trading arsenal! Happy trading!

I truly believe this easy Super Trend strategy tutorial can be a game-changer for many traders seeking clarity 💡 and profitability 💰. If you've found value in these insights, please hit the Like button on this idea 👍 and boost its visibility by sharing it with your fellow traders 🚀 (or even leaving a supportive comment! 💬). Your engagement ensures this accessible knowledge reaches and empowers more of our community 🤝. Let's build a stronger 💪, smarter 🧠 trading community together!

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

The Empirical Validity of Technical Indicators and StrategiesThis article critically examines the empirical evidence concerning the effectiveness of technical indicators and trading strategies. While traditional finance theory, notably the Efficient Market Hypothesis (EMH), has long argued that technical analysis should be futile, a large body of academic research both historical and contemporary presents a more nuanced view. We explore key findings, address methodological limitations, assess institutional use cases, and discuss the impact of transaction costs, market efficiency, and adaptive behavior in financial markets.

1. Introduction

Technical analysis (TA) remains one of the most controversial subjects in financial economics. Defined as the study of past market prices and volumes to forecast future price movements, TA is used by a wide spectrum of market participants, from individual retail traders to institutional investors. According to the EMH (Fama, 1970), asset prices reflect all available information, and hence, any predictable pattern should be arbitraged away instantly. Nonetheless, technical analysis remains in widespread use, and empirical evidence suggests that it may offer predictive value under certain conditions.

2. Early Empirical Evidence

The foundational work by Brock, Lakonishok, and LeBaron (1992) demonstrated that simple trading rules such as moving average crossovers could yield statistically significant profits using historical DJIA data spanning from 1897 to 1986. Importantly, the authors employed bootstrapping methods to validate their findings against the null of no serial correlation, thus countering the argument of data mining.

Gencay (1998) employed non-linear models to analyze the forecasting power of technical rules and confirmed that short-term predictive signals exist, particularly in high-frequency data. However, these early works often omitted transaction costs, thus overestimating potential returns.

3. Momentum and Mean Reversion Strategies

Momentum strategies, as formalized by Jegadeesh and Titman (1993), have shown persistent profitability across time and geographies. Their approach—buying stocks that have outperformed in the past 3–12 months and shorting underperformers—challenges the EMH by exploiting behavioral biases and investor herding. Rouwenhorst (1998) confirmed that momentum exists even in emerging markets, suggesting a global phenomenon.

Conversely, mean reversion strategies, including RSI-based systems and Bollinger Bands, often exploit temporary price dislocations. Short-horizon contrarian strategies have been analyzed by Chan et al. (1996), but their profitability is inconsistent and highly sensitive to costs, timing, and liquidity.

4. Institutional Use of Technical Analysis

Contrary to the belief that TA is primarily a retail tool, it is also utilized—though selectively—by institutional investors:

Hedge Funds: Many quantitative hedge funds incorporate technical indicators within multi-factor models or machine learning algorithms. According to research by Neely et al. (2014), trend-following strategies remain a staple among CTAs (Commodity Trading Advisors), particularly in futures markets. These strategies often rely on moving averages, breakout signals, and momentum filters.

Market Makers: Although market makers are primarily driven by order flow and arbitrage opportunities, they may use TA to model liquidity zones and anticipate stop-hunting behavior. Order book analytics and technical levels (e.g., pivot points, Fibonacci retracements) can inform automated liquidity provision.

Pension Funds and Asset Managers: While these institutions rarely rely on TA alone, they may use it as part of tactical asset allocation. For instance, TA may serve as a signal overlay in timing equity exposure or in identifying risk-off regimes. According to a CFA Institute survey (2016), over 20% of institutional investors incorporate some form of technical analysis in their decision-making process.

5. Adaptive Markets and Conditional Validity

Lo (2004) introduced the Adaptive Markets Hypothesis (AMH), arguing that market efficiency is not a binary state but evolves with the learning behavior of market participants. In this framework, technical strategies may work intermittently, depending on the ecological dynamics of the market. Neely, Weller, and Ulrich (2009) found technical rules in the FX market to be periodically profitable, especially during central bank interventions or volatility spikes—conditions under which behavioral biases and structural inefficiencies tend to rise.

More recent studies (e.g., Moskowitz et al., 2012; Baltas & Kosowski, 2020) show that momentum and trend-following strategies continue to deliver long-term Sharpe ratios above 1 in diversified portfolios, particularly when combined with risk-adjusted scaling techniques.

6. The Role of Transaction Costs

Transaction costs represent a critical variable that substantially alters the net profitability of technical strategies. These include:

Explicit Costs: Commissions, fees, and spreads.

Implicit Costs: Market impact, slippage, and opportunity cost.

While early studies often neglected these elements, modern research integrates them through realistic backtesting frameworks. For example, De Prado (2018) emphasizes that naive backtesting without cost modeling and slippage assumptions leads to a high incidence of false positives.

Baltas and Kosowski (2020) show that even after accounting for bid-ask spreads and market impact models, trend-following strategies remain profitable, particularly in futures and FX markets where costs are lower. Conversely, high-frequency mean-reversion strategies often become unprofitable once these frictions are accounted for.

The impact of transaction costs also differs by asset class:

Equities: Higher costs due to wider spreads, especially in small caps.

Futures: Lower costs and higher leverage make them more suitable for technical strategies.

FX: Extremely low spreads, but high competition and adverse selection risks.

7. Meta-Analyses and Recent Surveys

Park and Irwin’s (2007) meta-analysis of 95 studies found that 56% reported significant profitability from technical analysis. However, profitability rates dropped when transaction costs were included. More recent work by Han, Yang, and Zhou (2021) extended this review with data up to 2020 and found that profitability was regime-dependent: TA performed better in volatile or trending environments and worse in stable, low-volatility markets.

Other contributions include behavioral explanations. Barberis and Thaler (2003) suggest that TA may capture collective investor behavior, such as overreaction and underreaction, thereby acting as a proxy for sentiment.

8. Limitations and Challenges

Several methodological issues plague empirical research in technical analysis:

Overfitting: Using too many parameters increases the likelihood of in-sample success but out-of-sample failure.

Survivorship Bias: Excluding delisted or bankrupt stocks leads to inflated backtest performance.

Look-Ahead Bias: Using information not available at the time of trade leads to unrealistic results.

Robust strategy development now mandates walk-forward testing, Monte Carlo simulations, and realistic assumptions on order execution. The growing field of machine learning in finance has heightened these risks, as complex models are more prone to fitting noise rather than signal (Bailey et al., 2014).

9. Conclusion

Technical analysis occupies a contested but persistent role in finance. The empirical evidence is mixed but suggests that technical strategies can be profitable under certain market conditions and when costs are minimized. Institutional investors have increasingly integrated TA within quantitative and hybrid frameworks, reflecting its conditional usefulness.

While TA does not provide a universal arbitrage opportunity, it can serve as a valuable tool when applied adaptively, with sound risk management and rigorous testing. Its success ultimately depends on context, execution discipline, and integration within a broader investment philosophy.

References

Bailey, D. H., Borwein, J. M., Lopez de Prado, M., & Zhu, Q. J. (2014). "The Probability of Backtest Overfitting." *Journal of Computational Finance*, 20(4), 39–69.

Baltas, N., & Kosowski, R. (2020). "Trend-Following, Risk-Parity and the Influence of Correlations." *Journal of Financial Economics*, 138(2), 349–368.

Barberis, N., & Thaler, R. (2003). "A Survey of Behavioral Finance." *Handbook of the Economics of Finance*, 1, 1053–1128.

Brock, W., Lakonishok, J., & LeBaron, B. (1992). "Simple Technical Trading Rules and the Stochastic Properties of Stock Returns." Journal of Finance, 47(5), 1731–1764.

Chan, L. K. C., Jegadeesh, N., & Lakonishok, J. (1996). "Momentum Strategies." Journal of Finance, 51(5), 1681–1713.

De Prado, M. L. (2018). Advances in Financial Machine Learning, Wiley.

Fama, E. F. (1970). "Efficient Capital Markets: A Review of Theory and Empirical Work." Journal of Finance, 25(2), 383–417.

Gencay, R. (1998). "The Predictability of Security Returns with Simple Technical Trading Rules." Journal of Empirical Finance, 5(4), 347–359.

Han, Y., Yang, K., & Zhou, G. (2021). "Technical Analysis in the Era of Big Data." *Review of Financial Studies*, 34(9), 4354–4397.

Jegadeesh, N., & Titman, S. (1993). "Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency." *Journal of Finance*, 48(1), 65–91.

Lo, A. W. (2004). "The Adaptive Markets Hypothesis: Market Efficiency from an Evolutionary Perspective." *Journal of Portfolio Management*, 30(5), 15–29.

Moskowitz, T. J., Ooi, Y. H., & Pedersen, L. H. (2012). "Time Series Momentum." *Journal of Financial Economics*, 104(2), 228–250.

Neely, C. J., Weller, P. A., & Ulrich, J. M. (2009). "The Adaptive Markets Hypothesis: Evidence from the Foreign Exchange Market." *Journal of Financial and Quantitative Analysis*, 44(2), 467–488.

Neely, C. J., Rapach, D. E., Tu, J., & Zhou, G. (2014). "Forecasting the Equity Risk Premium: The Role of Technical Indicators." *Management Science*, 60(7), 1772–1791.

Park, C. H., & Irwin, S. H. (2007). "What Do We Know About the Profitability of Technical Analysis?" *Journal of Economic Surveys*, 21(4), 786–826.

Rouwenhorst, K. G. (1998). "International Momentum Strategies." *Journal of Finance*, 53(1), 267–284.

Zhu, Y., & Zhou, G. (2009). "Technical Analysis: An Asset Allocation Perspective on the Use of Moving Averages." *Journal of Financial Economics*, 92(3), 519–544.

Timeframes: Why They’re Fundamentally Flawed (And What To Do)When analyzing price action, timeframes serve as a convenient lens through which traders attempt to make sense of the market. They help us categorize price movement — bullish , bearish , ranging , trending , and so on — within a structured framework. But here’s the reality: candlesticks themselves aren’t real . Much like clocks or calendars, they’re simply man-made constructs — tools we've invented to measure and scale something intangible: time . I know that might sound a bit abstract, but stay with me.

While traders commonly rely on standard timeframes like the Daily, 4H, 1H, 15M , etc., it’s important to recognize that price doesn’t conform to these rigid intervals. The market moves continuously, and the “spaces between” those timeframes — like a 27-minute or 3-hour chart — are just as real . These non-standard timeframes often offer better clarity depending on the speed and rhythm of the market at any given moment.

This begs the question: How do we keep up with this ever-shifting pace? Do we constantly toggle between similar timeframes to recalibrate our analysis? Do we measure volatility? Amplitude? Period length? There’s no clear consensus, which leads to inefficiency — and in trading, inefficiency costs.

In my view, the solution lies in blending multiple nearby timeframes into a single, adaptive framework . We need a representation of price action that adjusts automatically with the speed of the market. And the answer is surprisingly simple — literally . It’s called the Simple Moving Average (SMA) .

Think an SMA is just a line representing past highs, lows, or closes? It’s much more than that. When used creatively, the SMA becomes a dynamic lens that filters noise, reveals trend clarity, and smooths out irregularities in price behavior. Rather than relying on a single metric, we can combine multiple SMA variations — highs, lows, opens, closes — into one composite view of the market . This gives us a continuously adjusting snapshot of average price action.

Once we adopt this approach, everything starts to click.

• Engulfing patterns become more reliable

• Liquidity sweeps occur less frequently

• Supply and demand zones become more precise

• Market structure begins to make consistent sense

With SMA-based price action , our strategies don’t just become clearer — they become smarter .

Want to See It in Action?

If you’re interested in applying this concept to your own trading strategy, check out my TradingView profile: The_Forex_Steward . There, you’ll find the SMA Price Action indicator used in the examples shown, as well as tools that apply this methodology to:

• Supply and Demand

• Market Structure

• Market Balance Levels

• Velocity & Momentum

• And more to come!

If you found this idea helpful, be sure to follow the page. I’ll be releasing more exclusive indicators and trading concepts soon — so stay tuned!

Sharing the advanced Bollinger Bands strategyHere are the Bollinger Band trading tips: *

📌 If you break above the upper band and then drop back down through it, confirm a short signal!

📌 If you drop below the lower band and then move back up through it, confirm a long signal!

📌 If you continue to drop below the middle band, add to your short position; if you break above the middle band, add to your long position!

Pretty straightforward, right? This means you won’t be waiting for the middle band to signal before acting; you’ll be ahead of the game, capturing market turning points!

Let’s break it down with some examples:

1. When Bitcoin breaks above the upper Bollinger Band, it looks strong, but quickly drops back below:

➡️ That’s a “bull trap”—time to go short!

2. If Bitcoin crashes below the lower band and then pops back up:

➡️ Bears are running out of steam—time to go long and grab that rebound!

3. If the price keeps moving above the middle band:

➡️ Add to your long or short positions to ride the trend without being greedy or hesitant.

Why is this method powerful?

It combines “edge recognition + trend confirmation” for double protection:

1. Edge Recognition—spot the turning point and act early.

2. Trend Confirmation—wait for the middle band breakout and then confidently add positions!

You won’t be reacting after the fact; you’ll be ahead of the curve, increasing your positions in the trend’s middle and locking in profits at the end. This is the rhythm of professional traders and the core logic of systematic profits!

Who is this method for?

- You want precise entry and exit points.

- You’re tired of “chasing highs and cutting losses.”

- You want a clear, executable trading system.

- You want to go from “I see the chart but don’t act” to “I see the signal and take action.”

Follow for more. Make sure to like this if you found it useful.

Golden Cross vs. Death Cross: What Do They Really Tell Us?Hello, traders! 🤝🏻

It’s hard to scroll through a crypto newsfeed without spotting a headline screaming about a “Golden Cross” forming on Bitcoin or warning of an ominous “Death Cross” approaching. But what do these classic MA signals can really mean? Are they as prophetic as they sound, or is there more nuance to the story? Let’s break it down.

📈 The Basics: What Are Golden and Death Crosses?

At their core, both patterns are simple moving average crossovers. They occur when two moving averages — typically the 50-day and the 200-day — cross paths on a chart.

Golden Cross: When the 50-day MA crosses above the 200-day MA, signaling a potential shift from a bearish phase to a bullish trend. It's often seen as a sign of renewed strength and a long-term uptrend.

Death Cross: When the 50-day MA crosses below the 200-day MA, suggesting a possible transition from bullish to bearish, hinting at extended downside pressure.

📊 Why They Work (and When They Don't)

In theory, the idea is simple: The 50-day MA represents shorter-term sentiment, while the 200-day MA captures longer-term momentum. When short-term price action overtakes long-term averages, it’s seen as a bullish signal (golden cross). When it drops below, it’s bearish (death cross).

This highlights a key point: moving average crossover signals are inherently delayed. They’re based on historical data, so they can’t predict future price moves in real time.

🔹 October 2020: Golden Cross

On the weekly BTC/USDT chart, we can clearly see a Golden Cross forming in October 2020. The 50-week MA (short-term) crossed above the 200-week MA (long-term), marking the start of Bitcoin's explosive rally from around $11,000 to its then all-time high above $60,000 in 2021. This signal aligned with growing institutional interest and the post-halving narrative, reinforcing the bull case.

🔹 June 2021: Death Cross

Just months after Bitcoin’s peak, a Death Cross emerged around June 2021, near the $35,000 mark. However, this was more of a lagging signal: by the time it appeared, the sharp pullback from $60K+ had already taken place. Interestingly, the market stabilized not long after, with a recovery above $50K later that year, showing that Death Cross signals aren’t always the end of the story.

🔹 Mid-2022: Another Death Cross

In mid-2022, BTC formed another Death Cross during its prolonged bear market. This one aligned better with the broader trend, as price continued to slide towards $15,000, reflecting macro pressures like tightening monetary policies and the collapse of major players in the crypto space.

🔹 Early 2024: Golden Cross Comeback

The most recent Golden Cross appeared in early 2024, signaling renewed bullish momentum. This crossover preceded a significant rally, pushing Bitcoin above $100,000 by mid-2025, as seen in your chart. While macro factors (like ETF approvals or regulatory clarity) also played a role, this MA signal coincided with a notable shift in sentiment.

⚙️ Golden Cross ≠ Guaranteed Rally, Death Cross ≠ Doom

While these MA crossovers are clean and appealing, they’re not foolproof. Their lagging nature means they often confirm trends rather than predict them. For example, in June 2021, the Death Cross appeared after much of the selling pressure had already played out. Conversely, in October 2020 and early 2024, the Golden Crosses aligned with genuine upward shifts.

🔍 Why Care About These Signals?

Because they help us contextualize market sentiment. The golden cross and death cross reflect collective trader psychology — optimism and fear. But to truly understand them, we need to combine them with volume, market structure, and macro narratives.

So, are golden crosses and death crosses reliable signals, or just eye-catching headlines?

Your chart tells us both stories: sometimes they work, sometimes they mislead. What’s your take? Do you use these MA signals in your trading, or do you prefer other methods? Let’s discuss below!

Two MAs, One Ribbon: A Smarter Way to Trade TrendsSome indicators aim to simplify. Others aim to clarify. The RedK Magic Ribbon does both, offering a clean, color-coded visualization of trend strength and agreement between two custom moving averages. Built by RedKTrader , this tool is ideal for traders who want to stay aligned with the trend and avoid the noise.

Let’s break down how it works, how we use it at Xuantify, and how it can enhance your trend-following setups.

🔍 What Is the RedK Magic Ribbon?

This indicator combines two custom moving averages:

CoRa Wave – A fast, Compound Ratio Weighted Average

RSS_WMA (LazyLine) – A slow, Smooth Weighted MA

When both lines agree on direction, the ribbon fills with:

Green – Bullish trend

Red – Bearish trend

Gray – No-trade zone (disagreement or consolidation)

Key Features:

Visual trend confirmation

No-trade zones clearly marked

Customizable smoothing and length

Works on any timeframe

🧠 How We Use It at Xuantify

We use the Magic Ribbon as a trend filter and visual guide .

1. Trend Confirmation

We only trade in the direction of the ribbon fill. Gray zones = no trades.

2. Entry Timing

We enter near the RSS_WMA (LazyLine) for optimal risk-reward. It also acts as a dynamic stop-loss guide.

🎨 Visual Cues That Matter

Green Fill – Trend is up, both MAs agree

Red Fill – Trend is down, both MAs agree

Gray Fill – No-trade zone, MAs disagree

This makes it easy to:

Avoid choppy markets

Stay aligned with the dominant trend

Spot early trend shifts

⚙️ Settings That Matter

Adjust CoRa Wave length and smoothness

Tune RSS_WMA to track price with minimal lag

Customize colors, line widths, and visibility

🧩 Best Combinations with This Indicator

We pair the Magic Ribbon with:

Structure Tools – BOS/CHOCH for context

MACD 4C – For momentum confirmation

Volume Profile – To validate breakout strength

Fair Value Gaps (FVGs) – For sniper entries

⚠️ What to Watch Out For

This is a confirmation tool , not a signal generator. Use it with structure and price action. Always backtest and adjust settings to your asset and timeframe.

🚀 Final Thoughts

If you want a clean, intuitive way to stay on the right side of the trend, the RedK Magic Ribbon is a powerful visual ally. It helps you avoid indecision and focus on high-probability setups.

What really sets the Magic Ribbon apart is the precision of its fast line—the CoRa Wave. It reacts swiftly to price action and often aligns almost perfectly with pivot reversals. This responsiveness allows traders to spot potential turning points early, giving them a valuable edge in timing entries or exits. Its accuracy in identifying momentum shifts makes it not just a trend filter, but a powerful tool for anticipating market moves with confidence.

Try it, tweak it, and let the ribbon guide your trades.

Engineering the Hull‑style Exponential Moving Average (HEMA)▶️ Introduction

Hull’s Moving Average (HMA) is beloved because it offers near–zero‑lag turns while staying remarkably smooth. It achieves this by chaining *weighted* moving averages (WMAs), which are finite‑impulse‑response (FIR) filters. Unfortunately, FIR filters demand O(N) storage and expensive rolling calculations. The goal of the Hull‑style Exponential Moving Average (HEMA) is therefore straightforward: reproduce HMA’s responsiveness with the constant‑time efficiency of an EMA, an infinite‑impulse‑response (IIR) filter that keeps only two state variables regardless of length.

▶️ From FIR to IIR – What Changes?

When we swap a WMA for an EMA we trade a hard‑edged window for an exponential decay. This swap creates two immediate engineering challenges. First, the EMA’s centre of mass (CoM) lies closer to the present than the WMA of the same “period,” so we must tune its alpha to match the WMA’s effective lag. Second, the exponential tail never truly dies; left unchecked it can restore some of the lag we just removed. The remedy is to shorten the EMA’s time‑constant and apply a lighter finishing smoother. If done well, the exponential tail becomes imperceptible while the update cost collapses from O(N) to O(1).

▶️ Dissecting the Original HMA

HMA(N) is constructed in three steps:

Compute a *slow* WMA of length N.

Compute a *fast* WMA of length N/2, double it, then subtract the slow WMA. This “2 × fast − slow” operation annihilates the first‑order lag term in the transfer function.

Pass the result through a short WMA of length √N, whose only job is to tame the mid‑band ripple introduced by step 2.

Because the WMA window hard‑cuts, everything after bar N carries zero weight, yielding a razor‑sharp response.

▶️ Re‑building Each Block with EMAs

1. Slow leg .

We choose αₛ = 3 / (2N − 1) .

This places the EMA’s CoM exactly one bar ahead of the WMA(N) CoM, preserving the causal structure while compensating for the EMA’s lingering tail.

2. Fast leg .

John Ehlers showed that two single‑pole filters can cancel first‑order phase error if they keep the ratio τ𝑓 = ln2 / (1 + ln2) ≈ 0.409 τₛ .

We therefore compute α𝑓 = 1 − e^(−λₛ / 0.409) ,

where λₛ = −ln(1 − αₛ).

3. Zero‑lag blend .

Instead of Hull’s integer 2/−1 pair we adopt Ehlers’ fractional weights:

(1 + ln 2) · EMA𝑓 − ln 2 · EMAₛ .

This pair retains unity DC gain and maintains the zero‑slope condition while drastically flattening the pass‑band bump.

4. Finishing smoother .

The WMA(√N) in HMA adds roughly one and a half bars of consequential delay. Because EMAs already smear slightly, we can meet the same lag budget with an EMA whose span is only √N / 2. The lighter pole removes residual high‑frequency noise without re‑introducing noticeable lag.

▶️ Error Budget vs. Classical HMA

Quantitatively, HEMA tracks HMA to within 0.1–0.2 bars on the first visible turn for N between 10 and 50. Overshoot at extreme V‑turns is 25–35 % smaller because the ln 2 weighting damps the 0.2 fs gain peak. Root‑mean‑square ripple inside long swings falls by roughly 15–20 %. The penalty is a microscopic exponential tail: in a 300‑bar uninterrupted trend HEMA trails HMA by about two bars—visually negligible for most chart horizons but easily fixed by clipping if one insists on absolute truncation.

▶️ Practical Evaluation

Side‑by‑side plots confirm the math. On N = 20 the yellow HEMA line flips direction in the same candle—or half a candle earlier—than the blue HMA, while drawing a visibly calmer trace through the mid‑section of each swing. On tiny windows (N ≤ 8) you may notice a hair more shimmer because the smoother’s span approaches one bar, but beyond N = 10 the difference disappears. More importantly, HEMA updates with six scalar variables; HMA drags two or three rolling arrays for every WMA it uses. On a portfolio of 500 instruments that distinction is the difference between comfortable real‑time and compute starvation.

▶️ Conclusion

HEMA is not a casual “replace W with E” hack. It is a deliberate reconstruction: match the EMA’s centre of mass to the WMA it replaces, preserve zero‑lag geometry with the ln 2 coefficient pair, and shorten the smoothing pole to offset the EMA tail. The reward is an indicator that delivers Hull‑grade responsiveness and even cleaner mid‑band behaviour while collapsing memory and CPU cost to O(1). For discretionary traders wedded to the razor‑sharp V‑tips of the original Hull, HMA remains attractive. For algorithmic desks, embedded systems, or anyone streaming thousands of symbols, HEMA is the pragmatic successor—almost indistinguishable on the chart, orders of magnitude lighter under the hood.

Color Your Trades: MACD 4C vs the Classic📊 Coloring Momentum: Comparing Standard MACD vs MACD 4C

Momentum indicators are a trader’s compass—but not all compasses are created equal. In this post, we compare the classic MACD with the visually enhanced MACD 4C , a four-color histogram tool that adds clarity and nuance to trend and momentum analysis.

Let’s break down how both tools work, how we use them at Xuantify, and how you can decide which one fits your strategy best.

🔍 What Are These Indicators?

Standard MACD (Moving Average Convergence Divergence) is a time-tested momentum indicator that plots the difference between two EMAs (typically 12 and 26) and a signal line (usually a 9 EMA of the MACD line). It’s simple, effective, and widely used.

MACD 4C , developed by vkno422 , builds on the classic MACD by introducing a four-color histogram and divergence detection , making it easier to interpret momentum shifts and trend strength visually.

Key Differences:

Standard MACD: Two lines + histogram (single color)

MACD 4C: Histogram only, but with four colors to show trend strength and direction

MACD 4C includes bullish/bearish divergence detection

🧠 How We Use Them at Xuantify

We use both indicators—but for different purposes.

1. Standard MACD – Clean Confirmation

We use it for classic trend confirmation and crossover signals . It’s great for traders who prefer minimalism and are comfortable interpreting line-based momentum.

2. MACD 4C – Visual Momentum Clarity

We use MACD 4C when we want a more intuitive, color-coded view of momentum. The four-color histogram helps us quickly spot trend strength, exhaustion, and divergence.

🧭 Color Coding in MACD 4C

MACD 4C uses four histogram colors (default settings):

Lime/Green : Bullish momentum building or continuing

Red/Maroon : Bearish momentum building or continuing

This makes it easier to:

Spot momentum shifts

Identify trend continuation

Detect divergence at a glance

⚙️ Settings That Matter

Both indicators allow customization, but MACD 4C offers more visual tuning:

MACD 4C:

Adjustable fast/slow MA and signal smoothing

Toggle divergence detection

Color-coded histogram for quick reads

Standard MACD:

Clean, minimal, and widely supported

Best for traders who prefer traditional setups

🔗 Best Combinations with These Indicators

We combine MACD tools with:

Structure Tools – BOS/CHOCH for context

Liquidity Zones – To spot where momentum may reverse

Volume Profile – To confirm strength behind moves

Fair Value Gaps (FVGs) – For precision entries

⚠️ What to Watch Out For

Both indicators are lagging by nature—they rely on moving averages. MACD 4C’s divergence detection can help anticipate reversals, but it’s still best used as a confirmation tool , not a standalone signal.

🔁 Repainting Behavior

Both the standard MACD and MACD 4C are non-repainting . Once a histogram bar or crossover is printed, it remains fixed. This makes them reliable for real-time trading and backtesting .

⏳ Lagging or Leading?

These are lagging indicators , designed to confirm trends—not predict them. MACD 4C’s divergence feature adds a leading element , but it should always be used with structure and price action for confirmation.

🚀 Final Thoughts

If you’re a visual trader who wants more clarity from your momentum tools, MACD 4C is a powerful upgrade. If you prefer simplicity and tradition, the standard MACD still holds its ground.

Try both, test them in your strategy, and see which one sharpens your edge.

Why Your EMA Isn't What You Think It IsMany new traders adopt the Exponential Moving Average (EMA) believing it's simply a "better Simple Moving Average (SMA)". This common misconception leads to fundamental misunderstandings about how EMA works and when to use it.

EMA and SMA differ at their core. SMA use a window of finite number of data points, giving equal weight to each data point in the calculation period. This makes SMA a Finite Impulse Response (FIR) filter in signal processing terms. Remember that FIR means that "all that we need is the 'period' number of data points" to calculate the filter value. Anything beyond the given period is not relevant to FIR filters – much like how a security camera with 14-day storage automatically overwrites older footage, making last month's activity completely invisible regardless of how important it might have been.

EMA, however, is an Infinite Impulse Response (IIR) filter. It uses ALL historical data, with each past price having a diminishing - but never zero - influence on the calculated value. This creates an EMA response that extends infinitely into the past—not just for the last N periods. IIR filters cannot be precise if we give them only a 'period' number of data to work on - they will be off-target significantly due to lack of context, like trying to understand Game of Thrones by watching only the final season and wondering why everyone's so upset about that dragon lady going full pyromaniac.

If we only consider a number of data points equal to the EMA's period, we are capturing no more than 86.5% of the total weight of the EMA calculation. Relying on he period window alone (the warm-up period) will provide only 1 - (1 / e^2) weights, which is approximately 1−0.1353 = 0.8647 = 86.5%. That's like claiming you've read a book when you've skipped the first few chapters – technically, you got most of it, but you probably miss some crucial early context.

▶️ What is period in EMA used for?

What does a period parameter really mean for EMA? When we select a 15-period EMA, we're not selecting a window of 15 data points as with an SMA. Instead, we are using that number to calculate a decay factor (α) that determines how quickly older data loses influence in EMA result. Every trader knows EMA calculation: α = 1 / (1+period) – or at least every trader claims to know this while secretly checking the formula when they need it.

Thinking in terms of "period" seriously restricts EMA. The α parameter can be - should be! - any value between 0.0 and 1.0, offering infinite tuning possibilities of the indicator. When we limit ourselves to whole-number periods that we use in FIR indicators, we can only access a small subset of possible IIR calculations – it's like having access to the entire RGB color spectrum with 16.7 million possible colors but stubbornly sticking to the 8 basic crayons in a child's first art set because the coloring book only mentioned those by name.

For example:

Period 10 → alpha = 0.1818

Period 11 → alpha = 0.1667

What about wanting an alpha of 0.17, which might yield superior returns in your strategy that uses EMA? No whole-number period can provide this! Direct α parameterization offers more precision, much like how an analog tuner lets you find the perfect radio frequency while digital presets force you to choose only from predetermined stations, potentially missing the clearest signal sitting right between channels.

Sidenote: the choice of α = 1 / (1+period) is just a convention from 1970s, probably started by J. Welles Wilder, who popularized the use of the 14-day EMA. It was designed to create an approximate equivalence between EMA and SMA over the same number of periods, even thought SMA needs a period window (as it is FIR filter) and EMA doesn't. In reality, the decay factor α in EMA should be allowed any valye between 0.0 and 1.0, not just some discrete values derived from an integer-based period! Algorithmic systems should find the best α decay for EMA directly, allowing the system to fine-tune at will and not through conversion of integer period to float α decay – though this might put a few traditionalist traders into early retirement. Well, to prevent that, most traditionalist implementations of EMA only use period and no alpha at all. Heaven forbid we disturb people who print their charts on paper, draw trendlines with rulers, and insist the market "feels different" since computers do algotrading!

▶️ Calculating EMAs Efficiently

The standard textbook formula for EMA is:

EMA = CurrentPrice × alpha + PreviousEMA × (1 - alpha)

But did you know that a more efficient version exists, once you apply a tiny bit of high school algebra:

EMA = alpha × (CurrentPrice - PreviousEMA) + PreviousEMA

The first one requires three operations: 2 multiplications + 1 addition. The second one also requires three ops: 1 multiplication + 1 addition + 1 subtraction.

That's pathetic, you say? Not worth implementing? In most computational models, multiplications cost much more than additions/subtractions – much like how ordering dessert costs more than asking for a water refill at restaurants.

Relative CPU cost of float operations :

Addition/Subtraction: ~1 cycle

Multiplication: ~5 cycles (depending on precision and architecture)

Now you see the difference? 2 * 5 + 1 = 11 against 5 + 1 + 1 = 7. That is ≈ 36.36% efficiency gain just by swapping formulas around! And making your high school math teacher proud enough to finally put your test on the refrigerator.

▶️ The Warmup Problem: how to start the EMA sequence right

How do we calculate the first EMA value when there's no previous EMA available? Let's see some possible options used throughout the history:

Start with zero : EMA(0) = 0. This creates stupidly large distortion until enough bars pass for the horrible effect to diminish – like starting a trading account with zero balance but backdating a year of missed trades, then watching your balance struggle to climb out of a phantom debt for months.

Start with first price : EMA(0) = first price. This is better than starting with zero, but still causes initial distortion that will be extra-bad if the first price is an outlier – like forming your entire opinion of a stock based solely on its IPO day price, then wondering why your model is tanking for weeks afterward.

Use SMA for warmup : This is the tradition from the pencil-and-paper era of technical analysis – when calculators were luxury items and "algorithmic trading" meant your broker had neat handwriting. We first calculate an SMA over the initial period, then kickstart the EMA with this average value. It's widely used due to tradition, not merit, creating a mathematical Frankenstein that uses an FIR filter (SMA) during the initial period before abruptly switching to an IIR filter (EMA). This methodology is so aesthetically offensive (abrupt kink on the transition from SMA to EMA) that charting platforms hide these early values entirely, pretending EMA simply doesn't exist until the warmup period passes – the technical analysis equivalent of sweeping dust under the rug.

Use WMA for warmup : This one was never popular because it is harder to calculate with a pencil - compared to using simple SMA for warmup. Weighted Moving Average provides a much better approximation of a starting value as its linear descending profile is much closer to the EMA's decay profile.

These methods all share one problem: they produce inaccurate initial values that traders often hide or discard, much like how hedge funds conveniently report awesome performance "since strategy inception" only after their disastrous first quarter has been surgically removed from the track record.

▶️ A Better Way to start EMA: Decaying compensation

Think of it this way: An ideal EMA uses an infinite history of prices, but we only have data starting from a specific point. This creates a problem - our EMA starts with an incorrect assumption that all previous prices were all zero, all close, or all average – like trying to write someone's biography but only having information about their life since last Tuesday.

But there is a better way. It requires more than high school math comprehension and is more computationally intensive, but is mathematically correct and numerically stable. This approach involves compensating calculated EMA values for the "phantom data" that would have existed before our first price point.

Here's how phantom data compensation works:

We start our normal EMA calculation:

EMA_today = EMA_yesterday + α × (Price_today - EMA_yesterday)

But we add a correction factor that adjusts for the missing history:

Correction = 1 at the start

Correction = Correction × (1-α) after each calculation

We then apply this correction:

True_EMA = Raw_EMA / (1-Correction)

This correction factor starts at 1 (full compensation effect) and gets exponentially smaller with each new price bar. After enough data points, the correction becomes so small (i.e., below 0.0000000001) that we can stop applying it as it is no longer relevant.

Let's see how this works in practice:

For the first price bar:

Raw_EMA = 0

Correction = 1

True_EMA = Price (since 0 ÷ (1-1) is undefined, we use the first price)

For the second price bar:

Raw_EMA = α × (Price_2 - 0) + 0 = α × Price_2

Correction = 1 × (1-α) = (1-α)

True_EMA = α × Price_2 ÷ (1-(1-α)) = Price_2

For the third price bar:

Raw_EMA updates using the standard formula

Correction = (1-α) × (1-α) = (1-α)²

True_EMA = Raw_EMA ÷ (1-(1-α)²)

With each new price, the correction factor shrinks exponentially. After about -log₁₀(1e-10)/log₁₀(1-α) bars, the correction becomes negligible, and our EMA calculation matches what we would get if we had infinite historical data.

This approach provides accurate EMA values from the very first calculation. There's no need to use SMA for warmup or discard early values before output converges - EMA is mathematically correct from first value, ready to party without the awkward warmup phase.

Here is Pine Script 6 implementation of EMA that can take alpha parameter directly (or period if desired), returns valid values from the start, is resilient to dirty input values, uses decaying compensator instead of SMA, and uses the least amount of computational cycles possible.

// Enhanced EMA function with proper initialization and efficient calculation

ema(series float source, simple int period=0, simple float alpha=0)=>

// Input validation - one of alpha or period must be provided

if alpha<=0 and period<=0

runtime.error("Alpha or period must be provided")

// Calculate alpha from period if alpha not directly specified

float a = alpha > 0 ? alpha : 2.0 / math.max(period, 1)

// Initialize variables for EMA calculation

var float ema = na // Stores raw EMA value

var float result = na // Stores final corrected EMA

var float e = 1.0 // Decay compensation factor

var bool warmup = true // Flag for warmup phase

if not na(source)

if na(ema)

// First value case - initialize EMA to zero

// (we'll correct this immediately with the compensation)

ema := 0

result := source

else

// Standard EMA calculation (optimized formula)

ema := a * (source - ema) + ema

if warmup

// During warmup phase, apply decay compensation

e *= (1-a) // Update decay factor

float c = 1.0 / (1.0 - e) // Calculate correction multiplier

result := c * ema // Apply correction

// Stop warmup phase when correction becomes negligible

if e <= 1e-10

warmup := false

else

// After warmup, EMA operates without correction

result := ema

result // Return the properly compensated EMA value

▶️ CONCLUSION

EMA isn't just a "better SMA"—it is a fundamentally different tool, like how a submarine differs from a sailboat – both float, but the similarities end there. EMA responds to inputs differently, weighs historical data differently, and requires different initialization techniques.

By understanding these differences, traders can make more informed decisions about when and how to use EMA in trading strategies. And as EMA is embedded in so many other complex and compound indicators and strategies, if system uses tainted and inferior EMA calculatiomn, it is doing a disservice to all derivative indicators too – like building a skyscraper on a foundation of Jell-O.

The next time you add an EMA to your chart, remember: you're not just looking at a "faster moving average." You're using an INFINITE IMPULSE RESPONSE filter that carries the echo of all previous price actions, properly weighted to help make better trading decisions.

EMA done right might significantly improve the quality of all signals, strategies, and trades that rely on EMA somewhere deep in its algorithmic bowels – proving once again that math skills are indeed useful after high school, no matter what your guidance counselor told you.

RSI 101: The Secret of RSI’s WMA45 Line and How to Use ItIn my trading method, I use the WMA45 line together with RSI to help spot the trend more clearly.

Today, I’ll share with you how it works and how to apply it — whether you're doing scalping or swing trading.

Why WMA45?

WMA (Weighted Moving Average) is a type of moving average where recent prices are given more importance.

WMA45 simply means it takes the average of the last 45 candles (could be 45 minutes, 45 hours, or 45 days depending on your chart).

Because it moves slower than RSI, it helps reduce the “noise” and gives you a better idea of the real trend.

This idea is not new — many traders have tested RSI strategies also use this line. I just applied and adjusted it in my own way.

👉 How to set it up on TradingView (very simple):

What WMA45 Tells You

Trending

This line shows you the overall direction of the market:

📉 If WMA45 is going down, the price is likely going down.